I tried QuntX's algorithm that bridges the gap between traders employed by financial institutions and individual investors!

An article about SMART TRADE, a trading tool that can create trading programs (algorithms) for stocks and other assets using Python.

The future of stock investing lies in SMART TRADE, the Python-powered trading tool.

Here, many developers participate in algorithm development seminars, and developers themselves are continuallydevelop and list their algorithms. SMART TRADE Co., Ltd. also develops in-house or, operates the store "QuntX (Quantex) that sells the collected algorithms.

In Wall Street and among English-speaking financial institutions that conduct self-trading, as well as in Japanese financial institutions, the number of traders placing manual orders has fallen sharply, and stories of traders being replaced by those who use programs have become common.

In addition, there are many news articles indicating that seasoned traders who have long traded on discretionary basis are dedicating themselves to learning programming, starting with Python.

What is happening in professional financial institutions is starting to happen in the world of individual investors, led by SMART TRADE, and there is no doubt that this is a noteworthy service for investors who are sensitive to financial products.

Today, we would like to report on the usability of the algorithms available on QuntX.

Immediately, we visited the QuntX site.

There are probably hundreds of algorithm developers, perhaps over a thousand, and a substantial number of algorithms are listed by many developers; among them, they select the good performers, and you can currently view and obtain 22 algorithms.

After purchasing an algorithm, you simply receive the stock buy/sell signals generated by the algorithm via LINE or e-mail, and place orders manually with your brokerage, making it very simple and straightforward.

From the 22 algorithms, this time we selected [Official] 2019 Fall 5G

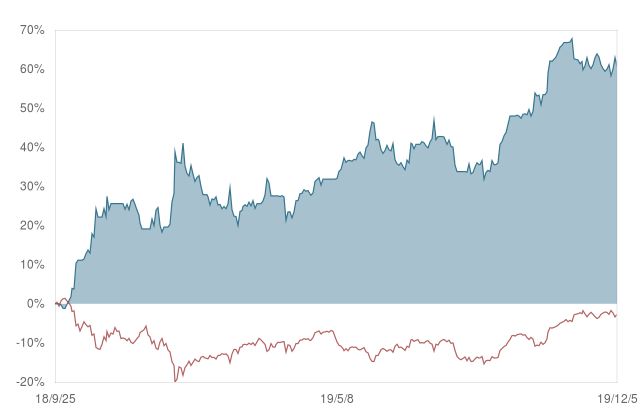

5G-related individual stocks have growth potential, and above all, the historical profit-and-loss curve's upward trajectory is excellent.

officially certified by SMART TRADE.

The actual operation also seems to be low in stress.

Being focused on 5G stocks, I personally think there is ample potential for the above P/L curve to keep rising.

Notifications for buy/sell signals can be configured in the “My Algorithm” screen below.

In addition to LINE, you can also send notifications to Slack. More and more companies are adopting Slack these days, so it should be convenient for those familiar with it.

Algorithms created by investors who are knowledgeable about many investments and can program in Python. Try using the best ones for your investments.

QuntX's algorithms may further bridge that gap.

[Official] 2019 Fall SC BEST50 Stocks - Small Capital Edition

[Official] 2019 Fall REITs

[Official] 2019 Fall Semiconductors

[Official] 2019 Fall 5G

[Official] 2019 Fall SC BEST50 Stocks