Good news for MT5 discretionary traders! USD/JPY at 0.4 pips! The AvaTrade president, the first to be introduced in Japan, speaks about its appeal

The fact that MT5 has finally been introduced into Japan's FX market is mentioned in the article

AvaTrade Japan: MT5 (MetaTrader 5) service launched with the industry's narrowest spreads!

As already announced, this time, regarding MT5's appeal, AvaTrade Japan Co., Ltd. President Hiro Niwa explained in a video.

Video points discussed:

1. Above all, the spread cost is cheap and narrow: USD/JPY at 0.4 pips.

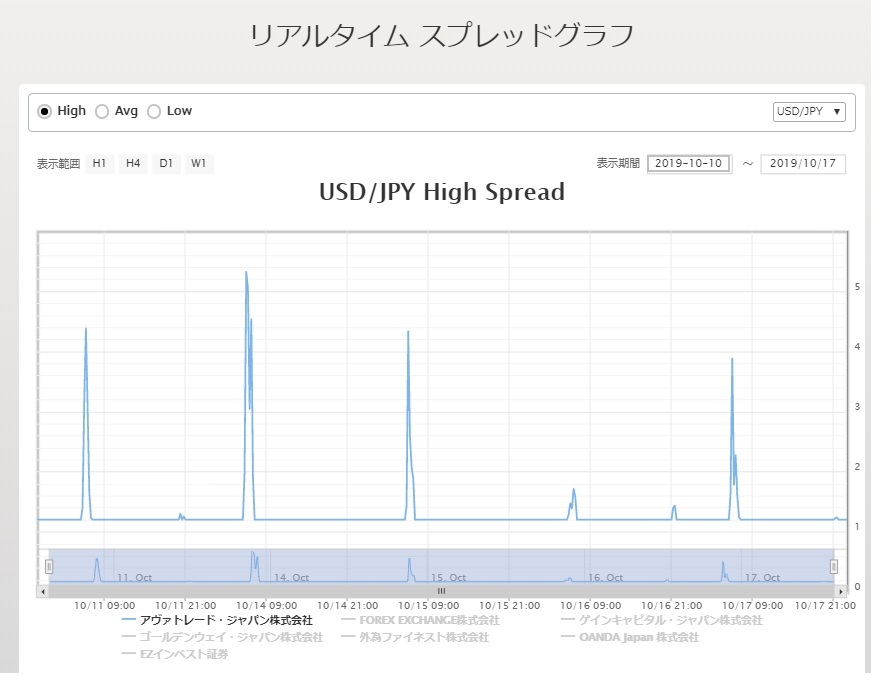

AvaTrade Japan's MT4 spreads are, as shown in the image below, generally around 1.2 pips for USD/JPY, which by Japanese FX company standards is not considered particularly narrow; it's a normal spread.

The reason is that AvaTrade Japan collaborates with investment advisory firms, and since the majority of investors use automated trading services or discretionary trading advisory services provided by these firms, there is no choice but to widen the spreads to recover the costs of that investment advice.

AvaTrade Japan's MT4 spread

is mostly stable around 1.2 pips, but you can see the spread widens for a brief period in the early morning Japan time.

However, with MT5, they do not partner with such investment advisory firms; instead, they want discretionary traders to use chart analysis to trade with AvaTrade Japan, and they have steered to narrow the USD/JPY spread to 0.4 pips.This means you can perform chart analysis and enter/exit directly from the chart.

That means you can perform chart analysis and execute entries and exits directly from the chart.

2. Tick data exists in the historical data for the past several days.

The existence of tick data is, in fact, a sign of confidence from FX companies that, yes, spreads do widen at times, but please take note of this point.

Generally, brokers advertise “principally fixed spreads,” but every company inevitably sees spreads widen during economic indicators releases, especially in the morning Japan time.

This background is that FX companies do not want to take on investor orders when there is no counterpart in the interbank market to pass them to; even if they do, they want investors to bear the cost.

AvaTrade Japan, by publishing tick data, lets you observe price movements during times when spreads tend to widen at economic indicator releases in the morning Japan time, and shows that even though spreads are narrow on a principle, there are times when they open wide compared with other FX companies.

In the video, Mr. Niwa himself operates MT5 and, checking the spread at the employment data release with tick data, found that at 21:30 before the employment release, for the 30 seconds before the release it was stable at 0.4 pips, and three minutes after the release it remained stable at 0.4 pips.

You could say they are offering an exceptionally competitive price.

Primarily for discretionary traders, AvaTrade Japan offers a narrow spread of 0.4 pips for USD/JPY, and moreover, even during times when spreads tend to widen during economic indicator releases in the morning Japan time, AvaTrade Japan MT5 remains relatively stable; this could be considered an essential trading account tool for succeeding in FX investing.

AvaTrade Japan Co., Ltd. MT5 Account Opening