Is the market volatile in weeks that include Major SQ? Anomalies surrounding SQ and the appeal of options and futures trading

Last week, December 13, 2019, was a Major SQ day, the day when the Special Quotation (SQ) for futures and options is calculated.

The Nikkei Stock Average and USD/JPY rose sharply from the previous day on the 12th, with the Nikkei rising about 400 points and USD/JPY about 100 pips.

The rise this time was driven largely by fundamental factors such as the UK general election and statements by President Trump, but

SQ factors also contributed to lifting buying pressure across a wide range of securities.

A Major SQ week is said to be prone to market volatility, but what exactly is SQ?

I would like to introduce when it occurs and how it affects the market.

What SQ Is

It is an abbreviation of Special Quotation, and in Japanese it is called the Special Settlement Index Calculation Day,

and it refers to a “special price” used to settle before the final settlement date.

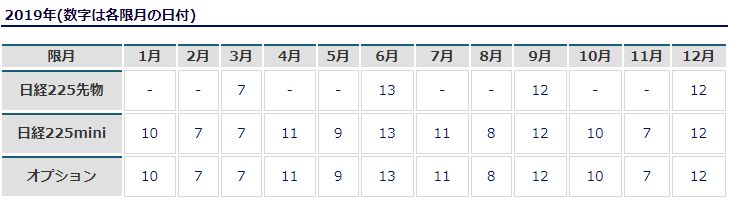

In futures trading, the second Friday of March, June, September, and December,

and in options trading, the second Friday of each month is the SQ day, with the preceding day the 12th acting as the last trading day.

A day when the SQ days for futures and options coincide is called Major SQ.

(SQ that applies only to monthly options trading is called Minor SQ)

(Image source:HS Securities)

What the SQ Value Is:

It is calculated based on the opening prices of the Nikkei 225 constituent stocks. After all stocks have opened, their opening prices are used to

calculate the SQ value.

(Source for the 2019 SQ value:HS Securities)

If you do not settle by the last trading day, you will be forcibly settled at the SQ value

In FX, you can choose when to settle, but for futures and options, the contract expiration is fixed,

so if you do not settle by the last trading day before the SQ, you will be forcibly settled at the SQ value.

Therefore, because there are various expectations among those who profit from selling and those who profit from buying, the market tends to be volatile ahead of Major SQ.

Anomalies Associated with Major SQ

◆ Phantom SQ

On the Major SQ calculation day, the Nikkei average does not touch the SQ value.

The upward “phantom SQ” that is higher than the intraday high of the Nikkei average is said to weaken the market in the following weeks, while the downward “phantom SQ” that is below the intraday low is said to strengthen the market in the following weeks.

Other notes,

・ Major SQ days tend to see the Nikkei average rise

・ The week with Minor SQ tends to see the Nikkei average fall

・ In weeks with Minor SQ, intraday volatility tends to be higher

These are the observed features.

These anomalies are said to have less impact in recent years, but due to psychological factors, they can affect the market in the short term.

Now, in the futures and options markets where such special SQ days exist, it may still be an investment market that is not well known.

In fact, the Nikkei 225 Mini can be started with about 66,000 yen in margin, and operating in units of 1 lot yields about 10,000 yen in profit if the price moves by 100 yen. In FX, even with a margin of 0.1 lot on USD/JPY at about 45,000 yen, a 100-pip move would earn only about 10,000 yen, so

from a volatility perspective, the Nikkei 225 may be more efficient.

If you’re a little interested in futures and options, why not try this?

◆ Free Video!

The 'Essence and Appeal of Nikkei 225 Options Trading' by a consistently profitable options trader

Related products:

Nikkei OP Selling

Ultra-simple practical Nikkei 225 Options Strategy Introduction — Basics

~Approximately 99% probability of earning 10–15% annually~

The era is now automated trading!

We also offer numerous stock automated trading solutions usable with Nikkei 225 futures, mini, and more.

◆ GatorsRobo: Nikkei 225 Futures Automated Trading

Connected online to your broker's trading server via Kabu.com API,

developed by an automated trading professional for serious winning automated trading robots

◆ AutoTrade 225

A 'Nikkei 225 Auto Trading Tool' that lets you set your desired investment rules

A cloud service that lets you trade even when your computer is off!

◆ Nikkei 225 Futures Auto Trading Mini (Mini) Dedicated Scalping (Source code available / for experimentation)

AutoTrade 225 for Nikkei 225 Futures Mini—a dedicated scalping auto-trading software.

Since settlements occur within the same day, you don’t have to worry about forced settlements due to SQ.

In addition, there are plenty of tools for stocks and futures/options.

“Stocks & Futures API”Please take a look below↓↓↓

Related articles:kabu.com API: trading environments once only accessible to brokerages and hedge funds, now available to individual investors!