Bonus trades only during indicators? 3 indicator trading tools that can also be left running

Even busy workers who can't stare at charts all the time may trade only when important indicators, such as employment statistics, are released.

Taking the employment statistics (the first Friday of every month) as an example, in 2019 USDJPY on average20-40 pips in the 30 minutes around the releasethe price fluctuated.

Note!

What is the Employment Statistics: It is the most watched U.S. economic indicator among the economic indicators,During April–October daylight saving time, releases occur at

21:30 JST; during November–March standard time, releases occur at22:30 JST.

Indicator trading can yield a large number of pips in just a few minutes—it's like a bonus opportunity—but you may wonder which direction it will move, whether to follow the trend or to trade contrarian, and what strategy to choose.

However, around the release times spreads can widen and order execution delays can occur, so you should carefully evaluate the FX accounts you use for indicator trading.

◆What strategies are there? Indicator trading

Among the many indicator-trading tools on GogoJungle, we will introduce representative ones by strategy.

■OCO trend-following method + savvy exit

Go with the Employment Statistics

Using OCO orders (placing two orders simultaneously, canceling the other when one is filled) you trend-follow in the direction hit. Since you are not using multiple positions, risk is easier to manage.

Additionally, you can configure up to five indicator-trade schedules..

Just check important economic indicators at the start of the month or week and set the date/time—after that, you can leave it to run!

What stands out is the type of settlements, including break-even + trailing stop after securing a certain pip amount, as well as a candle-stop feature that places the stop at the recent high or low.

■PyramidingTechnique

MyPyramid Indicator Trading

This is a trend-following method that chases the breakout in the breakout direction by gradually reducing the lot size as 1.0 > 0.8 > 0.6, etc.

It is advantageous when one side breaks out.

《Features》

・Pre-specified indicator date/time is possible (1 EA per trade; can be reserved a week or even a month ahead)

・Entry when the price moves by XX pips from the specified time; if it doesn't move, cancel the order within the specified time

・If one side enters, the other side can be canceled

・Both sides can enter

・After entry, pyramid by the specified pip interval times the specified multiple (e.g., 1, 0.8, 0.6, …)

・If price falls by a certain percentage from the high (or conversely if it rises in a down move), close all positions or close at a specified number of pips

▲Trade sample (modifiable from default values)

This also supports backtesting in visual backtest mode, so you can build various strategies with different ranges and lot sizes.

(Note: In both real and demo, you should change the magic number each time; and because the Web authentication method is old, you need to place the authentication file auth_indicaters.ex4 into the Libraries folder)

■ Hedging + Martingale Contrarian Method

EA that automates hedging trading strategies

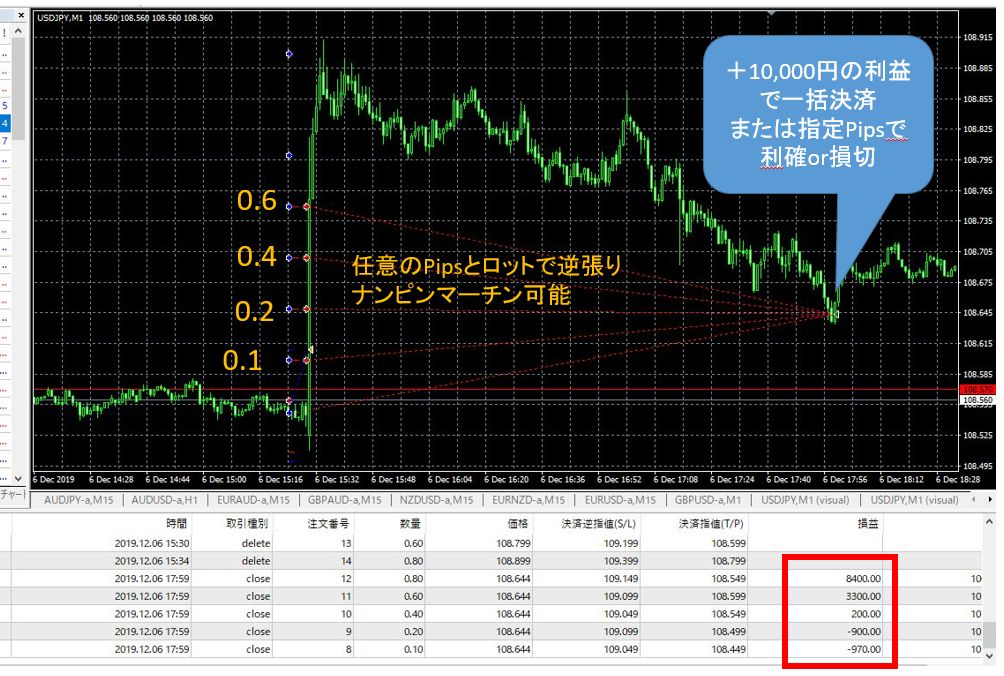

This contrarian strategy places contrarian martingale averaging trades at a specified time with a user-defined price range and lot size.

You can choose with or without hedging, and it works on charts that swing up and down or show whipsaw price action.

If the market makes a large breakout and doesn’t return, losses can be large.

This too can be backtested in visual backtest mode, so you can build various strategies with different ranges and lot sizes.

▲Trade image (Pip width and lot sizes are freely adjustable)

Also, because of high customization, you can use it not only around indicator times but also as a day-trading method on currency pairs that range with large price moves.

◆When is the indicator release? For those who tend to forget

Display today's indicator information on MT4

HT:Tool to display/notify today's economic indicators on MT4 (external link)

Finally, we'd like to introduce MT4 accounts known for high fill rates.

Saxo Bankhas the narrowest spreads and a 100% fill rate even during employment statistics releases!

Opening an MT4 account is now more accessible, with a minimum deposit of 1,000,000 yen.

Please try the high fill rate for yourself!

Oanda Japanis also popular for its overall strength!

Oanda Lab's indicators are popular, and features like order books and currency strength charts are also available.

Available too.

Written by Tera GogoJungle Marketing.