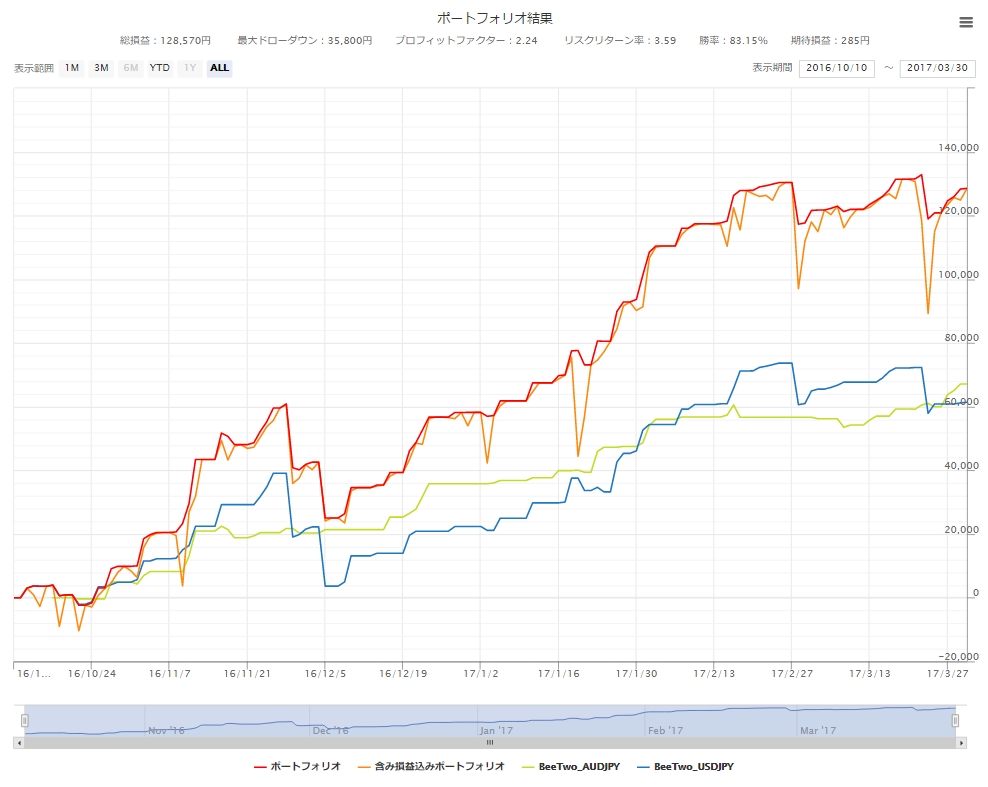

The appeal is that losses are small! BeeTwo AUDJPY on an uptrend

A steady uptrend is attractive!

BeeTwo AUDJPY

【EA Overview】

Currency pair: AUDJPY

Timeframe: 5 minutes

Maximum stop loss: 100 pips (logic exit)

Take profit: 13 pips

Maximum positions: 6

"Don't Cross Dangerous Bridges" Safe-Driving EA

【EA Features】

・A logic combining six moving averages, RSI, and WPR to aim for long-term stability.

・The logic allows a maximum of 6 positions.

・The six positions have different entry or exit timings and are designed to accommodate various price movements. (Depending on price movements, entries and exits may occur simultaneously.)

・No averaging down, Martingale, or hedging.

・It avoids entries during time periods with unfavorable moves, such as mornings in Tokyo, London, and New York markets.

・All positions are closed on Fridays (before the weekend).

・Logic is evaluated at chart bar close, so there is no difference between 'All ticks' in backtests and control points, and forward deviation is small.

・Includes money management (compounding) feature

【High Profit Factor & Risk-Reward Ratio】

In five months of forward operation

Profit factor 4.33,

Risk-reward ratio 4.27

This simply means a high win rate with a favorable risk-reward design.

The maximum stop loss is 100 pips, but most exits are logic-based,

On average, 5.9 pips approximately.

As evidence, the maximum drawdown during the period was 15,720 JPY, while it earned roughly four times that, about 67,150 JPY.

Recommended margin is 235,000 JPY with 25x leverage, which is quite modest.

With a recommended margin of 1,000,000 JPY, running 0.4 lot would still have a maximum drawdown of about 60,000 JPY,

the five-month forward period would yield a profit of just under 270,000 JPY!

【Backtest & Forward Performance Comparison】

As you can see from this graph,

losses are quite small relative to annual profits.

In 2015, the worst year in backtests, annual gain was 790 pips,

other years are stable at 1000–2000 pips.

The forward period runs from late October 2016 to late March 2017, five months,

gains of 671 pips in five months, and at this rate, 1000–1300 pips per year seems achievable.

【Bee Series: Differences from Other Currency Pairs】

The Bee Series consists of Bee One and Bee Two.

For both Bee One and Bee Two, USDJPY performs best, but the drawdown size is

a bit concerning.

Bee Two AUDJPY has no large drawdown waves and is an EA that is expected to rise relatively steadily.

Blue: Bee Two USDJPY

Green: Bee Two AUDJPY

USDJPY is a popular currency pair for EAs, but why not consider using other currencies as risk hedges?

Bee Series is also recommended for building a portfolio♪