Even with a fixed lot, an expected annual return of 29.1%; profits increase even more with variable sizing! A market-aligned short-only EA 'Finely_P_EURJPY'

Currently the best performing in long-term forward tests.

An EA for the EUR/JPY market with an expected annual return of 29% even with fixed lots

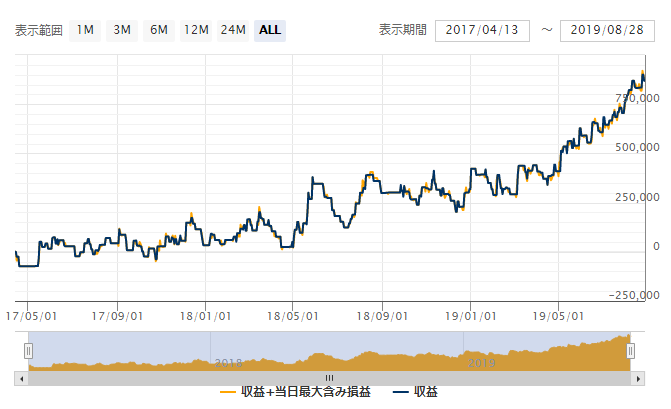

The forward test period started in April 2017, and more than two years have passed; performance has improved even more this year.

It seems to use a logic that enters only on short positions.

【Finely_P_EURJPY概要】

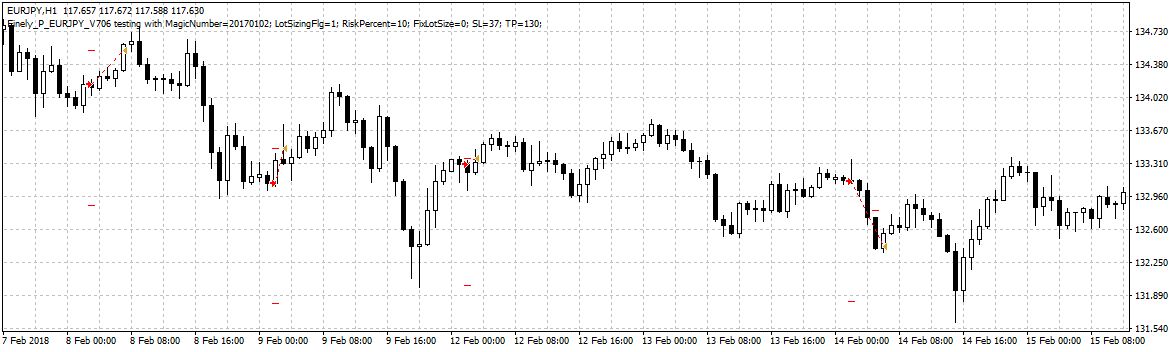

The timeframe used by Finely_P_EURJPY is the 1-hour chart; it is an EUR/JPY–specific EA.

Maximum stop loss is set to 37, and take profit is 130. Profits can be extended by trailing orders.

Because it holds positions for a long time—from scalping to position trading—the stop loss is designed to work quickly.

【バックテスト分析】

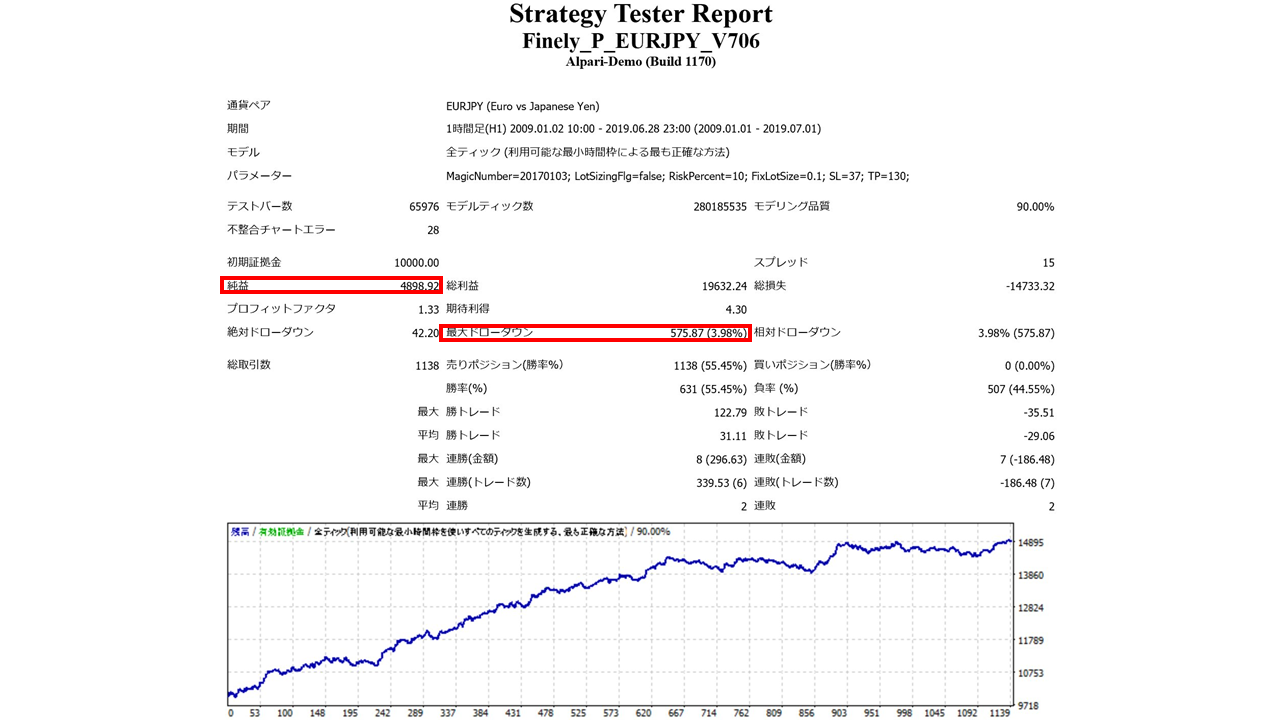

Finely_P_EURJPY has variable lots by default, but first we will review backtests with a fixed 0.1 lots for 2009–2019 (early). The spread is 15 and denominated in USD.

・Fixed Lot

2010.01.01‑2019.06.30

Spread 1.5

Net profit +538,000 yen (annual average 50,000 yen)

Maximum drawdown ‑63,000 yen

Total trades 1,138 (annual average 108)

Win rate 55.45%

PF 1.33

Recommended margin amount is

5 + (6.3*2) = 17.6 (ten-thousand yen)

so the safe operating funds are typically around 180,000 yen.

The expected annual return in this case isapproximately 29.1%.

Since only one position can be held, with fixed lot you can keep drawdown low and start with a smaller required margin.

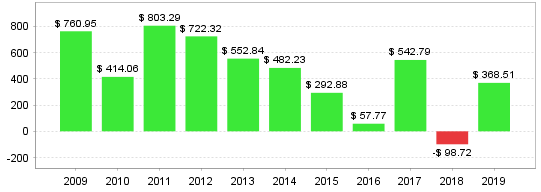

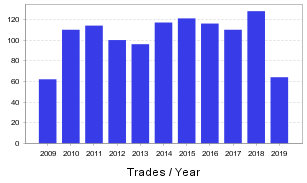

・Annual revenue

Only 2018 incurred a loss, but this year has already earned as much as the past average profit in just half a year.

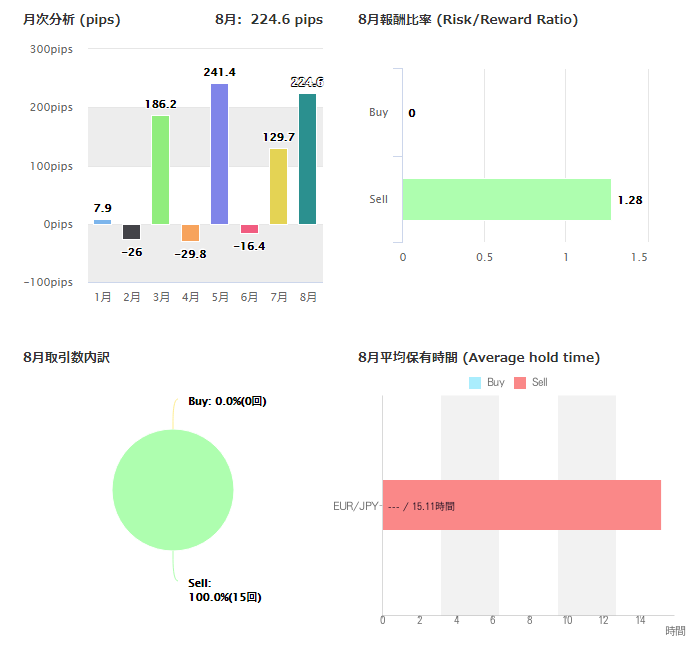

・By year and month

Looking month by month, the loss portion is larger. However, the losses themselves are small while profits are large, so in the long run it shows a loss-cutting-profit-increasing pattern.

Because the number of trades isn’t very high, results may require a longer-term view to become evident.

・Number of trades

The number of trades isn’t high, but it seems to perform averaged trades that are not swayed by excessive profits.

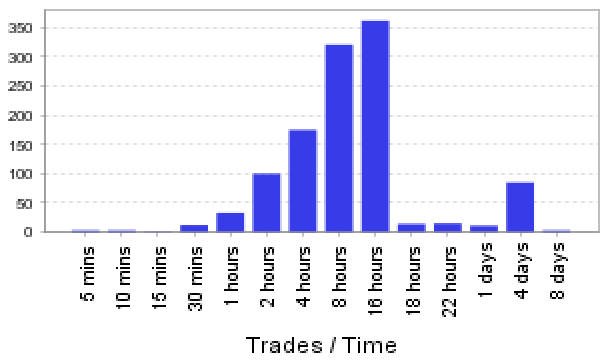

・Holding time

The most common holding time is 8–16 hours; scalping or holdings of more than a week are rare.

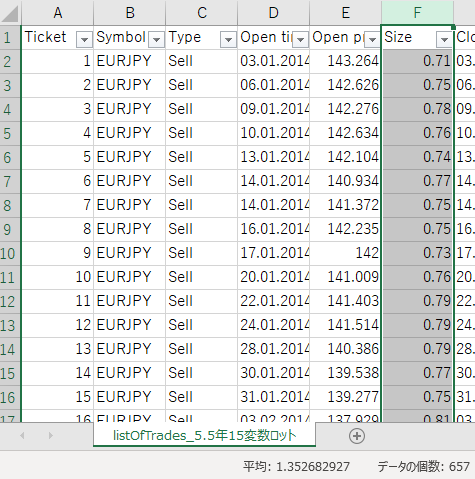

・Variable Lot

Next, Finely_P_EURJPY automatically adjusts the lot size relative to capital by default.

The period to review is 2014–2019 first half.

Net profit +1,713,000 yen

Maximum drawdown ‑1,015,000 yen

Total trades 656

Win rate 55.34%

PF 1.13

Because the lots are not fixed, the maximum drawdown is larger, so the PF is lower, but

in half the fixed-lot period, it has produced more than three times the net profit.

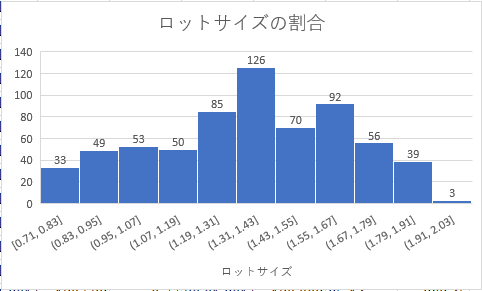

Regarding the lot size, looking at the 5.5-year history, starting with $10,000 capital

the average is about 1.35 lots, and the maximum ranges from 0.71 to 2.03 lots—about a threefold spread; high lots are not excessively large.

This can be adjusted with parameter settings (default risk% is 10).

Incidentally, looking at a backtest for 5.5 years with variable lots starting from about 200,000 yen, close to the previously calculated required margin for fixed-lot,

even with 200,000 yen, you can achieve nearly 300,000 yen in net profit without insolvency.

Fixed-lot has the advantage of keeping maximum drawdown low; if you want to pursue profits, the default variable-lot is good. Even so, drawdown would be about 30–40% of total funds.

【トレード分析】

Blue: Long Red: Short

Entry is only on short. Viewed on higher timeframes, this appears to be an EA suited for a down-trending EUR/JPY.

Even when a short move goes against you, it quickly cuts losses, so holding times tend to be short. Trailing orders are also present, so as seen earlier, longer holding times can still be profitable.

From what we’ve seen, the combination of default variable-lot, a loss-cutting-profit-increasing strategy, and short-only entries suited to the EUR/JPY market work effectively and yield substantial profits. Given the current favorable forward performance, this is a recommended EA.