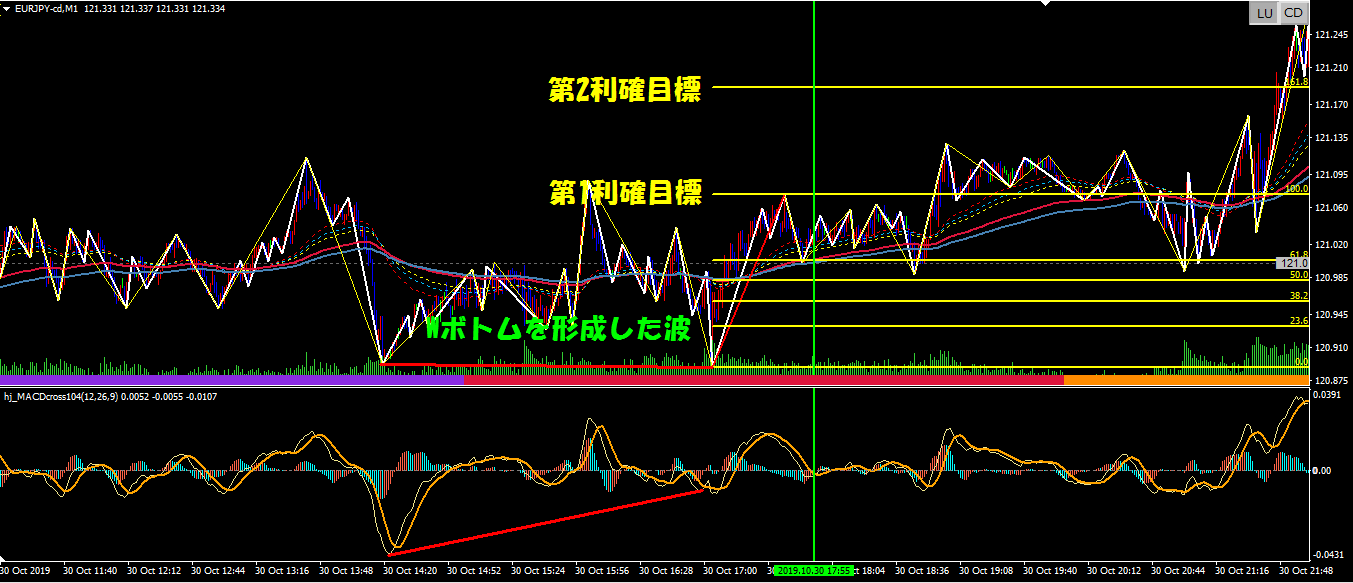

[10/31] Waves can occur not only in the evening but also at night! Example of EUR/JPY trade

Hello! I’m Sakki, a wave trader (@skiym_aaa).@skiym_aaa I am a full-time trader after quitting my first job after three years.

My trading style is day trading,

and I trade aiming for the third wave of Elliott Wave every day.

Now, let's quickly look at the Elliott Wave that occurred yesterday (10/30)!

★ EUR/JPY 1-minute chart Night (23:55)22.1pips gained!

※ The Fibonacci retracement is drawn from the end of Wave 1 toward the start point.

- Entry rationale (Wave 1 confirmation basis) → The wave that formed a double bottom

- Entry → After a 61.8% retracement by Fibonacci, MACD gold cross

- Target profit → 100% (5.3 pips) and 161.8% (16.8 pips) by Fibonacci

- Stop loss → 23.6% of Fibonacci

- Point → Divergence is occurring.

This time, I treated the divergent W-bottom wave as Wave 1.

Even if the pullback low or rally high isn’t broken, such a wave tends to be Wave 1!

Well then, see you tomorrow!

【Blog】

↓ I’m sharing my own trading performance and the method explained here, “Wave Trading”!

“How to Start as a NEET at 25”

【Twitter】

↓ I tweet updates about blog posts and real-time Elliott Wave examples!