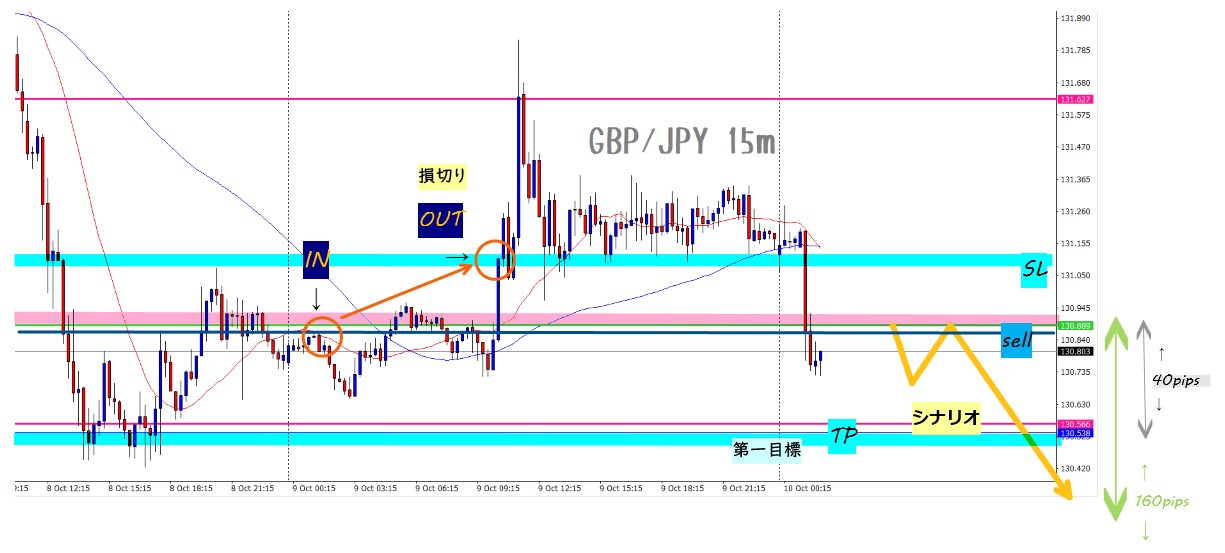

【Scenario】【Trade Result】【FX】Learning from a Stop Loss: October 10, 2019 (Thursday) 【GBP/JPY】

Hello, good evening, this is Chii-ko.

From yesterday's trade results

Result: Stop-out

The result was a stop-out.

In the afternoon, after I went for a Dragon Quest walk and came back, it had become a stop-out, you know.

As I wrote in yesterday morning's scenario article,

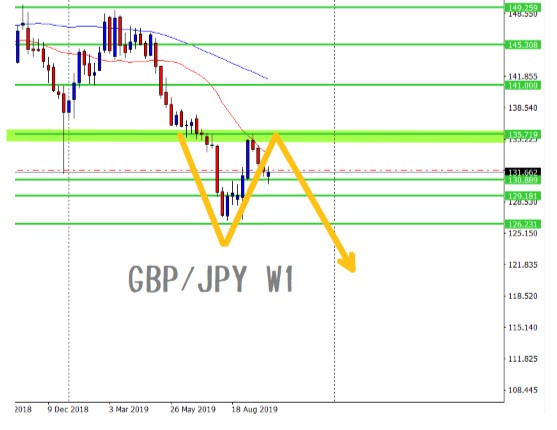

If you stop out in a selling direction, there may be a short-term upward move on higher timeframes, so please check. A short-term rise could be forming, so please verify.

Today's daily chart (as of 8:30 on 10/10)

① 10/8

② 10/9

③ Currently

prices go up and down day by day, so the future is unpredictable.

This is always the premise.

The previous day's candle for (②) closed as a bullish candle, you know.

Price movement forms by rising and falling.

High → Low → High → Low → High

There are no exceptions to this.

High → High → Low → High → Low → Low

This is the same thing.

Forecast and rules are separate.

Reflection session

You’re probably thinking, what suddenly happened?

I’m writing this at night from here.

In the morning, while I was writing the article,

there was a gap between what I understood from the environment and my own thinking,

and because I noticed it

I couldn’t continue writing the article.

Recently I was thinking of starting a new swing-trade project.

I was also thinking of the rules, and I thought it would be fine as long as the loss-width stayed within capital management.

I planned to secure a slot for day-trade losses and make it work.

Prices were around the weekly line, so there was a chance to enter near the line!

And just as I thought, this morning was exactly that timing, so

I entered while writing the article.

However, even when I tried to continue writing the article, there was a sense of mismatch and I couldn’t write.

So I analyzed it.

To put the conclusion first, I felt this was a symptom of “posi-positivity” (positional trading obsession).

I decided I shouldn’t do day-trading since I shouldn’t act on a scenario, so I can’t do it

If I did, it would be a violation of the rules, so no!

Swing is in alignment with the direction, and

there’s no major release of employment data soon, and the timing seems fine,

I wanted to hold a position though I couldn’t day-trade,

and I started justifying why I could do something somehow.

As I wrote in yesterday's article, in the daily chart explanation section,

>>If you stop out in a selling direction, there may be a rising move on the higher timeframe, so please check.

Since I was stop-out anyway, I naturally decided to check, but today even if a pattern appeared I’d pass on the trade.

By the way, the baseline is day-trading.

So, okay, day-trade is off, and from today I’ll run a swing-trade project.

Day-trading is difficult given the situation, so would a swing-trade project be okay???

→ Is that even possible? lol, right >www

Usually I don’t think this way, but what’s going on?

Since the entry conditions are the same, of course I should decide that I can’t enter here, too.

But because I wanted to enter near the line, and the pattern showed a pullback, I sold.

I’m treating it as a missed-day-trade, you know.

So why is this happening????

>>If you stop out in a selling direction, there may be a rising move on the higher timeframe, so please check.

Where did that go?

At the moment of entry, I wasn’t thinking about that kind of thing.

I felt a sense of anticipation, nothing more.

Then when trying to write the article, huh? I can’t seem to write anything?

What is this??

This happened.

I was writing that selling is a bit difficult under these conditions, but

Wait, didn’t I enter under swing-rule?

No explanation, but what was that???

Why did I sell??

This is strange, isn’t it?

In the end, it may seem like a result-oriented hindsight, but I’m deliberately including the outcome.

And it’s a kind of joke to receive such a thorough washout, you know lol

That said, the loss was within expectations thanks to the stop loss being in place, haha

Lessons

Follow the scenario!

I seem to be following the scenario, but I’m ignoring the caution notes, aren’t I?

The scenario would say, when this happens, do this,

>>If you stop out in a selling direction, there may be a rising move on the higher timeframe, so please check.

Having confirmed this condition, the trade should have been waited for, of course.

If you don’t wait, you’ll die!

That became the title of a trade article I wrote.

Nice miss!

If you don’t wait for the selling conditions to align, you might end up in dire trouble, see.

It’s a good thing it didn’t become a profit by mistake, right?

If you end up profiting by mistake, next time you might profit again when you’re wrong, which is dangerous.

Also,

Thank goodness for the stop loss!

There were good parts too, you know lol

The pound-yen pair is highly volatile, so I’ve seen moves of over 100 pips in an instant many times.

As long as you have a stop loss in place, you can limit losses to what you’ve already tolerated.

However,

since I realized the mistake in the morning, exiting the position on the spot was the correct decision.

Leaving a loss unmanaged is not good, right?

I think I was trying to survive.

※ “I think”

Until I could write the continuation of the article, I spent over 12 hours wandering the Dragon Quest streets as a form of escapism.

I was using writing to prevent emotional trading and managed to suppress it,

but this time it took longer to accept the mistake.

There was a lot to learn from this trade.

Because the gas work is happening, there’s no hot water~

Yes!

I hope this is useful.

Thank you for viewing until the end.

You can check the latest information on Twitter.

Please follow me.