[September 2019] An AUD/NZD-exclusive EA that has been performing well for over a year on Oceania currency pairs "Prospect_FX_AUDNZD"

Achieve substantial profits by trading that aligns with the higher-timeframe market

A swing EA targeting the rare AUD/NZD currency pair

Forward period is 13 months starting from mid-August 2018.

The results have been particularly strong since May of this year.

【Prospect_FX_AUDNZD Overview】

The currency pair targeted is the AUD/NZD pair, an Oceania currency pair.

Because the markets are close, correlations are strong, and the period from the morning to late morning in JST is active.

The timeframe used is 15-minute candles; the maximum number of positions is 10, which is relatively high, and the trading style ranges from day trading to swing, with longer holding times.

From a weekly perspective, the AUD/NZD market shows a gradual downtrend, and since 2014 the range width has been relatively easy to understand, so the EA appears to be a logic that fits that condition.

Even within ranges, many trends that span the full price range occur, so large profits can be expected.

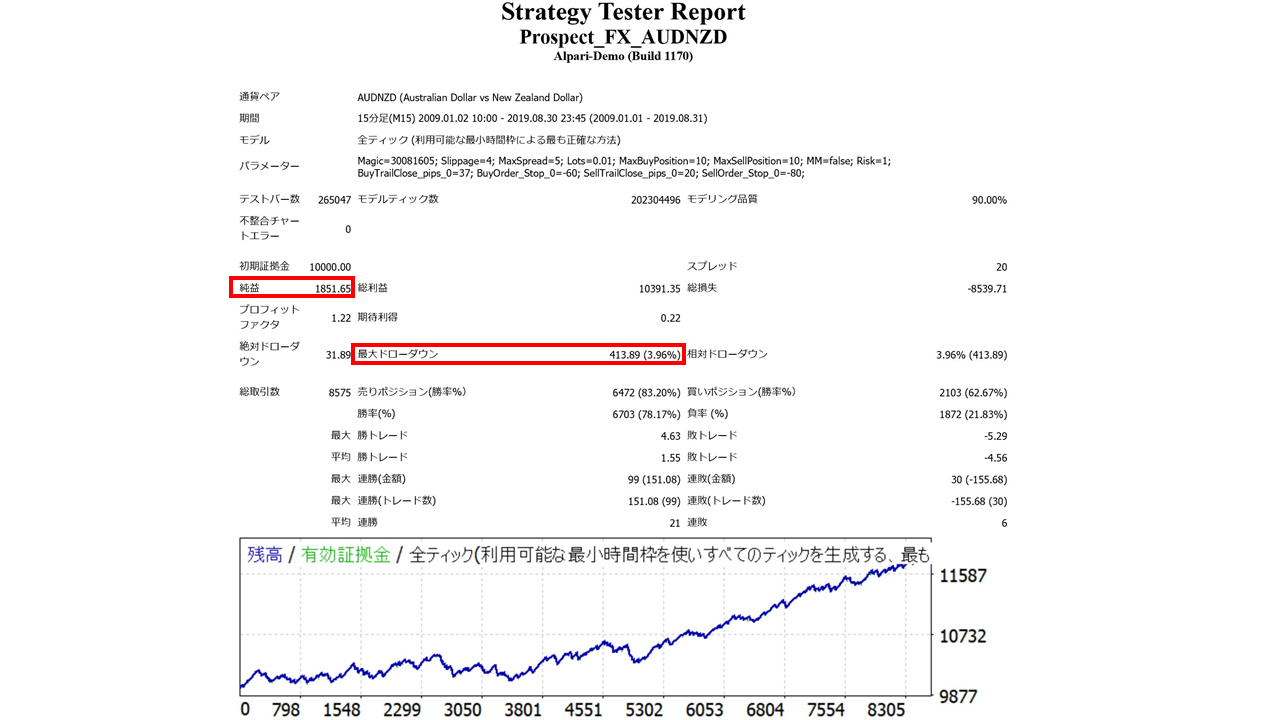

【Backtest Analysis】

Since both simple and compound interest operations are possible, we will examine both (USD-denominated, initial margin of $10,000).

1. Simple Interest Operation

With the maximum number of positions set to 10, we reduce the lot size to 0.01 for analysis.

Spread is 20. The period runs from 2009 to the end of August 2019.

2009.01.01‑2019.08.31

Net profit +¥203,000 (annual average ¥19,000)

Maximum drawdown −¥45,000

Total trades: 8,575 (annual average 805)

Win rate 78.17%

PF 1.22

Recommended margin is fixed at 0.01 lots

(0.3*10) + (4.5*2) = 12 (ten-thousand yen)

Expected annual return is15.8%.

Since the maximum number of positions is 10, it should be a guideline to operate at 1/10 the lot size when running other EAs.

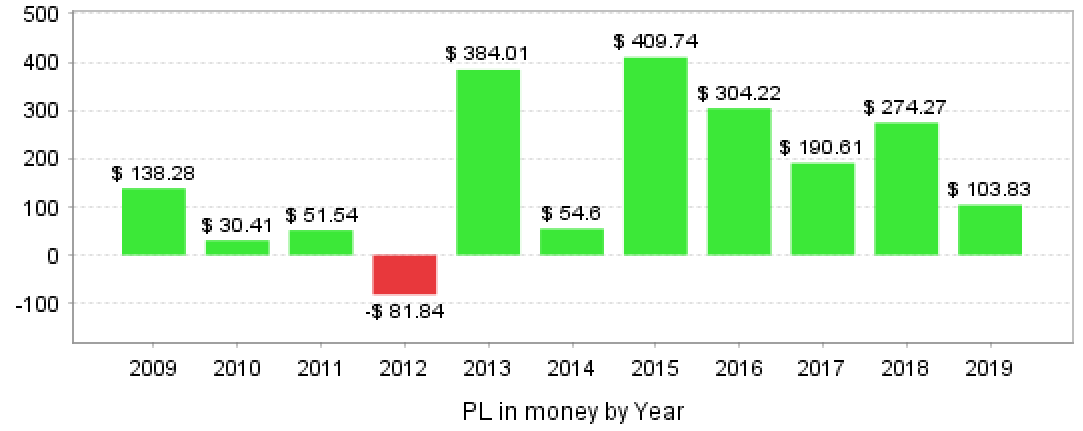

・Yearly Revenue

Profits in every year except 2012.

Since the market conditions observed from 2014 onward, profits have risen and performance has improved.

As confirmed in forward testing, 2019 should also see further gains.

・Year/Month

On a monthly basis, losses occur at a rate close to the win rate.

If you look closely, profitable months often occur in succession, which suggests that “Prospect_FX_AUDNZD” reliably captures market direction over a span of several months.

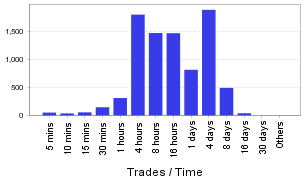

・Holding Time

Average is about half a day to four days.

Because settlements are controlled by the average profit across multiple positions, holding times tend to be relatively long.

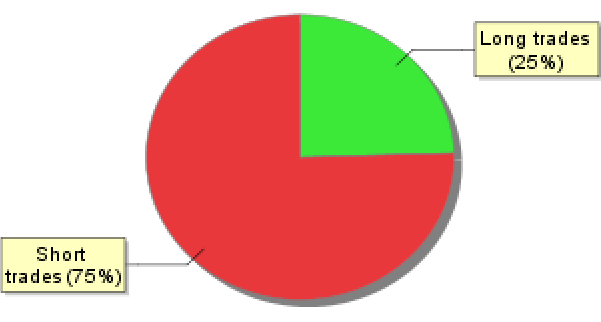

・Position Ratio

Over roughly ten and a half years, the long:short positions have been 1:3.

2. Compound Interest Operation

The backtest period for compounding is about half that of simple interest.

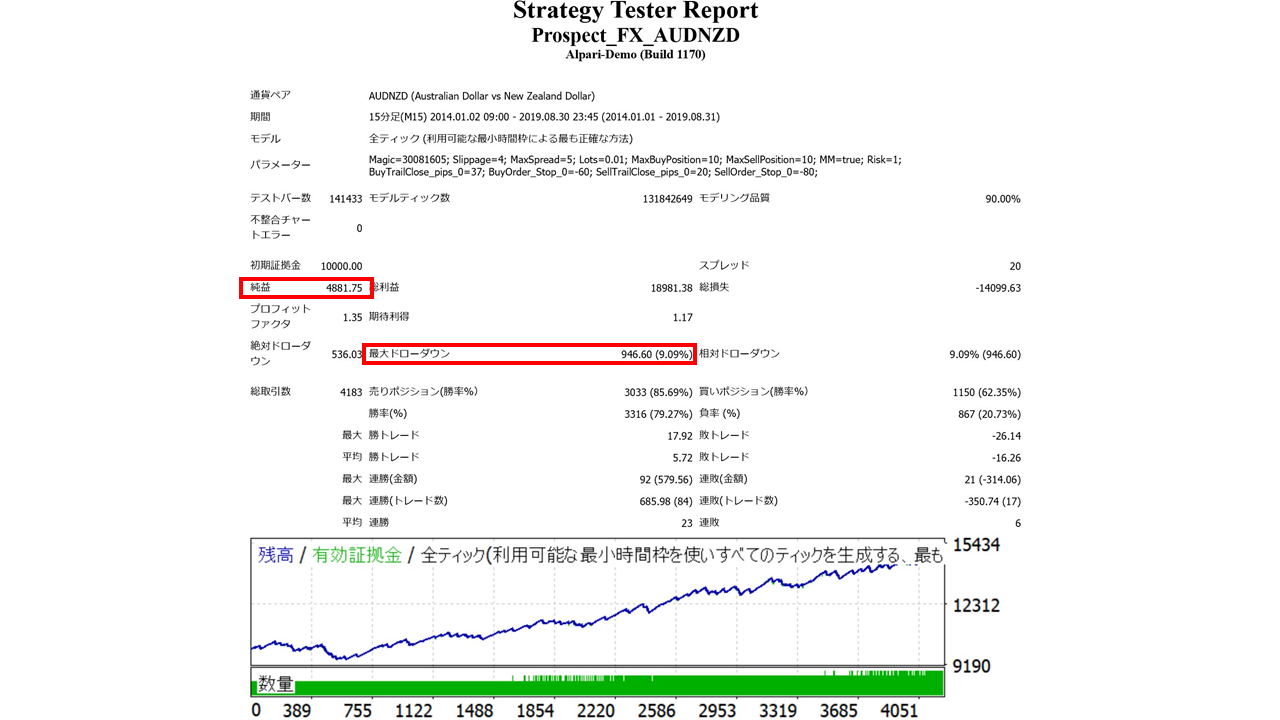

・Default Settings

2014.01.01‑2019.08.31

Net profit +¥536,000

Maximum drawdown −¥1,040,000 (9.09%)

Total trades: 4,183

Win rate 79.27%

PF 1.35

RF 5.15

Because of compounding, it yields more profit in a shorter period than before.

Since the maximum drawdown is 9% of the total funds, I would like to look for a more capital-efficient value (Prospect_FX_AUDNZD allows adjusting the ratio of margin to return via parameters when using compound settings. The default is Risk = 1.0).

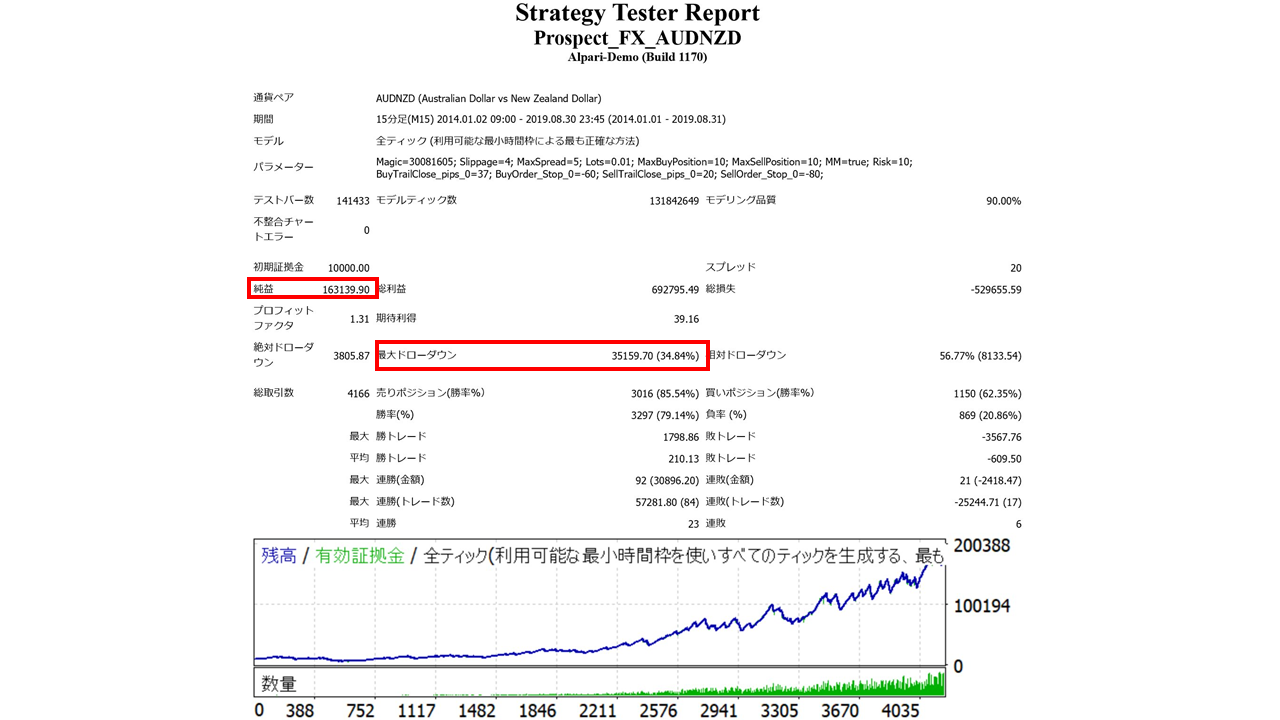

・Risk=10.0 Setting

Net profit +¥17,945,000

Maximum drawdown −¥3,867,000 (34.84%)

Total trades: 4,166

Win rate 79.14%

PF 1.31

RF 4.64

In about five and a half years, even with 0.01 lots, it yielded an extraordinary net profit of ¥17,000,000. However, the maximum drawdown was −¥3,860,000, reducing more than 30% of the total funds, which caused the PF and Recovery Factor (RF; a measure of risk-return defined as net profit divided by maximum drawdown) to fall below the default settings.

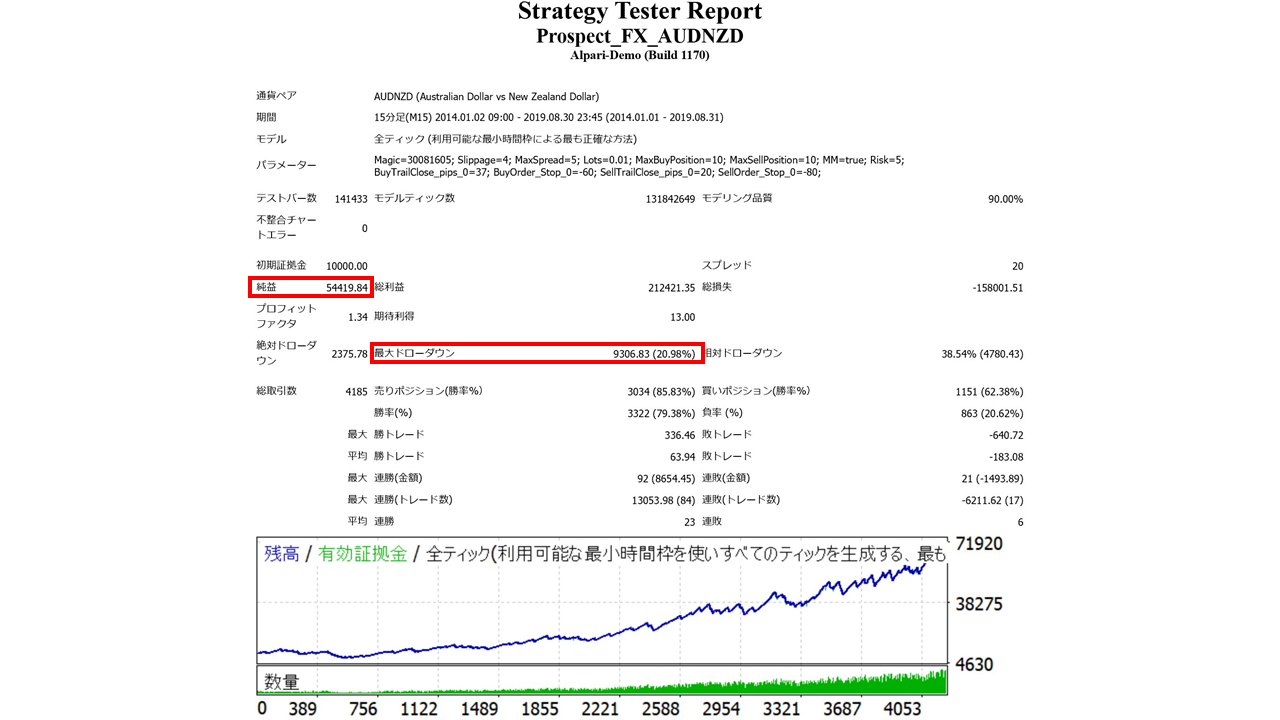

・Risk=5.0 Setting

Net profit +¥5,986,000

Maximum drawdown −¥1,023,000 (20.98%)

Total trades: 4,185

Win rate 79.38%

PF 1.34

RF 5.85

Net profit roughly ¥6,000,000, somewhat less than before, but the maximum drawdown was kept to about 20%, and PF approached the default setting. RF reached its peak.

This approach seems to provide more stable earnings while maintaining better capital efficiency. When actually operating, we recommend thoroughly backtesting your own trading environment in advance in this way.

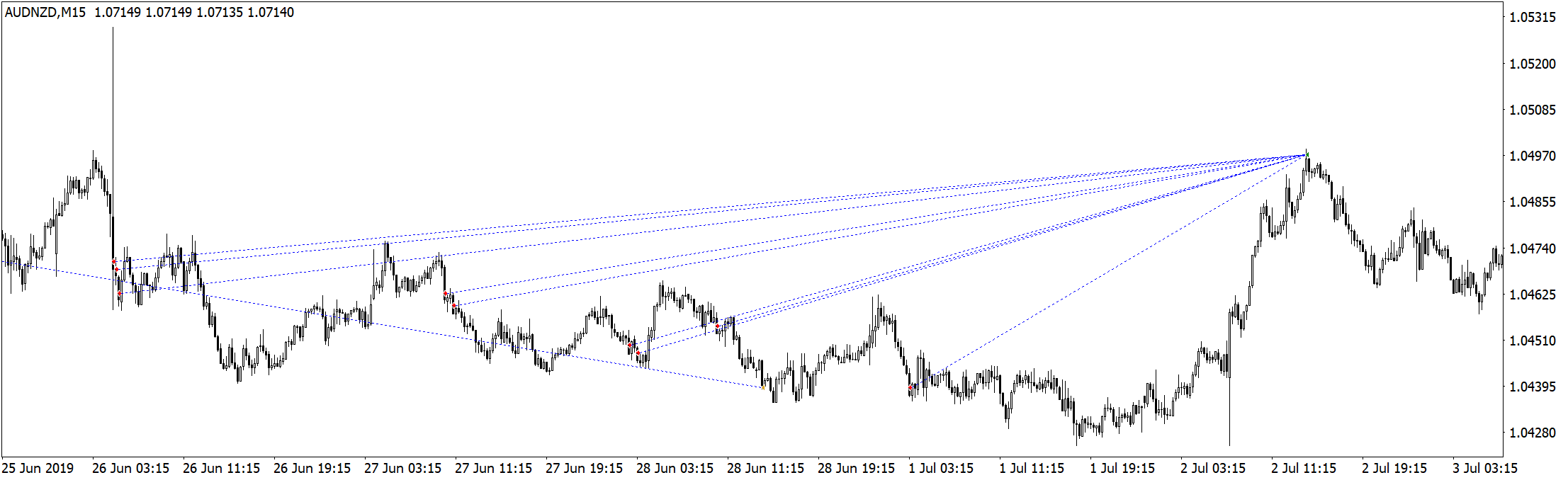

【Trade Analysis】

Here we review the trades within the backtest period on a chart.

Blue: Long Red: Short

Entry timing uses multiple smaller entries for contrarian timing.

With up to 10 positions, entries are staged, and once the overall average profit across positions becomes sufficient, a bulk close is used to secure substantial profits.

As shown, profits are generated by a long-term AUD/NZD strategy.

Provided the market direction aligns with the EA, there should be no losses that cannot be recovered unless there is extreme market volatility, and it should continue to earn large profits.