The USD/JPY that isn't moving, up or down? 2020/2/18【Rikio Shima's Premium Video School Summary】

The “Shima Rikio FX Premium Video School” began selling on GogoJungle in November 2019.

Although you understand economic news and have studied technical analysis, when you actually face a chart you still don’t know where to enter, where to cut losses, or where to take profits... this is a learning and information-delivery content to build practical trading skills.

(Updated February 18, 2020)

The Structure of the “Shima Rikio FX Premium Video School”

【Delivery Frequency】

Once a week or more

【Delivery Method】

Videos are delivered on “Investment Navi+.”

【Delivery Content】

Market Recap (5-minute Market)

Basics of Technical Analysis

Fundamental Analysis

Options Information

Other content added as needed

【Pricing】

Monthly 3,500 yen

On this page, we provide a sneak peek of the latest FX Premium Video Letter contents, fundamental analysis, and options information.

We will also add an index of past content, so you’ll know which issue you should watch by looking at this page.

This time we briefly introduce the content of Premium Video Letter Episode 15.

【Updated February 18, 2020 (Tuesday)】

In Episode 15, updated on February 17, 2020, the video explains “5-minute Market” and “What the investment banks are looking at for this week’s forex.”

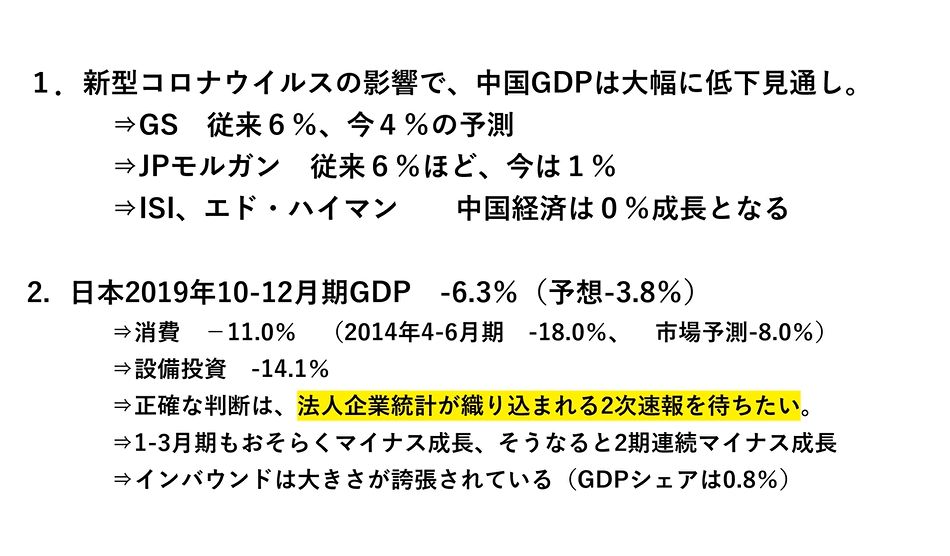

As expected, the topic centers on the novel coronavirus. China’s GDP is expected to deteriorate significantly.

Japan’s GDP also contracted more than forecast.

【5-Minute Market】

The USD/JPY is range-bound with about a 50-pip swing; it will move in one direction or the other, so I’d like to pick it up on dips.

EURUSD was the good performer; daily range is small, but it has dropped about 200 pips over roughly two weeks.

The move was led by EURGBP, highlighting the weakness of EUR.

Is it now the time for a rebound in the pound?

Also mentioned are AUDUSD, NZSDUSD, EURCHF,

and which cross-Swiss currency pairs to hold given the long-term strength of CHF.

There was no analysis of options information this time, but options information is provided every few issues.

<Point!> About Options Information

We explain current large options orders and expiration dates while watching actual screens.

Knowing options information helps identify price levels where the market tends to stall and price bands that are more likely to be reached.

We are covering three weeks of NY option cut information.

Please also take a look here

>How can you apply options information to trading?

(Related videos)

【FX Video】 How does Rikio Shima teach you pro knowledge? How to apply options information to trading? (1)

【FX Video】 How does Rikio Shima teach you pro knowledge? How to apply options information to trading? (2)

Note: Those who purchase the monthly 980 yen “Money Up” can view for free. Standalone article price: 500 yen

Table of Contents for Past Premium Video School (to be added in order)

【Episode 1】

- Technical Analysis (Beginner) — How to read moving averages

- Fundamental Analysis (Intermediate) — How that investment bank views the market

- Options Information (Advanced) — Viewing the biases in market orders

【Episode 2】

- Technical Analysis (Beginner) — The importance of money management and concrete trading steps

- Fundamental Analysis (Intermediate) — How that investment bank views the market

- Options Information (Advanced) — Viewing the biases in market orders

【Episode 3】

- Technical Analysis (Beginner) — MACD

- Fundamental Analysis (Intermediate) — How that investment bank views the market

- Technical Analysis (Intermediate) — How that investment bank analyzes it

- Options Information (Advanced) — Viewing the biases in market orders

【Episode 4】

- Recent market recap

- Basics of Technical Analysis — Why do trends occur?

- Technical Analysis Course (Intermediate) — How that investment bank analyzes it?

- Fundamentals Course (Intermediate) — What is that investment bank saying?

- Options Information (Advanced) — Viewing the biases in market orders

【Episode 5】

- Goldman Sachs 2020 Recommended Trades Analysis

【Episode 6】

- Market Outlook Following the FOMC

- Options Information

【Episode 7】

- 5-Minute Market “UK Conservative Party Large Victory”

【Episode 8】

- 5-Minute Market “After a Gap-Up Rally, How to Respond”

【Episode 9】

- “5-Minute Market” + “This Week’s Forex Market as Seen by Investment Banks”

【Episode 10】

- “5-Minute Market (BOE Preview and Options Market Check)”

【Episode 11】

- “5-Minute Market” + “This Week’s Forex Market as Seen by Investment Banks”

【Episode 12】

- “5-Minute Market (Whether to Play the Year-End/New Year Setup)”

【Episode 13】

- “5-Minute Market” + “This Week’s Forex Market as Seen by Investment Banks”

【Episode 14】

- “5-Minute Market” + “This Week’s Forex Market as Seen by Investment Banks” + A Report on the US Forex Report

【Episode 15】

- “5-Minute Market” + “This Week’s Forex Market as Seen by Investment Banks”

Sales page is here

written by Tera GogoJungle Marketing.