High likelihood of making a profit if the win rate is over 50%! The ten-year total number of trades exceeds 10,000, and high-frequency trading is also a major attraction of the EA 'TurtleMagic_GY_15m_scal'

Set TP and SL to the same ratio

Maintain small losses and maximize profits with a trailing stop

Build profits while limiting losses “TurtleMagic_GY_15m_scal

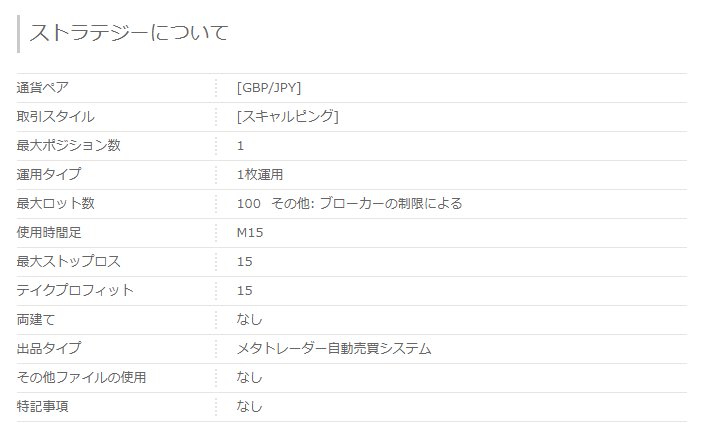

【TurtleMagic_GY_15m_scal Overview】

The trading style is short-term. The forward period spans two months from June 2019 to August 2019, and the profit graph is also upward trending.

The maximum drawdown is also below 10%, indicating low risk.

Notably, both take profit and stop loss are set at 15 pips, with a 1:1 ratio. Therefore, it appears possible to profit with a win rate of over 50%. It also includes a trailing stop, which activates after moving 15 pips from entry.

The currency pair is GBP/JPY, and the maximum number of positions is 1.

Averaging down and Martingale are not used; profits are pursued with contrarian trading.

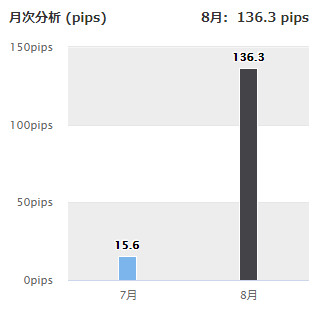

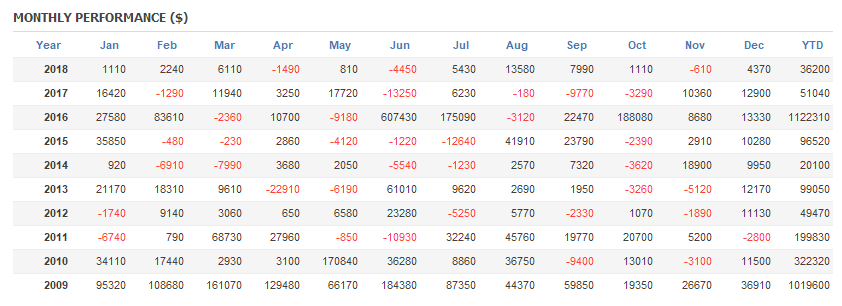

■Monthly Analysis

June yields 15.6 pips and August yields 107.2 pips. The total for the two months is 122.8 pips, showing strong performance.

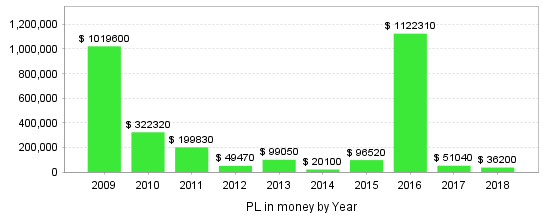

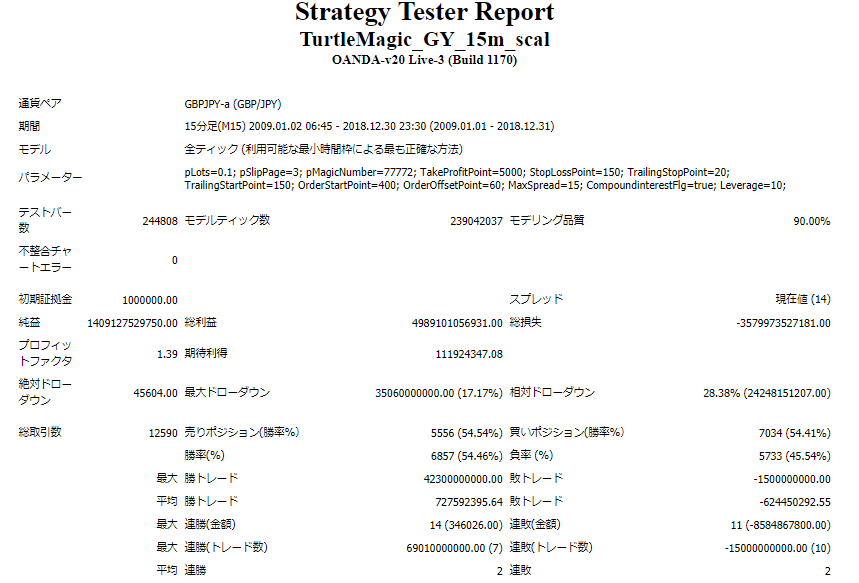

【Backtest Analysis】

2008.01.01–2018.12.31

Spread 14.0

Fixed 0.1 lot

Net profit +3.066 million yen (annual average 0.306 million yen)

Maximum drawdown −470,000 yen

Total trades 12,590 (annual average 1,259)

Win rate 54.54%

PF 1.35

Recommended margin, fixed at 0.1 lot

(5.2)+(4.7×2)=14.6(万円)

This results in an expected annual return of 200%, a staggering figure.

Moreover, the high frequency of trades is appealing; over ten thousand trades in ten years. Even on an annual basis, more than 1,000 trades per year, steadily generating profits.

■Yearly and Monthly Analysis

Looking by year, 2009 and 2016 show substantial profit growth, while other years show steady earnings. It consistently generates profits and embodies the principle of small losses and large profits.

Looking by month, the amount of a single loss is kept small.

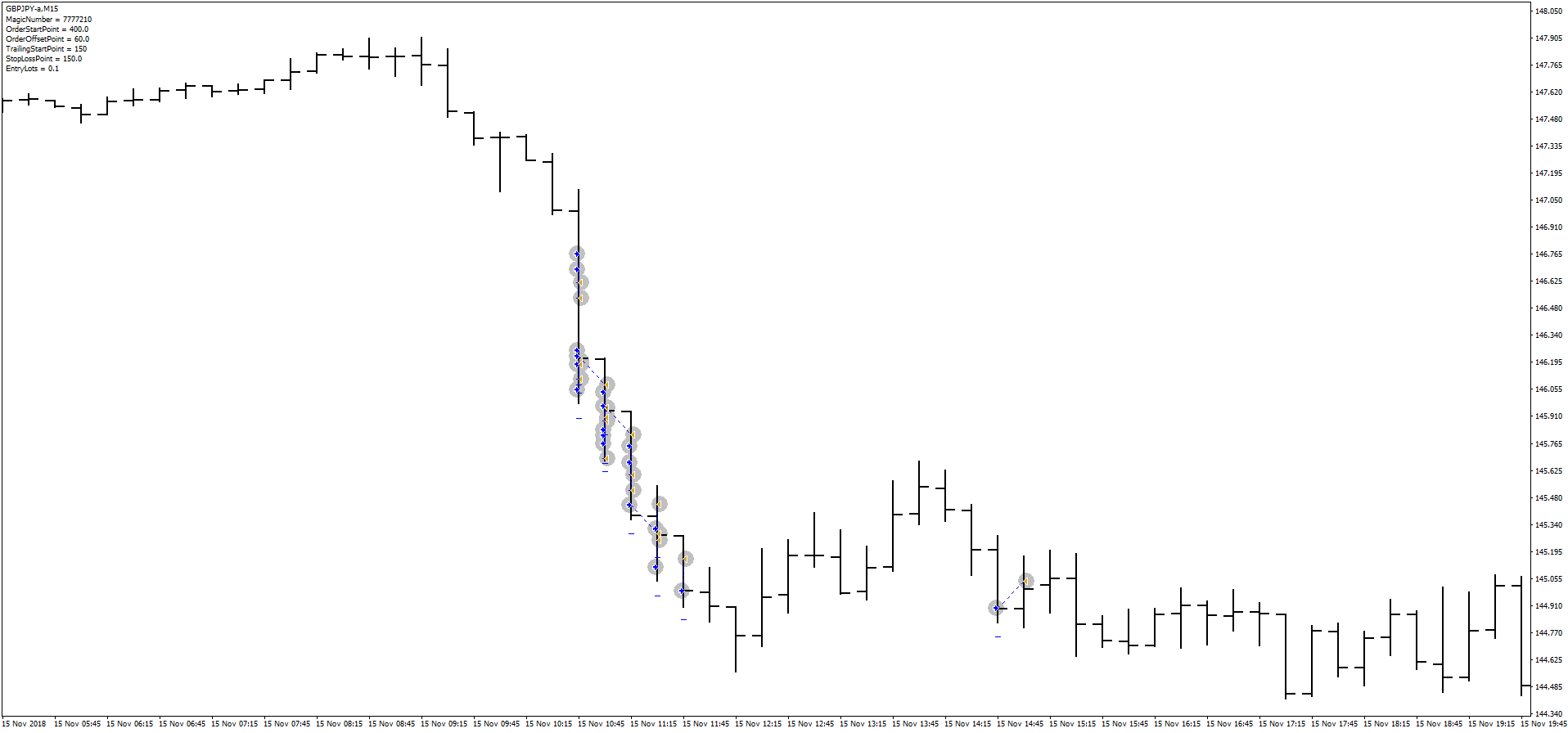

■Trade Image

This is an example of a trade. Blue is buy, red is sell. It repeats buying and selling over a short period. It buys on declines and sells on rises.

This also trades by buying during declines. It basically uses a contrarian strategy.

■Compounding Strategy

With compounding, it exceeds 1 trillion yen over ten years. Relative drawdown is below 30%, indicating relatively low risk.

The main attraction is the very high expected profit. With few losses, long-term operation can yield large gains.

The number of trades is also high; on average, about 3–4 trades per day. It is recommended for those who prefer a scalping-type EA that executes many trades.

Also, in forward testing with simple interest, the maximum drawdown is 6.57%, and backtests show only around the 1% range, indicating very low risk, making it beginner-friendly.