You can earn money even without a high win rate! An EA that excels at both simple and compound interest『Even losing is winning [EUR/JPY version]』

A top-quality EA developed by Double I3 makes its debut!

As the name suggests, it steadily builds profits even with a low win rate.

「Lose at everything but win [EUR/JPY version」

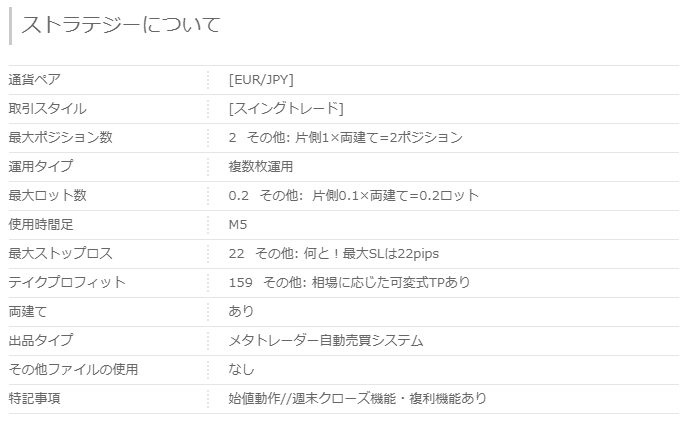

【Lose at everything but win [EUR/JPY version] Overview】

The forward period is roughly two months, from mid-August 2019 to early October 2019.

The win rate so far is 33.33%, but profits have been earned.

The traded currency pair is the major EUR/JPY. The maximum single-sided lot size is 0.1, with hedging up to 0.2 lots in total.

The maximum number of positions is also set at 0.2 positions (0.1 on one side with hedging).

It also includes a weekend close feature and compounding functionality.

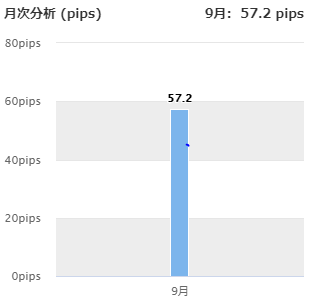

■Monthly Analysis

In September, 57.2 pips were gained.

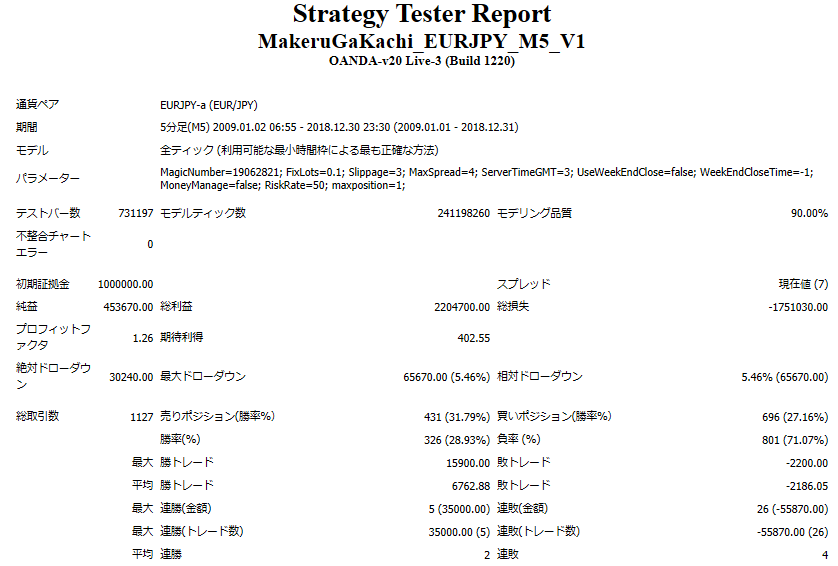

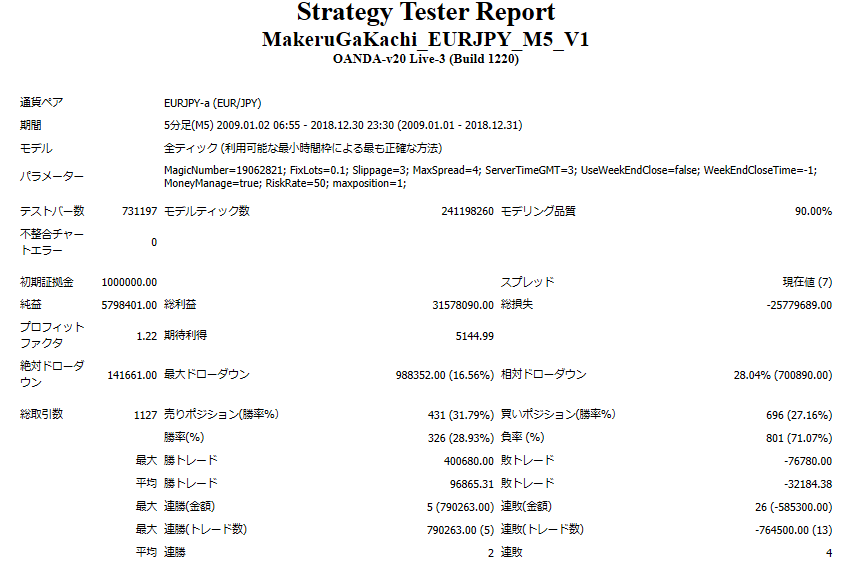

【Backtest Analysis】

2009.01.01‑2018.12.31

Spread 7.0

Fixed 0.1 lots

Net profit +45.3万円(annual average 4.5万円)

Maximum drawdown −6.5万円

Total trades 1127 (annual average 112.7)

Win rate 28.93%

PF 1.26

Recommended margin amount is fixed at 0.1 lots

(4.6*2)+(6.5.5*2)=22.2

This yields an expected annual return of 20%

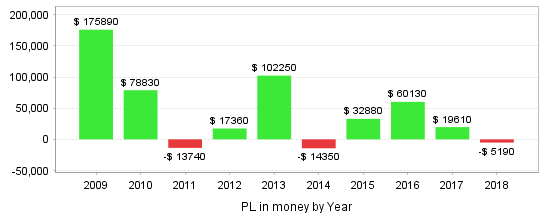

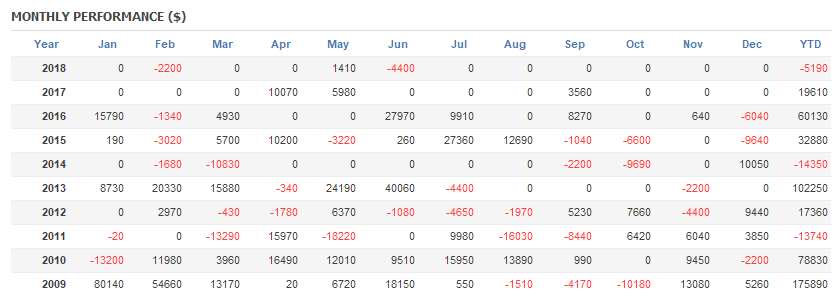

■Yearly/Monthly Profit and Loss

Among ten years, 2011, 2014, and 2018 show losses, but they are offset by the other years, so it may not be a major concern. The losses are not large.

There are many months with zero profit, but it is a type of EA that steadily earns profits.

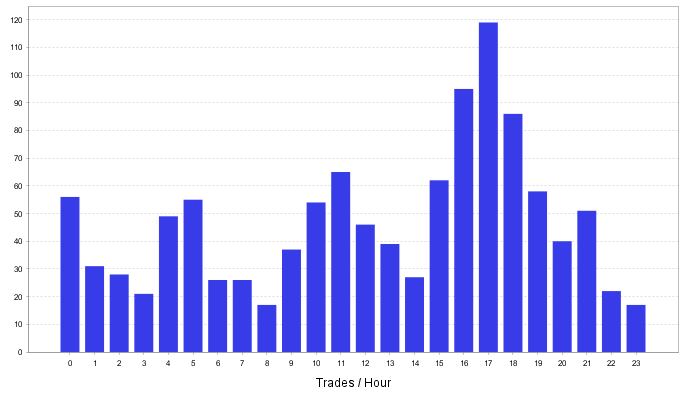

■Holding Time

Looking at holding times, most trades are around 5 minutes, leaning toward scalping to day trading. It can hold for up to 4 days.

■Trading Time by Day of Week

Trading times are often 15:00–19:00, but it has been operated consistently in other time periods as well.

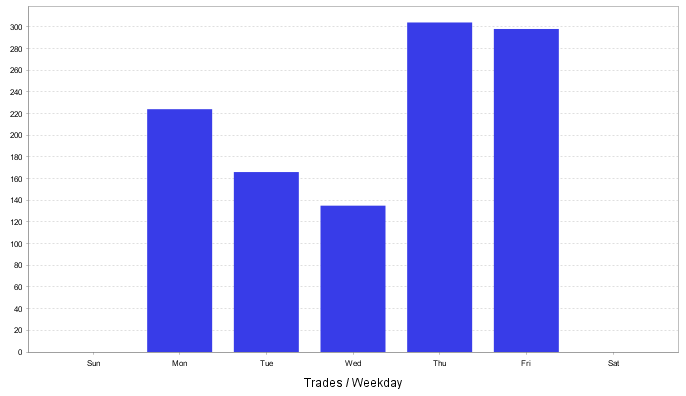

■Day of Week

By day of week, Thursdays and all days show higher activity. It may be influenced by the weekend close feature.

■CompoundingOperation

Looking at the results of compounding, it earns substantial profits with a small lot size.

The win rate appears to be around 30% based on forward and backtests, but it steadily earns profits.

Maximum drawdown is also low, indicating low risk.

Compounding increases risk, but it can significantly grow even small amounts of capital.

Low win-rate EAs tend to be avoided, but if it reliably generates profits, it might be worth considering for a portfolio.