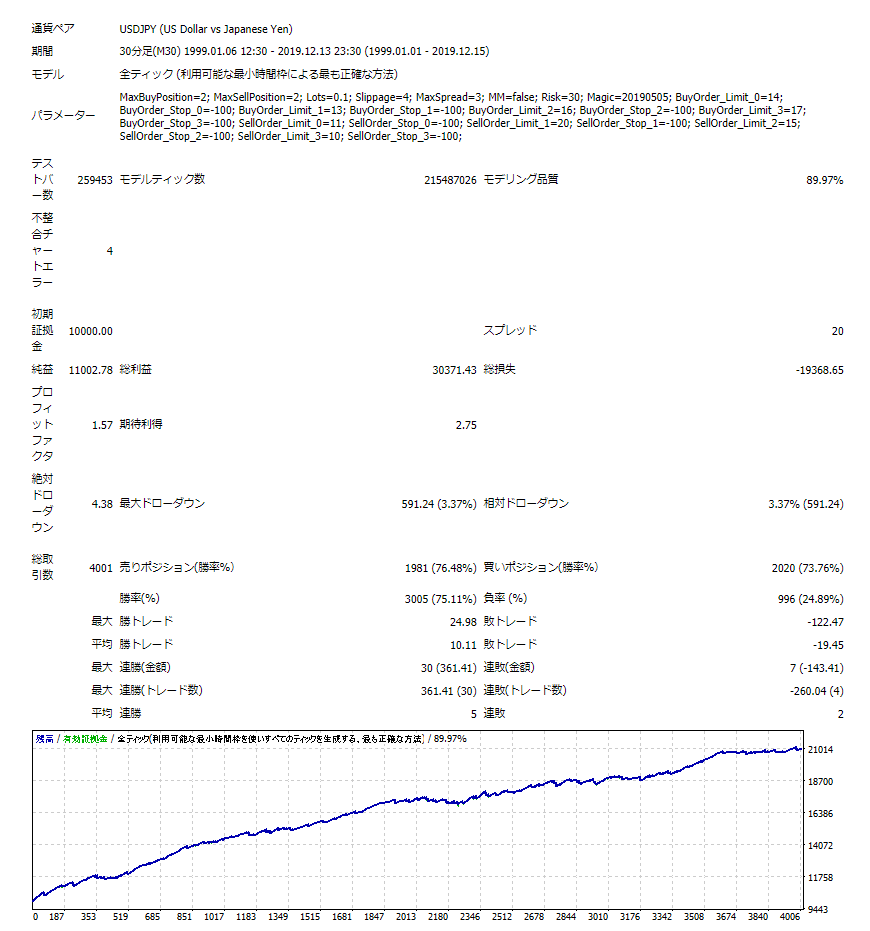

StarWolf bro uses Spread 2 pips for BT! Can be used with overseas accounts too!?

Following Star Wolf, StarWolf bro was also backtested with a 2-pip spread!

Even with a 2-pip spread, the recovery factor was 12 for Star Wolf, but 18 for bro!

The recovery factor is higher for bro, but the chart for Star Wolf rises more steadily to the right without a drop, and there are no annual losses, so it is difficult to decide which is better.

Both are excellent EAs, but in the GoGoJian Forward, Star Wolf recovered from the August DD, whereas bro has not recovered.

If both have similar forward graphs, there is no need to run them both at the same time, but since there are differences between the two EAs, it may be fine to run them simultaneously.

☆ USDJPY, 2-pip spread, 1999/1/1~2019/12/15 ☆

StarWolf bro, 2-pip spread, Monthly balance table

Even with a 2-pip spread, in years other than 2012 and 2018 there were no losses!

※ I also checked Star Wolf by month, and even with a 2-pip spread there were no annual losses.

⇒Backtest Star Wolf with a 2-pip spread! Can it be used with overseas accounts?!

StarWolf bro had no losses from January to July 2019, but it went into a draw in the month I released...

The discrepancy between backtest and forward test is almost nonexistent, as you can see.