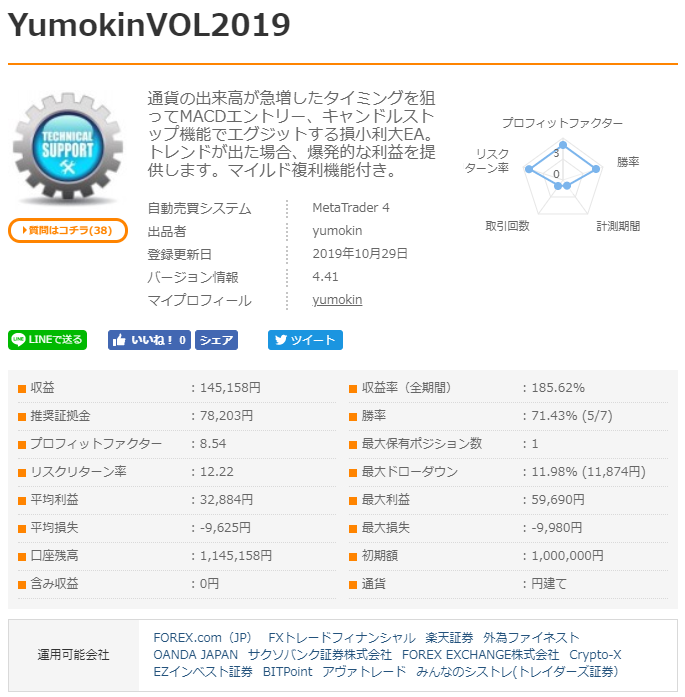

Expected annual return of 40%↑ with compounding available, and substantial profits! The GBP/JPY Swing EA "YumokinVOL2019"

Small loss, big gainto earn big

The reversal risk is also well covered by robust logic including the "Candle Stop Function" and other features

GBP/JPY Dedicated Swing-Trade EA

※As of November 12, 2019, with the version upgrade of this EA, we have updated the data and analysis regarding「Backtest Analysis」.

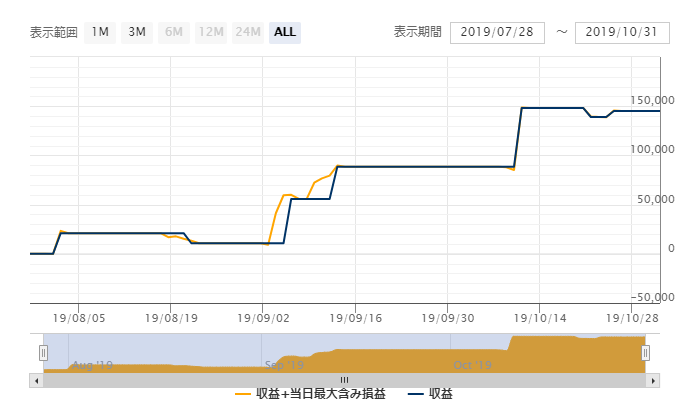

The forward period has progressed to about three months.

Because this is a swing-trade, the number of trades is small, but profits are substantial when positions are closed.

【YumokinVOL2019 Overview】

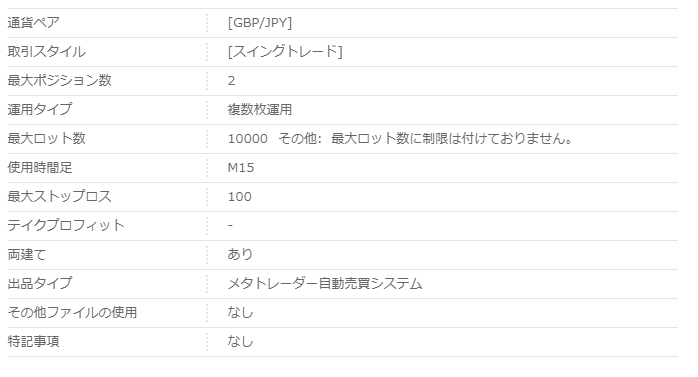

“YumokinVOL2019” is a GBP/JPY-only EA on a 15-minute chart.

The stop loss is set at 100, and it seems to allow hedging with up to two positions.

Also, because it uses the internal logic of the settlement-support tool “Settlement Support-kun” with its Candle Stop Function, it will set the stop loss at the lowest price for a recent long candle and at the highest price for a recent short candle.

⇩Details of Settlement Support-kun⇩

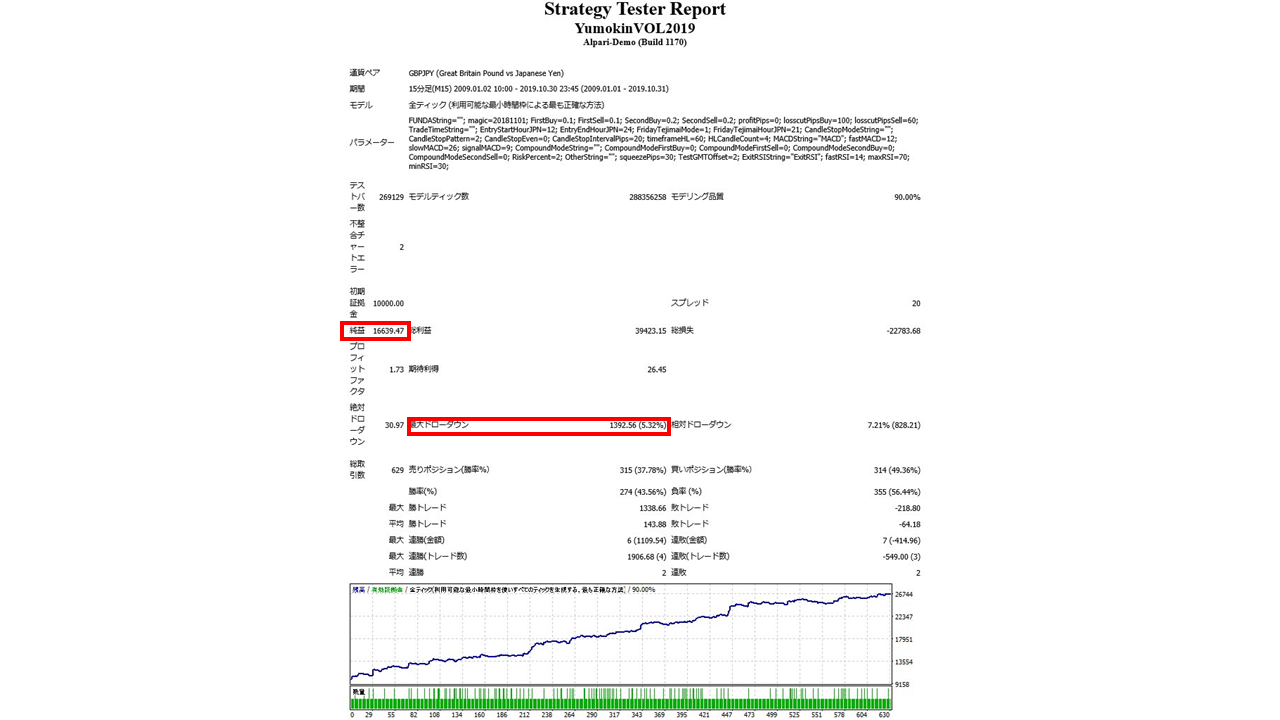

【Backtest Analysis】

※As of November 12, 2019, a version upgrade has been confirmed, so the data has been updated.Backtest period covers 2009 to the end of October 2019.

2009.01.01‐2019.10.31

Spread 2.0

Net profit+ ¥1,830,000 (annual average ¥169,000)

Maximum drawdown -¥153,000

Total trades 629 (annual average 58)

Win rate 43.56%

PF 1.73

Recommended margin amount fixed at 0.1 lot

(5.5×2)+(15.3×2)=41.6(万円)

Therefore, 420,000 yen or more is a safe operating benchmark.

The expected annual return in this case is about 41.6%.

Although the number of trades is low and the win rate is low, the PF is very high, and substantial profit is earned per trade.

Maximum drawdown is also low at 5.32%, and the expected annual return exceeds 40%, a remarkable result.

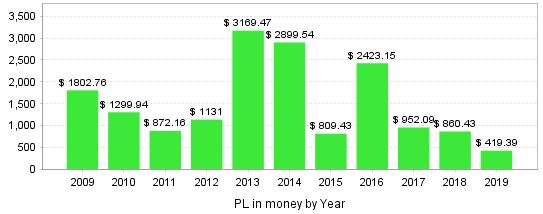

・Annual Profit

Since 2009, it has earned profits every year, and it can handle both historical and current market conditions.

Looking monthly, it is common to see over $400 earned in a month in recent results, making profitability attractive.

The profit range when in the positive is large; YumokinVOL2019 captures price movements with logic that does not miss the profit opportunity.

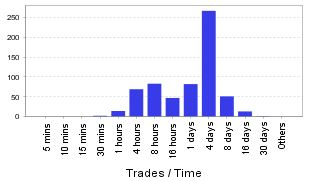

・Holding Period

Being a swing-trade type, the holding period is worth noting.The most common holding period is about 4 days, which suggests the “weekend exit mode” is functioning.

・Mild Compounding Feature

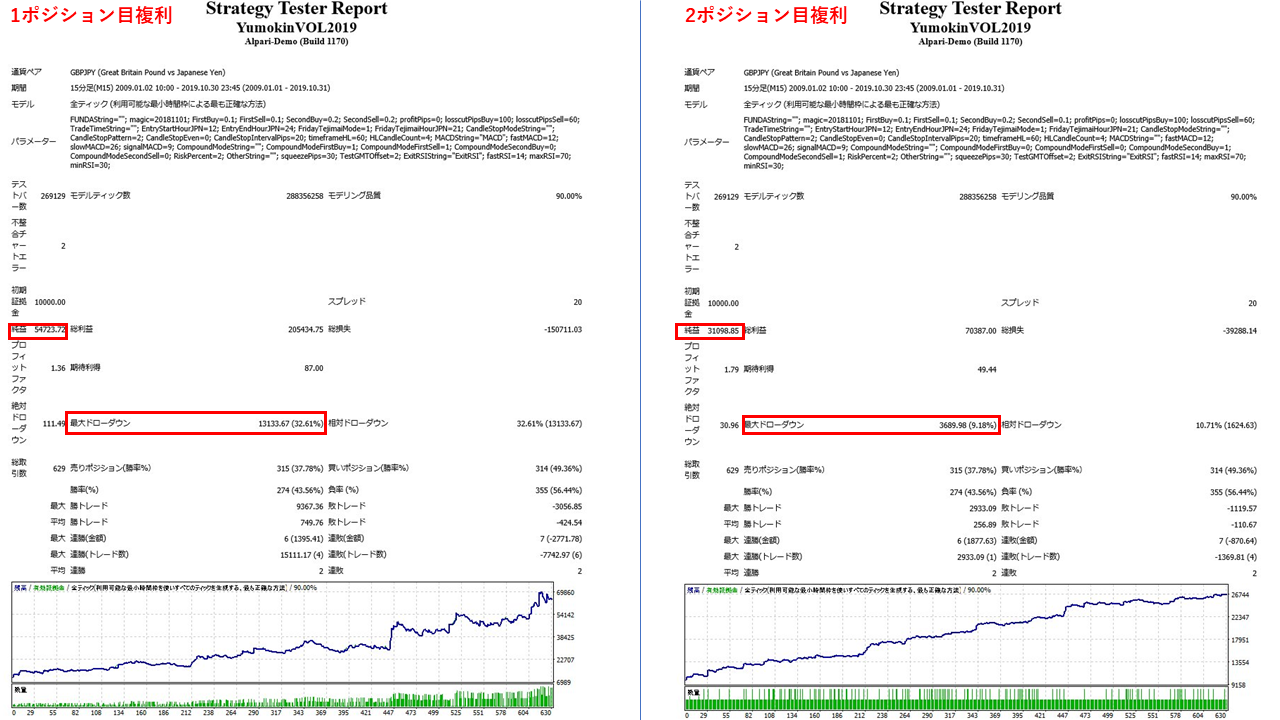

You can set compounding for each position individually in the parameter settings.This time, we compare (1) compounding only for the first position (Long/Short) and (2) compounding only for the second position (Long/Short).

① First Position Compounding

Net profit +¥6,010,000

Maximum drawdown -¥1,444,000

Total trades 629

PF 1.36

Compounding only the first position increases entry opportunities, so net profit rises dramatically (about 3.2x compared with simple interest).The tradeoff is higher drawdown, though kept to about 30%.

Net profit +¥3,420,000

Maximum drawdown -¥405,000

Total trades 629

PF 1.79

Compounding only the second position reduces the compounding-entry timing compared with case ①, so net profit growth is more modest, but the advantage is a lower drawdown remains (9.18%), and net profit grows, PF 1.79, yielding overall excellent results.

Although the number of trades is the same, which position is used for compounding greatly changes profit, max drawdown, PF, and other metrics.

Parameter settings allow even finer compounding settings for only one direction (long or short), so it’s good to tailor settings by combining the EA’s features with market analysis.

As the feature name suggests, you can operate with mild compounding by allocating it according to your preference.

【Trading Analysis】

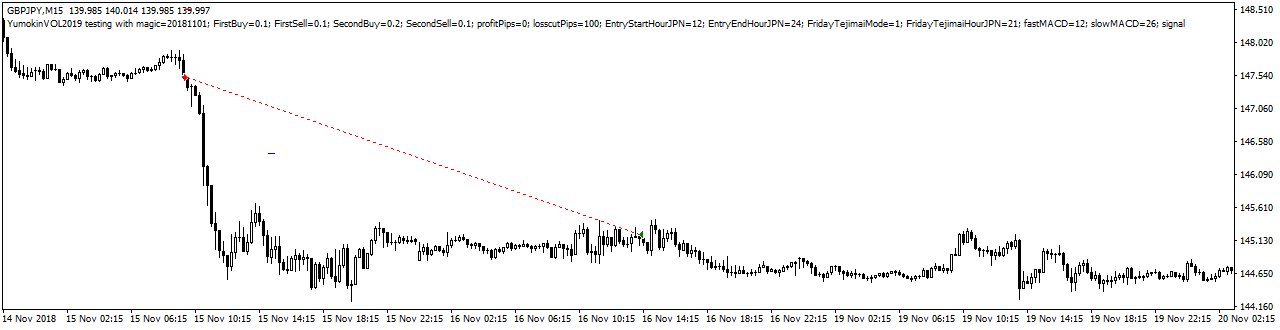

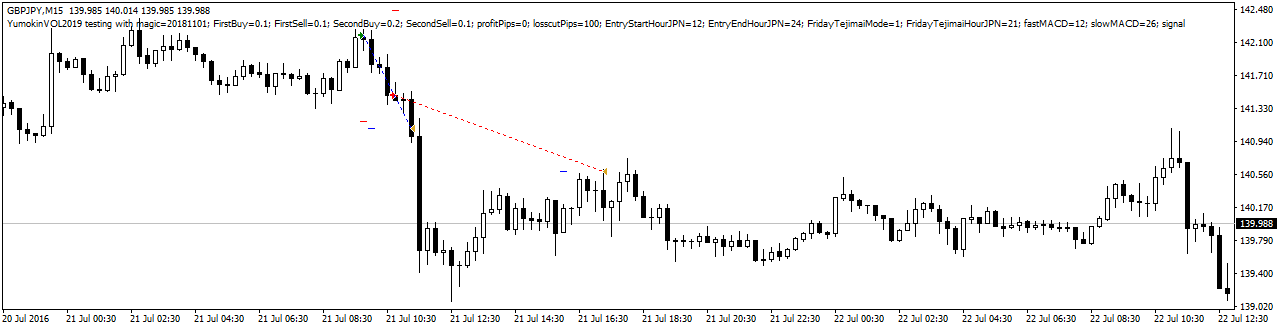

You can review the trades during the backtesting period on the chart.Blue: Long Red: Short

Case ①

Entry uses MACD, so it detects sharp declines well, and as a swing trader, it captures the large price move without exiting immediately on the most recent rebound.

Case ②

Here, the first long position was moving unfavorably, so a second position was entered short.

The long was likely stopped out by the Candle Stop Function at the most recent low on the left edge of the chart.

The short position subsequently captured substantial profit.

【In Conclusion】

The above analyses show that YumokinVOL2019 is a low-trade, swing-trade EA that achieves a loss-small, profit-large profile, generating substantial profits per trade.If positions move in your favor, profits will continue to grow; even when adverse, the built-in hedging of the second position and the Candle Stop Function minimize risk, making it a recommended EA for long-term substantial gains.

Product details are available here⇩