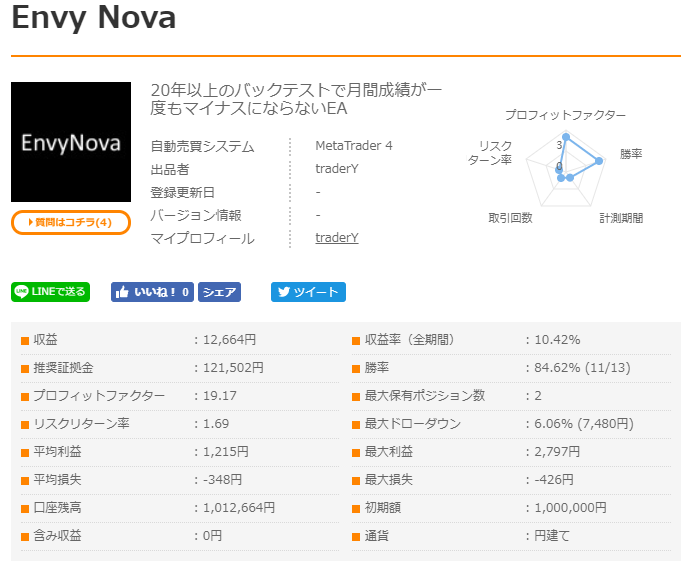

Fast profit-taking speed and the resilience to endure reversals! An EA with two strengths, undefeated on a monthly basis: "Envy Nova"

Increase profits with shallow take-profits,

Aim for overall profit by adding positions even when the market moves against you

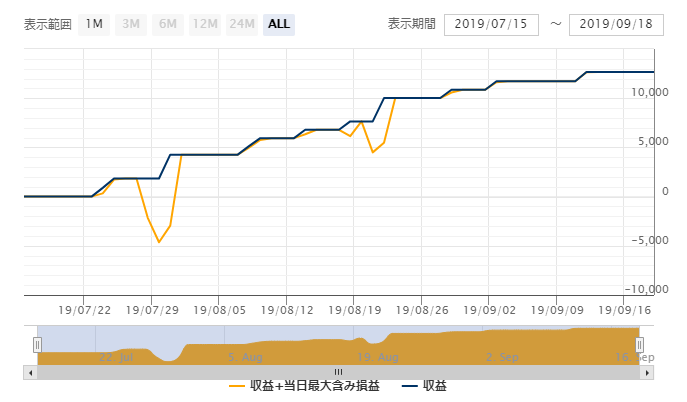

The forward-test period is only two months starting from mid-July 2019, which is still short, but profits have been gradually accumulated despite temporary drawdowns.

【Envy Nova Overview】

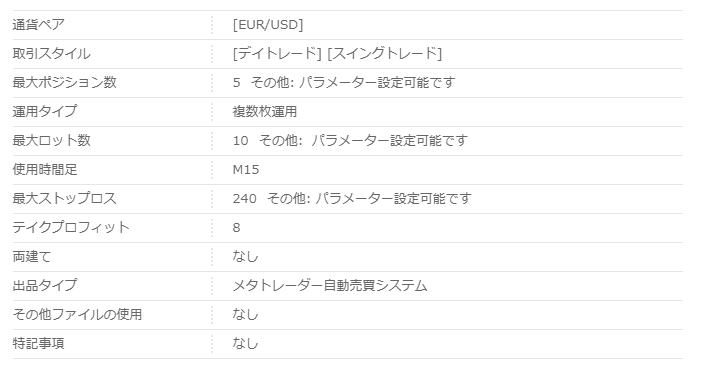

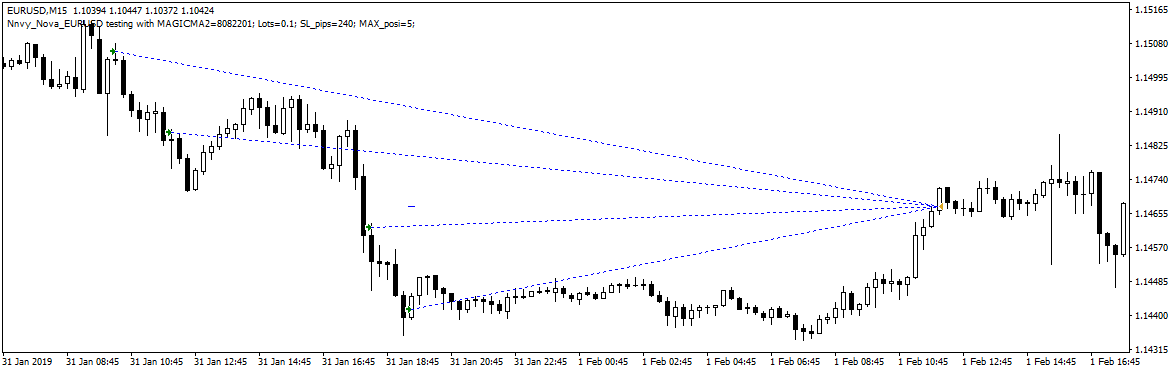

The time frame used by Envy Nova is 15-minute bars, and it is an EUR/USD-only EA.

The maximum stop loss is 240 pips, and the take profit is 8 pips.

The maximum number of open positions in the initial settings is 5, and the lot size increases as the number of positions increases.

・Initial setting 0.1

First position → 0.1 lot; Second position → 0.18 lot; Third position → 0.32 lot; Fourth position → 0.58 lot; Fifth position → 1.05 lot

Therefore, when holding the fifth position,the total becomes 2.23 lots..

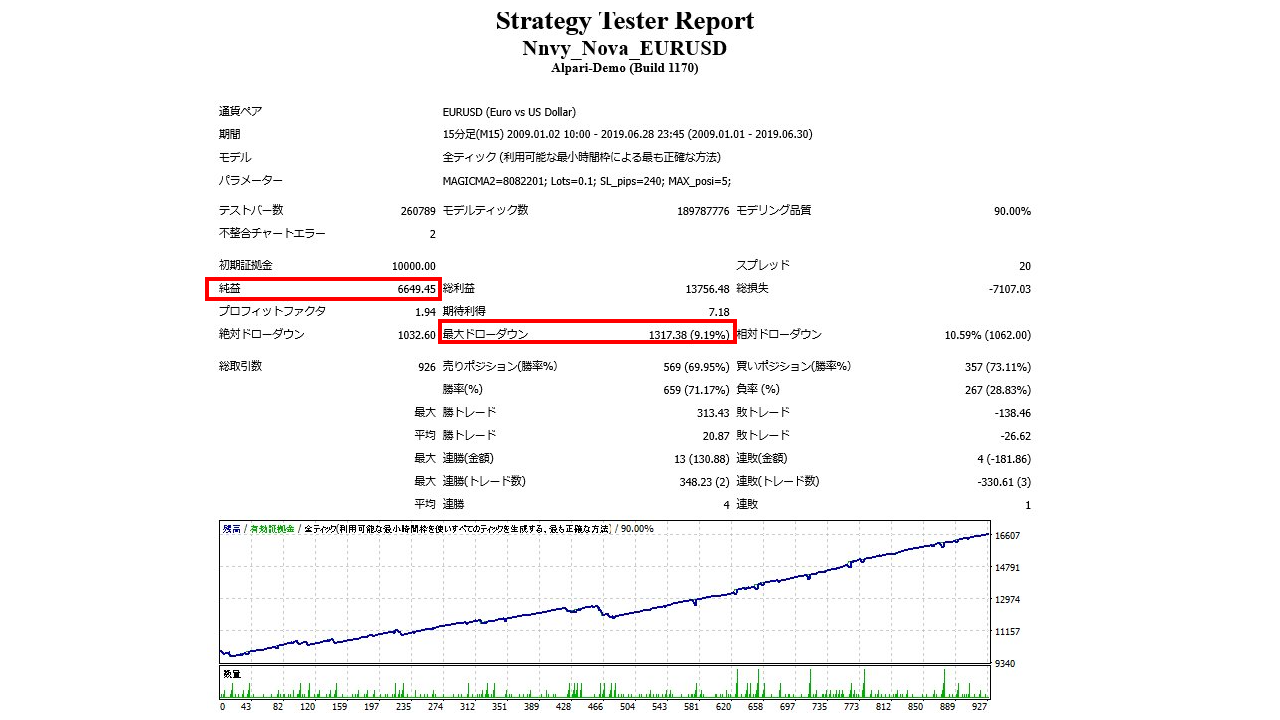

【Backtest Analysis】

We will examine Envy Nova over a 10.5-year period from 2009 to the end of June 2019.

The initial lot is 0.1 lot, and the spread is set to 20, larger than what is listed on the product page.

2009.01.01‑2019.06.30

Initial lot 0.1 Spread 2.0

Net profit + ¥731,000 (annual average ¥69,000)

Maximum drawdown − ¥144,000

Total trades 926 (annual average 88)

Win rate 71.17%

PF 1.94

Although the number of trades is relatively small, the profit factor of 1.94 shows a strong result.

The recommended margin at this time, assuming a maximum leverage of 25x

111.5 + (14.4*2) = 140.3 (ten thousand yen)

so about 1.4 million yen is the guideline for safe operation.

The expected annual return isapproximately 12.9%.

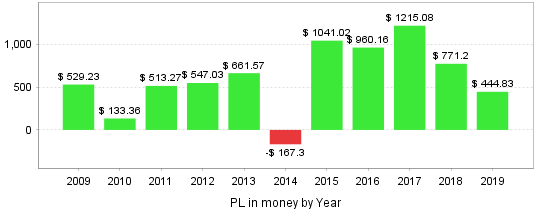

・Annual revenue

Excluding 2014, the annual revenue averages around $700. Notably, the average over the most recent five years is higher.

・By year and month

Even on a month-by-month basis, there are few losing months. Since 2014, there have been no losing months on a monthly basis.

Following the backtest, the forward results after July also look favorable, and there is reason for optimism going forward.

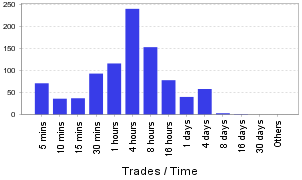

・Holding time

The trading style ranges from day trading to swing trading, but many trades have short holding times of only a few minutes.

Likely because the take-profit is shallow, many positions reach the target within a short period due to significant price moves.

As noted later, there are patterns of taking profits with either a single position or multiple positions via averaging down/martingale. Trades closing with a single position are expected to have shorter holding times, so a higher share of short-term trades across the total holding time is considered favorable (not that holding positions longer is inherently bad).

・Multiple positions and lot sizes

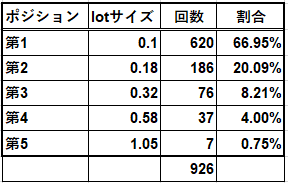

Envy Nova increases the lot size from the second position onward.

Therefore, we analyze the position distribution over the 10.5-year backtest period.

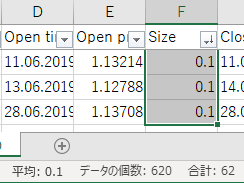

①First position (0.1 lot)

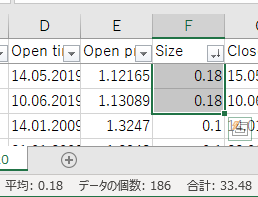

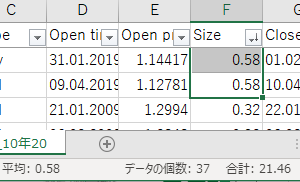

②Second position (0.18 lot)

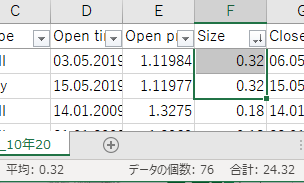

③Third position (0.32 lot)

④Fourth position (0.58 lot)

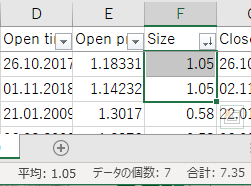

⑤Fifth position (1.05 lot)

In summary,

Trades up to the second position account for 85% of all trades, and up to the third position account for 95%.

Therefore, it seems unlikely that the maximum of five positions in the initial settings is commonly reached.

Furthermore, during the backtest, there was not a single instance of losses triggered by the initial stop-loss value of 240.

Thus, losses come only from the lot-size differences when closing multiple positions with an average loss of about 8 pips, andthe price averaging effect of averaging down appears to be functioning well (losses are being softened).

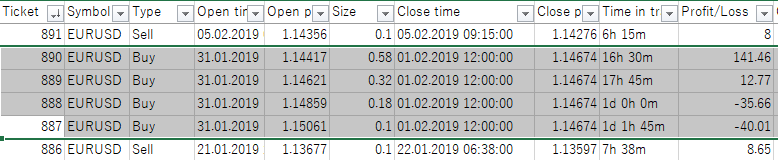

【Trade Analysis】

Blue: Long Red: Short

Because take-profit is 8 pips and shallow, trades finish quickly.

From what has been observed,most conditions for holding multiple positions are not for adding positions to increase profit, but fornamping (averaging down) when the 1st position is in drawdown.

In this case, the settlement shows the 1st and 2nd positions as negative, but the 3rd and 4th positions were positive. Since the later positions are larger in lot size, this trade ends overall aspositive.

Trade history ↓

That’s all we have seen, butEnvy Nova isan EA that uses multiple positions, but many of its trades are profitable even with just the first position.

If the price moves against you, add higher-multiplied-lot positions to aim for total profit at a single exit.

Although the required capital is high, it is an EA that can be expected to yield a stable increase in profits for that capital.