What are the benefits of dispersing risk?

Hello!

This time, I would like to write about diversifying risk.

First, what is the risk in Forex?

It is,the capital decreases.

If you are managing to increase your capital, it makes no sense to reduce it, right?

That’s wherediversifying riskcomes in.

By diversifying risk, you can reduce the possibility of capital loss.

When the chance of capital loss decreases, the chance of profit naturally increases.

The way to diversify risk in Forex is,using multiple EAs.

By doing so, even if one EA incurs losses, the profits from other EAs can compensate

and you can limit losses while increasing profits.

However, there is a problem with this.

That is,you need to purchase many EAs.

Investment capitalasthe cost of purchasing EAswould become too high, which defeats the purpose, right?

“I want to maximize the invested capital while minimizing EA purchase costs.”

To meet such requests, the developed EA isPanda-A_M15_EURUSDbecomes.

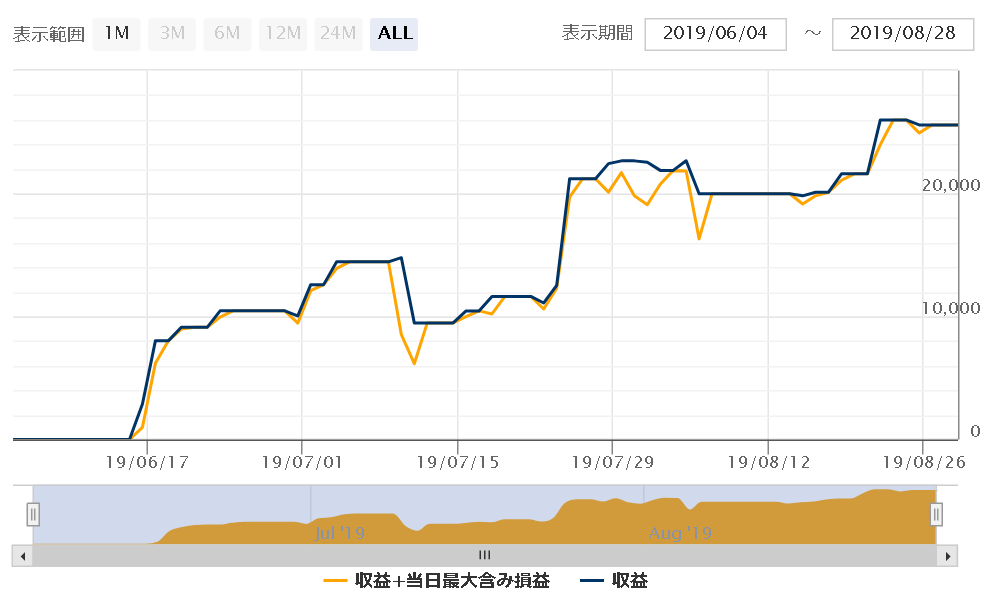

Panda-A_M15_EURUSDis a six-different-logic hybrid EA that can diversify risk while being a single EA.

It is a hybrid EA that can diversify risk.

Even in current volatile markets, it generates stable profits.

Please take this opportunity to check it out.