【FX】Tonight's Pound/Yen strategy and thinking: October 1, 2019 (Tuesday)【Pound/Yen】

This is Chiiko.

Thank you as always.

This timethe approach and thoughts on tonight's pound-yenare the talk.

Last trade result was a stop loss, right?

Kept shorting and stopping out ~ this plunge lol

I feel a little dejected ( ;∀;) though I’m not actually, I think that’s natural lol

Tonight’s drop was like a sleeping child suddenly waking—dramatic!

It was splendid lol

Nothing will break the balance without some trigger; I wonder if a trend will form in one direction or the other.

That has been the mood lately.

Now, to the main content.

Definition of a Beginner

Someone who has mastered one or more methods but does not possess the skills to consistently win.

And that is it.

In short, anyone who hasn’t mastered a method and is losing is a beginner. The amount of knowledge or years don’t matter.

Simply put, people who are winning may be in the transient range of victory, so they might still be within the beginner's scope.

That’s the idea.

Tonight’s Decline

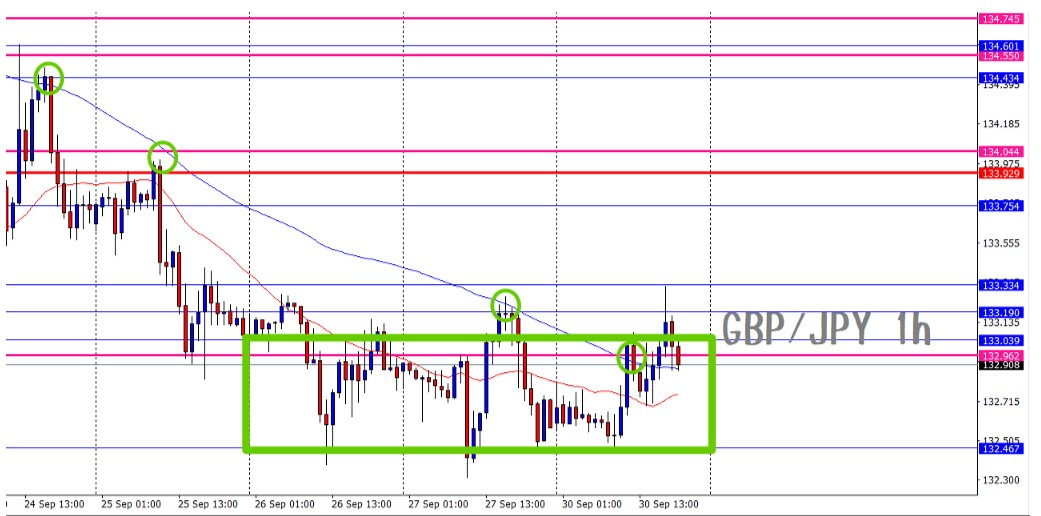

Just by looking at this image,

“Oh, it would be nice to grab that area,”

you wonder how to take it, right?

But that doesn’t have much meaning.

It’s disappointing, but even if you look at the chart and think “maybe I could have taken it this way?”

you’re just thinking of the take, so it can’t be used next time.

Next, the method many of you are curious about.

How to Take Tonight’s Decline

For those drawing channel lines, it’s a breakout, so following it isn’t 100% guaranteed, but

there is an edge, so entering has value, right?

This is fairly well-known, so many people might know it.

People who know it, lol

How many high-probability entry patterns exist as a stock?

That’s one of its strengths, right?

However—that is only a strength if you understand it correctly and can use it well.

There is no such thing as being skilled or unskilled from this decline alone

I understand congratulating those who took it, but

what basis determines “skilled”?

Saying “you’re skilled because you took it!” shows a lack of understanding of how to win.

If we reflect on tonight’s decline, who needs to rethink? If you are trading with the channel-breakout method but didn’t enter after looking at the chart,

that’s a sign you haven’t practiced enough. Maybe you should practice lol.

The method is just an example. Since this is the method I know, I used it as an example.

Regardless of the method, the common issue is a lack of understanding of the method and lack of practice.

As for me

I haven’t adopted the channel-line breakout method, so not taking a trade isn’t a big deal for me.

Subjectively, I’d like to take it, of course lol

But—I trade using a horizontal line roll reversal method,

and if you’re using that method, there’s no bounce back, so you can’t enter.

You’d know it’s odd to take a trade with no entry point, so you’re content with not taking it.

No, no, you knew it! You’ve written it!

Not taking it—are you stupid?

Aren’t you going to pick up the fallen money?

Is it really like that?

Taking every opportunity isn’t the right answer

Not being able to take a trade isn’t the problem.

The correct approach is to take what your own method can take.

For that reason, I recommend mastering one method.

Advantages of Narrowing Down

The advantages of sticking to one are

For beginners who haven’t mastered even one method, adding others leads to

confusion.

Some people think this confusion is due to weak mental state, but

the cause is that you’re trying to enter without understanding the method.

No amount of mental training will solve it.

For geniuses, doing as you please is fine, but

one of the common reasons beginners struggle or self-styled beginners fail is using multiple methods or mixing them in a personal way.

Half-measures cause more harm than good.

If you know it, it’s okay to store it away until you might need it, but it often shows up at crucial moments.

For example, during a losing streak. When you’re not in control, you can’t handle it.

I want to win, I want to win, I must recover no matter what!

Trading with superficial knowledge in this situation won’t end well.

Knowing something can even be harmful.

Gaining Not Getting Confused or Wavering

The benefit of narrowing is not getting confused and not wavering.

This is extremely important.

Even in normal times, when you attempt to enter, you may hesitate.

If I don’t decide quickly, the entry point will be gone! Quick decision!

Something like that. You get anxious, right?

Then it’s the worst, right?

Entering while still unsure is scary because you’re in a state of not knowing.

The fear level is completely different when you know the edge exists.

Also, combining multiple methods makes the entry points multiply several times over.

Include this here, include that there.

Entry points that appear with a half-baked understanding of methods...

They invite unnecessary entries.

To Win

It’s not enough just to grab fallen money.

In investing, though; in daily life, sometimes you don’t know.

However, not acting and turning the money into the local police often yields better outcomes, so it’s usually better to report it lol

First, master one.

Even one method is incredibly deep.

After understanding that, if you need another one, you can add it.

This level is just right.

Having one is fine; having another is simply greedy.

If you want to win easily, you should master one.

Isn’t that simple and easy?

All for winning.

To win=to achieve the goals beyond it!

We were taught that one method in FX is enough. I also think one is enough.

After that, just refining that method will increase profits, which would be good to experience as a success story.

The end (*´з`)

Looking now, it seems to be surging again, huh lol

You know which ones aren’t worth taking, right?

That’s reassuring lol

Thank you always for viewing.

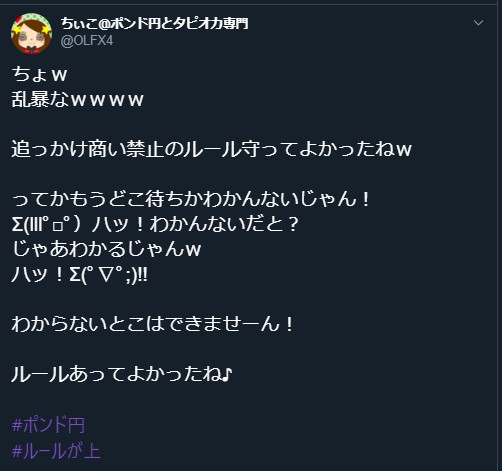

The latest information can be checked on Twitter.

Please follow me.