Off to a strong start this year! A stable 40% annual return in CHF/JPY: 'Oracle CHF'

In 2020, the market has already started, but has the EA operation resumed?

GogoJungle's forward tests are operated during year-end and New Year regardless of indicators, and from the New Year we would like to introduce a promising EA.

An EA that remains stable with one position, not affected by the 2015 Swiss franc shock, expected to yield 300-400 pips per year!

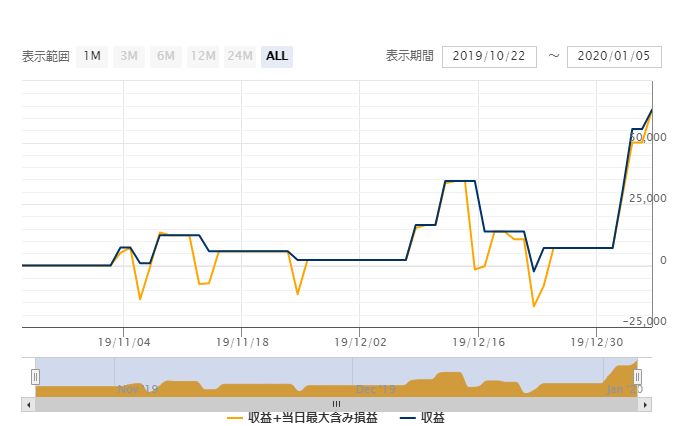

Forward testing started in November 2019, and after about two months of operation, the acquired Pips are +63Pips, with profits of +63,256 yen per 1 lot.

On January 2 and 3, 2020, each gained over 20 pips, greatly updating profits!

The win rate is 57%, not high, but the average profit is 15,000 yen and the average loss is -9,400 yen, giving a good risk-reward balance,

and this is an EA that leaves a profit by repeating wins and losses.

▲Trade history to date

Looking at the trade history list, the stop losses are shallow, from -6 pips to -20 pips, so a single loss does not dramatically reduce the account funds.

As in the recent two-win streak, large consecutive wins can lead to substantial monthly profits.

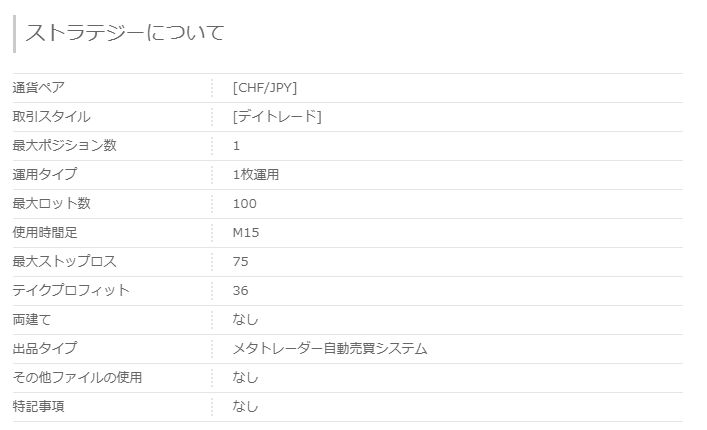

◆System Overview

A notable feature is that the target is the rare currency CHFJPY (Swiss Franc/Yen).

There was the 2015 Swiss shock, and some may have suffered greatly, but

whether such a turbulent 2015 market could be survived by this system is something we will verify via backtests in the

backtest.

◆Backtest Analysis

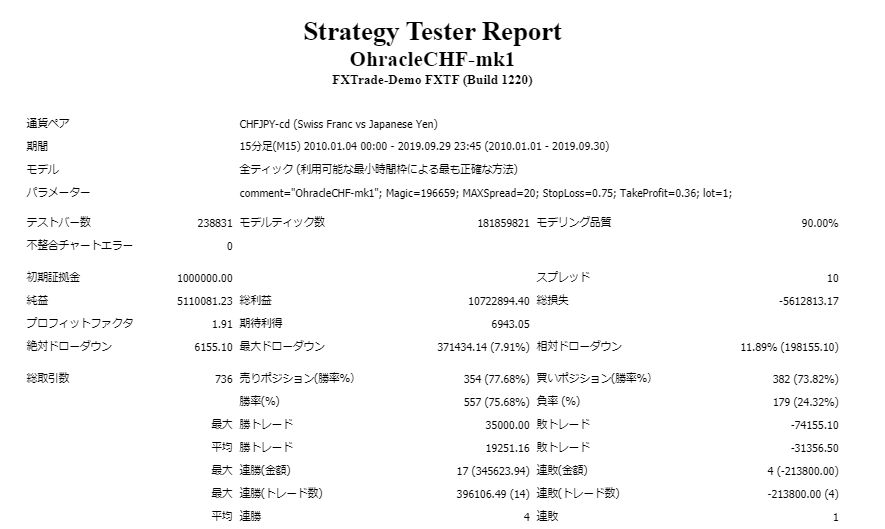

From a simple backtest, the expected value over roughly 10 years of backtesting shows

1.0 lot operation,

Maximum drawdown -370,000 yen

Annual average number of trades 74

Annual average profit/loss 510,000 yen

Recommended margin 1,290,000 yen

Expected annual return 40%

※Recommended margin calculation formula = { (margin) + (maximum drawdown × 2) }

That is the result.

A 40% expected annual return for a rare currency pair is an unexpectedly notable point, isn’t it!

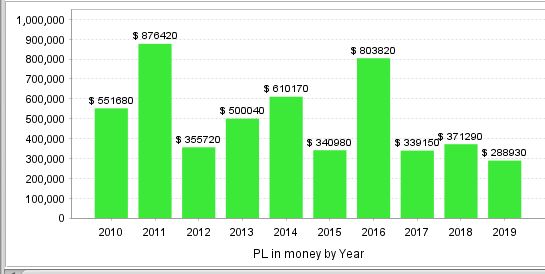

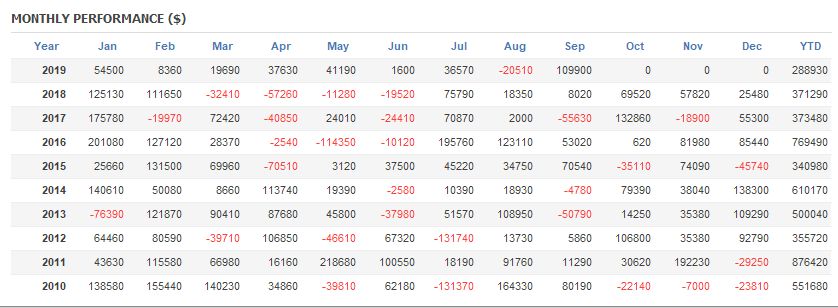

【Annual Profit/Loss】 ※Profit in Japanese Yen for 1.0 lot operation

In 2011 and 2016 there are standout annual profits of 800,000 yen, but there are no losses throughout the year,

and even the turbulent 2015 yielded profits in the 300,000 yen range, about the same level as other years!

When we think of 2015, you know? With the removal of the Swiss bank’s unlimited intervention, the market moved more than 2000 pips in just a few tens of minutes—an alarming market.

Additionally, there was a significant market shift in January 2019 as well, but there were no particularly large losses.

This is because, unlike many other rare-currency EAs that use averaging down/martingale across multiple positions,

this is a single-position EA with a 75-pip stop loss, so during sharp market moves losses are limited and risk of damage to the market is small.

【Monthly Profit/Loss】

In January 2015 and January 2019 there are no losses!

Looking at charts from 2016 onward, volatility decreases cause some months to show negative values on a monthly basis.

↑2016–2019 Swiss Franc/Yen chart

Conversely, even in recent years with poorer performance, you can still earn about 300 pips–400 pips per year (1.0 lot yields roughly 300,000–400,000 yen),

so at least that level of profit can be expected.

Regardless of market timing, even with rapid market fluctuations, you can expect stable profits on an annual basis; this is the strength of ‘Oracle CHF.’

◆Operational Notes

For forward testing, we use “Gaitame Finest.”

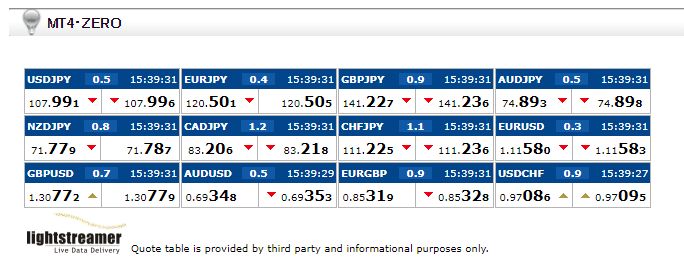

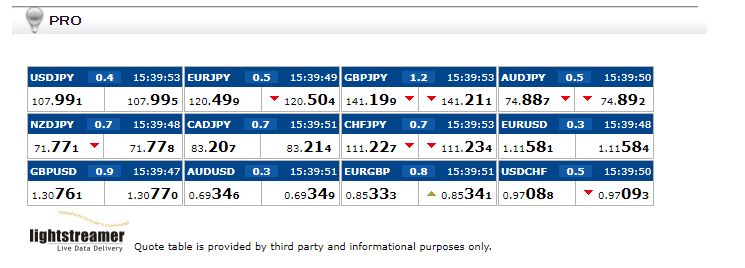

The CHFJPY spread on Gaitame Finest is1.0–1.2 pipsapproximately, which is close to the backtest spread of 1.0.

↑Gaitame Finest, MT4ZERO spread.CHFJPY 1.1 pips

↑Gaitame Finest, MT4ZERO spread.CHFJPY 0.7 pips

written by Tera GogoJungle Marketing.