Do not panic about medium- to long-term strategy! Draw in the USD/JPY and GBP/JPY! Regarding the U.S. employment report, these were the signs that appeared for short-term trading!

The notable U.S. employment data were revised upward for the previous month as well, showing a strong result, but

in the currency market, dollar buying did not advance after the release and instead the market lost steam.

Dollar-yen had risen into the 115 yen area, but at the week-end close it failed to hold 115 yen, suggesting a range-bound market until next week's FOMC.

Since it ended without holding 115 yen, it seems unlikely to move much until next week's FOMC.

Now, over the weekend, an analysis article on dollar-yen by Ask Ultimate MAX/Shadow was posted,

https://fx-on.com/navi/detail/?id=1503&na=4

and I would like to explain how to strategically approach this in the long term using Ask Ultimate MAX & Ultimater.

I would like to explain using these tools.

First, on the daily chart for dollar-yen, it hit a ceiling in the 118 yen area, and after that it entered the Ichimoku cloud, which reduced the uptrend momentum.

However, when it dips lower, it is supported and rebounds, and going forward the two irregular lagging lines

will, if they reliably stay above the actual price, provide upside momentum.

This is the weekly chart for dollar-yen: after dropping below 100 yen in a bear market, it sharply recovered after the U.S. presidential election

and moved into a pullback phase after breaking through the Ichimoku cloud, with buy signals emerging as it stayed above the cloud's upper boundary.

It is being supported by the cloud upper boundary. Currently, a buy signal is on the long-term chart, and in the short term, the 115 yen area is heavy,

but when it declines, this could be a level worth picking up.

In MAX, when overbought or oversold conditions occur, signals appear on multiple frames of the chart

so we have programmed it to show numbers that are not normally visible on a standard chart at a glance.

Now this is the pound-yen chart, which has a strong correlation with the dollar-yen market.

Looking at the daily chart first, after the Brexit era it reached the 148 yen area, but the 145 yen area remains heavy

and it has fallen below the Ichimoku cloud, so it remains unable to become a strong market yet.

This is the famous pound-yen weekly chart, and I was the first to indicate a major market reversal,

and even from around 190 yen the sell signals continued, and with Ultimater it suggested that up to near the U.S. presidential election area

a rough 50 yen drop was realistic, even up to around 135 yen!

Now this week, on the weekly chart, we are approaching an important point and attention should be on the lower boundary of the cloud.

Since this is the weekly chart, if at week-end the price moves into the cloud properly,

there is a strong possibility that the downward pressure could ease for a while, and it might even push above 150 yen.

Therefore, at this stage, the two trends are in opposition, but in the near future they seem to be converging in the same direction, so if the pound-yen moves into the cloud by week-end

the downward pressure should be alleviated for the time being.

If, by week-end, it cannot enter the cloud, downward pressure will recur.

Thus, dollar-yen may not extend its rise and could slip toward the upper end of the weekly cloud again,

so the strategy is to allow for some margin and wait for a pullback in dollar-yen,

while pound-yen is positioned to buy on a pullback and then sell on rallies.

This week there are policy rate announcements in the U.S., U.K., and the U.S., and with the G20 on the horizon at the weekend,

all eyes will be on how the dollar behaves after the FOMC.

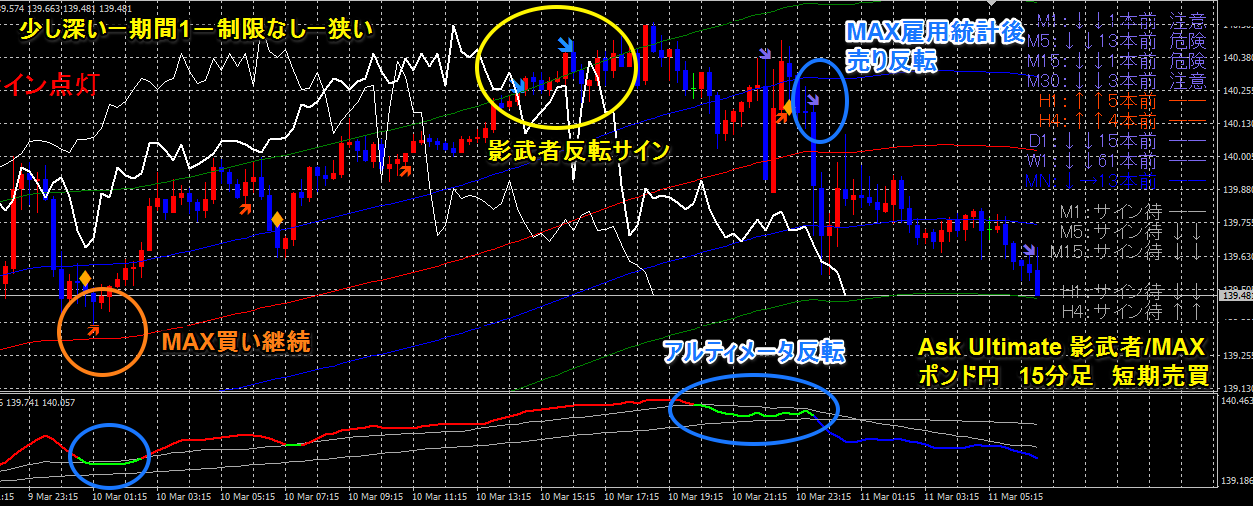

This is the weekend's 15-minute short-term trading chart for dollar-yen and pound-yen, combined with the U.S. employment data.

The charts for dollar-yen and pound-yen look similar, right?

Because the ADP employment data were strong, dollar buying and yen selling continued up to the announcement.

On the day of the release, dollar-yen also held around 115 yen, but the Shadow Warrior’s sell signal lit up here,

and after the release, reversal signals appeared on MAX and Ultimater as well.

If you display multiple indicators with different buy/sell conditions, you can see more than usual at a glance ………

In the short term, pound-yen moved almost the same as dollar-yen!

Ultimate Full-Intensive Trade to Master Trading!

★ Campaign left 9 copies

With this, you can grasp the market flow!

★ The campaign you can receive is shown when you click the image!

For traders who deeply love dollar-yen! This is the strongest version!

★ Ask series indicators come in a 3-item set at this price!

Quantities are limited!