Top of the risk-return ratio rankings! A morning-type one-position EA with over 50% annual return, "KUNAI_GBPUSD"

Low drawdown and high profits

Risk-return ratio currently top-class

If you want to maximize capital efficiency, compounding is the clear choice!

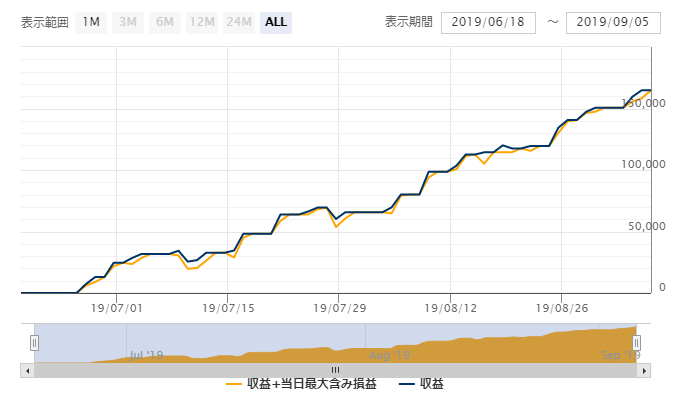

Forward testing period is still short, starting from mid-June 2019, but given the volatility and large price movements of GBPUSD, not seeing large drawdowns in profits is a sign of a solid EA. There is reason for optimism.

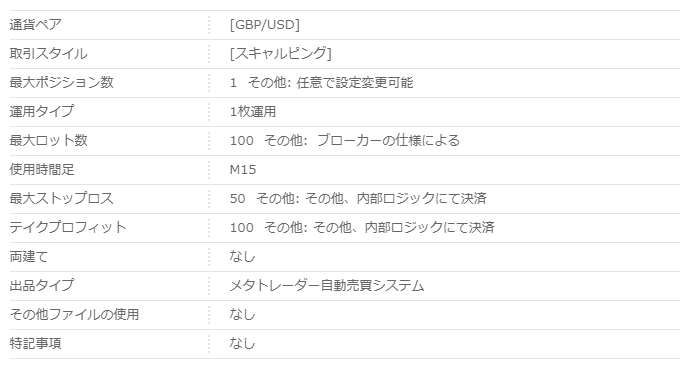

【KUNAI_GBPUSD Overview】

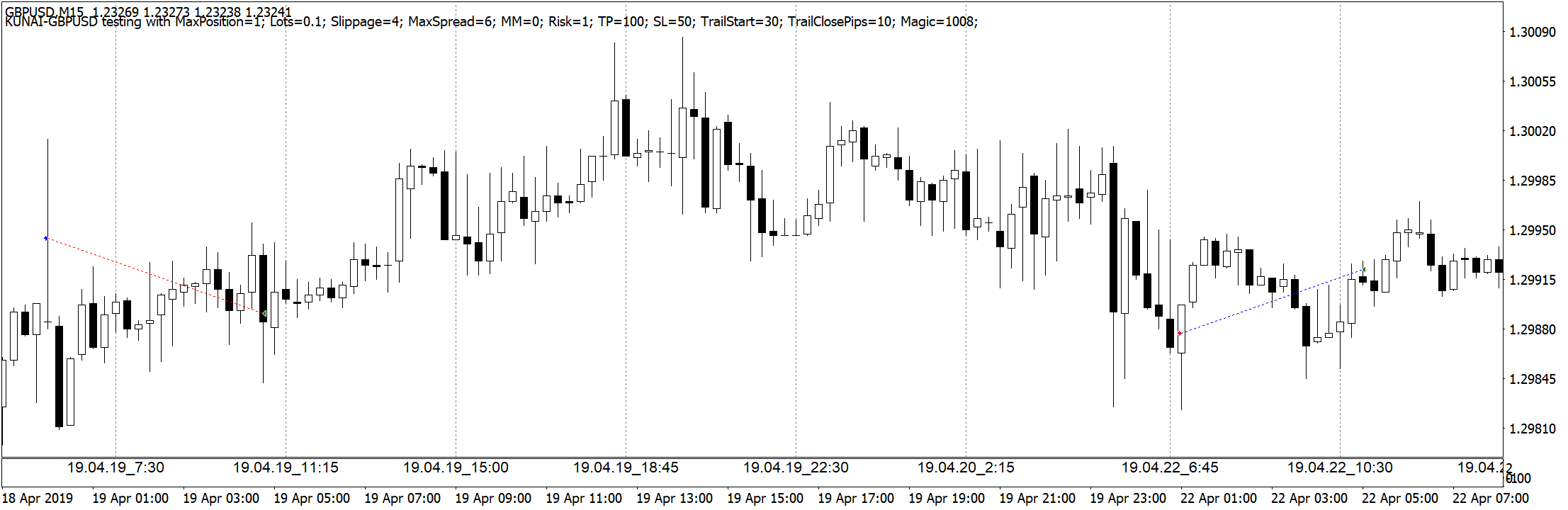

The time frame used by “KUNAI_GBPUSD” is the 15-minute chart, and it is an GBPUSD-only EA.

Max stop loss is 50, take profit is 100. In both cases, execution is determined by internal logic.

Max open positions: 1, and a trailing stop feature can be configured.

【Backtest Analysis】

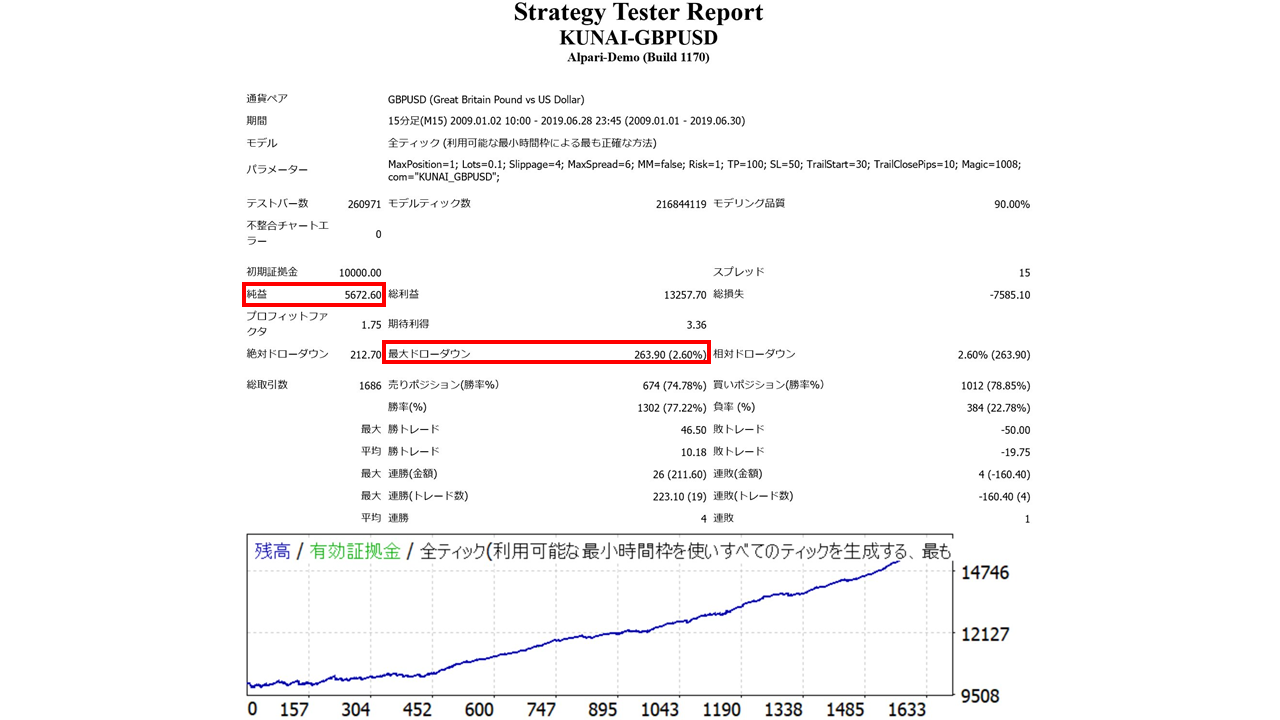

KUNAI_GBPUSD supports both simple and compounded operations, so we will look at both. With a fixed 0.1 lot and a spread of 15.

・Simple operation

We will review backtests from 2009 to the first half of 2019.

2010.01.01–2019.06.30

Spread 1.5

Net profit +623,000 yen (annual average 59,000 yen)

Maximum drawdown −28,000 yen

Total trades 1,686 (annual average 160 trades)

Win rate 77.22%

PF 1.75

Recommended margin amount is

11.1万円

Therefore a safe operation starts from around 120,000 yen.

The expected annual return in this case isapproximately 53.4%.

・Yearly revenue

Profits have been earned for more than ten consecutive years. In particular, the latest results are strong, with a profit of $383.3 in the first half of 2019.

・By year and month

Even when broken down monthly, there are few months with losses.

Drawdowns are kept low, with small losses and large gains.

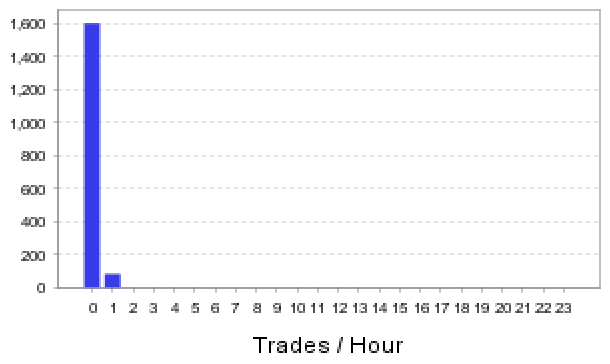

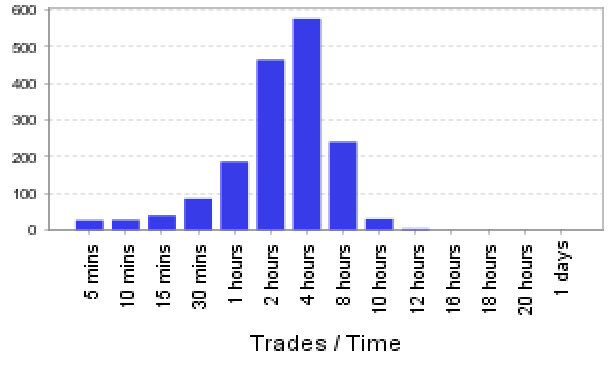

・Trading time and holding time

Trading times are 00:00–01:00 MT4, and trades occur in the Japanese morning.

The most common holding time is 4 hours; although it's a scalping-type EA, positions seem to be held relatively longer.

・Compounded operation

KUNAI_GBPUSD's compounded operation is examined over a 5.5-year period from 2014 to the first half of 2019 with a 20% risk setting.

Net profit +3.11 million yen

Maximum drawdown −284,000 yen

Total trades 881

Win rate 79.46%

PF 2.55

Compared with 10 years of simple (non-compounded) operation, it produced about five times the net profit.

Although max drawdown has increased, it remains only about 7% of the funds, and the PF is higher than with simple operation.

The risk-return ratio (total net profit ÷ maximum drawdown) is quite excellent, and because drawdown-induced temporary asset declines are minimal, compounding based on the account equity can effectively grow assets.

【Trade Analysis】

Blue: Long Red: Short

As noted earlier, positions are held relatively long, and entries are made in the early morning.

From what we have seen, on GoGoJungle's system-trade page the risk-return ratio ranks third (as of September 6, 2019), and when considering only the EA it ranks second, making it a reliable performance. Since many buyers value the risk-return ratio when purchasing an EA, please consider giving it a try.