BlackPanther USDJPY, created by a developer who is proficient in cryptocurrencies, FX, and other investments

As of December 24, 2019, there are 466 users of BlackPanther USDJPY, and the feedback from those customers is among the top for the more than 17,000 EAs listed on GogoJungle.

One reason is that the equity curve continues to rise to the right, as discussed in a recent article

It ranks among the top in the proportion of customers who first purchased an EA on GogoJungle in November 2018 and are still operating it as of December 2019.

Winning is undoubtedly the most important, but I would also like to look at other reasons why customers have had good success experiences.

Let's immediately look at forward test (performance measurement).

Measuring from January 27, 2016, it's nearly four years of data; there have been no significant drawdowns, and profits have accumulated. This is truly wonderful—a rare EA, no doubt.

Maximum 15 positions, so you need a large margin and there is drawdown risk, but as shown in the image above, the maximum drawdown is 10.09% (233,312 yen), which, as mentioned, isn’t large.

Now, we'll stop the forward test here and compare with the backtest.

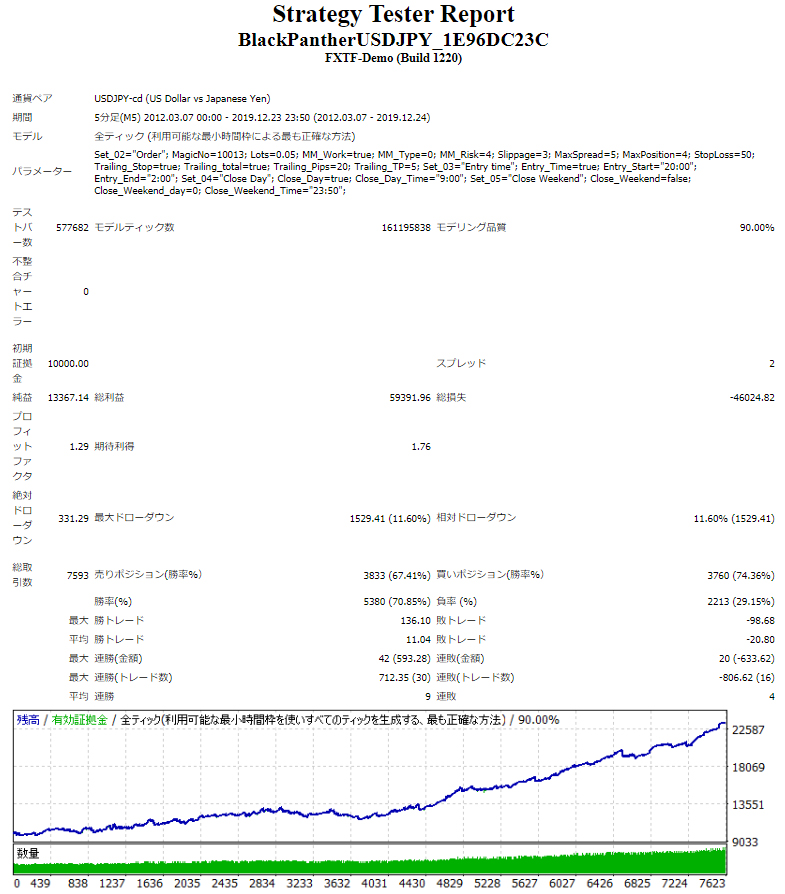

Backtest results with the parameters left at thedefault settings

Backtest results are from March 2012 onward, but when compared with forward tests starting in January 2016 or later, you can see that they trace nearly identical equity curves.

The reason backtest results and forward test results do not diverge is that, during EA development, they avoid over-optimizing to past market conditions (over-optimization). BlackPanther USDJPY appears to have been developed to accommodate various movements of the USD/JPY.

Now, let’s review the results in order;an article explaining the points to look for in an EAHonestly, how do you choose a good EA? describesthe items to check.

1. Forward results have accumulated to a reasonable extent, and the graph is upward-sloping

It would be fair to call it exemplary.

2. Low drawdown; not averaging-down or martingale

We cannot strictly say it has low drawdown, and since it holds 15 positions, a cautious expression is preferable.

Because it holds multiple positions, it does involve averaging down.

3. PF above 1.5Forward-test PF 1.38,Backtest PF 1.41, which is reasonably good.4. Risk-reward ratio = total profit ÷ maximum drawdown: 2.0 or higher is a guidelineForward-test 5.19,Backtest 9.82; these values are excellent.5. Risk-reward ratio = average profit ÷ average loss: above 1 and win rate above 50% means profitability remains.Forward-test 0.49,Backtest 0.55; these are low numbers, but win rates are 73.52% and 71.94%, respectively; considering the relationship with win rate, it’s quite good.Thus, as seen in backtests and forward tests, this is a very excellent EA.However, since many people are concerned about 15 positions, we changed the parameters to a maximum of 4 positions and ran a backtest.Backtest results for the four-position parameterThe results are, as expected, excellent.1. Forward results have accumulated to a certain extent, and the graph is upward-slopingIt would be fair to say it’s outstanding.2. Low drawdown; not averaging-down or martingale

Forward-test PF 1.38,Backtest PF 1.41, which is reasonably good.

4. Risk-reward ratio = total profit ÷ maximum drawdown: 2.0 or higher is a guideline

Forward-test 5.19,Backtest 9.82; these values are excellent.

5. Risk-reward ratio = average profit ÷ average loss: above 1 and win rate above 50% means profitability remains.

Forward-test 0.49,Backtest 0.55; these are low numbers, but win rates are 73.52% and 71.94%, respectively; considering the relationship with win rate, it’s quite good.

Thus, as seen in backtests and forward tests, this is a very excellent EA.

However, since many people are concerned about 15 positions, we changed the parameters to a maximum of 4 positions and ran a backtest.

Backtest results for the four-position parameter

The results are, as expected, excellent.

1. Forward results have accumulated to a certain extent, and the graph is upward-sloping

It would be fair to say it’s outstanding.

2. Low drawdown; not averaging-down or martingale

Maximum drawdown 1,529.41 (11.60%). Compared with 15 positions, the maximum drawdown ratio rose somewhat, but it’s within an acceptable range.

Because it holds multiple positions, there is averaging down, but it’s limited to 4 positions.

3. PF ≥ 1.5

4. Risk-reward ratio = total profit ÷ max drawdown: 2.0 or higher is a guideline

8.74; the speed at which drawdown impact is offset by profits appears to be fast.

5. Risk-reward ratio = average profit ÷ average loss; if above 1 and win rate above 50%, profits remain.

0.53 is a low figure, but it is offset by a win rate of 70.85%.

It’s clear that even with 4 positions, the results are more than sufficient. In practice,customers using it may have used 15-position settings or reduced the number of positions; it’s unclear, but likely many increased their capital and continued operating the EA afterward.

Mr. Trest, who created such a wonderful EA, has also listed other quality EAs.

That is SilverCoyote(Basic版).

Just by looking at the performance measurements, you can understand its excellence.

SilverCoyote(Basic版) has a maximum of 4 positions, so it can be considered easy to use with the basic settings.

Additionally,the reason Mr. Trest can develop so well is that he is a renowned cryptocurrency blogger.There is the fact that Mr. Trest is a well-known cryptocurrency blogger.

The following are articles written by Mr. Trest, and many customers subscribe to them both during the crypto boom and now.

Written by Hayakawa