Trading logic fully disclosed! A scalping tool that visualizes complex buy/sell decision criteria in a simple way, "Jiatama FX Scal V2"

All trading logic revealed!

Filter market conditions with multiple indicators,

By tightening entry conditions,trend-following at ironclad pointsbecomes possible!

”Weekdays 16:00–23:00” 1-minute time-frame scalping indicator & order tool

『Jiatama FX Scal V2』

An order tool with a “Safety” feature that only allows entries when conditions are met,

Escape the wasteful “button-pushing habit”

【Recommended for these people!】

▶ Beginners ◀

・You enjoy scalping but tend to trade with unclear justification

・If the market moves against you, you try averaging down or Martingale to salvage it

・You don’t clearly know when to take profits; you tend to delay exits to chase profits, often ending in a loss

▶ Intermediate or higher ◀

・You want to use signs that clearly show buy/sell logic

・You trade on the medium-to-long term but also want to try scalping

◆ What is the trade logic of Jiatama FX Scal V2?

MACD and RSI are used to filter the market direction,

Keltner Channel and Envelopes are used to determine range conditions,

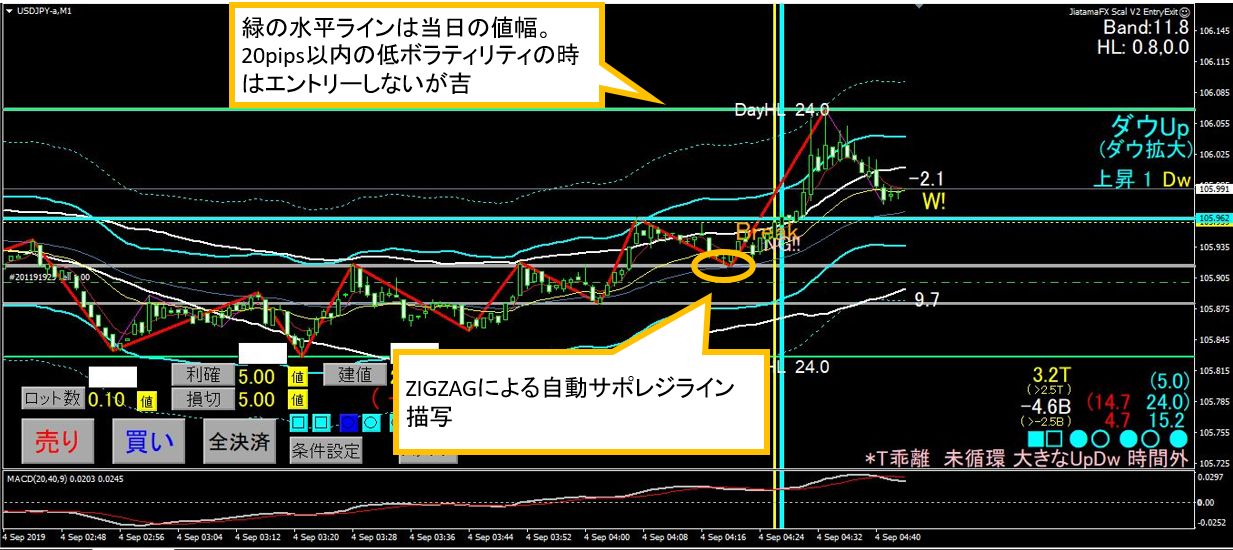

and multi-timeframe ZigZag, moving-average cycles, and Dow Theory are used to gauge wave size and entry timing.

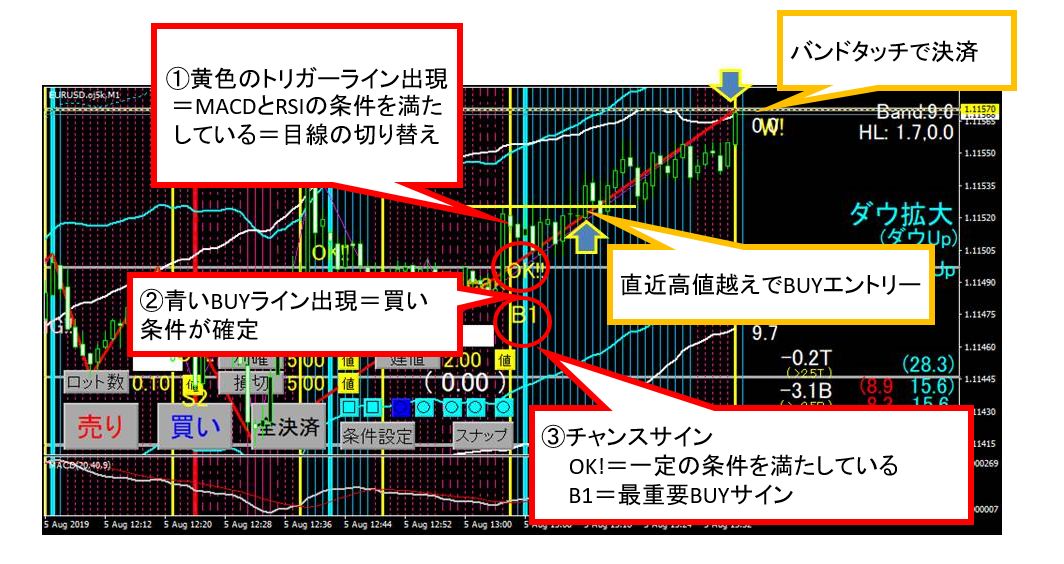

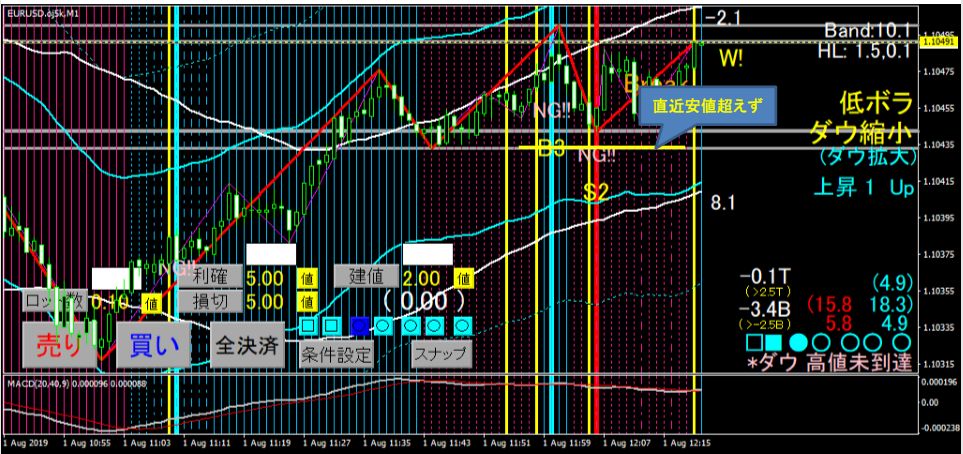

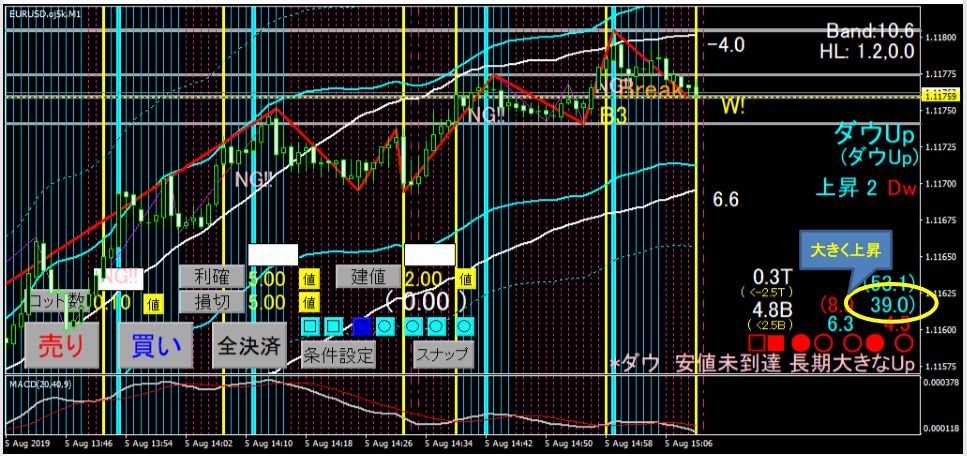

First, a simple flow up to entry is shown.

1. Yellow trigger line for market reversal appears

2. Entry direction line appears

3. When entry conditions match, a chance signal (B, S, OK, NG) appears to enter, or after a chance signal appears, enter clearly by breaking the recent high/low.

4. Exit when price touches the band or when the trigger line reappears

Next, we will explain in detail the trading logic for how each line and signal appears.

Market judgment by indicators

1. MACD and RSI entry conditions align (buy/sell direction)> Yellow trigger line appears

For a buy: when conditions ① and ② are met

① On the 1-minute chart, MACD (20,40,9) with MACD > Signal

② On the 1-minute RSI (14), RSI >= 51

For a sell: when conditions ① and ② are met

① On the 1-minute MACD (20,40,9) with MACD < Signal

② On the 1-minute RSI (14), RSI <= 49

2. Blue or redEntry line appears

Conditions for entry line appearance are as follows

【Buy】

① The current price exceeds the high of the candle where the trigger occurred.

② The three EMAs (short: 5, mid: 20, long: 40) are arranged from top in one of the following orders,

(Long 40 > Short 5 > Mid 20)・(Mid 20 > Short 5 > Long 40)・(Short 5 > Mid 20 > Long 40) and,

1-minute MACD (20,40,9) shows MACD > Signal.

③ Not in a range. The conditions to determine a range are the following two.

(Envelopes(20, EMA, 0.05) band contains the Keltner_ATR_Band(50.0, 3.5) band) = K-range

(Keltner_ATR_Band(50.0, >3.5) band contains Envelopes(20, EMA, 0.05)) = E-range

【Sell】

③ Not in a range. The conditions to determine a range are the following two.(Envelopes(20, EMA, 0.05) band contains the Keltner_ATR_Band(50.0, 3.5) = K-range)

(Keltner_ATR_Band(50.0, >3.5) band contains Envelopes(20, EMA, 0.05) = E-range)

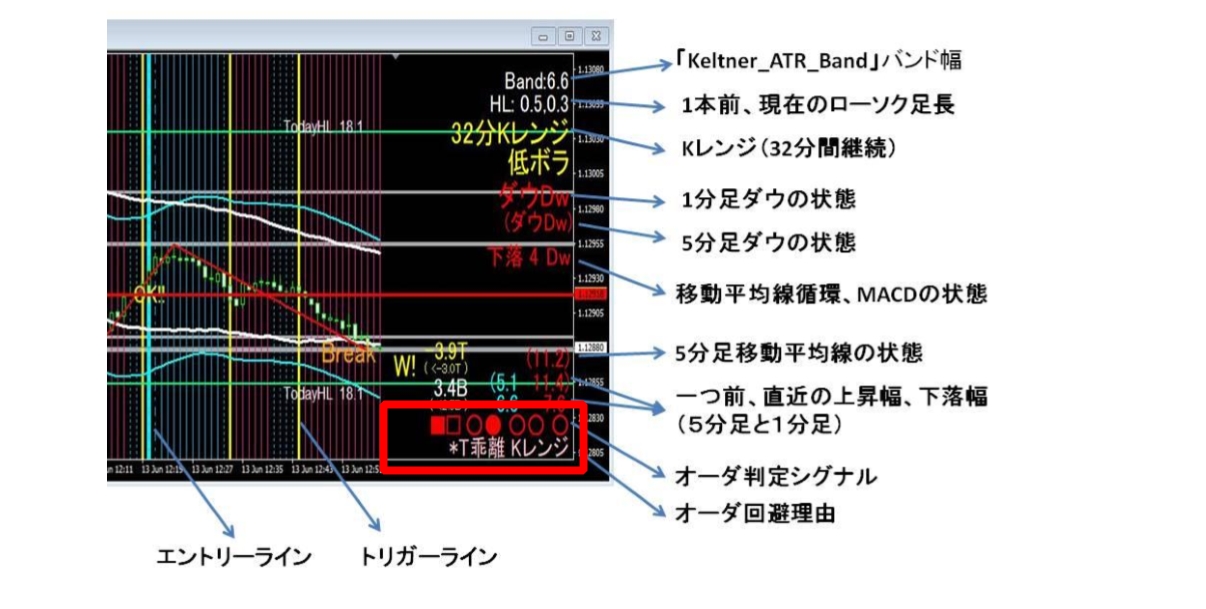

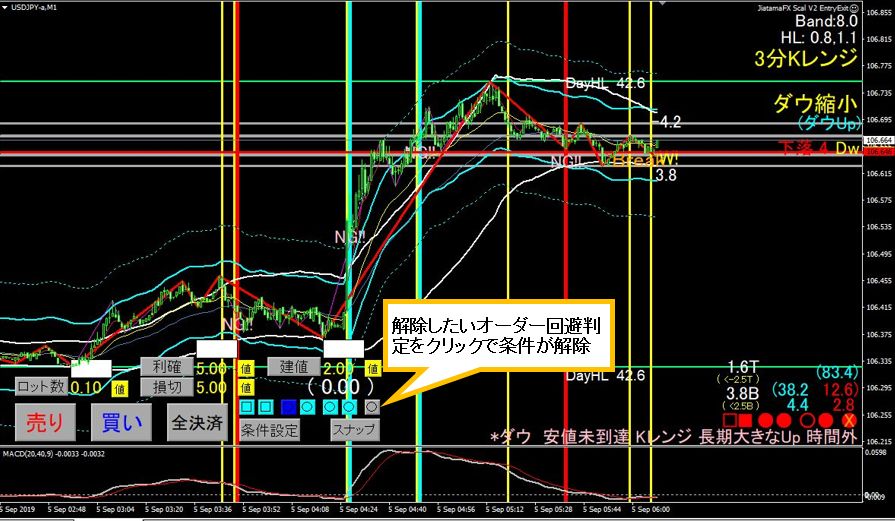

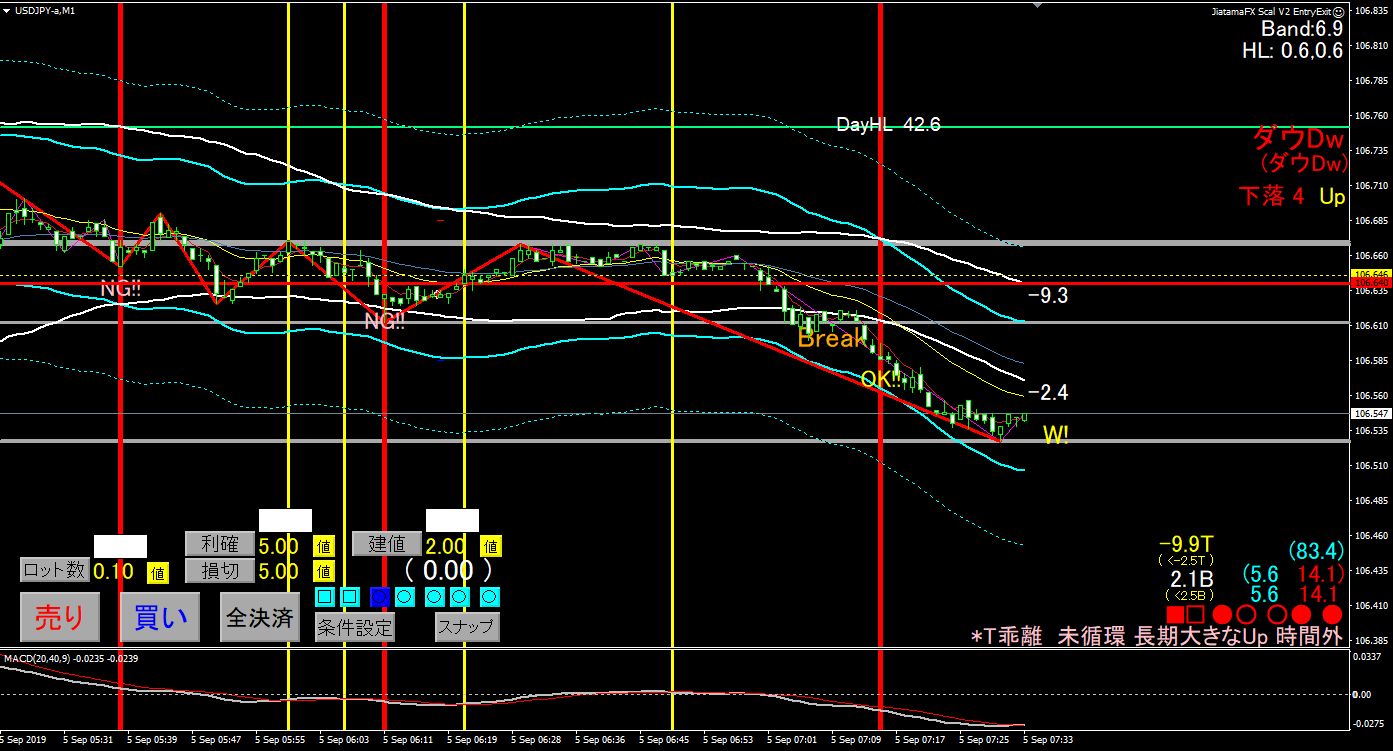

Next, to decide if you should really enter, seven filters including target range, Dow wave on 1- and 5-minute charts, and volatility are used to filter.

If these detailed ancillary conditions do not align, an order-avoidance reason is clearly shown at the chart bottom as a signal with □ and ◯; if the conditions do not match, the area is filled black and the reason is shown in text.

※ Orange text indicates the order-avoidance reason text.

Order judgment conditions and symbol order

1. The first ◯ is a black-out condition

・The current price does not exceed the high/low of the trigger candle (entry target)

・Moving-average cycle has not reached entry state

“High/Low not reached” and “not cycled”

2. The second ◯ is a black-out condition

・It is a range (E-range, K-range)

The Dow does not agree with the current buy/sell.

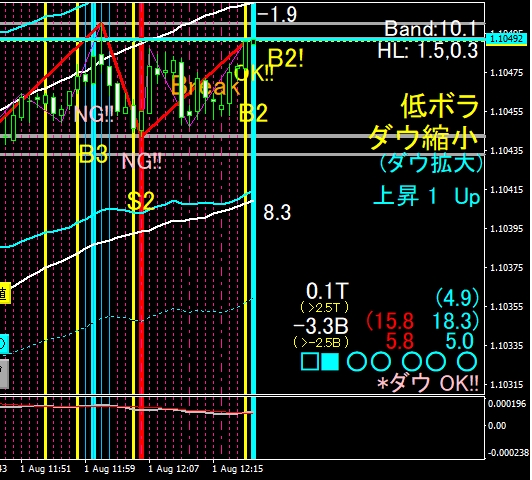

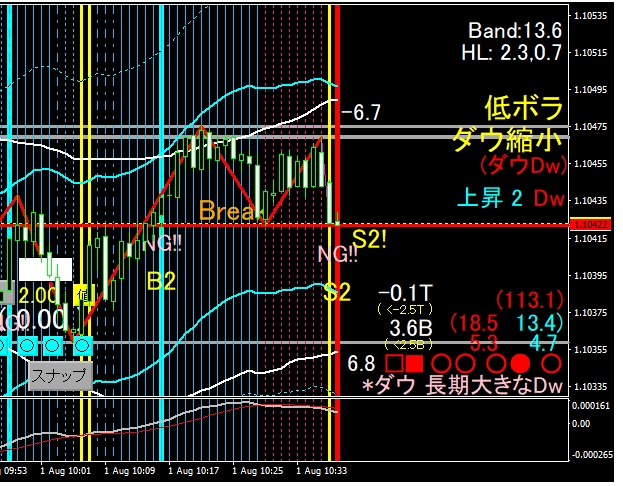

Levels of Chance Signals

In Jiatama FX ScalV2, depending on the filtered market state via indicators and the difference in order-judgment match, different real-time chance signals appear.

OK! B2

NG! S2

Trading examples with different chance signals (including passes)

B1 Ironclad buy entry. You may enter immediately, but place an order on a break of the recent high, with decision on the envelope band touch or the opposite trigger line for exit.

S2 Entry. Enter as soon as the entry line appears since it has broken the recent low. Exit on band touch.

S2 Pass pattern. Not clearly exceeding the recent low.

B3 Pass pattern. The recent 5-minute Dow has already risen by 35 pips or more (long-term big Up).

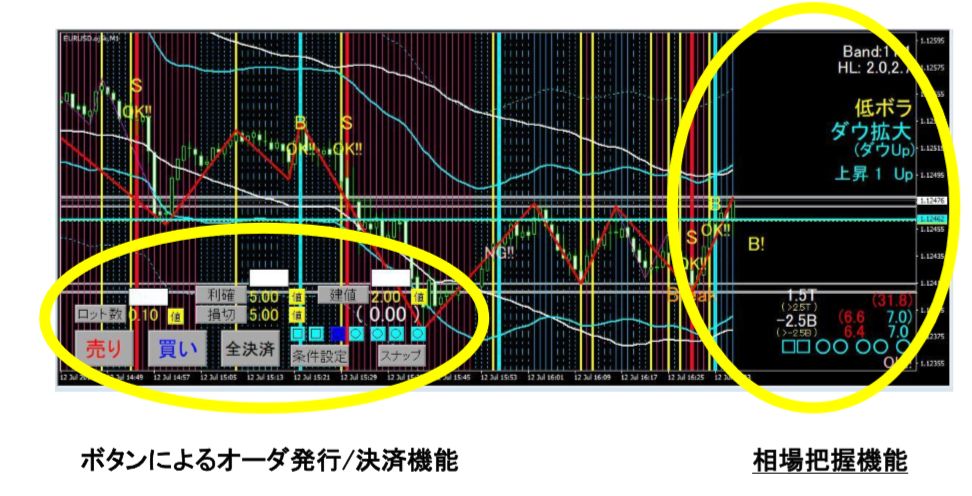

Not just indicators! A tool EA with multiple functions

Feature 1: Order judgment-integrated entry & exit EA (order tool)

What you see bottom-left is the order function. In addition to buy/sell orders, there are full-close buttons and default TP (take profit) and SL (stop loss) simultaneous order features.

Furthermore, by default, there is a breakeven move of the stop when the profit goes beyond 2 pips, moving the stop to the entry price!

Even with just this,it focuses on how to avoid losses.

What is notable isthe seven order judgments are linked to the order-entry function.

After the entry line appears,you can only place an order if a Chance Signal (S1, B1, S2, B2, S3, B3) is active.

Also, you can modify conditions yourself to find trading opportunities. If you click the “Order Judgment Mark” on the order panel, conditions are released and you can place orders with the order button.

For example, if you want to trade outside Tokyo hours (not between 16:00–23:00), click the rightmost ◯ Order-Avoidance button to allow orders outside hours when conditions are met.

Clicking the second □ from the left will release the condition for “Dow” not being aligned.“Dow”not aligned

Clicking the fourth ◯ from the left will release the condition for “Long-term big Up/Dw.”“Long-term big Up/Dw”not aligned

However, the third ◯ from the left,the order-avoidance judgment that current price is not exceeding the trigger candle high/lowcannot be released. It is an essential element for trend-following entries.

Also,if you change conditions using the order-avoidance buttons, the Chance Signals like S1, B1 may disappear. In that case, if the modified conditions align,you will simply see S, B. Please note.

Feature 2: Auto-snap at trigger line and entry line appearance

Frequently Asked Questions

Interested in the seller…

To finish, I’d like to introduce the seller, “Jitomo FX.”

A man who understands both investing and computers!

Background as a system engineer. FX experience for ten years. Five years ago, he released “Jiatama FX (Jiatama FX)” and introduced discretionary trading to many, gaining their support.

Since then he has consistently pursued discretionary trading using tools. In October 2018, he announced on his blog the one-minute discretionary trade “Jiatama FX Scal.”

This is the culmination of his experience. The final form of the trading he aimed for!

He also runs the following blog.

“FX MT4 EA Auto-Creation Software (Domestic & Overseas) – Comparison & Review”

(Quoted from the seller profile)

Overall verdict:

Because several indicators and texts are displayed, at first you might feel overwhelmed by information.

However, instead of properly confirming the state of each indicator before judging whether to enter, Jiatama FX Scal V2 filters with text and order-judgment marks as systematically as possible.

Also, the safety-feature entry & exit panel prevents the common human habit of overtrading, reflecting the seller’s kindness and consideration—an asset that says, “Please don’t lose.”

For 1-minute scalping, you cannot aim for tens of pips in a single trade, but with multiple indicator filters and carefully filtered entry points, the precision is considerable.

Why does a signal appear here on the chart?

Why can’t you enter here?

If you’ve wondered about these, this tool will likely provide the answers.

Although it is advertised for EURUSD, any volatile currency pair is OK.

Especially in recent markets, USDJPY moves a lot, so watching several cross-yen pairs may be worthwhile—this is advice from the seller, Jiatama FX.

If you’d like to read and understand the manual first, please consider getting it.

Free! Public release

JiatamaFX Scal V2 Trading Manual

If you’re interested from this article and want to try it, please visit the sales page!

This price, with entry & exit tools, is hard to beat!

written by Tera. GogoJungle Marketing