In a thin market ahead of year-end and New Year, the Dow, the Nikkei, and the USD/JPY all rose on expectations that U.S.-China trade frictions would ease!

In the newsletter distributed by the investment salon “Emori Tetsu's Real Trading Strategy,”the freshest information that is surely useful for trading is packed in abundantly. The major advantage is that you can verify analyses of many markets, including stocks, bonds, and currencies, all at once.

Thus you can effectively utilize Mr. Emori Tetsu's recommended Global Macro Strategy.

◇ About Global Macro Strategy

The investment strategies introduced in this newsletter belong to the “Global Macro Strategy” category in the hedge fund industry. This is the method most hedge funds around the world excel at, the so-called “mainstay” of hedge fund management.This strategy involves, keeping an eye on all markets and seeking investment opportunities to aim for profits. Regardless of price rises or falls, if price movements are anticipated, you bet on them (you wager). Volatility increases potential profits, so when opportunities arise, we strike boldly.In a world where global conditions are uncertain, price fluctuations in major markets such as currencies, stocks, interest rates, and commodities have become even larger. Therefore, forecasts for each market have become extremely difficult. In such market conditions, a macro perspective that operates across a broader range of markets—the “Global Macro Strategy”—is advantageous.

Here we excerpt from the newsletter distributed on December 27, 2019.

〔EQUITY & BOND MARKET〕

【US & Europe Stock and Bond Market Commentary & Analysis】

U.S. stocks rebounded on expectations that U.S.–China trade frictions would ease. The Dow Jones Industrial Average rose 105.94 points to 28,621.39, a new intraday high for the index in two days. The S&P 500 gained 16.53 points to 3,239.91, and the Nasdaq Composite advanced 69.51 points to 9,022.39, breaking the 9,000 level for the first time and extending a 10-day streak of gains. The Russell 2000 fell 0.3406 points to 1,677.66. The VIX slipped 0.02 to 12.65, and the SOX rose 2.29 to 1,864.49. At a briefing on the 26th, China’s Ministry of Commerce spokesperson Gao Feng said that China and the United States remain closely coordinated toward signing the Phase 1 agreement and are proceeding with the necessary procedures. Trump also stated on the 24th that “the deal has been concluded. We are translating the document now,” and that he intended to sign promptly. With light trading during the Christmas holiday season, buying favored the expectation of an early signature in early January next year. Amazon led the advance on the 26th. This year’s holiday season reportedly set a record, with billions of items ordered worldwide and tens of millions of Amazon-brand electronics purchased. Mastercard also announced on the 26th that U.S. online retail sales from November 1 to Christmas Eve were up 18.8% year over year. The resilience of consumer spending, a key driver of the U.S. economy, was reconfirmed as a positive factor. Amazon rose 4.5%, Apple 2.0%, and Facebook 1.3% higher. The S&P 500 is up 29% year-to-date, and if the trend continues, this would be the largest annual gain since 2010. Within the S&P 500, consumer discretionary stood out; healthcare was the only sector to close in negative territory.

Dow Jones Daily

Created with: TradingView

【Japan Stocks & Bonds Market Commentary & Analysis】

The Nikkei Stock Average rose 142.05 points to 23,924.92, and the TOPIX rose 9.78 points to 1,731.20, marking a rebound for the first time in seven days. Volume was 821.86 million shares. With Wall Street closed for Christmas yesterday and only few cues, the Nikkei opened near the previous session’s close. Later, as a result of the lingering decline since last week that made Japanese stocks appear cheap, buying was led by futures and pushed higher. It may also have been encouraged by December’s last trading day for rights. In the afternoon, volatility faded, trading around the high 23,900s. Amid scarce materials, Shanghai shares remained firm, providing one of the few supportive factors for Japanese stocks. The forex market moved slightly weaker yen on the day, further boosting buying in semiconductor-related and other cyclically sensitive stocks. With few foreign investors, trading value was in the low trillions. Individual investors had been selling, but with investment capacity, stocks with solid earnings or other favorable elements were conspicuously bought.

November’s new housing starts fell 12.7% year over year to 73,523 units, marking a fifth consecutive monthly decline. Banks tightening apartment loan screenings led rental housing to fall below year-ago levels for the 15th consecutive month. Rental housing dropped 17.5% to 28,779 units. Owner-occupied homes, including custom-built houses, declined 7.3% to 23,655 units, for the fourth consecutive month of decline. Compared with May 2014 after the previous consumption tax increase, the decline is smaller, suggesting there is no post-hike rebound. For condominiums and other for-sale housing, starts fell 10.3% to 20,819 units. The year-ago pace of condominium starts had surged.

Nikkei Average Daily

Created with: TradingView

〔CURRENCY MARKET〕

USD/JPY rose. Supported by risk-on sentiment from expectations of easing U.S.–China trade tensions, it climbed into the upper 109s. At the 26th regular briefing, China’s Ministry of Commerce spokesperson Gao Feng stated that China and the U.S. remain closely coordinated toward signing the Phase 1 agreement and are continuing to work out the necessary steps before signing. President Trump also indicated on the 24th that he intends to sign promptly, which has increased a sense of alignment between the two sides. This helped push the safe-haven yen lower as traders bought dollars. However, as year-end approaches and market participants thin out, U.S. weekly initial jobless claims and other statistics elicited little reaction. The yuan was around 1 USD = 6.9911 yuan, essentially flat. Currencies sensitive to trade issues rose, with the Australian and New Zealand dollars advancing against the U.S. dollar. The Canadian dollar also rose. Meanwhile, the euro–dollar rose slightly, and the pound–dollar recovered from a recent low.

USD/JPY Daily

Created with: TradingView

【Currency Trading Strategy】

Maintain a long position in USD/JPY. It is close to a new high and may move sharply higher. It has broken out from the interaction of the 5-day moving average and the 288-day moving average. Sudden moves around year-end and New Year are possible, but caution is needed, and such moves cannot be foreseen. A prudent approach is to steadily follow the trend. If it clearly exceeds 109.70, USD/JPY could move in a completely different direction — i.e., a substantial yen depreciation. Currently, such a view is not widely held in the market. Most market participants still emphasize yen appreciation risk. However, considering the investment flows of Japanese institutional investors, there could be an unexpectedly sharp yen depreciation. Thus, I am considering the possibility of a substantial yen depreciation next year. There is also a possibility of a move toward 120.

Additionally, the long-term trend remains upward. The long-term trend reversal point is 107.35 yen. That is a very low level, so it makes little sense to expect a decline at this stage. Rather, I would look to buy the dips down to 107.50 yen. I would like to place staggered buy orders at 109.15, 108.90, 108.25, and 108.00 yen.

Investment targets are the USD, JPY, EUR, GBP, AUD, NZD, and CAD. Trading will be concentrated in USD and JPY pairs.

USD/JPY: Long

EUR/USD: Long

GBP/USD: Long

AUD/USD: Long

NZD/USD: Long

USD/CAD: Short

EUR/JPY: Long

GBP/JPY: Long

AUD/JPY: Long

NZD/JPY: Long

CAD/JPY: Long

〔COMMODITY MARKET〕

【Precious Metals Market Commentary & Analysis】

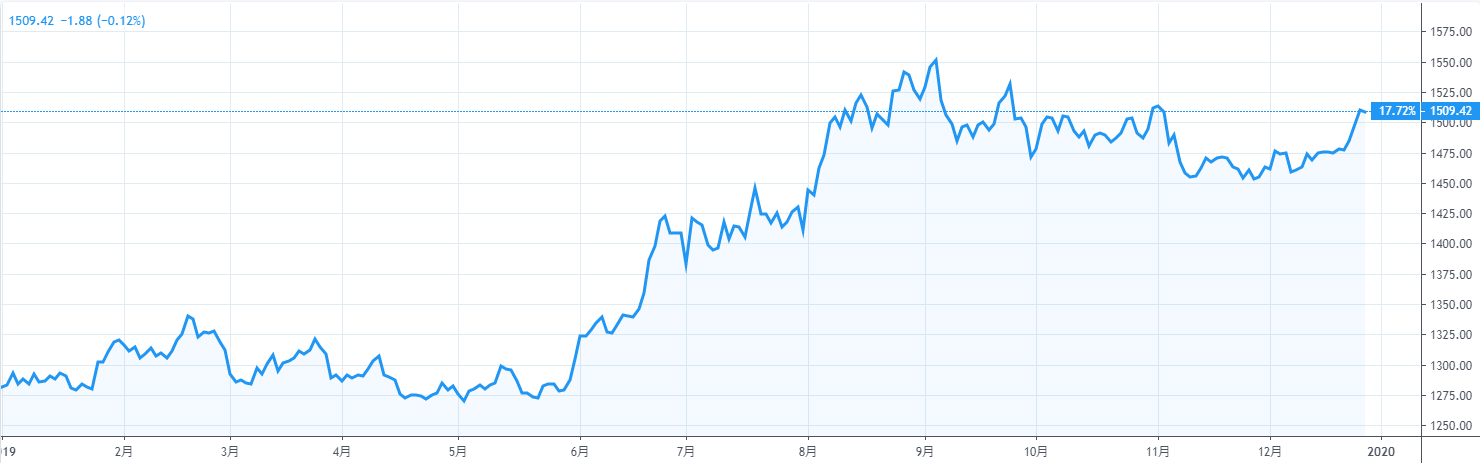

Gold prices rose toward a two-month high, staying above the key level of $1,500. With light volume during the Christmas holiday season, investors are preparing for a potential stall in the rally of equities. At one point, gold reached $1,512.30, the highest since November 4. In recent weeks, as expectations for the outlook of U.S.–China trade talks boosted U.S. stocks to historic highs, gold prices have continued to push to new highs. Platinum rose 1.5% to $952.70, a high not seen since September 24. Silver, platinum, and palladium continued to rise.

Gold / USD Daily

‘Emori Tetsu's Real Trading Strategy’ (Tetsu Emori)Quoted.