【Scenario】【FX】Weekly Scenario Breakdown for the 2nd week of October: Reaching Scenario Points【GBP/JPY】

Hello, good evening, this is Chiiko.

The Pound/Yen is in a fall in this autumn of downtrends.

Since it entered a new price range after yesterday's decline, I’ll start from writing the scenario.

Technically, the shape is kinda nice right now, haha.

The feet lack momentum, so entering might be hesitant (*´з`)

W1: Weekly

The downtrend is continuing, as usual.

Still the same.

D1: Daily

The downtrend is continuing.

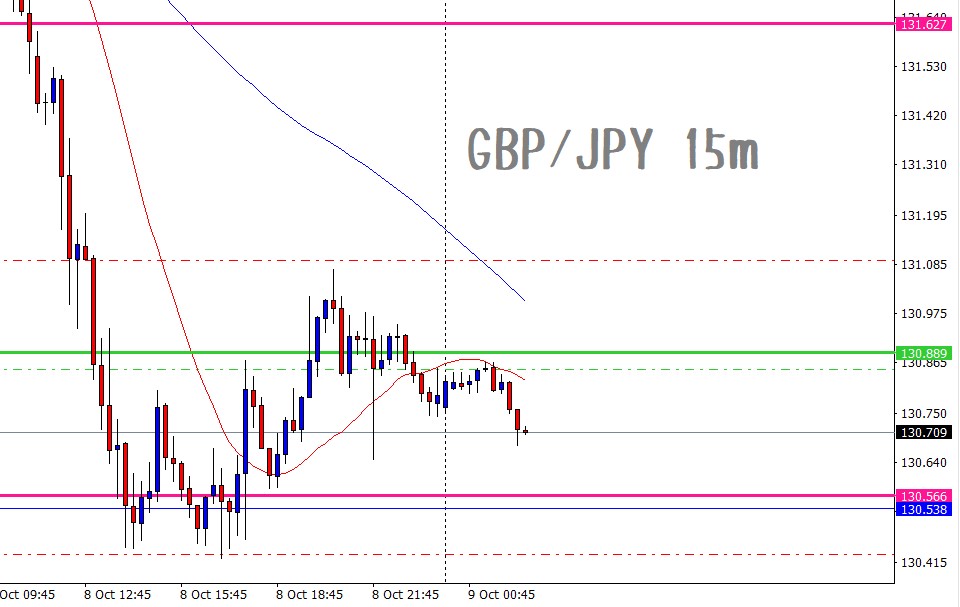

The weekly line around 130.889 hasbeen reached.

At the point of completion of the candle, it was a wick.

Will it break through like this, or resist?

If the sell side hits stop loss, in the long term(※)there may be a short-termupmove forming, so please check.

※There was an error in the expression on 10/10, so it has been grayed out.

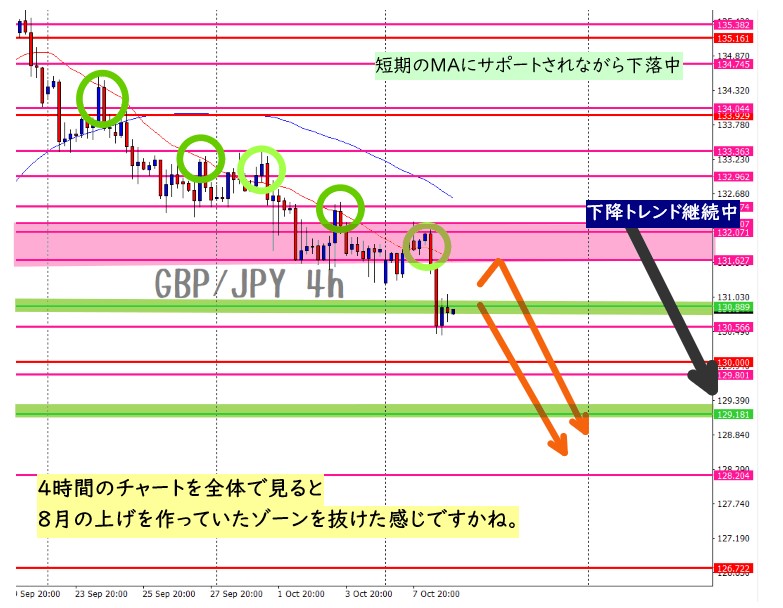

4h: Four-hour

The downtrend is continuing.

Declines while supported by short-term MAs.

It feels like it broke below the zone that had built the August rise.

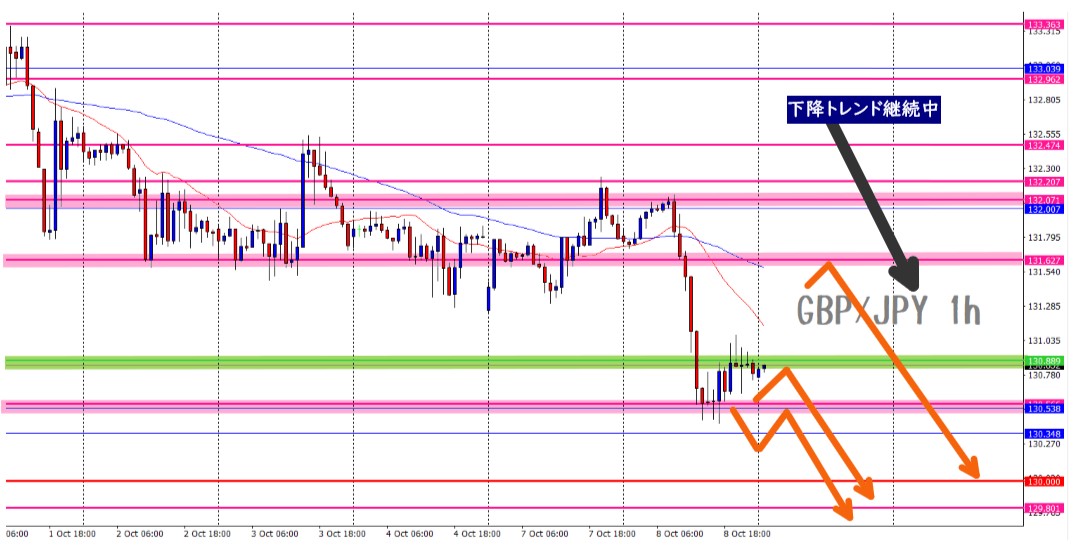

1h: 1-hour

The downtrend is continuing.

Same as the 4-hour, a selling scenario.

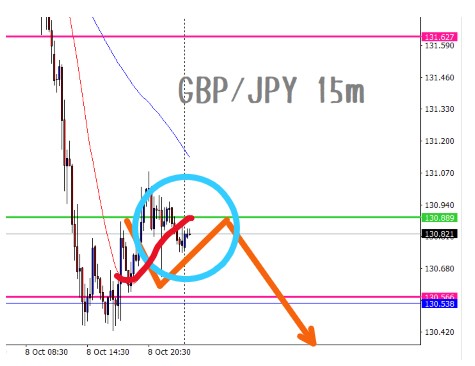

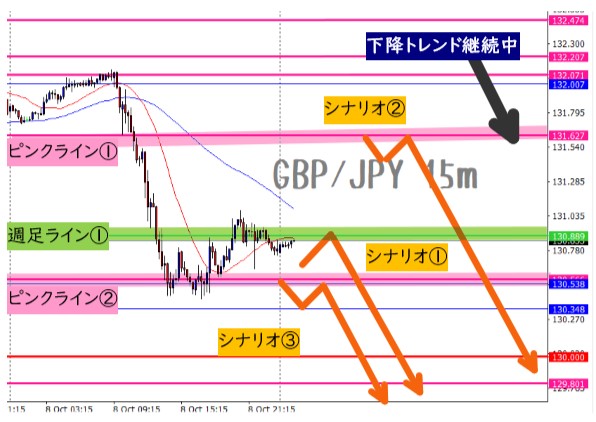

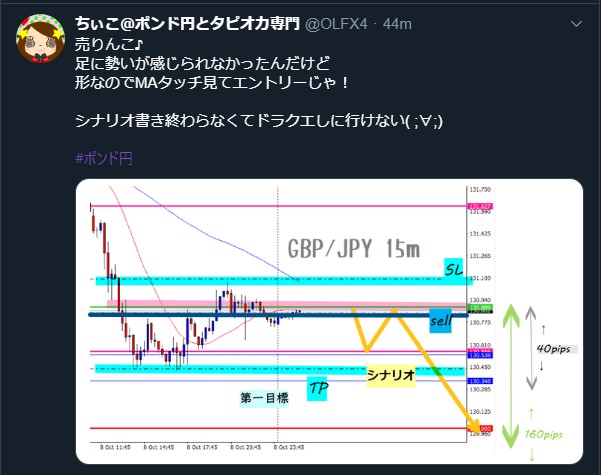

15m: 15-minute

The higher-timeframe trend is down, so,mainly sellingwill be traded.

The weekly line is broken at the body level on the 4-hour chart, so you could consider the weekly as having broken down.

(Scenario ②):If the weekly line ①is broken above,Pink line ①wait for a pullback to sell.

(Scenario ③):Below alsoPink line ②same idea. Sell on the pullback as it falls.

(Scenario ①):Now it is at the greenWeekly line ①and a pullback is forming.

If later on the 4-hour chart shows a pullback pattern, the upward momentum may come, so waiting could be safer.

Summary

【Direction】

Weekly: ▼ Down

Daily: ▼ Down

4-hour: ▼ Down

1-hour: ▼ Down

【Key Points】

★Entered a new price range, but the basic trend is still down.

~as usual~

★If the 4-hour and 1-hour charts move into a horizontal range, wait until a move occurs to reduce unnecessary stop losses.

★Wait at the line boundary. Do not enter at a halfway point on higher timeframes.

Monday gap closure

It closed nicely.

Close a gap against the trend is generally NG, so this is OK.

In hindsight, I should have bought.

This is the worst thinking.

Understanding why it’s better not to go against the trend eliminates feelings of regret when you miss out.

If it’s positive, it’s correct. If negative, it’s incorrect.

Escaping this mindset is very important.

In Entry

Entered as planned and in line with the scenario, so OK.

Wake up at 6:30, create scenario

Entry at 7:30

Now at 8:30.

Nice feel to it ♪

As for the scenario, it may differ from the forecast.

Forecast: I think it will be like this, so I’ll do this

Scenario: If this happens, do this

Scenario is a trading plan.

If the movement deviates from the scenario, it is not planned, so the choice is not to trade.

This is to avoid being swayed by trading based on analysis and plans.

Thank you for reading to the end.

You can check the latest information on Twitter.

Please follow me.