The developers of the highly popular 'Flashes' series announce a new standard for mid-rate trading EA! 'Tokyo Myth'

Flashes Developer's new EA!

The fixed-timeTokyo Fix Trade and the EA'sauto-tradingarea perfect match!

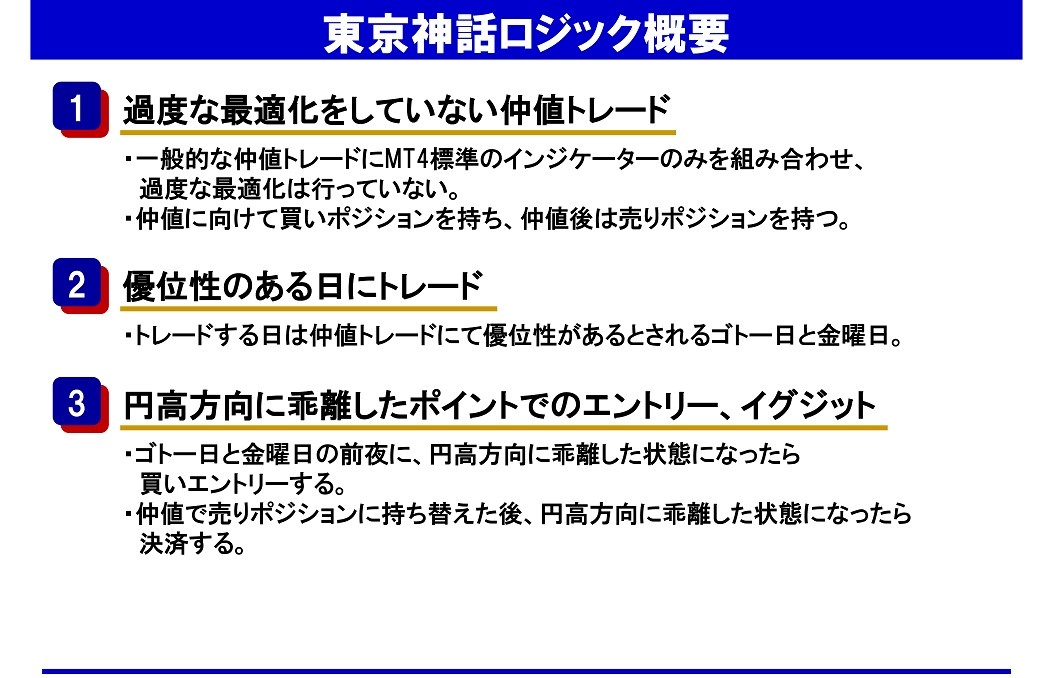

【Tokyo Myth Overview】

1.Developer Profile

Trader Kaibe

Formerly a chemical R&D professional at a major manufacturer. FX history is 13 years, with a peak return of 6,300% over nine months. Self-taught in automated trading programming languages, and in 2017 participated in the“Robin Cup” as a runner-up in automated trading.

Blog:https://www.traderkaibe.com/

Twitter:https://twitter.com/k_flashes

Over 1,000 users, the “Flashes for USDJPY” and its EURUSD version are popular among many traders.

ThatTrader Kaibedeveloped a new EA“Tokyo Myth”.

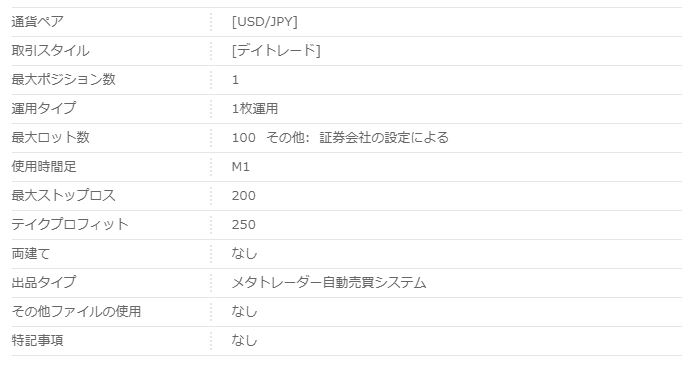

2.Strategy

A USD/JPY day-trading EA designed for the 1-minute chart.

Max positions is 1, max stop loss 200, max take profit 250.

The logic is based on the Tokyo FX market's fixing rate.

On Go-To days or the night before Friday, if there is a deviation toward yen appreciation, it enters long; at the fixing it switches to a short position and closes when the deviation moves toward yen depreciation.

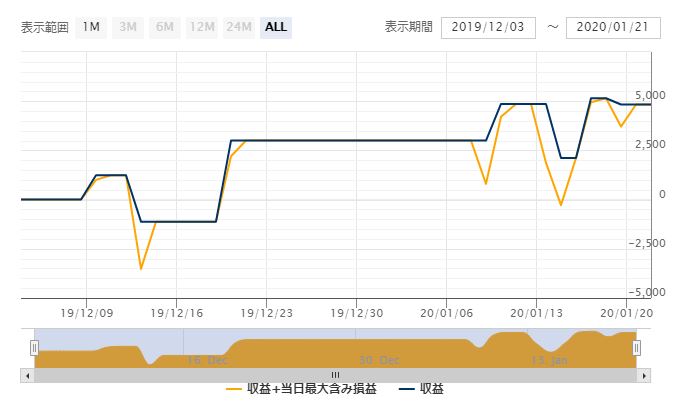

【Forward Test Results】

Because the forward performance spans from December 3, 2019 through the year-end holidays, forward results are limited and still fairly linear, but numerically they are not much different from the backtest results described below in win rate and PF, so there is reason to expect continued performance.

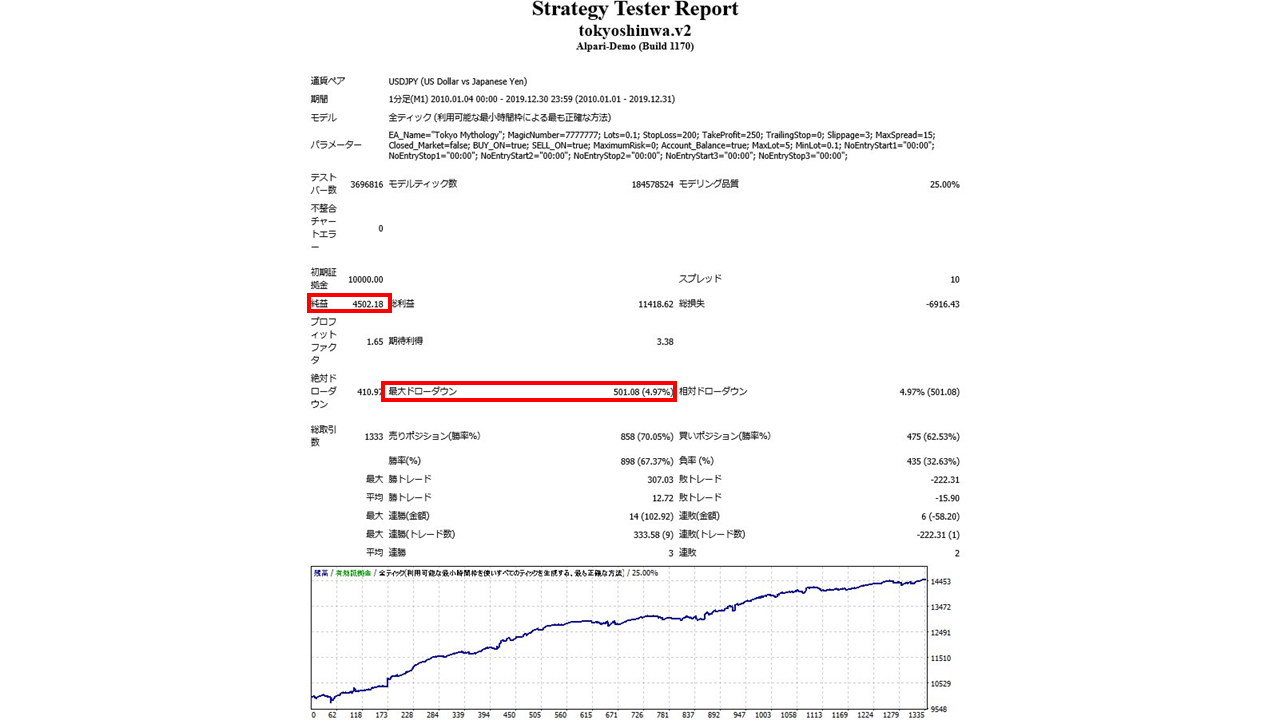

【Backtest Analysis】

Backtest period covers 2010 through 2019 end. 0.1 lot, spread of 10 points.

2010.01.01–2019.12.31

Net profit +495,000 yen (annual average 49,000 yen)

Max drawdown −55,000 yen

TotalTrades 1,333 (annual average 133)

Win rate 67.63%

PF 1.65

Win rate is64.54%.Profit factor is 1.65, high, and the max drawdown is low, so the overall period shows a stable, smooth profit curve.

The recommended margin for 0.1 lot is fixed,

15.5(ten-thousand-yen units) = 155,000 yen

, and safe operation is possible from around 160,000 yen.

The expected annual return in this case is31.9%.

・Annual Revenue

Although 2014 earnings were weak, during the measured10-year period profits were earned in every year.

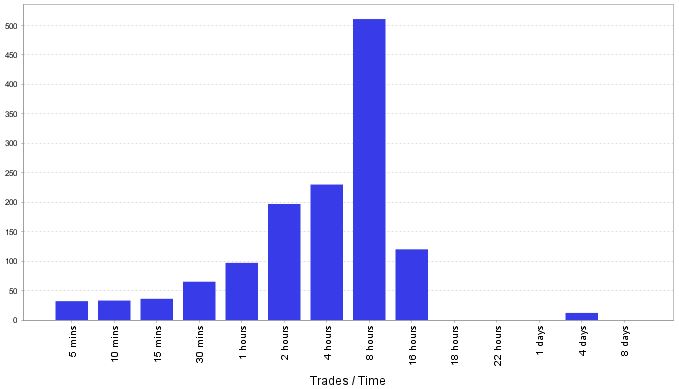

・Holding Time

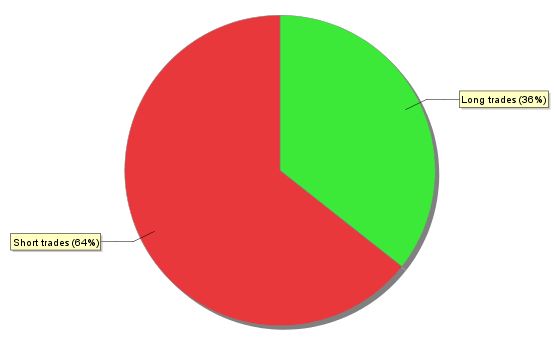

・Position Ratio

Because there is a tendency to target yen appreciation from the fix, the short portion accounts for a little over 60%.

・Chart Analysis

Here we review trades from the backtest period on a chart.

The chart shows the fixing and also displays Japan time via an indicator.

Blue: Long Red: Short

Case 1

(5-minute chart) Trades around the fixing. Before the fixing on December 6, price moved strongly toward yen appreciation while holding a long position; at the fixing it settled and switched to a short. Turning large price moves from early morning to morning into profit is a strength of the EA compared to discretionary trading.

Case 2

Trading on December 20, 2019, the Go-To day near year-end before the weekend. The price moved sharply toward yen appreciation in tandem with the fixing, and profit-taking occurred about 30 minutes later.

【End】

That said, Tokyo Myth is an EA that trades during the Tokyo fix.The combination of fix-based trading that targets distinctive price moves and an EA that does not require traders to be glued to the market, working with a fixed logic, is excellent, wouldn’t you agree?

Regarding the logic, not only does it capitalize on the advantage of the fix-based anomaly, but also being developed by Trader Kaibe, who has proven track record and trust in EA design, this is an EA sure to shine in 2020.