High-frequency trading EA for EUR/JPY! Check out "Armada," which is also ideal for your portfolio

Shows its true value whether used alone or in a portfolio!

Armada: steadily piling up profits through stable trading

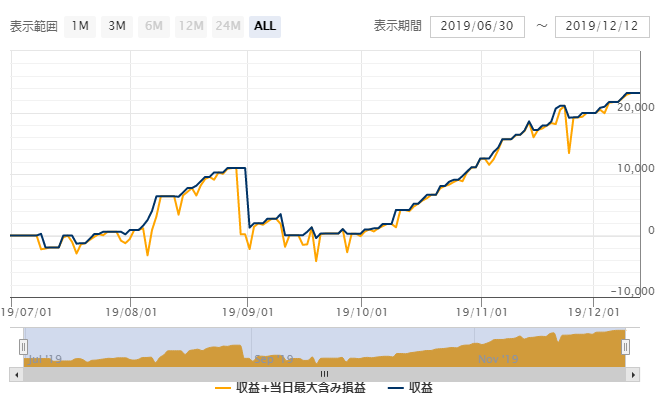

The forward period lasts about five months. There was a substantial drawdown in September, but from October it has been on a strong upward trajectory.

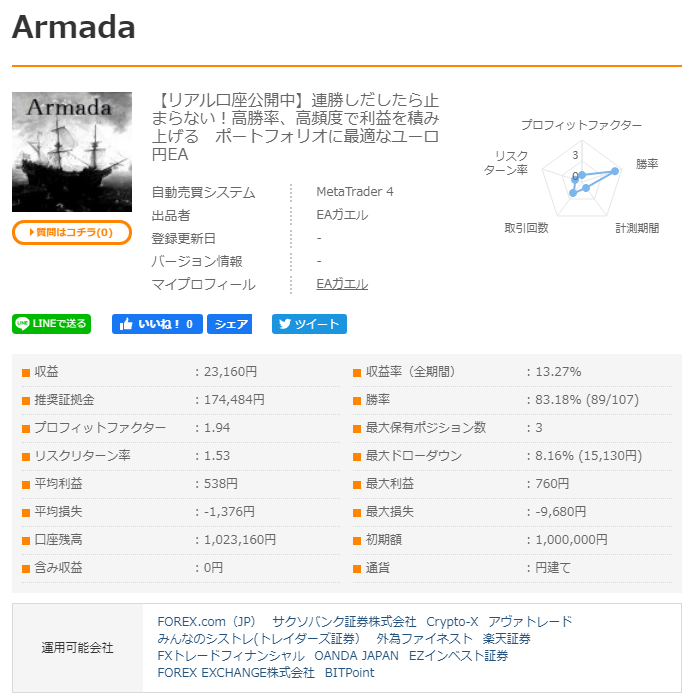

【Armada Overview

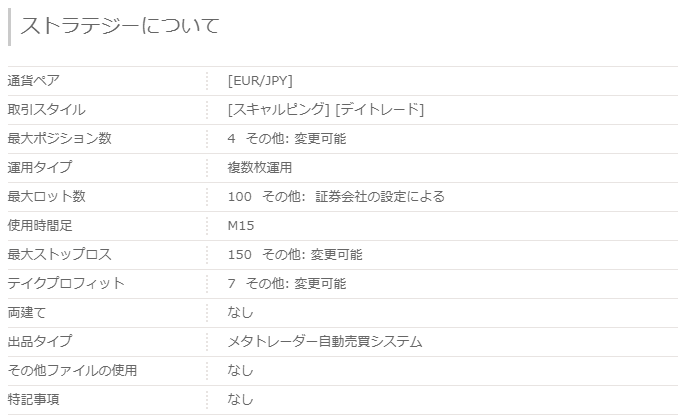

This is EUR/JPY only. The maximum number of positions is four, but it seems you can adjust it freely. Also, the sales page states that high performance can be achieved even with one fixed position.

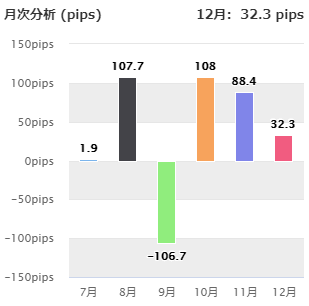

■Monthly Analysis

These are the monthly results for 2019. There was a large loss in September, but the other months delivered excellent results.

A total of 231.6 pips were gained, averaging about 38.6 pips per month.

It initially shows -100 pips, but has steadily earned profits.

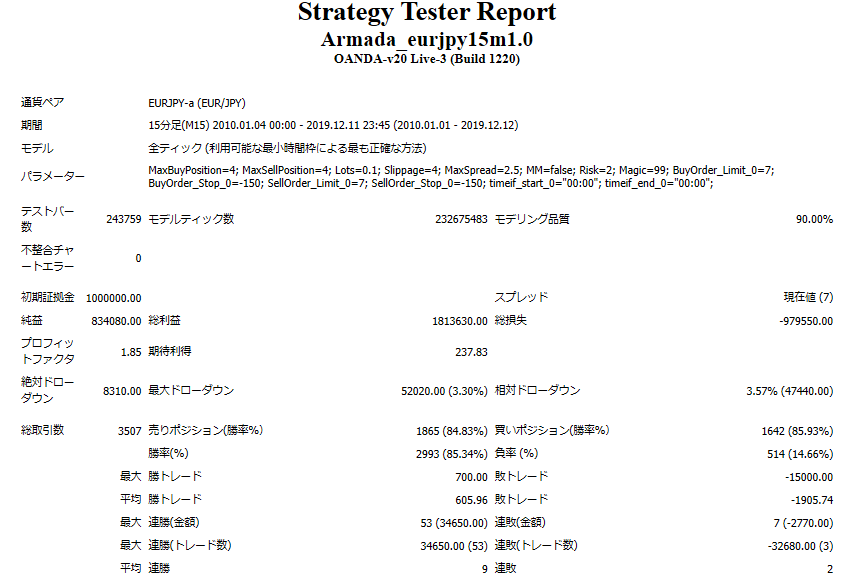

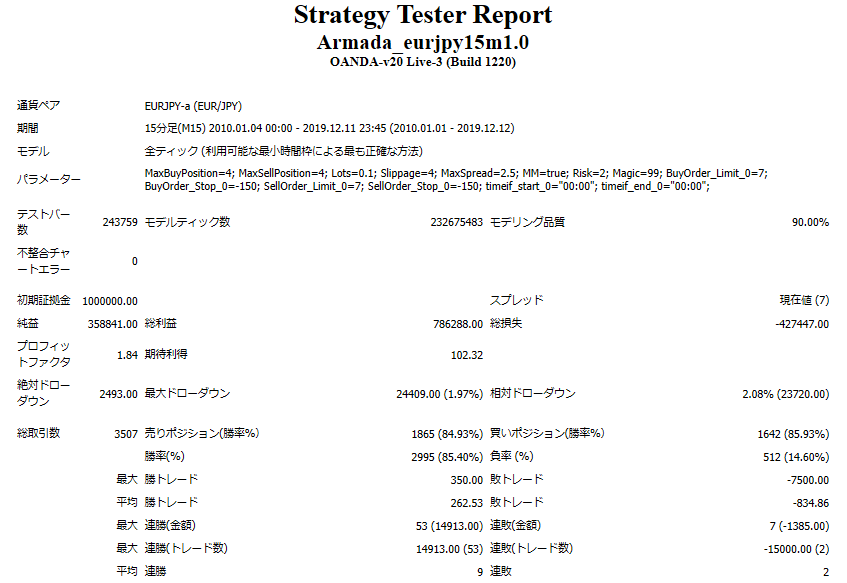

【Backtest Analysis】

2010.01.01‐2019.12.12

Spread 7.0

Net profit +834,000 yen (annual average 83,000 yen)

Maximum drawdown -52,000 yen

Total trades 3,507 (annual average 350)

Win rate 85.34%

PF 1.85

The maximum drawdown was in the low 3% range, very low, and the PF was close to 2.

Running with 4 positions, the drawdown is low, so even small amounts can be traded with confidence.

Recommended margin amount is fixed at 0.1 lot

(4.9×4)+(5.2×2)=30(万円)

The expected annual return in this case is about 27%.

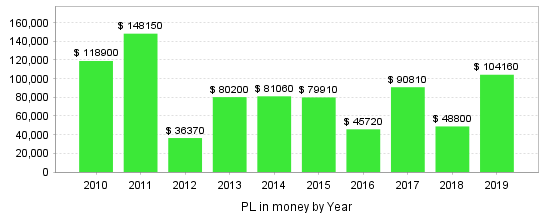

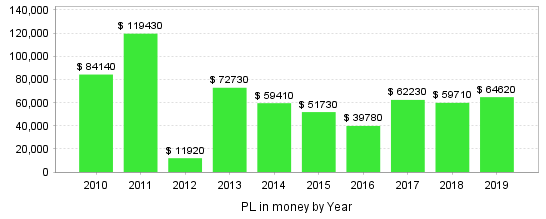

・Annual Profit

Yearly results with default settings. There were no negative years in ten years.

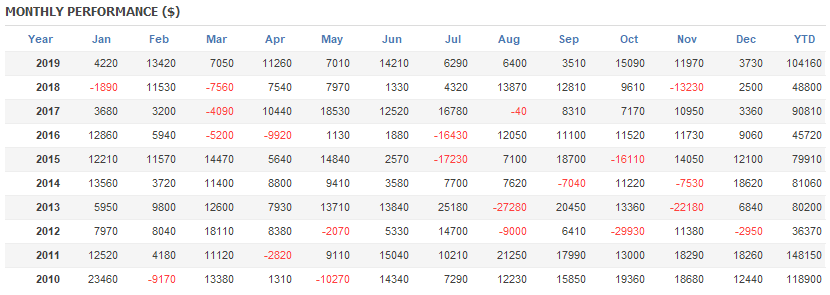

・Monthly Profit

Looking at monthly results, large drawdowns are not often observed. It is an EA that earns steadily.

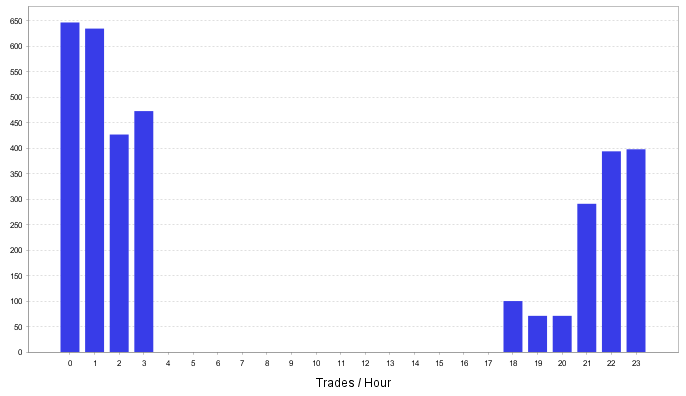

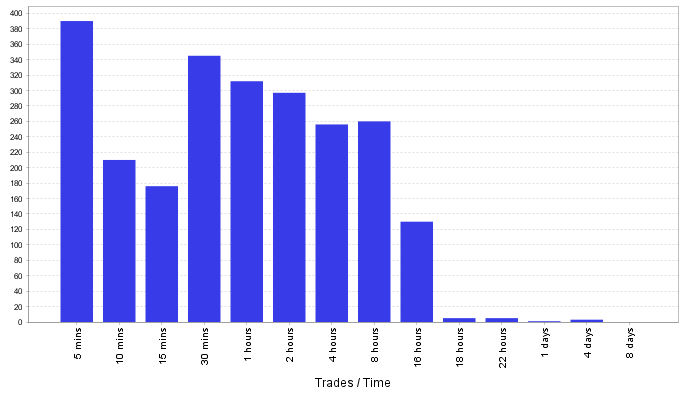

・Trading Time

As EUR/JPY, the trading hours are mainly during European time.

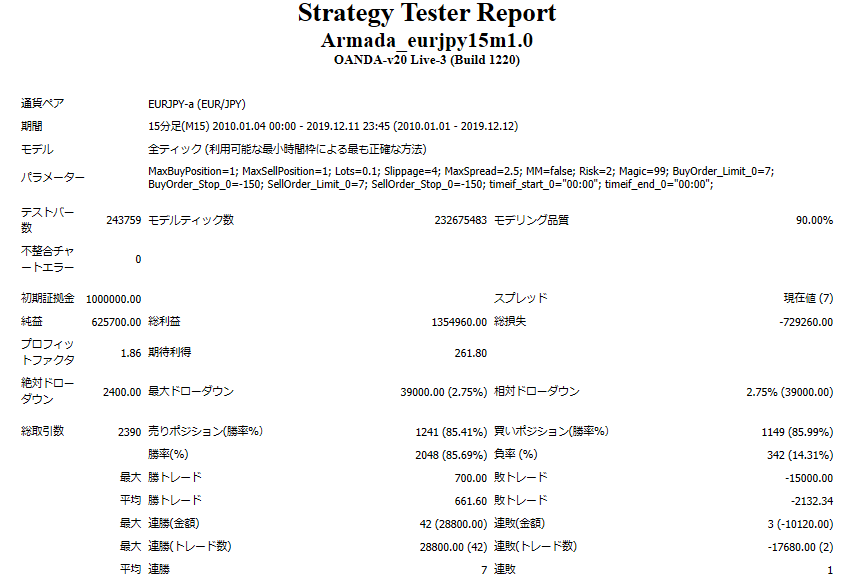

・1 Position

Because it can deliver high performance even with one fixed position, I ran a backtest.

2010.01.01‐2019.12.12

Spread 7.0

Net profit +62.5万円( annual average 6.25万円)

Maximum drawdown -3.9万円

Total trades 2,390 (annual average 239)

Win rate 85.69%

PF 1.86

Similar results, but the maximum drawdown dropped below 3% and the PF improved by 0.01.

(4.9)+(3.9×2)=12.7(万円)

The expected annual return in this case isabout 49%, a significant improvement.

・Annual Profit

If set to 1 position, yearly results are largely unchanged, and it has operated stably without any losses.

・Monthly Profit

Similarly, monthly results show steady earnings.

・Holding Time

As noted on the product page, the trading style ranges from scalping to day trading.

・Compounding

2010.01.01‐2019.12.12

Spread 7.0

Net profit +35.8万円( annual average 3.58万円)

Maximum drawdown -2.5万円

Relative drawdown-2.4万円

Total trades 2507 (annual average 2509)

Win rate 85.40%

PF 1.84

Backtest was performed with compounding enabled.

Max drawdown is under 2%, and relative drawdown is about 2%, enabling very low-risk operation.

・Portfolio

On the product pageyou can view the portfolio's live results on Myfxbook.

Single-use yields stable profits, and it's highly convenient to include in a portfolio, making it a stable EA.

The current forward performance continues to trend upward and is in excellent condition.

Why not consider implementing it now?

2010.01.01‐2019.12.12

Spread 7.0

Net profit +834,000 yen (annual average 83,000 yen)

Maximum drawdown -52,000 yen

Total trades 3,507 (annual average 350)

Win rate 85.34%

PF 1.85

The maximum drawdown was in the low 3% range, very low, and the PF was close to 2.

Running with 4 positions, the drawdown is low, so even small amounts can be traded with confidence.

Recommended margin amount is fixed at 0.1 lot

(4.9×4)+(5.2×2)=30(万円)

The expected annual return in this case is about 27%.

・Annual Profit

Yearly results with default settings. There were no negative years in ten years.

・Monthly Profit

Looking at monthly results, large drawdowns are not often observed. It is an EA that earns steadily.

・Trading Time

As EUR/JPY, the trading hours are mainly during European time.

・1 Position

Because it can deliver high performance even with one fixed position, I ran a backtest.

2010.01.01‐2019.12.12

Spread 7.0

Net profit +62.5万円( annual average 6.25万円)

Maximum drawdown -3.9万円

Total trades 2,390 (annual average 239)

Win rate 85.69%

PF 1.86

Similar results, but the maximum drawdown dropped below 3% and the PF improved by 0.01.

(4.9)+(3.9×2)=12.7(万円)

The expected annual return in this case isabout 49%, a significant improvement.

・Annual Profit

If set to 1 position, yearly results are largely unchanged, and it has operated stably without any losses.

・Monthly Profit

Similarly, monthly results show steady earnings.

・Holding Time

As noted on the product page, the trading style ranges from scalping to day trading.

・Compounding

2010.01.01‐2019.12.12

Spread 7.0

Net profit +35.8万円( annual average 3.58万円)

Maximum drawdown -2.5万円

Relative drawdown-2.4万円

Total trades 2507 (annual average 2509)

Win rate 85.40%

PF 1.84

Backtest was performed with compounding enabled.

Max drawdown is under 2%, and relative drawdown is about 2%, enabling very low-risk operation.

・Portfolio

On the product pageyou can view the portfolio's live results on Myfxbook.

Single-use yields stable profits, and it's highly convenient to include in a portfolio, making it a stable EA.

The current forward performance continues to trend upward and is in excellent condition.

Why not consider implementing it now?