The USD/JPY stalls after clearing the event in the United States; next, watch the cross-yen pairs for the yen’s outlook!

The G20 finance ministers and central bank governors meeting held in Germany seemed to have closed without a joint statement clearly affirming the focus on “anti-protectionism,”

but market participants appear to view that the impact on exchange rates may not be limited.

Comments from officials of each country are expected to come out from now on,

so it would be prudent to keep an eye on them.

Regarding the exchange rates, it is said that the wording “reducing trade imbalances” was added,

which could become somewhat inconvenient for the yen, so we should also

listen to what officials from various countries say about currencies.

Now, after the FOMC passed a major event, the U.S. dollar has stalled

and most currency pairs have been sold.

From such movements, for a while the market may move away from the dollar-centered regime

and European currencies could be targeted again.

Last week, the pound fluctuated wildly on policy rates and minutes, and the euro also hinted at the possibility of tightening as the ECB’s exit strategy emerges,

and the euro surged; in particular, EUR/USD

if it stays above 1.08, it looks likely to break out of the current range, which could give the dollar some support for EUR/USD.

3/18 Blog post

・A bad-tasting week end…

3/17 Blog post

・European currencies are heading toward an exit strategy; sellers, beware!

3/16 Blog post

・Even after a big event, the rally cannot continue! This is how it remains…

3/15 Blog post

・Is it starting to move? The important thing is the trend of that currency

EUR/JPY has entered the cloud, and the USD/JPY is supported by the weekly cloud upper boundary

If EUR/USD breaks higher, EUR/JPY would break through the current cloud upper boundary.

Also, if EUR/USD remains capped and USD/JPY lacks upside momentum,

it would break to the downside again and test the lows.

It is simple but very difficult; if this trend is a long-term strong indicator

then it is okay to wait for the signal to light up!

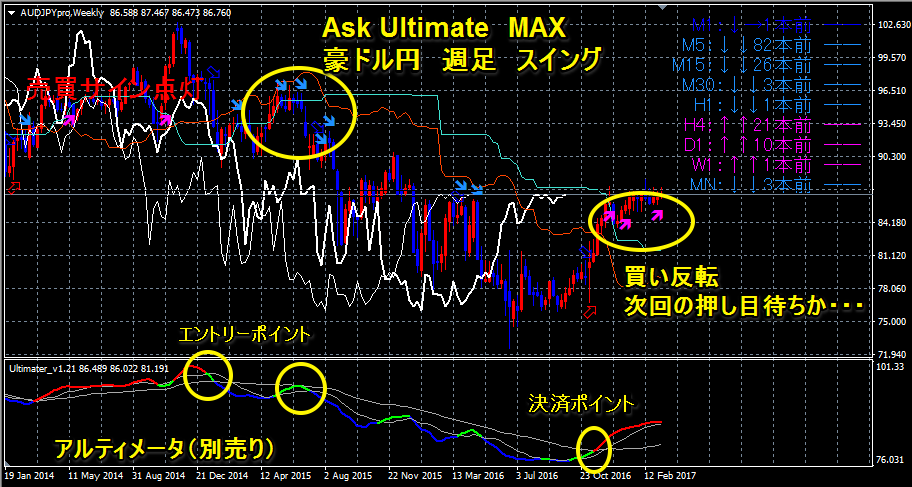

AUD/JPY has broken the weekly cloud and is in a solid market, but the upside may be capped until around May.

However, if it remains well-supported by the Ichimoku cloud and keeps the buy signal, it could resume rising from the second half of this year.

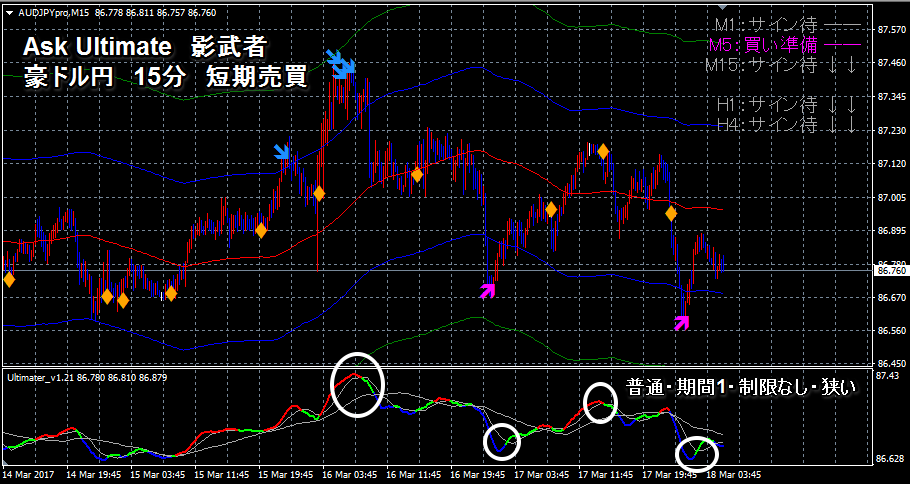

For short-term trading, Ask Ultimate Kagemusha is recommended!

Please refer to the previous article for Pound/Yen and Dollar/Yen.

・Mid- to long-term strategy: Do not rush! Dollar/Yen and Pound/Yen – wait for the pullback!

In the U.S. employment report, such signals appeared for short-term trading!

Cross Yen pairs are a multiplication of the dollar/yen and other currencies,

and sometimes Pound/Yen or Euro/Yen may become the leading currencies that pull the dollar/yen higher.

P.S. Chart

Kagemusha Pound/Yen 15-minute chart