Mr. Tetsuo Inoue: When it comes to commodities, supply and demand are what drive them (three charts of speculators including the foreign exchange market)

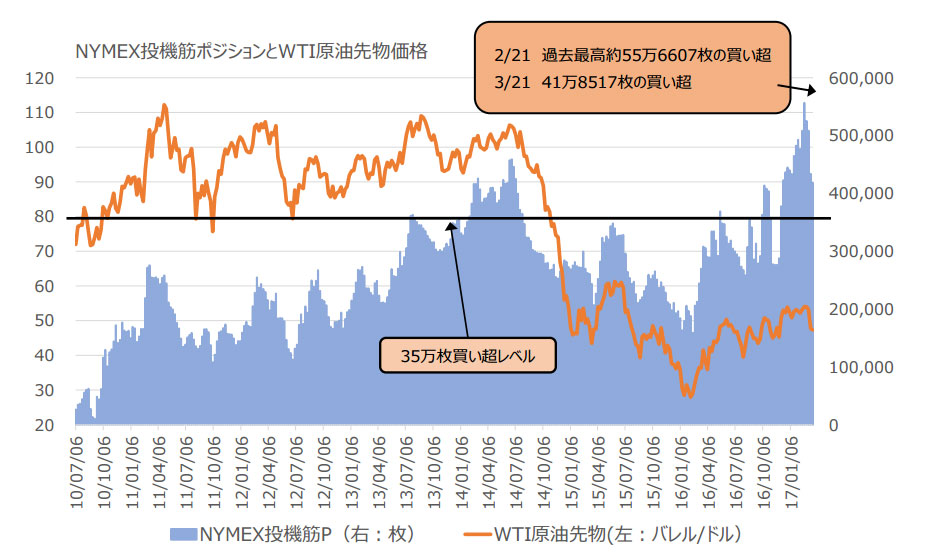

Now, first of all regarding the crude oil market which has been under harsh criticism, the rig count—the number of active drilling rigs across the United States—continues to edge up slightly each week. On average, it’s around ten rigs per week. In addition to the Permian, the count has also bottomed out in the shale mecca regions of Bakken and Eagle Ford (though efficiency isn’t very high) and is turning into a gradual increase. Also, although there are seasonal factors, inventories are at an all-time high. The question “Is the pipeline with Canada really necessary?” makes you wonder. It is puzzling why those labeled as “commodity experts” do not point out that the reason U.S. inventories are high is that imports from the country remain high. After all, commodities are all about supply and demand (as price-setting power)…

Regarding the NYMEX speculative positions that I have continued to point out, the week of 2/21, with a record high net long of 556,607 contracts, had fallen to 418,517 contracts by 3/21. That is a rapid unwind of 25% in about one month, a quarter. However, there are still positions to be reduced to reach the long-standing “speculator net long limit” of 350,000 contracts. Eventually, they will likely fall to around 300,000 contracts.

Until then, I have no intention of buying at all. For one thing, before I founded my current company, I worked at Asia’s largest fund-of-funds (a fund that combines several hedge funds to reduce total risk and pursue stable returns). I know that the total capital of funds dealing in commodities has not increased since 2012. The buildup of speculative long positions in a market where overall capital hasn’t grown implies nothing but “unwinding selling” later on.

OPEC announced this week that, before the end of May’s summit, as usual, a meeting of concerned parties will be held. This is the meeting where Iran boycotted last year when I first started this newsletter. It is expected to solidify a re-commitment to production cuts there, and many so‑called “experts” are hoping for that, but the impact is likely to be temporary. To repeat: in commodities, supply and demand are strong. (As an aside, the person I respect as a commodity—especially crude oil—expert is Mr. Hirokazu Kabeya of Daiwa Securities.)

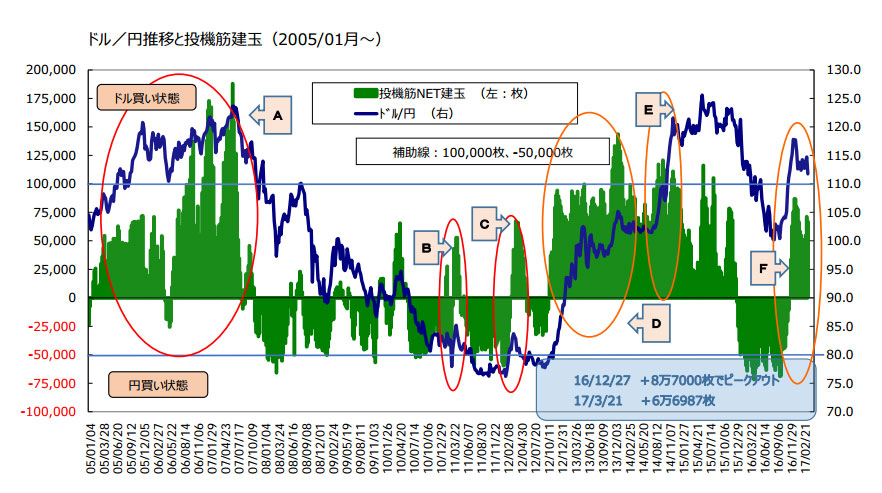

Now, the dollar/yen speculative positions, after peaking at the end of last year, bottomed at 50,517 contracts (the dollar-buying/yen-selling) in the week of 2/21 when NYMEX crude futures positions reached their historic highs as noted above. Three weeks later, on 3/14, they had risen by 43% from the bottom to 71,297 contracts, and last week they declined to 66,987 contracts, down about 4,300. I believe that unless Japanese stocks are bought again by foreigners, this renewed rise will not translate into a stronger dollar. (However, as I wrote before about dollar/yen movements, after a range-bound period I expect a gradual dollar appreciation and another range formation.)

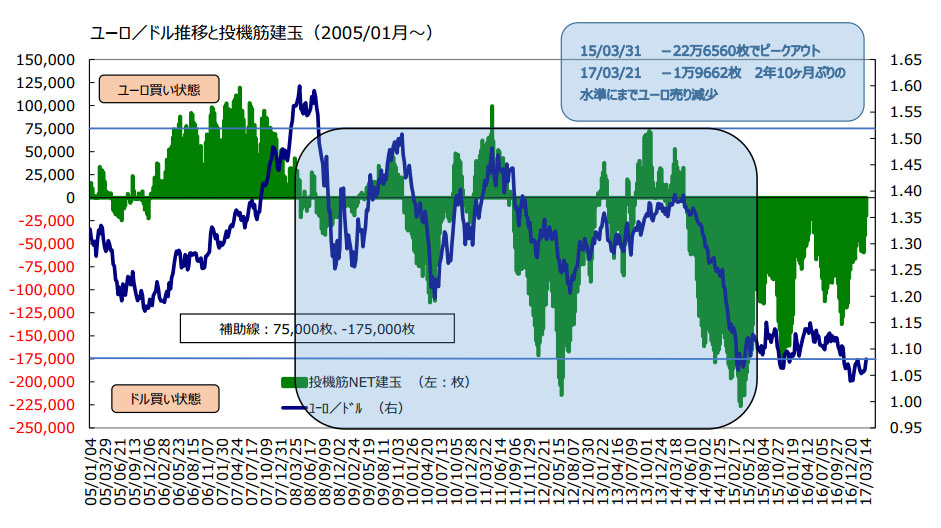

Finally, EUR/USD. Please look at the chart, but after the boxed area, the market has continued with little interest or appeal. Supply and demand fluctuate greatly, and the exchange rate moves accordingly, but despite the moves in positions, the movements of the exchange rate itself lack dynamism. Therefore, it remains a tiring environment with little profit.