An AUDNZD-exclusive EA that keeps winning with only short entries『Baby steps』

The currency pair'stargeting its characteristicsshortselling specialistexpert

with time differenceholding multiple positionsto keep

even the initial minor reversals become net positivescalping-to-day-trade EA

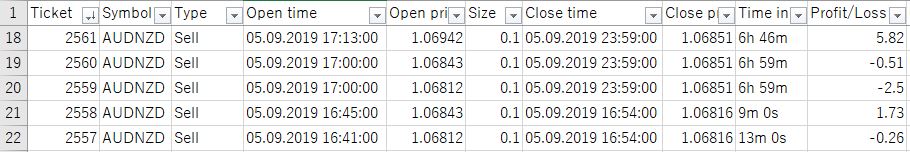

The forward period is currently about two months. Significant profits have been earned in late October.

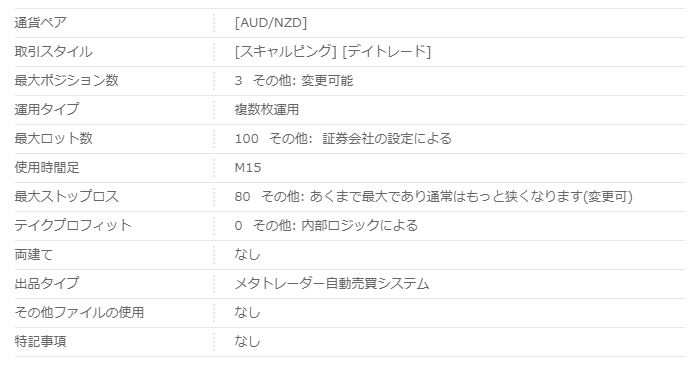

【Baby steps Overview】

The target currency pair is AUD/NZD, a pair of currencies from Oceania.

The timeframe used is 15 minutes, and the maximum number of positions is 3; this is a scalping-to-day-trading type EA.

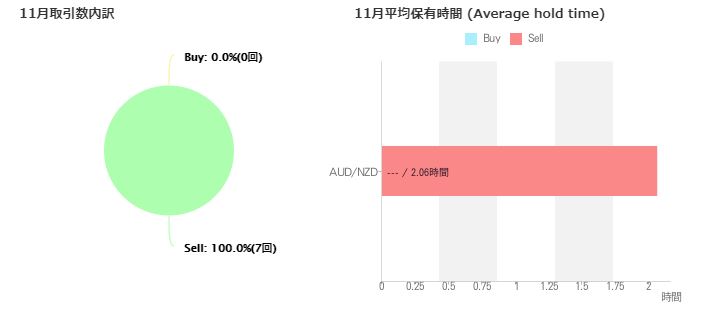

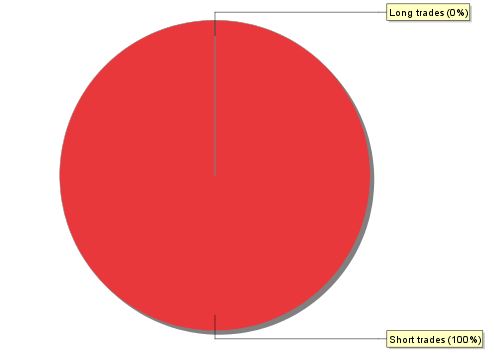

As seen in the forward-test's trade breakdown, the positions held are short only.

The AUD/NZD market shows a gradual downtrend on longer timeframes since 2010, so the logic appears to focus only on short positions.

AUD/NZD weekly chart

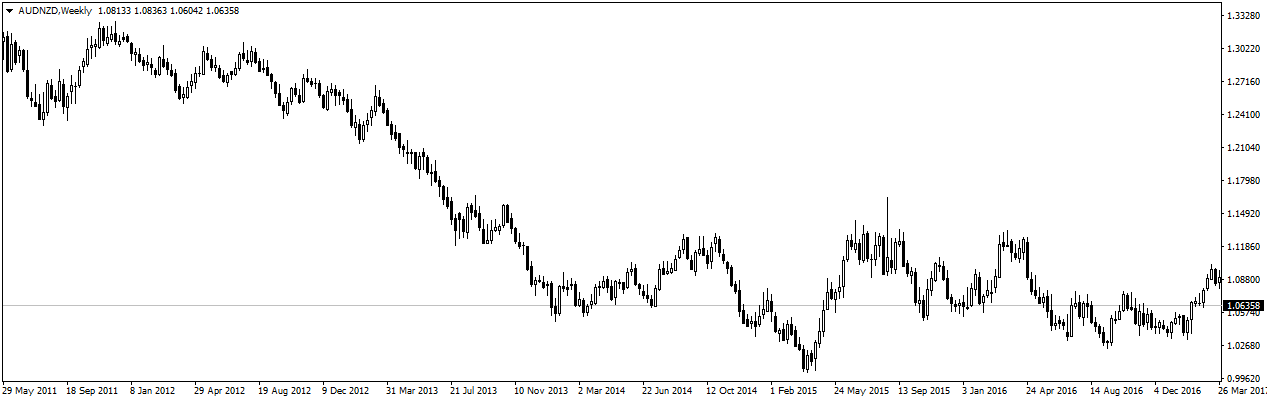

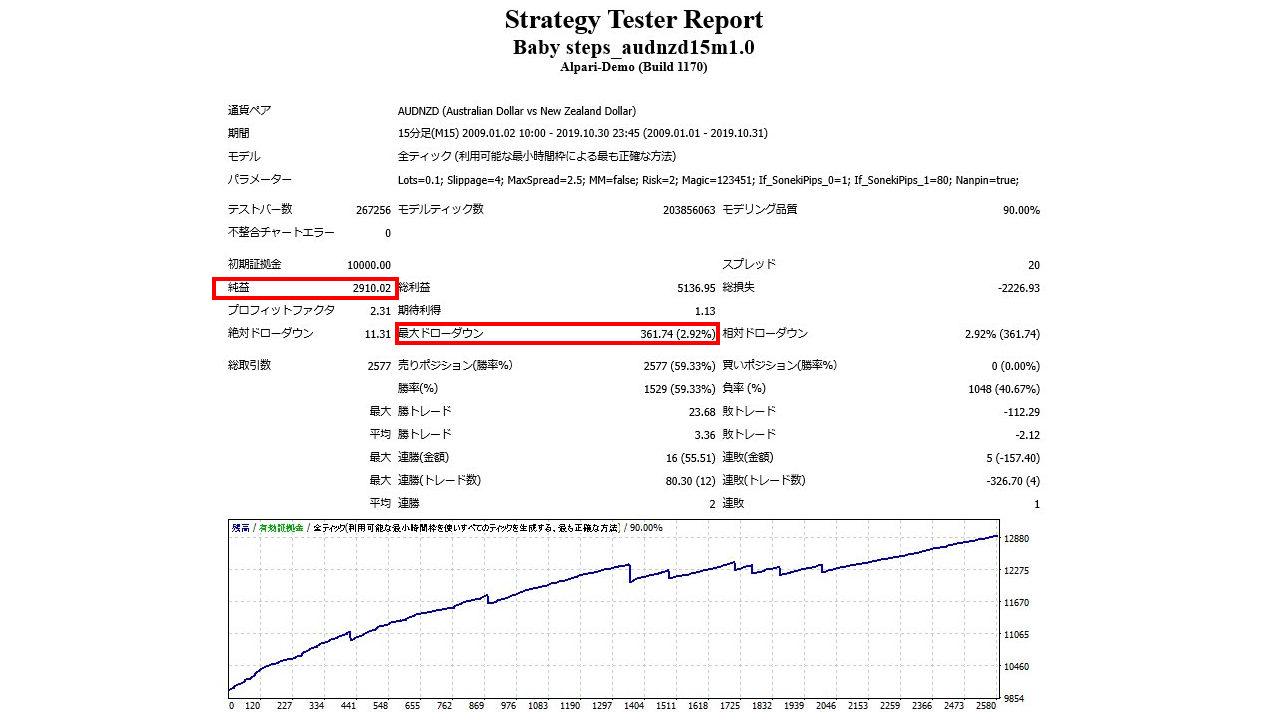

【Backtest Analysis】

The backtest period covers 2009 to the end of October 2019. The spread is 20.

2009.01.01–2019.10.31

Net profit +320,000 yen (annual average 29,000 yen)

Maximum drawdown −39,000 yen

Total trades 2,577 (annual average 238)

Win rate 59.33%

PF 2.31

Recommended margin is fixed at 0.1 lot

(3*3) + (3.9*2) = 16.8 (ten-thousand yen)

The maximum drawdown is below 3%, and the PF is very high.

With a low margin per position and the currency pair's low drawdown, operating multiple positions safely from around 170,000 yen seems feasible.

With a low margin per position and the currency pair's low drawdown, operating multiple positions safely from around 170,000 yen seems feasible.

The expected annual return in this case is17.6%.

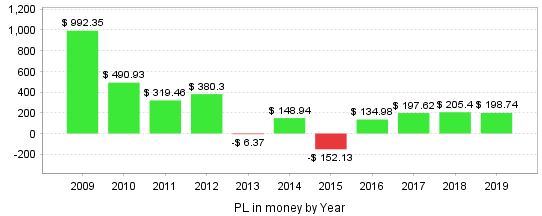

・Annual Revenue

It has yielded profits over about nine years, excluding 2013 and 2015. 2009 shows notable gains, but others are relatively stable with fewer fluctuations.

・By Year and Month

Win rate is over 90% on a monthly basis. In particular, the no-loss performance in the last three years indicates it can adapt to current market conditions.

Unless there are major fluctuations or sharp reversals in the AUD/NZD market, it should continue to generate profits reliably.

・Position Composition

As with the forward test, backtests over the past ten years also show short-only trades.

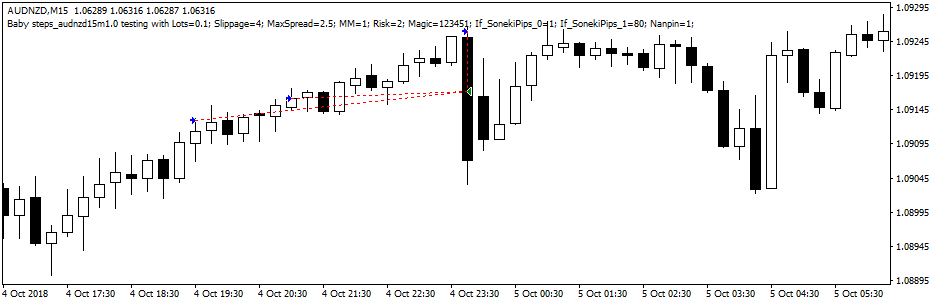

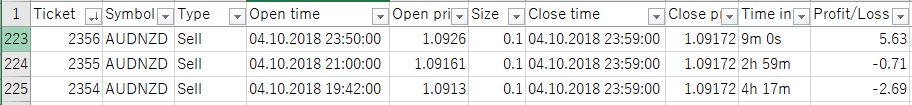

【Trade Analysis】

Here we review the trades from the backtest period on the chart.

Blue: Long Red: Short

Case 1

Opening 1–3 positions and closing all at once is a pattern often seen on the chart. In this case, positions 1–2 incurred losses, but after taking the third position there was a sharp drop, and at the bulk close it ended up net positive.

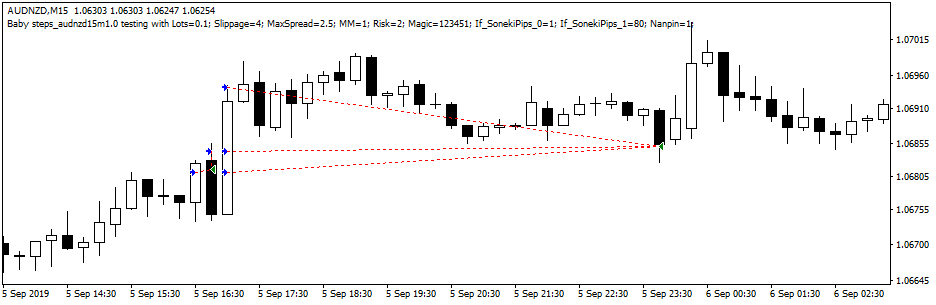

Case 2

Since this is scalping, once profitable, exits are quick and you can immediately take the next position.

Conversely, there is also the aspect of holding the third position for several hours to secure substantial profits.

Conversely, there is also the aspect of holding the third position for several hours to secure substantial profits.

From what we have seen, although it is an EA for multiple positions, the maximum drawdown is low and it is a stable EA that clearly understands the currency pair's characteristics.

Although entries are only short, the logic reliably captures downward phases, making it a recommended EA with stable profits.

The product page is here ↓

× ![]()