An EA that supports multiple currencies and reliably earns profits, "Mechanical Sequencer"

Leveraging the techniques of an author who has won awards in the MT4 Performance Evaluation Contest!

Five-currency support makes it an ideal EA for your portfolio: “Mechanical Sequencer”

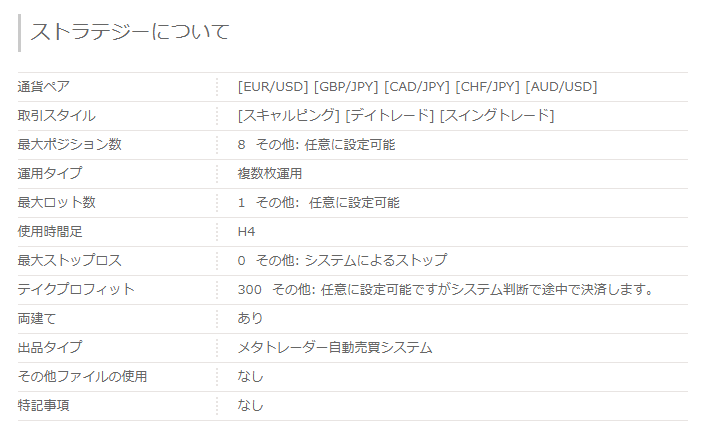

【Mechanical Sequencer Overview】

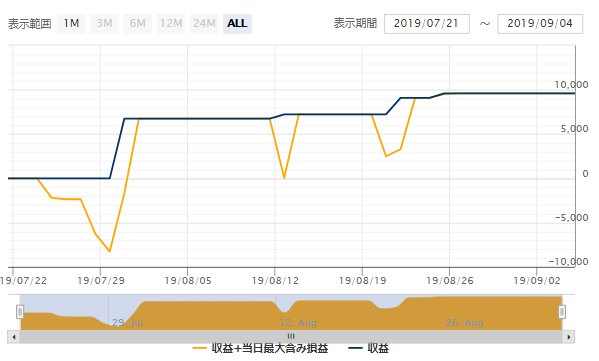

The forward period lasted about two months from July 2019 to September 2019.The forward revenue graph is nearly flat, but profits have been realized, so there is reason to be optimistic about the future.

The traded currency pairs seem to be mainly EURUSD, but they also support GBP/JPY, CAD/JPY, CHF/JPY, and AUD/USD. They plan to add more currencies in the future. It is useful not only for standalone operation but also for portfolios.

According to the product page, it primarily targets trades aiming for reversals and trends on higher timeframes, and trades held for several days in a swing fashion appear to be its main mode.

The maximum number of positions is 8, but it can be configured as desired.

※It supports currency pairs other than EURUSD, but in that case use the "Multi-Currency Set File" that comes as a bonus.

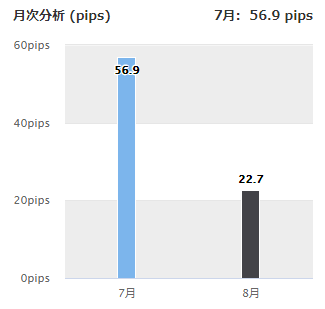

■Monthly Analysis

In the two-month monthly analysis, July gained 56.9 pips and August 22.7 pips. Total 79.6 pips.

【Backtest Analysis】

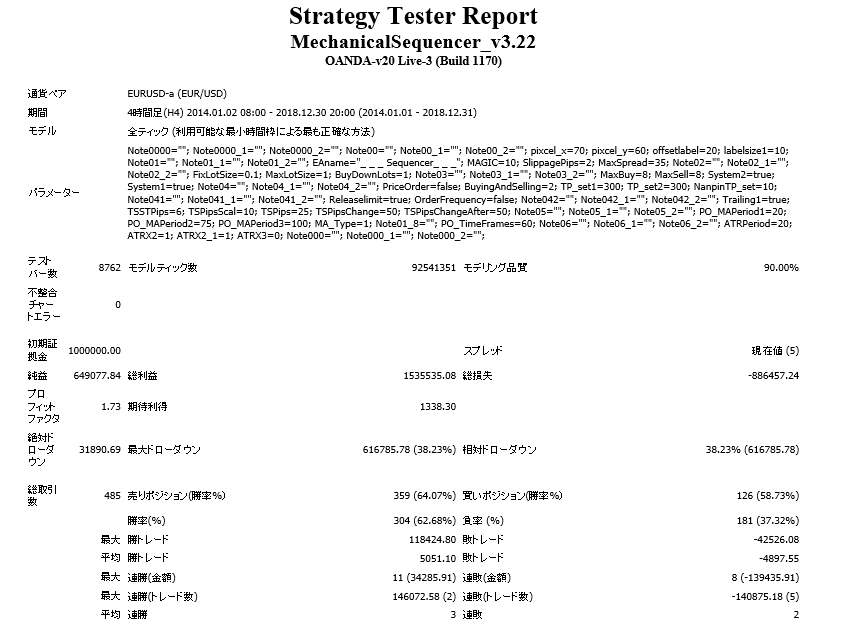

●EURUSD

EUR/USD has earned about 649,000 yen over five years.

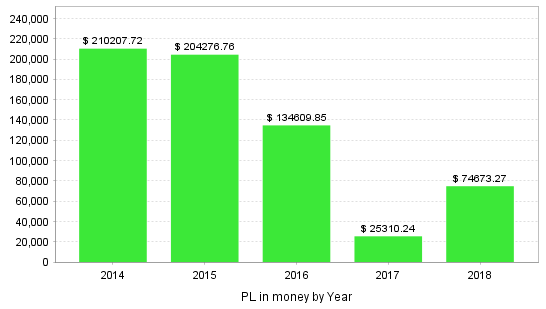

■Annual P/L

In yearly terms, profits have been realized across the entire period.

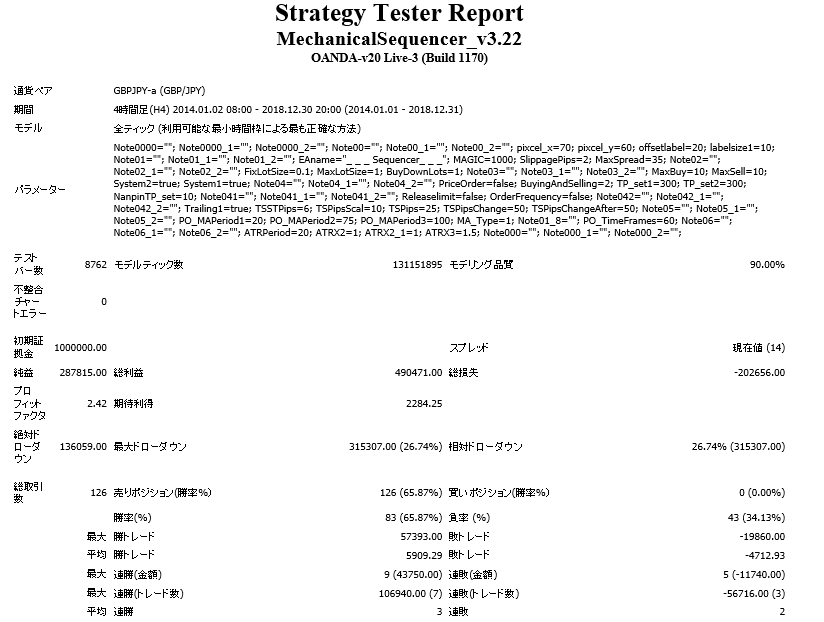

●GBP/JPY

GBP/JPY has earned about 288,000 yen over five years, with a PF of 2.42, a good result.

■Annual P/L

There are peaks, but overall profits have been earned across the entire period. The relative drawdown is also low, so considering risk, it is safer than EURUSD.

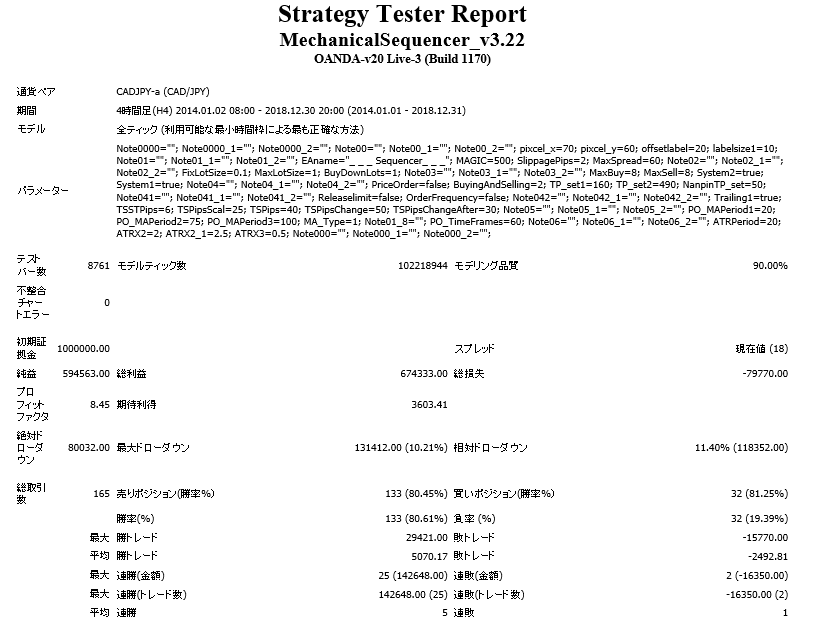

●CAD/JPY

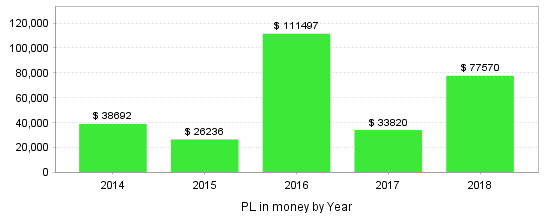

■Annual P/L

Profits are very stable year by year.

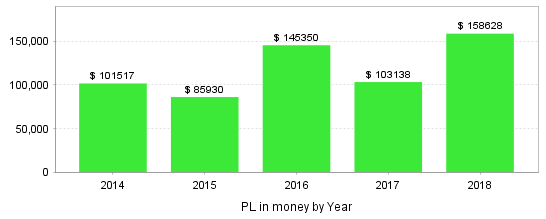

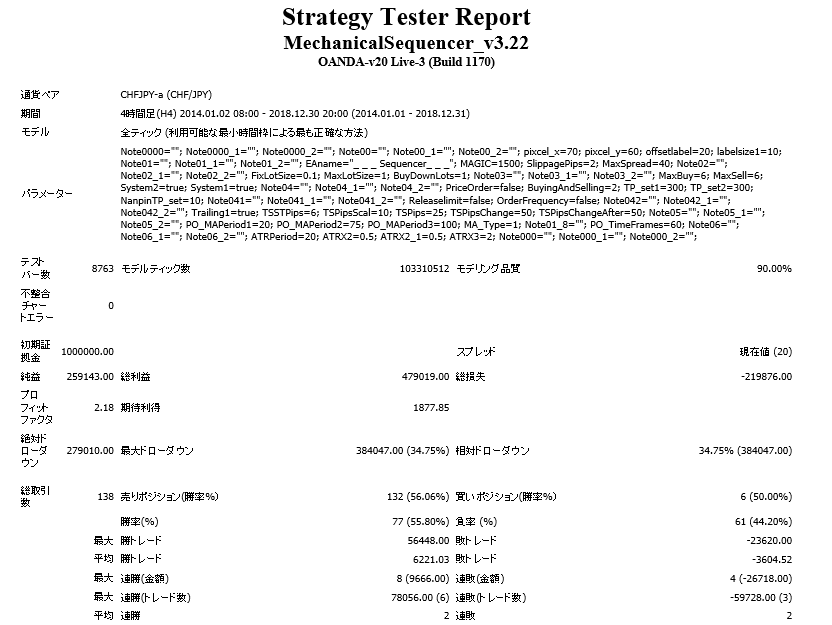

●CHF/JPY

■Annual P/L

2015 and 2016 are especially lucrative. Other years are also excellent.

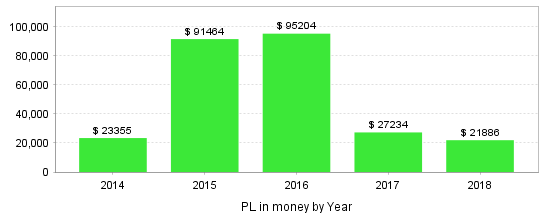

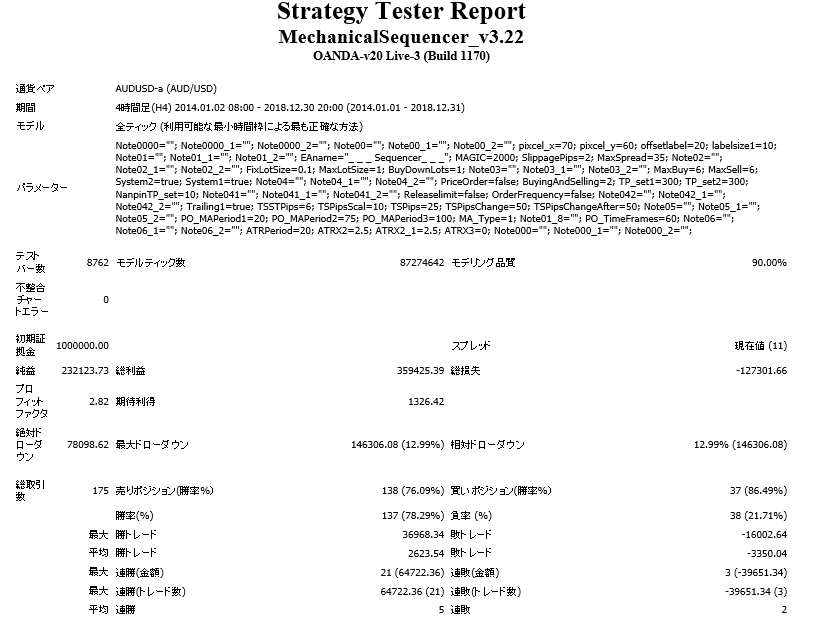

●AUD/USD

The profit for AUD/USD over five years is a net profit of 230,000 yen. It also has PF of 2.82 and relative drawdown of 12%, which is favorable.

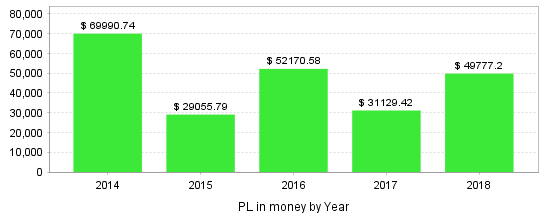

■Annual P/L

Yearly is also stable.

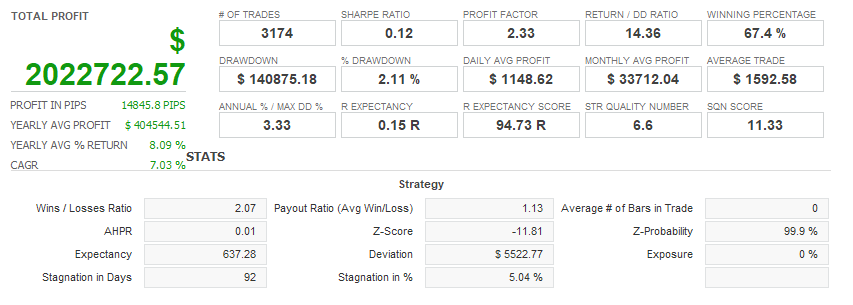

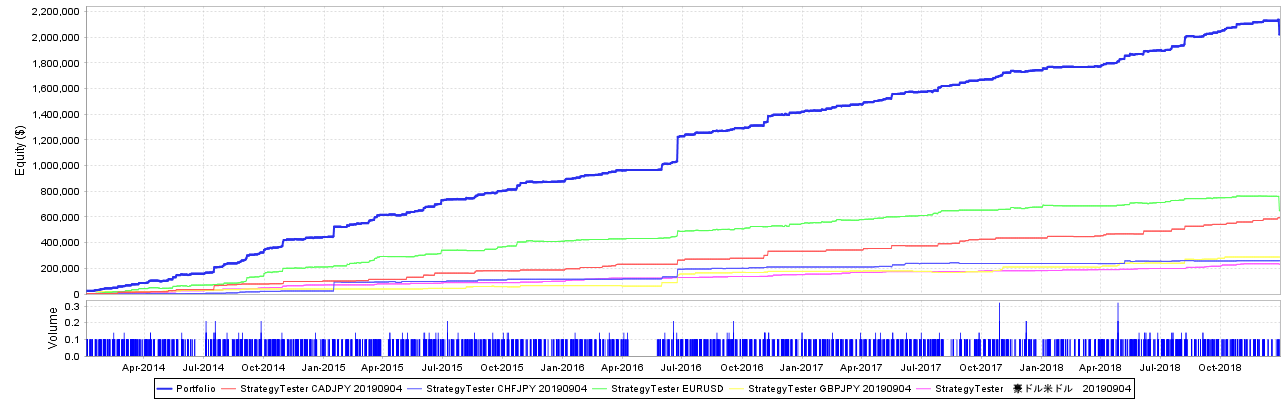

【Portfolio Analysis】

When building a five-currency portfolio, it shows very high efficacy. The graph trends upward to the right. It dipped slightly in 2018, but is expected to perform well.

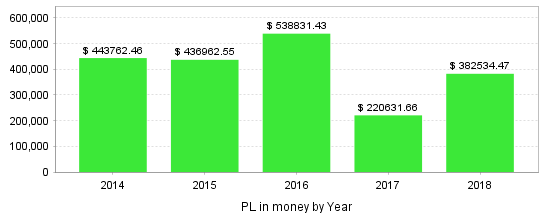

■Annual P/L

Yearly results are very stable. In the graph, momentum faded toward the end of 2018, but it still achieved large gains.

As for EURUSD, which it focuses on, it also seems promising when comparing forward tests and backtests, and other currencies also appear to be fully viable based on backtest results. Of course, since it supports five currencies, it should display its true value in a portfolio as well.

On the other hand, the total number of trades is low, and looking at the forward tests, it seems not to have been active recently, but when the market is favorable it should capture many pips.

The forward period has only progressed for about two months, so I look forward to the results after one year.