[Scenario][Trade Results][FX] If you misinterpret your reflection, a tremendously difficult ending awaits!: September 30, 2019 (Monday) [GBPJPY]

This is Chiiko.

Thank you always.

This timeIf you misjudge reflection, the ending can be extremely troublesomethere is a story that awaits!

First, the results of the trade on the scenario.

Thank you in advance.

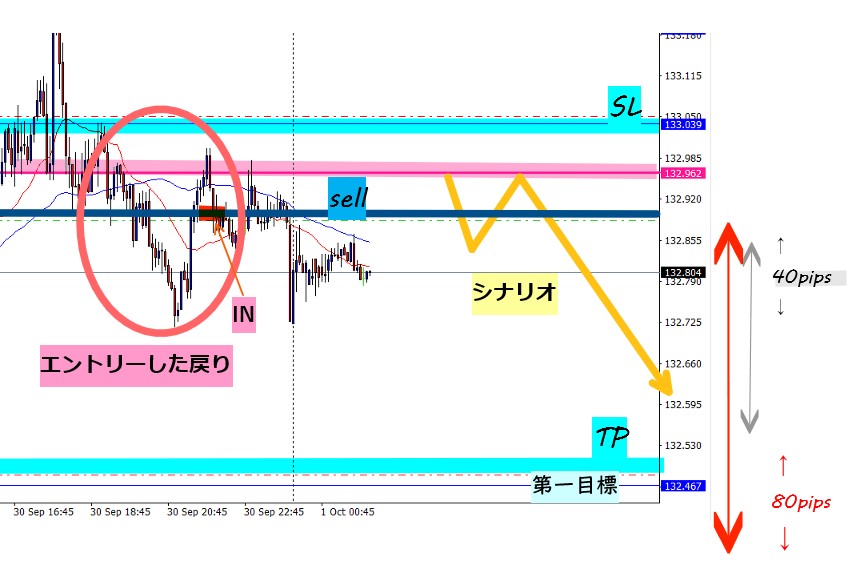

★ Entry

Around 6 PM, I think.

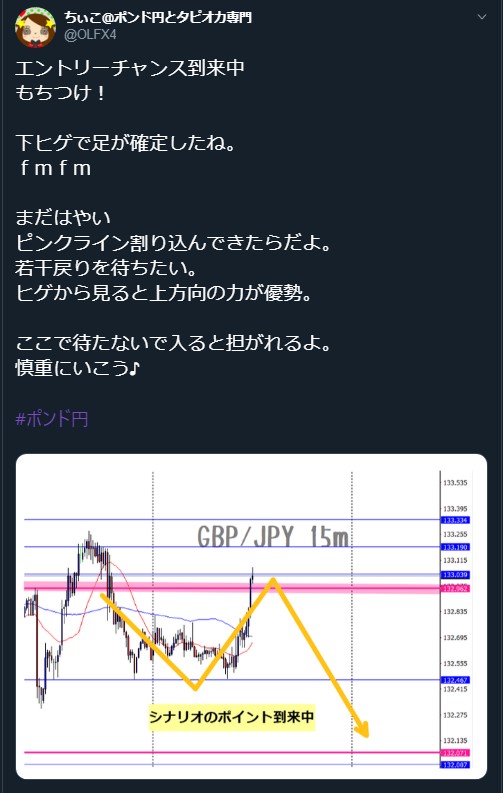

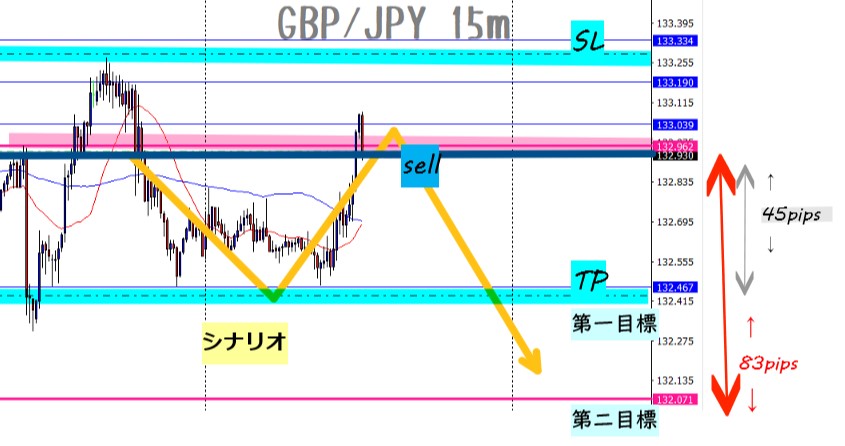

The entry point of the scenario came, so I entered.

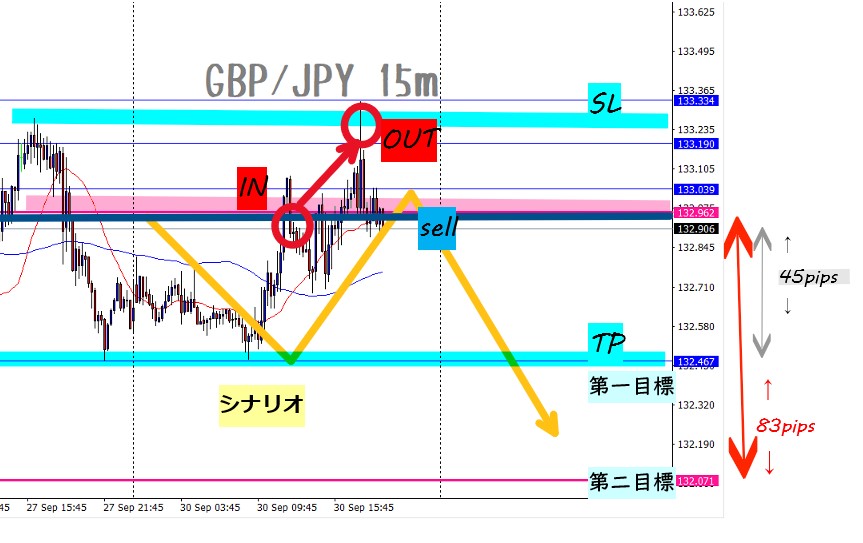

★ Result

The result was a stop loss ( ;∀;) — though I am sad,Nice tradesince it was close to a performance, this is almost like a production, lol

Even though it was a stop lossNice tradewhat??

Is that possible?

It is possible.

In trading, this happens quite often.

Everyone thinks a stop loss equals a bad trade, but

is it really so?

Let's verify.

☆ Analysis

Regarding analysis, this is not about finding mistakes in the stop-loss result.

This part is quite important.

I do not go back to think "maybe there was a mistake because of the stop loss."

I look at the differences in methods.

Did I do something different from usual, or did I violate the rules?

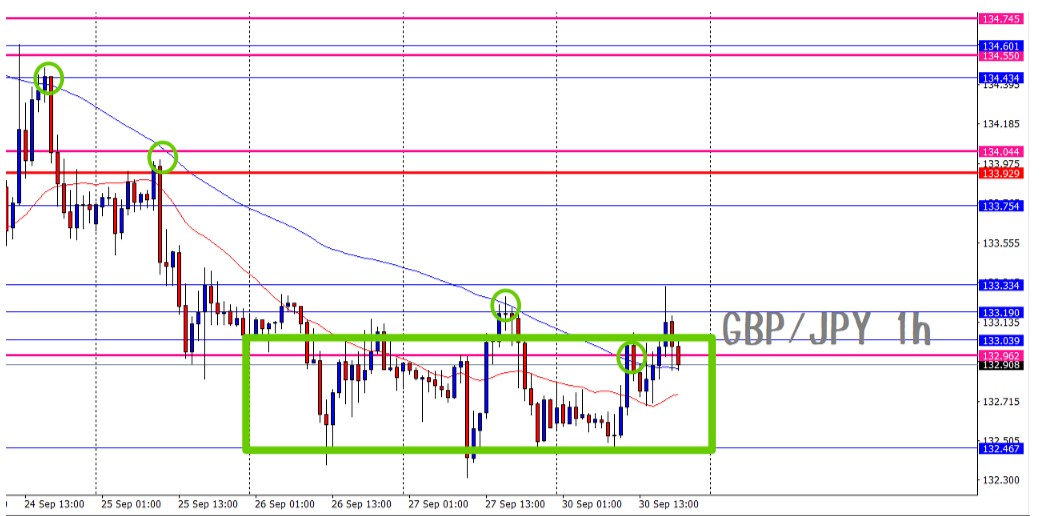

★ 1-hour chart: range within a downtrend

The current movement looks like this.

Sideways. A range.

There is nothing odd about it.

★ 4-hour chart: range within a downtrend

Same as the 1-hour, a range tendency.

No issues here either.

★ Others

NY hours and European hours.

Times when prices tend to move.

This stop loss was largely influenced by this, I think.

NY hours are known to be times when prices move more easily.

※ Information about NY time, European time, and daylight saving is abundant online, so please ask Mr. Google.

So, here is the important part.

Prices can move in either direction, and you never know which way.

Price movement is not something I can control, so

this time it moved upward significantly, huh

This might lead to some misunderstanding, but

In a simple description,

it just went against my position

and nothing was attached to it

just like that.

There is no basis for reflection here.

If you try to countermeasures, you end up not holding a position, and that becomes a countermeasure.

If you really hate it, it is an option.

So that’s the end of that.

★ Result of the analysis

Up to here, there were no mistakes at all. (I might be exaggerating lol within my understanding lol)

Only the results didn’t match.

So

When the timing comes, just do the same thing again.

No problem above all!

--------------------------------------------------------

Being able to perform analysis without being pulled by the results is very important.

Blindly

Stop-loss is wrong, therefore a failure!

If you don’t fix something, the result will always look bad, and you will keep making wrong corrections.

In shortgood things tobad thingsandmisperceptionto changeis what this means.

What happens as a result is…

It becomes a huge mess.

It is a mess ( ;∀;)!!!

That’s unpleasant, right?

So what to do to prevent this? You need a correct standard.

I think it is almost certain that reflective insights are valid only when compared to that standard.

First,Understand the methodaccuratelyis necessary.If you have the wrong understanding, the standard will be flawed, and misperception is unavoidable.

To avoid this,the mosteasilyis

this is what is said in tests and in the world.

Use it yourself. If there is a better method, please tell me.

The simplest method I know, so if there is a better method, it would be good to practice that.

There is not enough space here, soHere is the conclusion.

→ This expanded too much, so I trimmed a lot lol

Even if you have a good method,

if you understand it wrongly

and cannot use it well

you end up abandoning that method.

That would be a real waste.

There are many methods, so you should keep changing.

Choices are free, so changing is free, but

if you have a wrong understanding

and you cannot use it well

it becomes an infinite loop.

Probably you’ll repeat it until you die if you don’t quit.

Accuracy is something that requires study.

How solid your foundational knowledge is.

This is the key.

→ This topic will be in another episode

The discussion is getting off-track, so I’ll return.

It got long, so I cut some parts.

If there are parts where the discussion jumped, please tell me.

I would be happy.

“A very difficult ending”is,

you already have a profitable method!

Or you have already met it!

Are you discarding it wrongly?

That was the point.

♪ Bonus

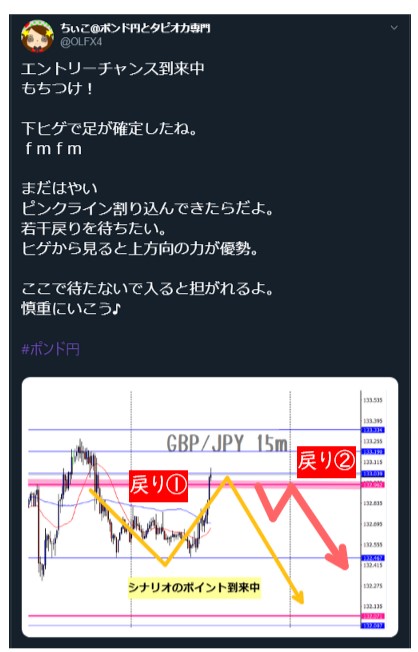

This time’s reflection point is here.

The timing of entry.

I had considered return ① as the scenario, but

entering here might be dragged into a loss.

Return ①>>>(resistance to being dragged)>Return ②

Waiting until Return ② is safer, right?

It’s not that Return ① is bad, but Return ② is safer, right?

the more you use it, the less you don’t know,

so you won’t hesitate, right?

Currently it looks like this.

On track.

I sold a return on the same line.

Each result is random, but… beyond that, good enough (*´з`)w

Thank you always for viewing.

The latest information can be checked on Twitter.

Please follow me.