An EA that earns steadily with low risk "Secret Weapon-2 (Secret Weapon-2)"

The logic using four technical indicators demonstrates a high degree of edge.

An EA that steadily earns PIPs with low drawdown.

【Secret Weapon-2 (Secret Weapon-2) Overview】

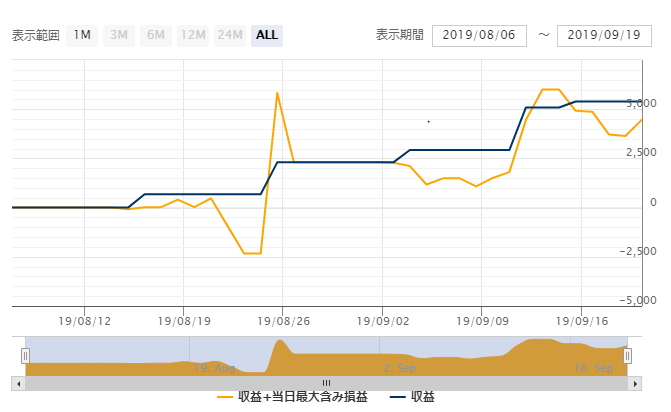

The forward period spans from early August 2019 to mid-September 2019, about one month, but the forward performance chart shows an upward trend.

The win rate stands at 100% so far.

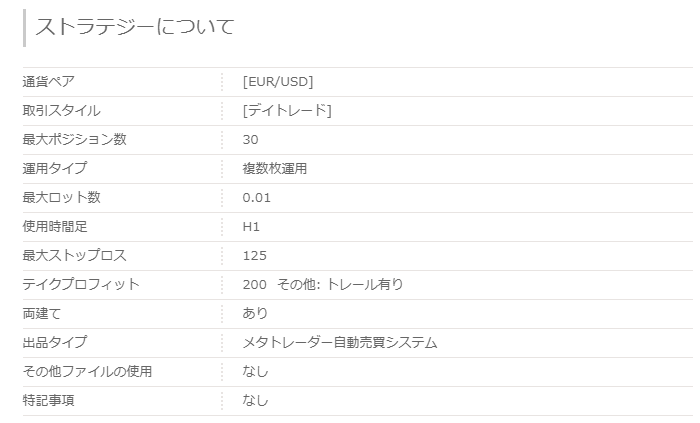

The traded currency pair is the major EUR/USD. The maximum lot size is 0.01, but according to the product page the maximum total is 0.32 lots. This can be adjusted via parameters.

Maximum number of positions is 30.

Maximum stop loss is 125, take profit is 200, and when profits exceed 55 pips, the trailing stop function activates.

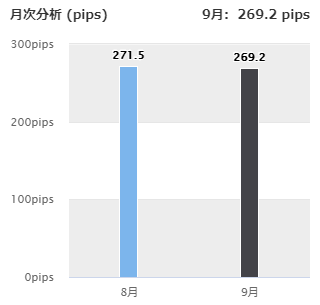

■Monthly Analysis

In August and September, more than 200 pips were earned in each month. In total, 540.7 pips were earned.

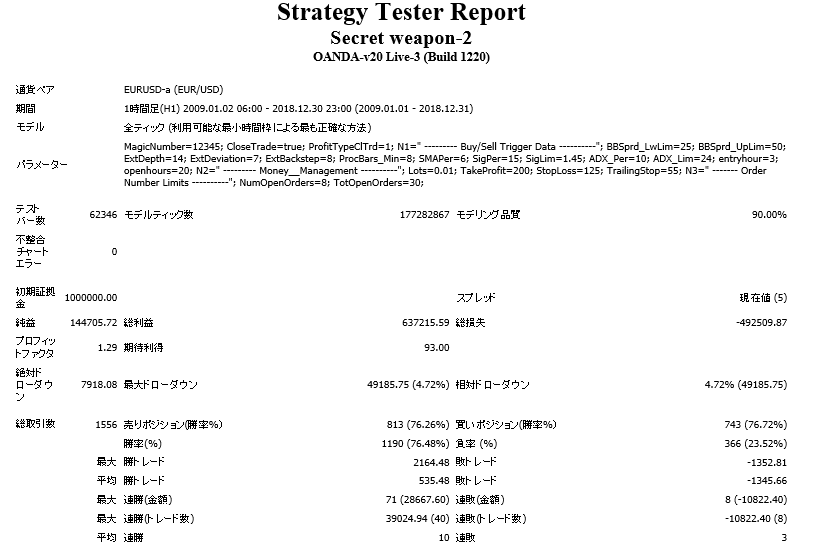

【Backtest Analysis】

2009.01.01‑2018.12.31

Spread 5.0

Fixed at 0.01 lots

Net profit +¥144,000 (annual average ¥14,000)

Maximum drawdown –¥49,000

Total trades 1,556 (annual average 155 trades)

Win rate 76.48%

PF 1.29

Recommended margin is fixed at 1 lot.

(0.48*30) + (4.9*2) = 24.2 ten-thousand yen

This yields an expected annual return of 5.9%.

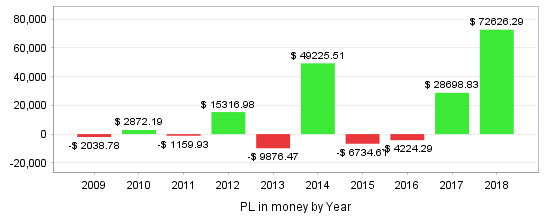

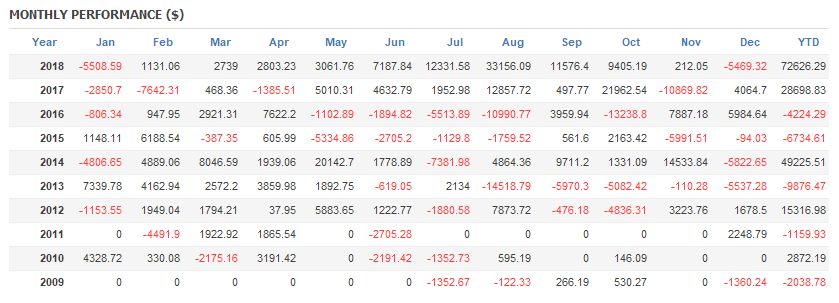

■Annual and Monthly P/L

Over ten years, five years were negative, but losses were small and profits covered them.

Looking at monthly data, losses do not appear large, while many months show substantial gains.

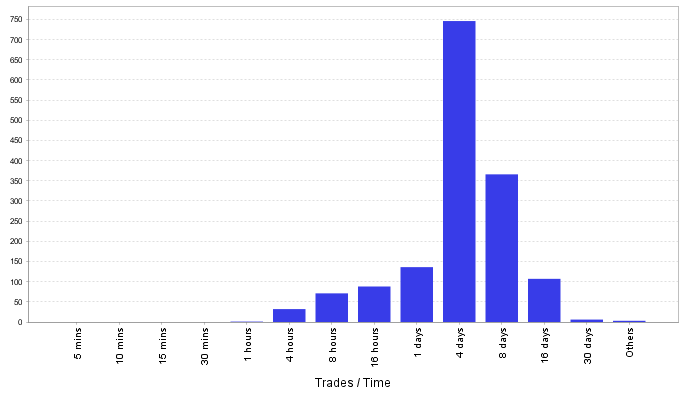

・Holding time

Holding times are mostly 1 day to 2 weeks. As stated on the product page, the trading is primarily day to swing trading.

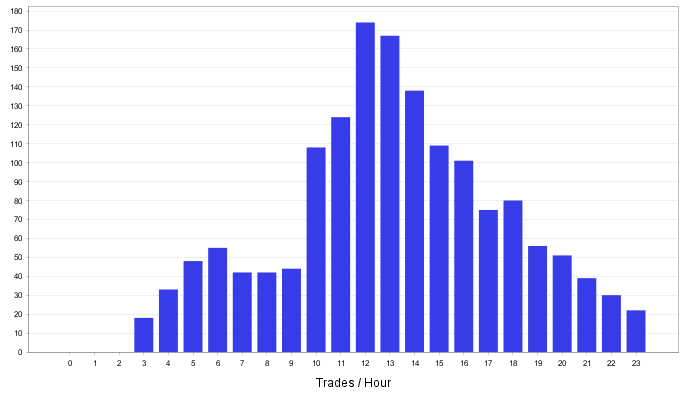

・Trading hours

Entries are made at times excluding 0:00–2:00; most trades occur in Tokyo time.

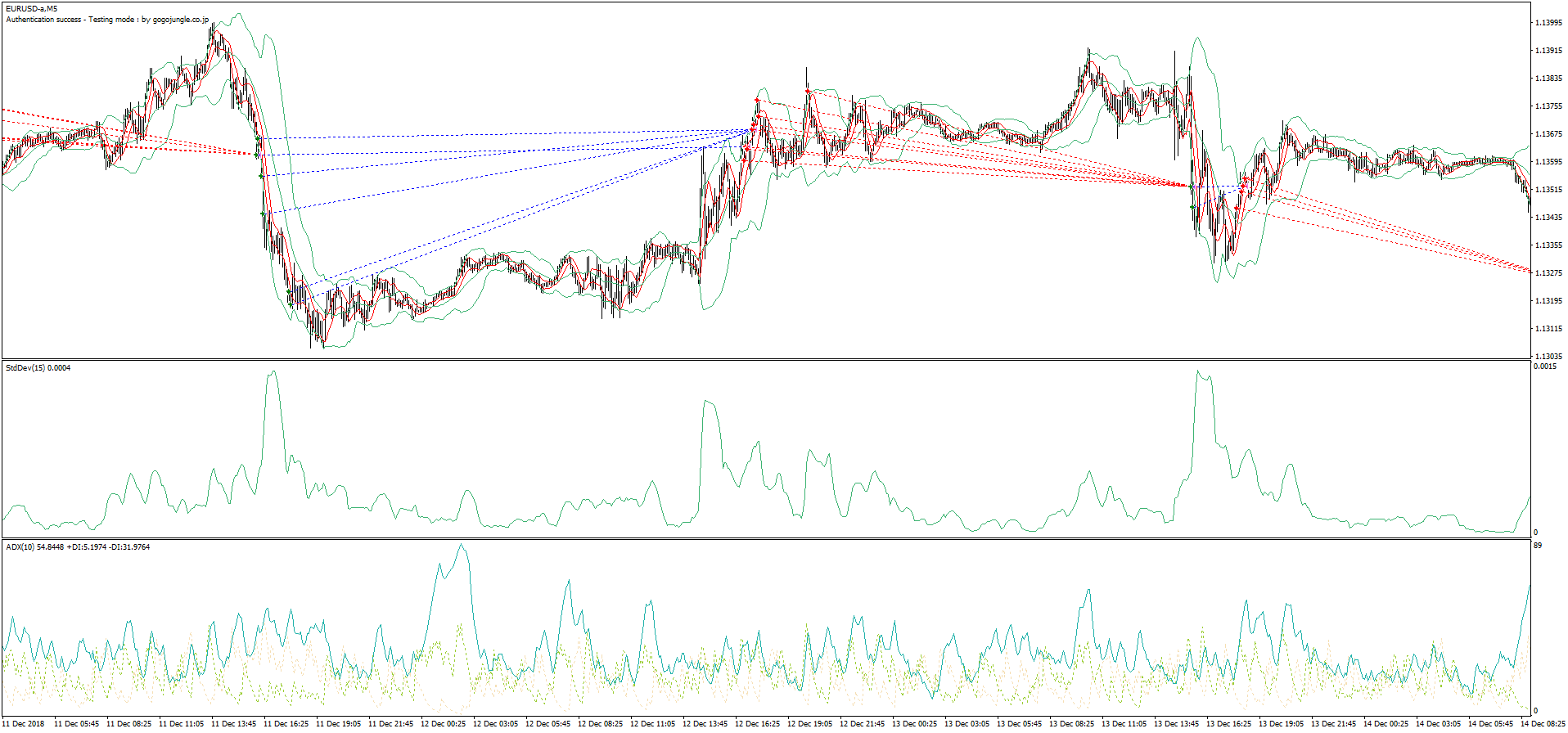

■Trading Image

▲Trading example. Green is buy, red is sell, pink is close. The logic enters in the direction where an edge appears based on Bollinger Bands, ZigZag, SMA, and ADX. From this example, you can see it trades with an edge.

Backtests show a low expected annual return, but the maximum drawdown is about 4.7%, allowing low-risk operation.

The recommended margin is also small, making it suitable for EA beginners to use.

On the other hand, the forward results show very large monthly pips earned, suggesting good potential.

Because the currency pair is EUR/USD, a major pair, this EA should be useful for portfolio construction.