An Expert Advisor 'Richard' that can become the main tool for USD/JPY trading with an expected annual return of 50% or more

Low drawdown, usable with a small margin.

Compound settings can be used to target the maximum profit even in standalone operation.

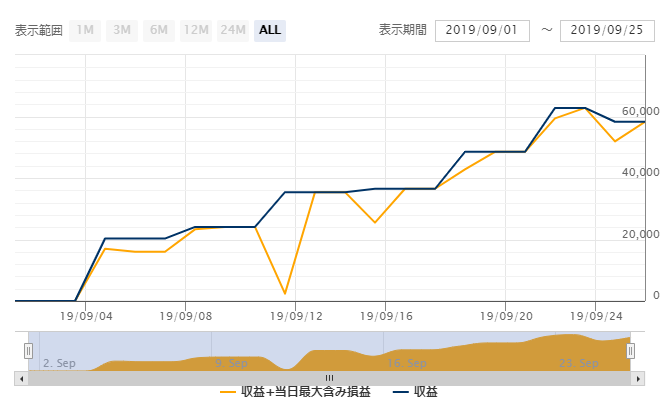

The forward performance is still in a short period, but it's off to a good start.

【Richard概要】

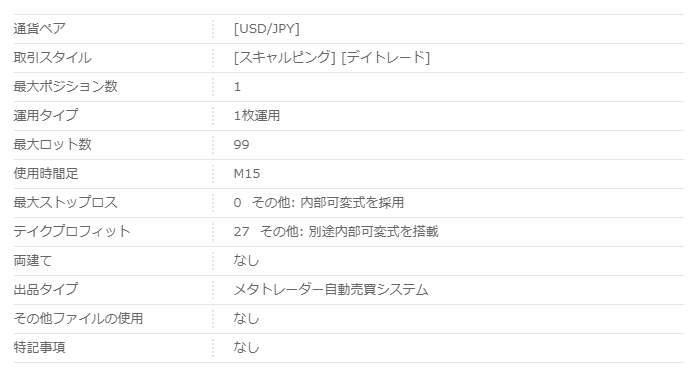

“Richard” is an EA dedicated to USD/JPY.

The timeframe used is a 15-minute chart, and the stop loss and take profit are determined by internal logic.

【バックテスト分析】

Richard supports compounding settings, so both simple and compound interest will be considered.

・単利運用

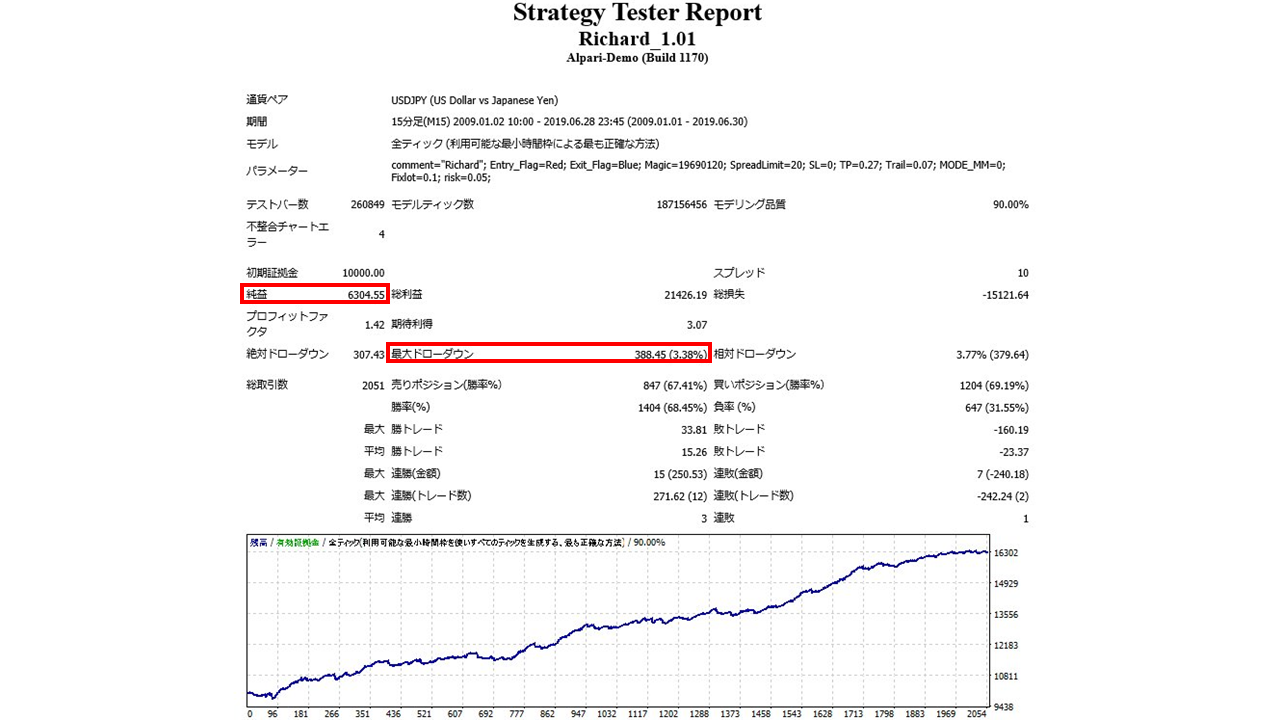

Backtest period spans 2009 to the end of June 2019, 10.5 years.

2009.01.01‐2019.06.30

Spread 1.0

Fixed at 0.1 lots

Net profit +693,000 yen (average annual 66,000 yen)

Maximum drawdown: -42,000 yen

Total trades: 2,051 (average 195 per year)

Win rate 68.45%

PF 1.42

PF 1.42 shows quite a good performance.

Recommended margin is fixed at 0.1 lot

4.5+(4.2*2)=12.9(万円)

Therefore, aiming for 130,000 yen or more seems safe for operation.

The expected annual return in this case isapproximately 51.1%.

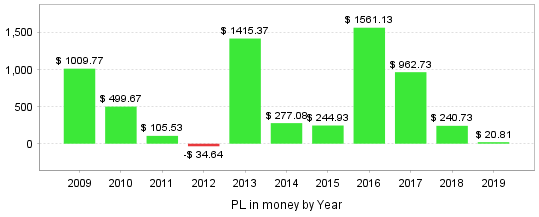

・年別収益

In the past 10 years, 2012 was a loss, but other years were solidly positive.

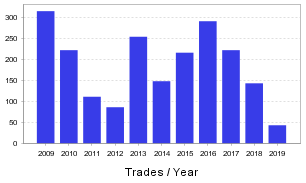

・取引回数

The number of trades appears to be correlated with annual earnings.

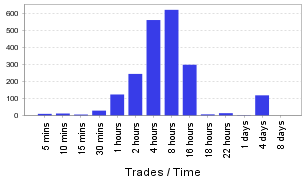

・保有時間

The types range from scalping to day trading, but the overall average holding time is 2–16 hours, so day trading is likely the main method.

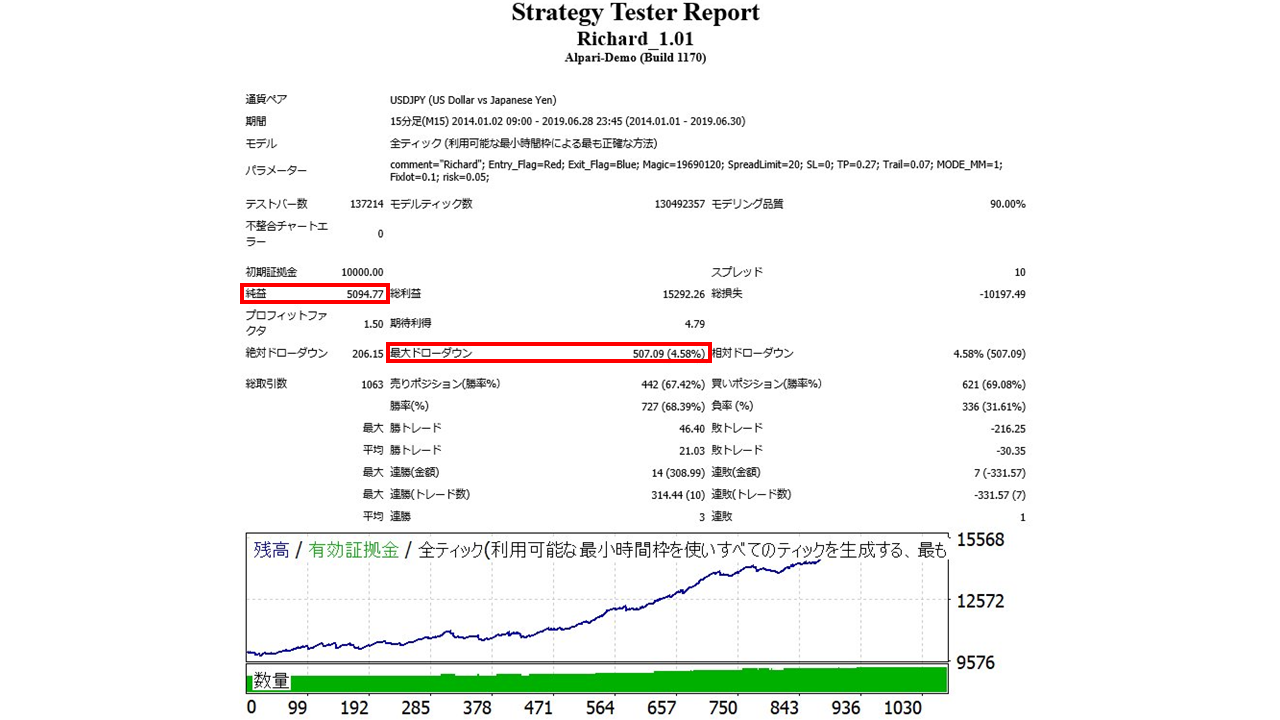

・複利運用

Compounding will be examined over a period from 2014-01-01 to 2019-06-30, 5.5 years.

2014.01.01‐2019.06.30

Spread 1.0

Initial margin 10,000 USD

Net profit +560,000 yen

Maximum drawdown: -55,000 yen

Total trades 1,063

Win rate 68.39%

PF 1.50

With the compounding effect, compared to simple interest, net profit was achieved at 1.23x in half the period. PF also improved to 1.50.

This performance uses the compounding setting (mode MODE_MM changed from FIX to MM in parameters); otherwise it is in the default state.

Richard’s low drawdown makes it attractive; I also tested higher risk by increasing acceptable risk from “0.05” to “0.2” to see how it performs with a bit more risk.

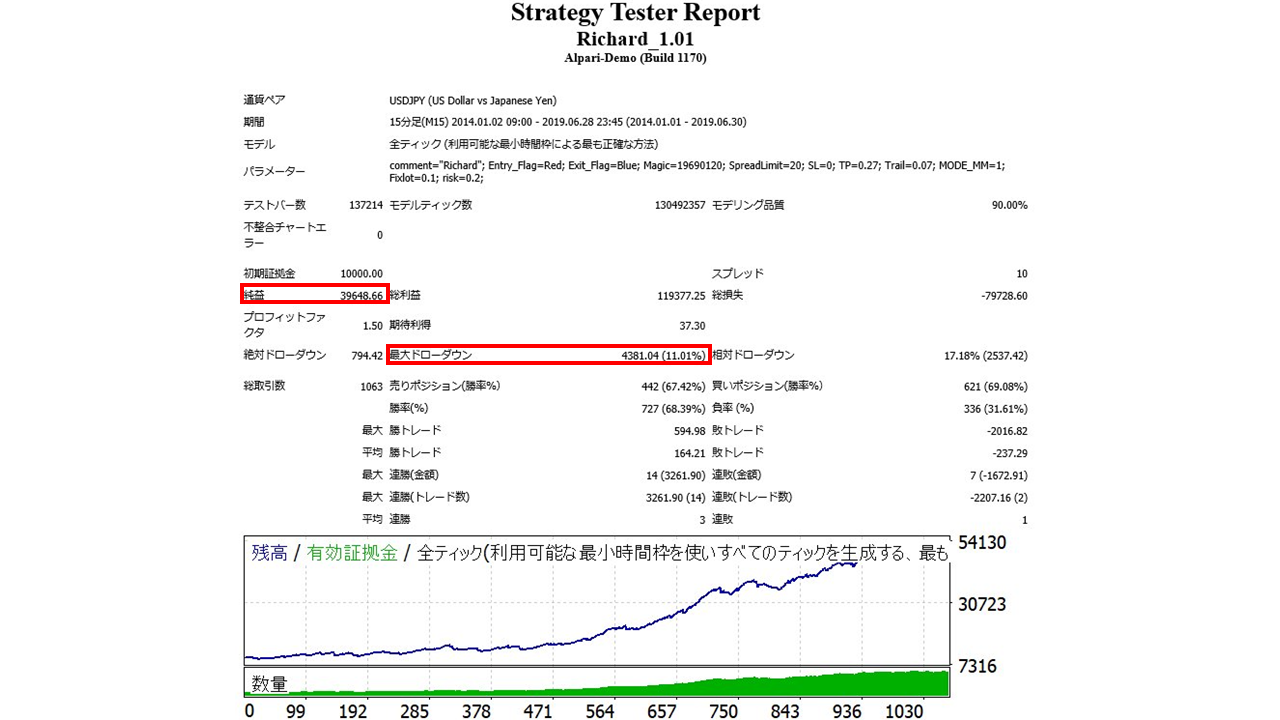

・複利運用(リスク許容度0.2)

2014.01.01‐2019.06.30

Spread 1.0

Net profit +4,361,000 yen

Maximum drawdown: -481,000 yen

Total trades 1,063

Win rate 68.39%

PF 1.50

Even with the same compounding, at four times the risk tolerance the maximum drawdown rose from 4.58% to 11.01%, and net profit increased from 560,000 yen to 4,361,000 yen—a 7.78x increase.

PF is 1.50, the same as the previous default operation, but when comparing risk-adjusted return (net profit ÷ maximum drawdown):

56÷5.5=10.18

② Risk tolerance set to 0.2

436.1÷48.1=9.06

The higher risk increases net profit significantly, but operationally the EA’s performance cannot be fully utilized.

Reference: risk-return rate for simple operation (10.5 years, PF 1.42)

69.3÷4.2=16.5

The default settings are still quite recommended, but this may vary depending on the operator’s funds and objectives, so please conduct thorough testing before operating.

From what we’ve seen, Richard is a robust, classic-type EA.

Because the maximum drawdown is low, when building a portfolio with other EAs the capital burden is light, and more importantly, as a major currency-pair EA, a performance with expected annual return over 50% is very attractive.

Even when used standalone, with compounding settings it should bring substantial profits.

It seems price increases are planned after October 2019, so the end of this month before the tax increase is the best value right now!

※October 15 Update

Currently featured in a seller spotlight titled “Fresh & Promising! Next-Generation Campaign,” which highlights the recently attention-worthy seller, we are featuring Richard’s developer Algo Signals. Limited in quantity, but a great chance to purchase Richard and other EAs at a bargain, so don’t miss it!!

Richard Dream Collaboration Set