Foreign Exchange Online - Masakazu Sato's Practical Trading Techniques | Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [This Month's Theme | Focus on Economic Indicators such as ISM. Short-term trading strategies for v

As U.S.-China trade negotiations and Brexit uncertainties ease to some extent, the year-end market, prone to sharp swings, has arrived. Over the past four years, the dollar/yen has tended to reach highs in November and December and then plunge rapidly around the year-end/new year period. In this article, we explain how to choose and use short-term technical indicators to profit from recent price moves in USD/JPY, EUR/USD, and GBP.

*This article is a reprint/re-edit of FX攻略.com January 2020 issue. Please note that the market information described in the body may differ from the current market conditions.

Profile of Masakazu Sato

Sato, Masakazu. After working at a Japanese bank, he joined French bank Paribas (now BNP Paribas) and held roles such as Interbank Chief Dealer, Head of Funding, and Senior Manager. He later became Senior Analyst at the online FX firm with the world's highest annual turnover. He has over 20 years of experience in the currency markets. He also appears on radio program NIKKEI "Stock Complete Live Commentary! Stock Channel↑" and Stock Voice "Market Wide—Foreign Exchange Information," and regularly provides market information on Yahoo Finance.

ISM Shock and other market focal points: U.S. economic indicators worsening due to the U.S.-China trade war

With just one month left in 2019, the Christmas holidays in Europe and the U.S. are approaching. In the past, this period was known for its quiet markets, but since the end of 2015, stock markets and USD/JPY have tended to hit highs by December and then plunge during year-end/New Year, a pattern repeated for four years. The U.S.-China trade war, which shook the financial markets in 2019, managed to reach a “Phase One” agreement in early October. The United Kingdom’s orderly departure from the EU remains unclear, but trends suggest avoidance of a disorderly exit. When viewed this way, year-end 2019 could see continued risk-on sentiment—higher dollar and higher stock prices.

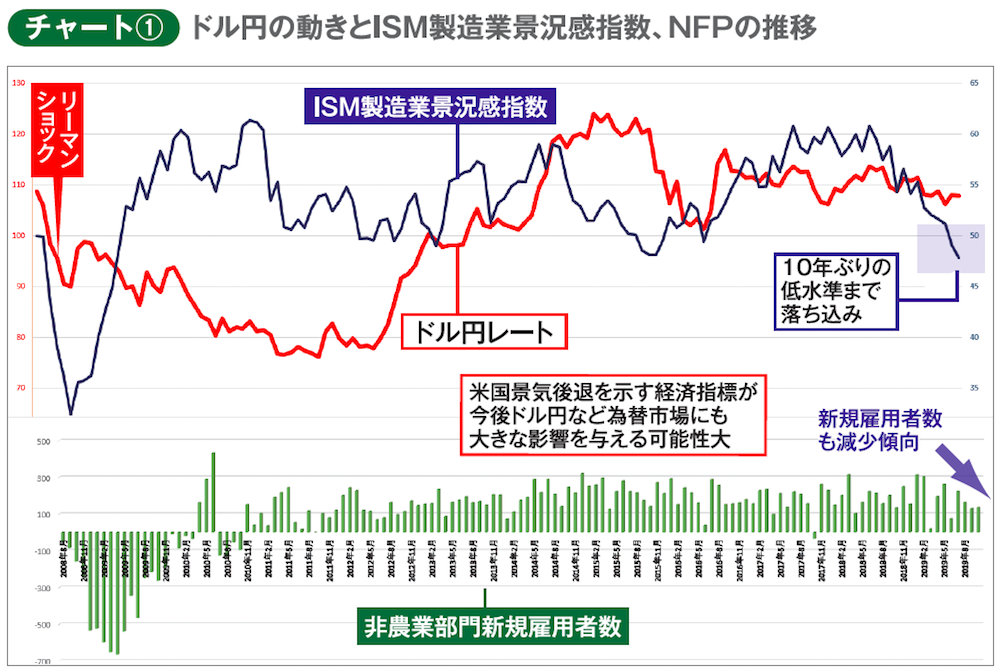

Going forward, the focus is likely to be on the real economy. How much the U.S. economy is affected by the trade war will be signaled by economic indicators. A key trigger has been the ISM manufacturing PMI released by the Institute for Supply Management. The index released in October (for September) deteriorated to its lowest level in over a decade, triggering the USD/JPY plunge described as the “ISM Shock.”

Chart ① shows the trend of USD/JPY, the ISM Manufacturing PMI, and nonfarm payrolls (NFP) from 2008, the year of the Lehman Brothers collapse.

Although the ISM index drop is clear, it is unclear whether this is temporary or will worsen further. However, in 2017–2018, NFP often exceeded 200,000 per month, while in August and September it fell short of expectations for two consecutive months.