Using the highly stable 'Pips_miner_EA' as the anchor, I tried to build a portfolio with Dr. Cat EA

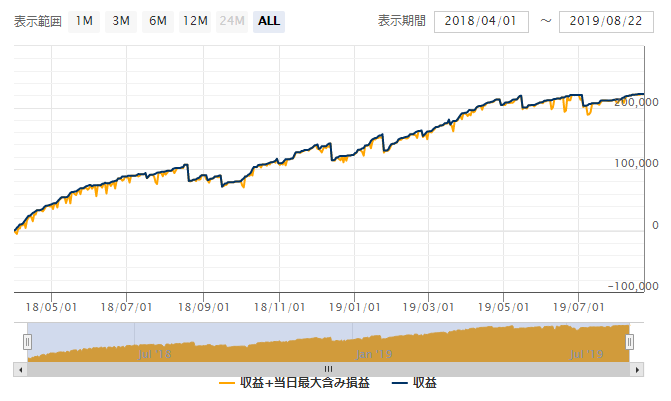

Steady upward trend even with long forward periods

Users over 2,000, the highly popular EA portfolio is also excellent

Even with a forward period of 1 year and 4 months, it has progressed without a significant drawdown.

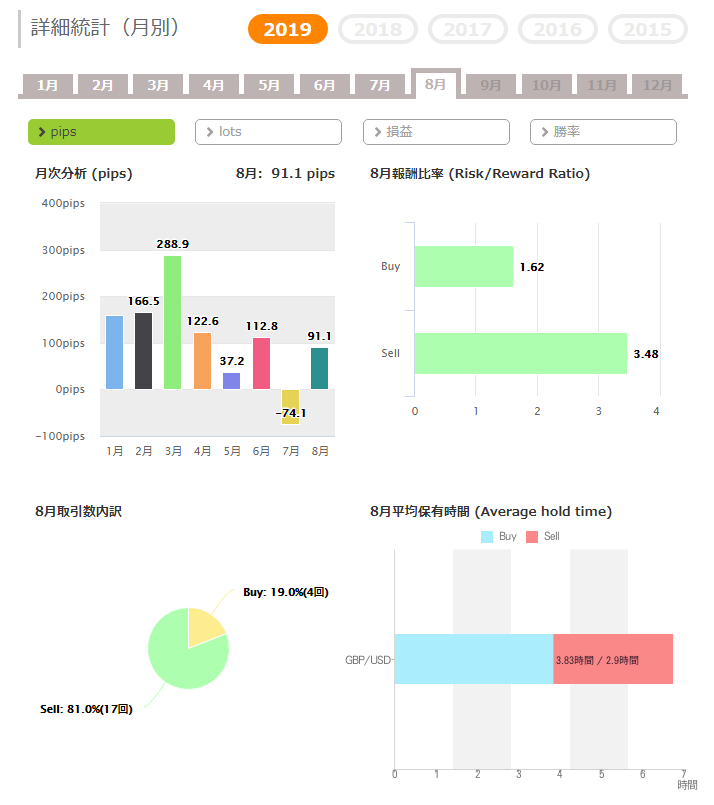

The total pips earned over roughly eight months in 2019 were 905.6 pips, averaging 113.2 pips per month.

Overall, the ratio of short positions is high.

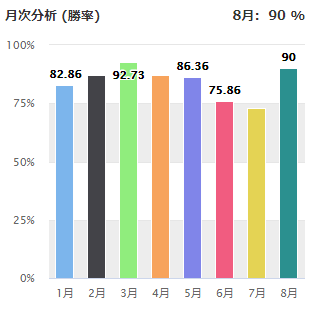

Even in the worst month, July, it maintains a high win rate of 73.08%.

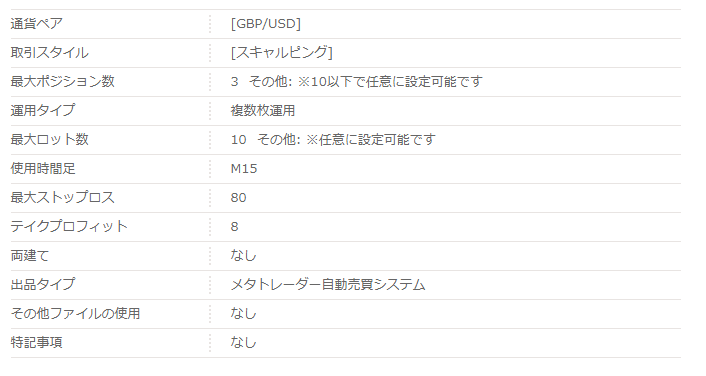

【Pips_miner_EA Overview】

The Pips_miner_EA uses the 15-minute chart and is a GBP/USD scalping EA.

Maximum stop loss is 80 pips, and the take profit is 8 pips.

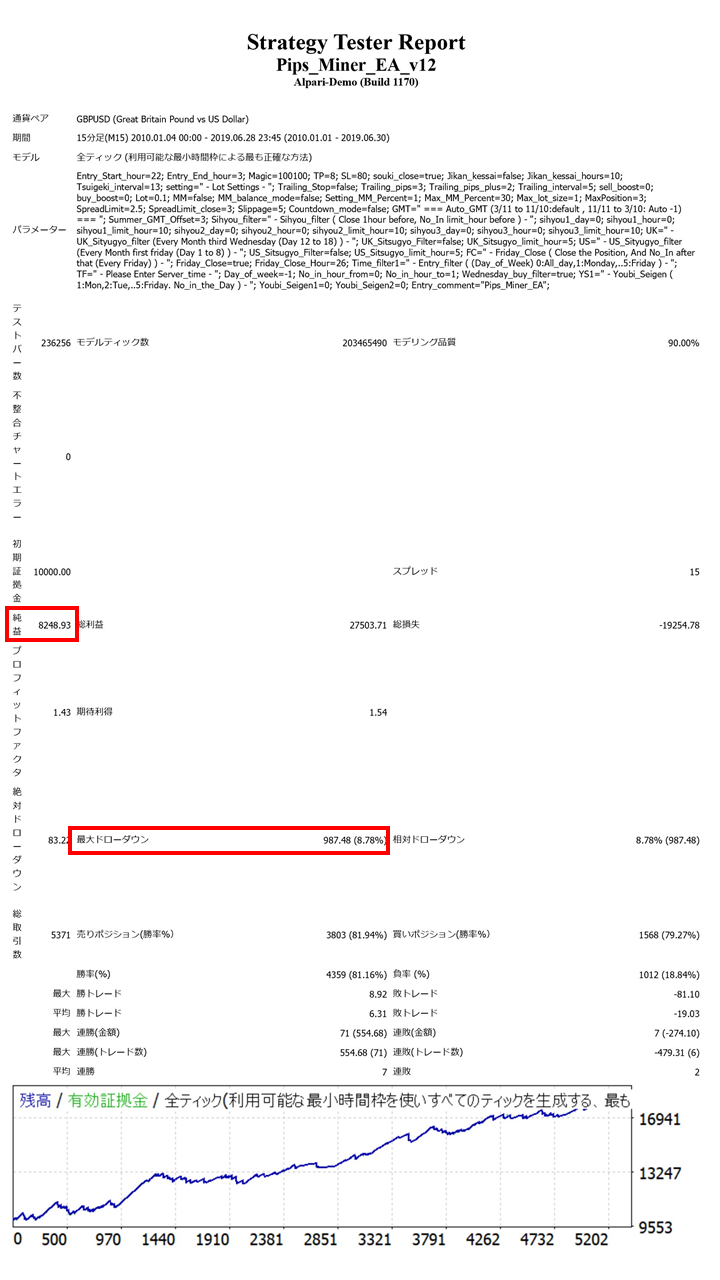

【Backtest Analysis】

Parameters are left at default settings. The spread is 1.5.

We will review backtests from 2009 to the first half of 2019.

2010.01.01‐2019.06.30

Spread 1.5

0.1 lot fixed

Net profit + ¥911,000 (annual average ¥95,000)

Maximum drawdown − ¥108,000

Total trades 5,371 (annual average 565 trades)

Win rate 81.16%

Profit Factor 1.43

Recommended margin amount is fixed at 0.1 lot

5.5*3+(10.8*2)=38.1(万円)

Therefore, the capital required for safe operation is at least 390,000 yen.

The expected annual return in this case isapproximately 25.1%.

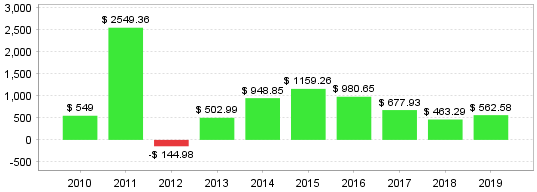

・Annual revenue

2010–2012 had large fluctuations in revenue, but from 2013 onward earnings have been stable.

・Number of trades

The number of trades is large, consistently over 500 per year.

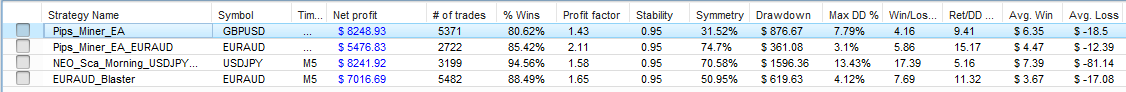

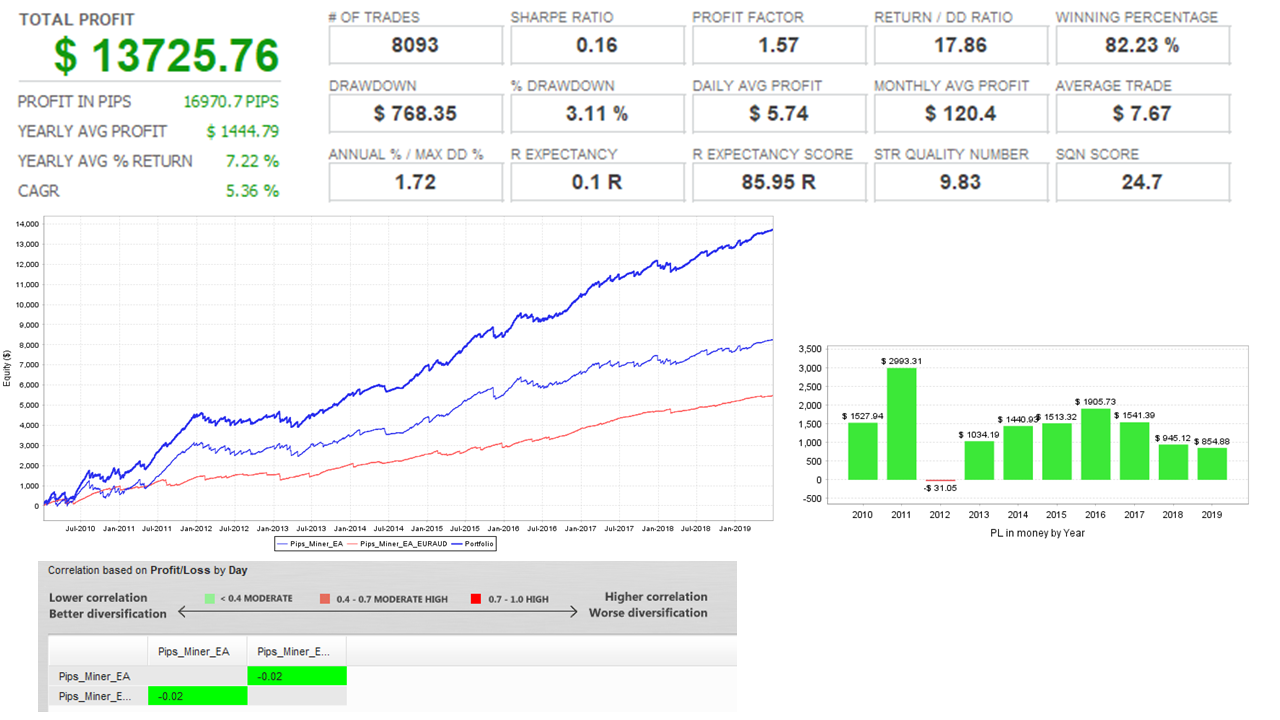

【Portfolio Analysis】

We will build a portfolio with backtests of Dr. Neko’s other EAs, the author of Pips_miner_EA, and evaluate performance and compatibility.

This time we combined Pips_miner_EA with three others: Pips_miner_EA_EURAUD, NEO_Sca_Morning_USDJPY_turbo, and EURAUD_Blaster.

Although small, the backtest results for each EA [Period 2010–2019-06-30, 0.1 lot fixed, spread 1.5]

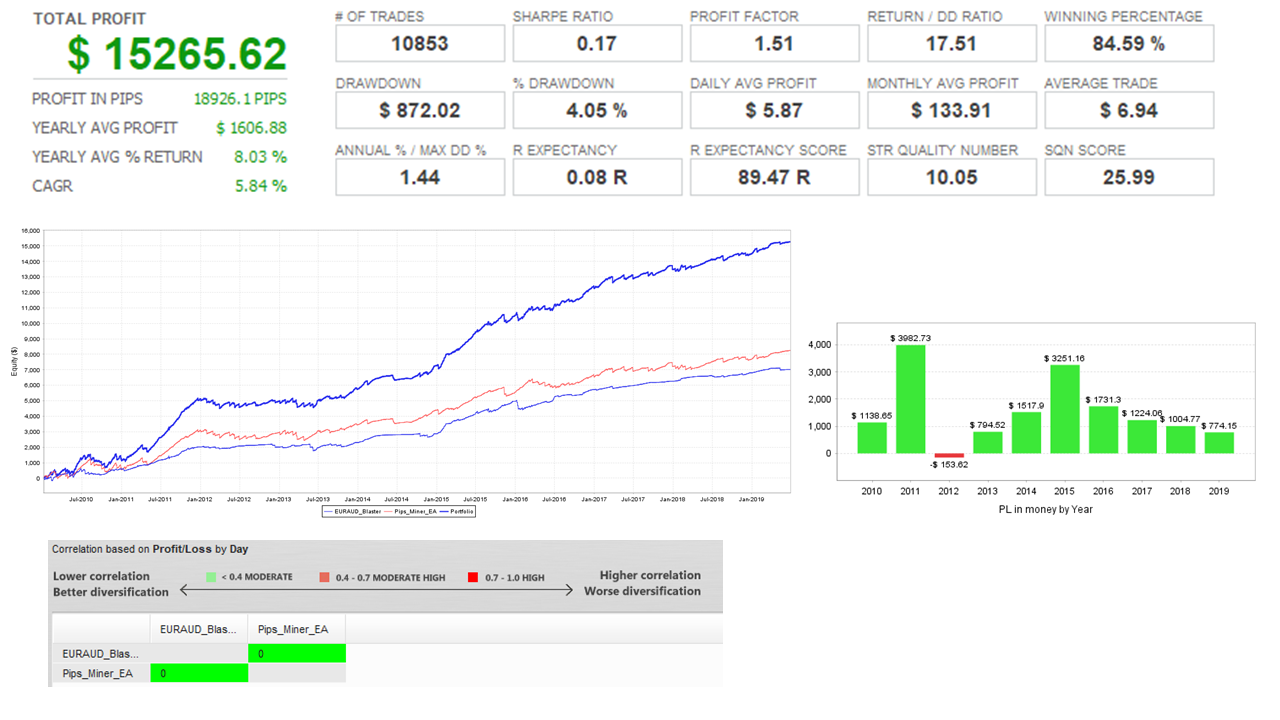

・Pips_miner_EA_EURAUD

The currency pair supported by Pips_miner_EA is EUR/AUD.

The red chart is Pips_miner_EA. Because the currency pair is completely different, the profit curves hardly intersect.

Correlation values are green and favorable. Moreover, both are multi-position EAs (max positions 3) and show a drawdown of about 84,000 yen over roughly ten years of backtesting, which is a strength.

Because they share the same name, the logic is similar, and annual earnings resemble running Pips_miner_EA alone.

This yields a stable portfolio unique to the popular Pips_miner_EA series, which is known for long-term operation and high-frequency trading.

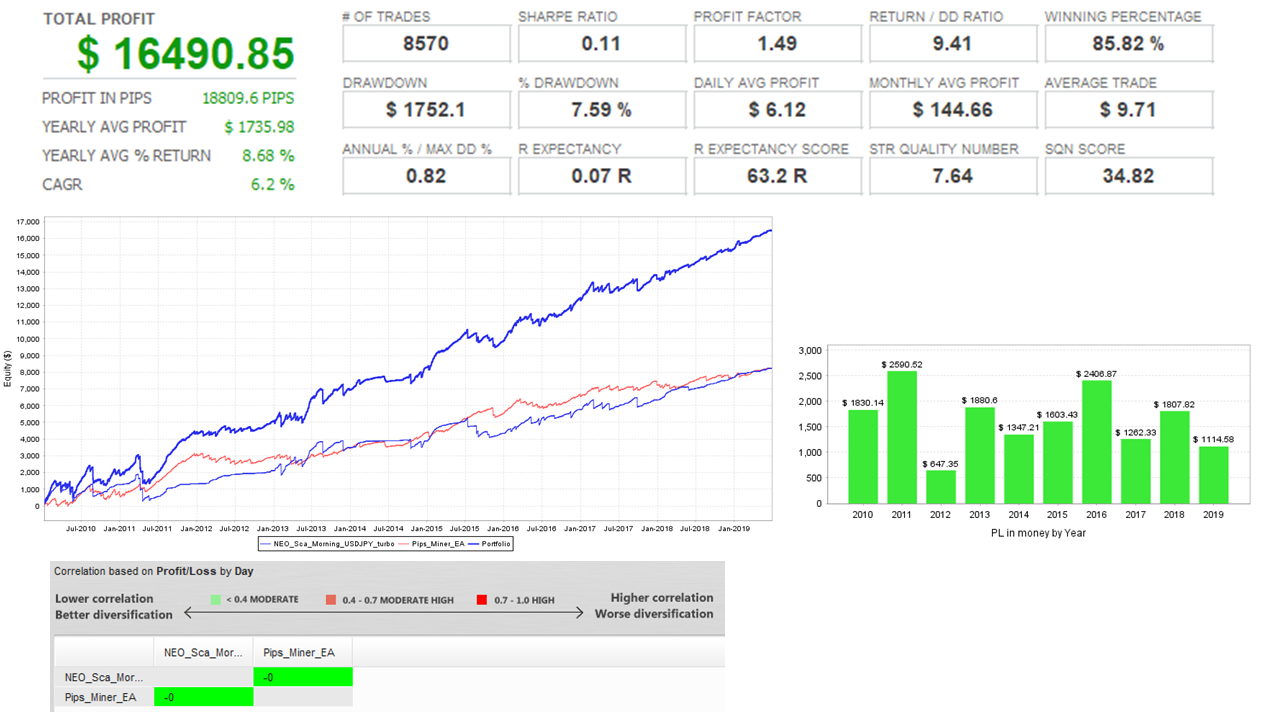

・NEO_Sca_Morning_USDJPY_turbo

This is also a USD/JPY scalping EA with a different currency pair from Pips_miner_EA.

Overall returns were higher than the previous portfolio, with net profit of 1,810,000 yen. Looking by year, profits were achieved in every year.

Because the currency pair is USD-based, there are many intersections with the red Pips_miner_EA chart. Therefore, drawdown is more than double that of the previous portfolio, so some caution is warranted in operation. It is more of a risk-taking portfolio aimed at larger returns.

The profitability trend is close to that of the first Pips_miner_EURAUD portfolio. Because Blaster is Dr. Neko's new release, the number of trades has increased significantly, and net profit has risen accordingly. Drawdown has slightly increased, so if you have extra margin for safe operation, you may want to use this to target larger profits.

We have reviewed three portfolio patterns; in any combination, the compatibility is good, and solid profits are produced.

Of course Dr. Neko's EAs are all suitable for long-term operation, and this is the result of the backbone Pips_miner_EA, which was very excellent. Since it is expected to perform well going forward, it is a recommended EA as a first step in composing a portfolio.