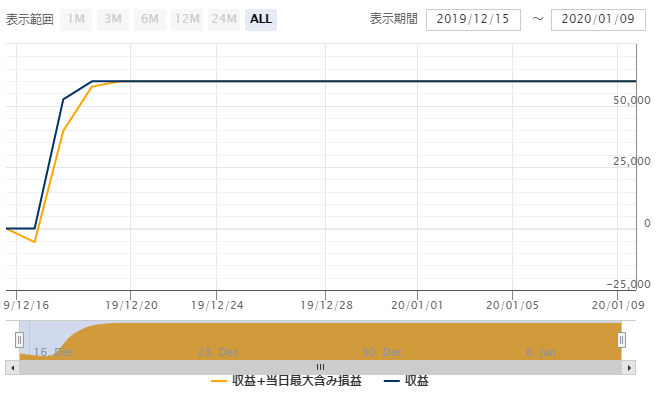

God EA with highly attractive profitability 『Grover_GBPJPY_M15』

Backtest results: 10 million yen earned over 10 years!

GBPJPY-focused 1-position EA that can dramatically increase your assets

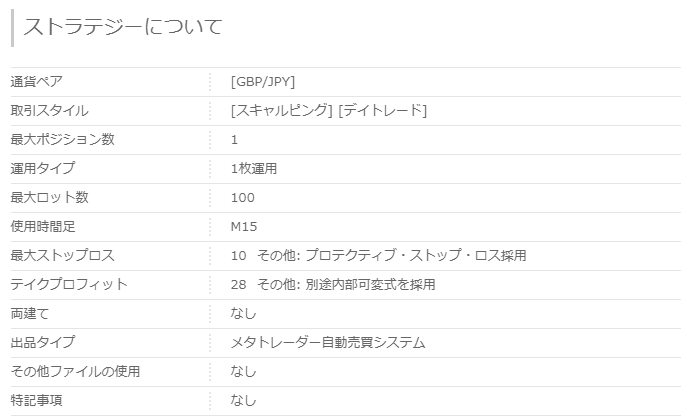

【Grover_GBPJPY_M15 Overview】

This is an EA that trades GBPJPY in a single position. It also features compounding and boasts a high rate of return.

The trading style ranges from scalping to day trading, but since it uses the 15-minute chart, it is likely leaning toward day trading.

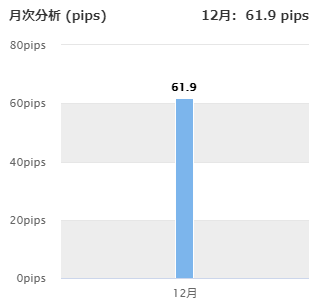

■Monthly Analysis

Pips earned in 2019: a steady start with 61.9 pips.

It seems 2020 has not been traded yet, but there is potential for optimism.

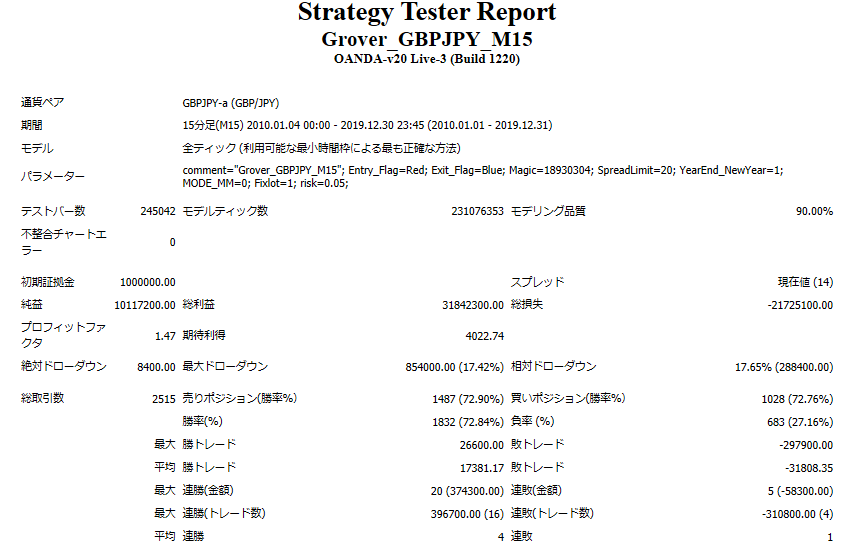

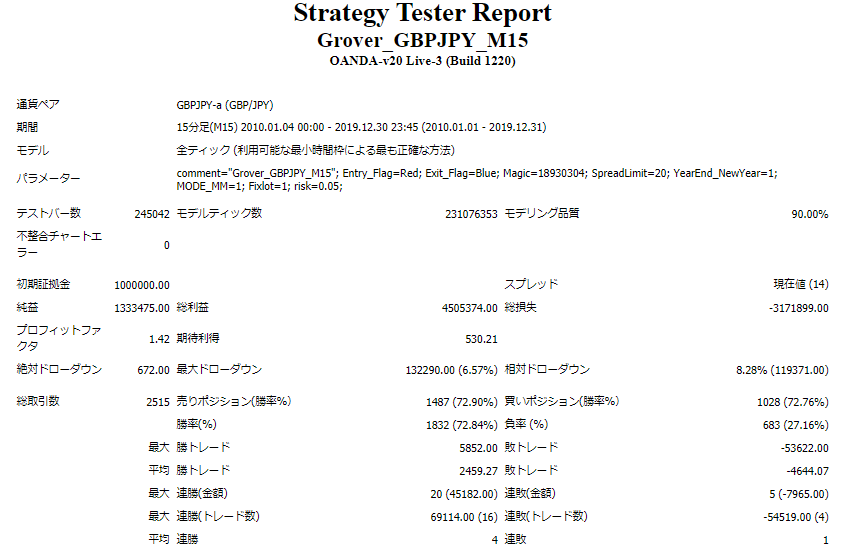

【Backtest Analysis】

2010.01.01‑2019.11.31

Net profit +10.117 million yen (annual average1.0117 million yen)

Maximum drawdown: -0.854 million yen

Total trades: 2515 (annual average 251 trades)

Win rate 72.84%

Profit Factor 1.47

Running with 1 lot would have yielded a tenfold increase over 10 years.

Required margin is

(57) + (85.4×2) = 227.8 (ten-thousand yen)

Expected annual return is 44%.

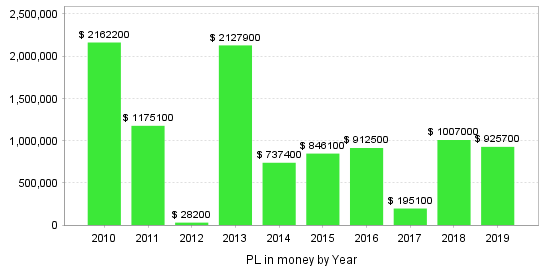

・Annual profit

This is the profit over 10 years. Profits were earned without any losses.

Being able to generate ample profits even in the difficult markets of 2018 and 2019 is a major attraction.

・Monthly profit

These are the monthly results for 10 years. There are few months with losses, but several months with large negative results.

However, it earns more than it loses, so it should be fine.

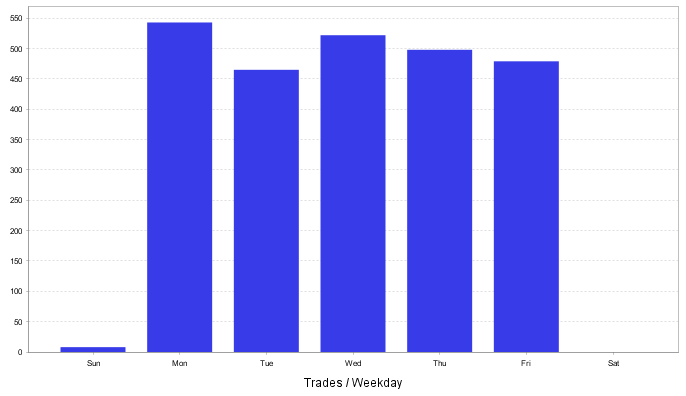

・Trading days

These are the days on which trades are executed during the week. Trading is evenly distributed across the days.

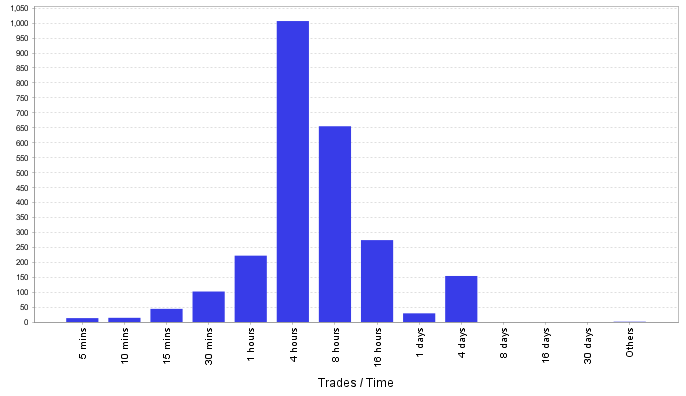

・Holding time

Holding time. Most are between 1 hour and 16 hours.

It seems to be predominantly day trading with frequent trades.

・Default

I tried default compounding.

Returns are not higher than with simple interest, but both maximum drawdown and relative drawdown are below 10%.

Because the risk value is 0.05, it focuses on low risk and steady gains.

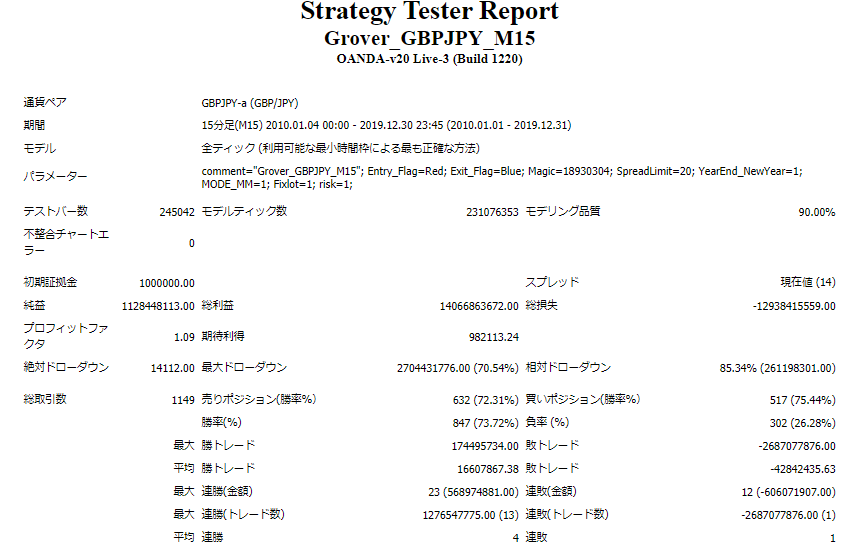

・risk1

Next, with the risk value set to 1, I performed compounding.

It showed very high profitability, with earnings exceeding 1 billion yen.

However, the maximum drawdown is 70% and the relative drawdown is 85%, so increasing the risk value to this extent appears to produce high risk/high return.

Backtest results for individual operations show anupward trend.

Average annual profit is 1,000,000 yen, and expected annual return is 44%, which is highly attractive.

Compounding can be adjusted by adjusting the risk value, which carries corresponding risk, but there is potential to earn substantially even in a short period.

If used in consultation with your own funds, it can be a powerful ally in growing your assets.