An EA that profits as it diversifies risk across three currency pairs "Three Arrows"

Make big profits with three pairs: GBP/JPY, AUD/JPY, and EUR/JPY.

Portfolio-friendly EA “Three Arrows”

【Three Arrows Overview

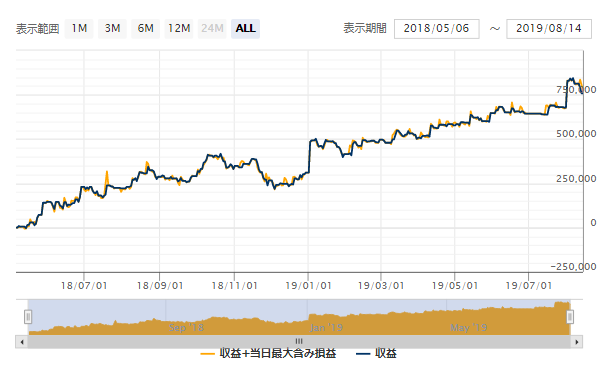

The forward period spans May 2018 to August 2019 (1 year and 3 months). Looking at the forward equity curve, there are troughs, but it is overall upward-sloping.

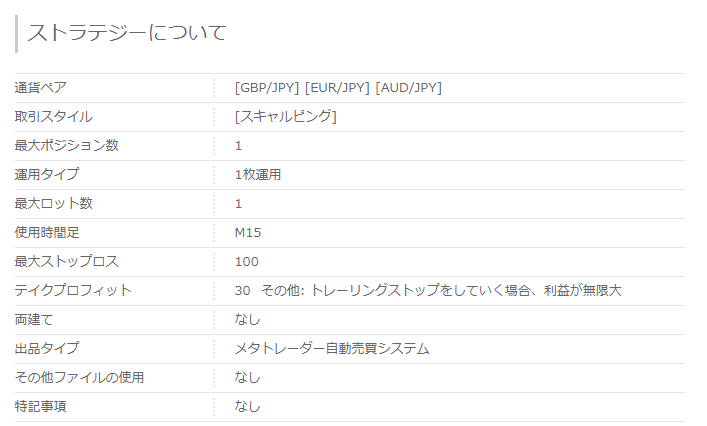

The tradable currency pairs are GBP/JPY, EUR/JPY, and AUD/JPY. It is useful not only as a standalone but also in a portfolio.

Maximum number of positions is 1.

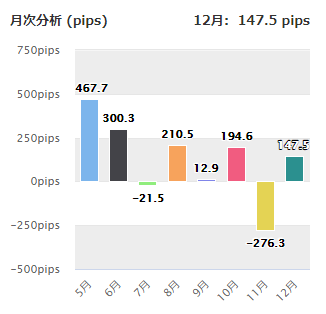

■Monthly Analysis

●2018

In 2018, total earned pips were 1,035.7 pips. There was a large drawdown of -276.3 pips in November, but it was offset in other years.

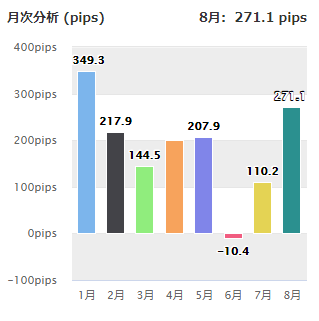

●2019

In 2019, about 8 months yielded 1,491 pips. January and August were particularly strong, and the other months were stable as well, except for June.

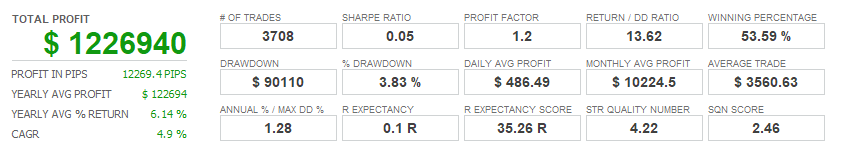

【Backtest Analysis】

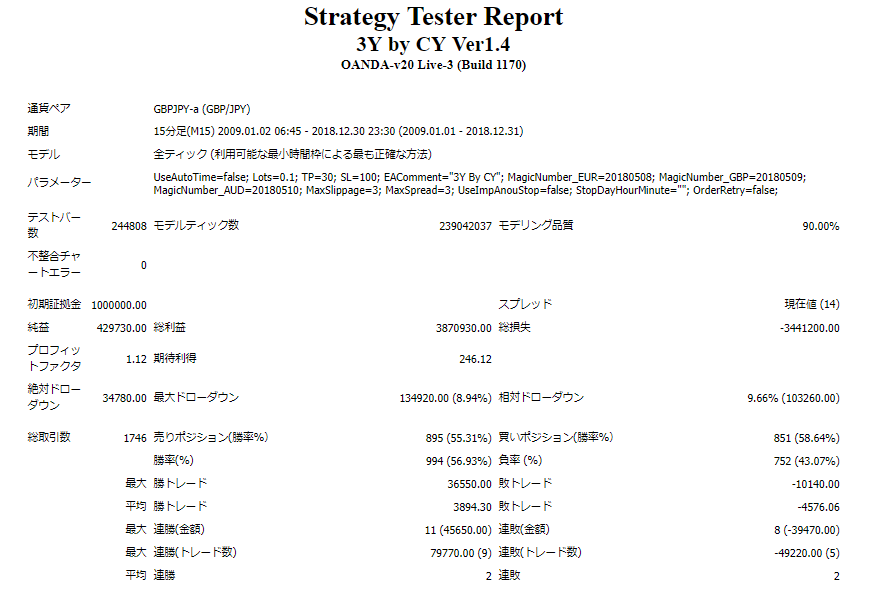

●GBP/JPY

2008.01.01‐2018.12.31

Spread 14.0

0.1 lot fixed

Net profit +4,300,000 yen (average per year 43,000 yen)

Maximum drawdown -135,000 yen

Total trades 1,746 (annual average 175)

Win rate 56.93%

PF 1.12

Recommended margin when fixed at 0.1 lot

(5.2)+(13.5×2)=32.2(万円)

This yields an expected annual return of 13%.

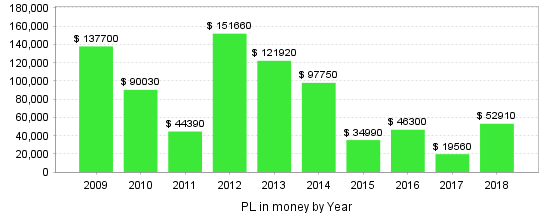

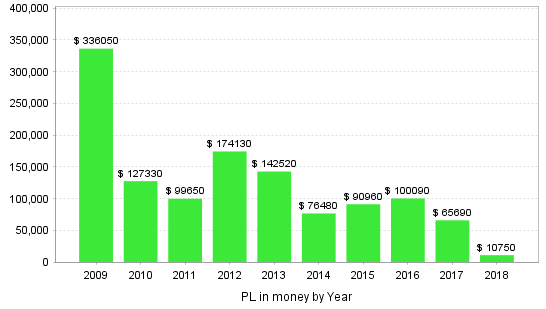

■Yearly/Monthly Profit and Loss

Looking at yearly results, the most recent two years are negative. However, other years are generally profitable, so the total is positive.

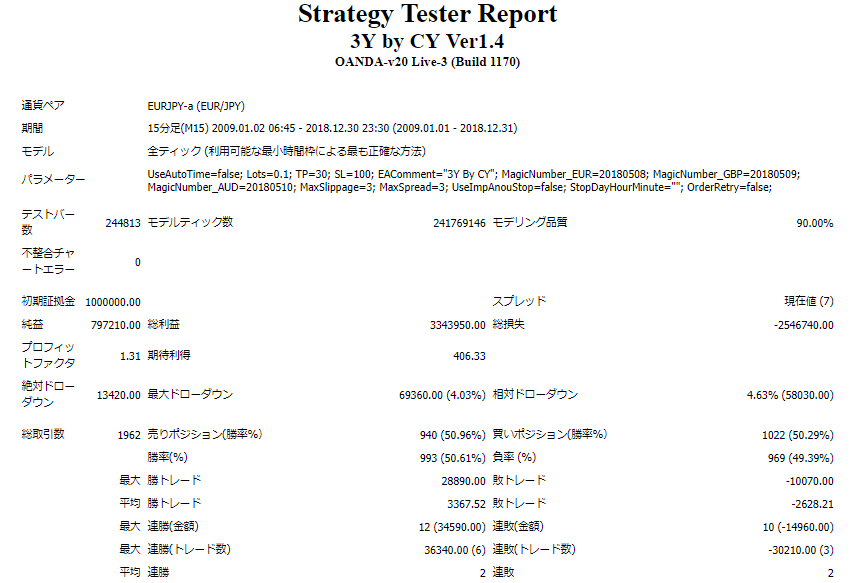

●EUR/JPY

2008.01.01‐2018.12.31

Spread 7.0

0.1 lot fixed

Net profit +7,970,000 yen (annual average 80,000 yen)

Maximum drawdown -69,000 yen

Total trades 1,962 (annual average 196)

Win rate 50.61%

PF 1.31

Recommended margin when fixed at 0.1 lot

(4.8)+(6.9×2)=18.6(万円)

This yields an expected annual return of 42%.

■Yearly/Monthly Profit and Loss

EUR/JPY has remained profitable in every year over the past 10 years.

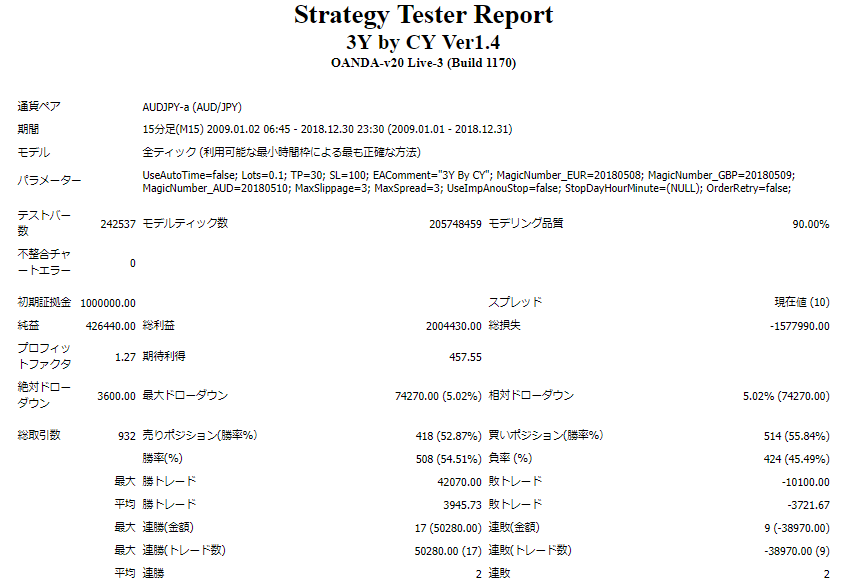

●AUD/JPY

2008.01.01‐2018.12.31

Spread 10

0.1 lot fixed

Net profit +4,260,000 yen (annual average 43,000 yen)

Maximum drawdown -74,000 yen

Total trades 932 (annual average 93)

Win rate 54.51%

PF 1.27

Recommended margin when fixed at 0.1 lot

(3.0)+(7.4×2)=17.8(万円)

This yields an expected annual return of 23%.

■Yearly/Monthly Profit and Loss

In 2014 and 2018 there were large losses, but other years were profitable.

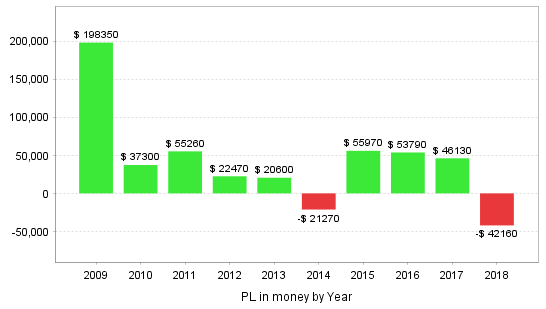

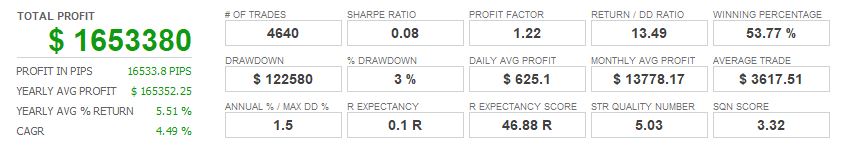

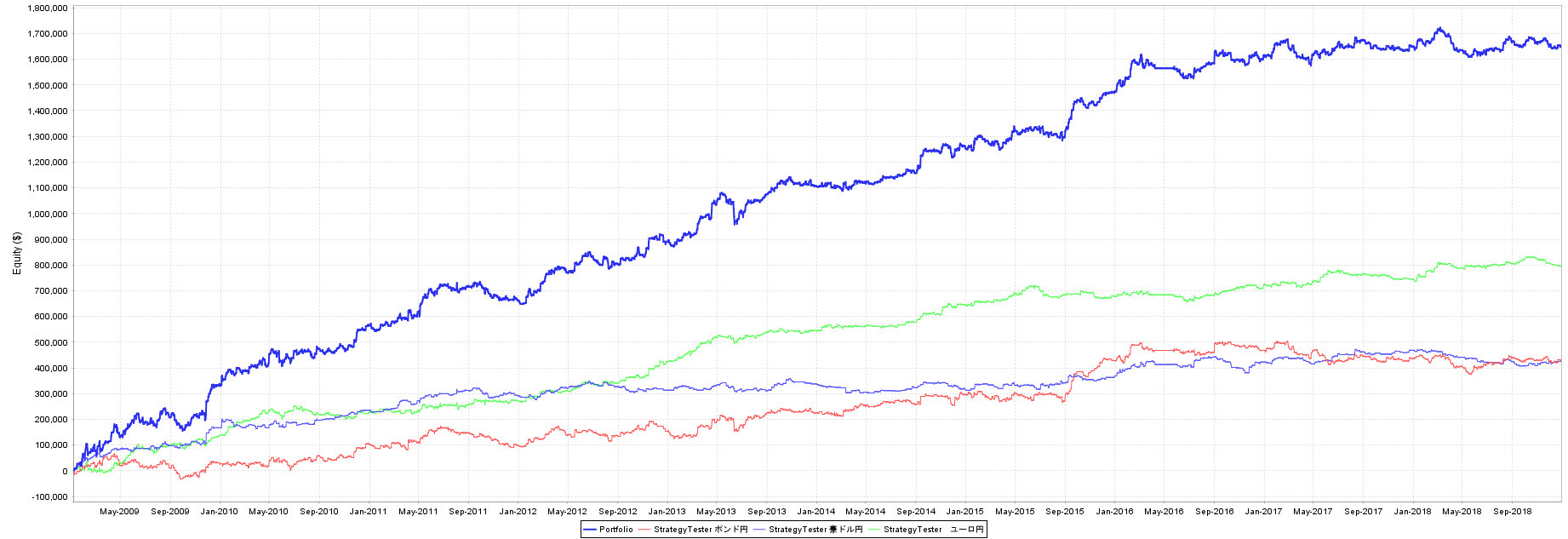

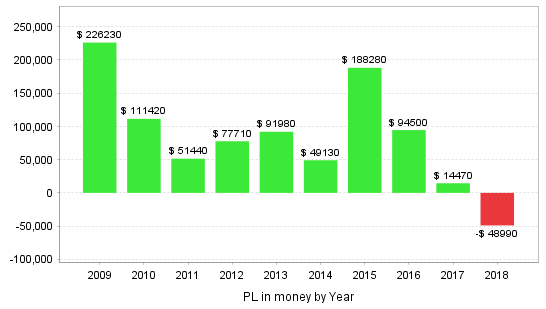

【Portfolio Analysis】

●Three currency pairs

This is a three-pair currency portfolio. Since 2017 it appears to have leveled off somewhat, but it has mostly continued to rise steadily.

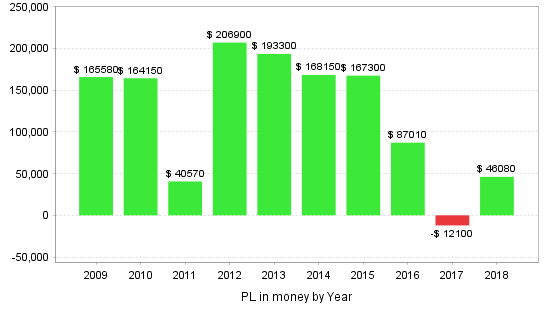

■Yearly Profit/Loss

Yearly results show a dip in the most recent two years, but there has been no ten-year loss and it remains stable.

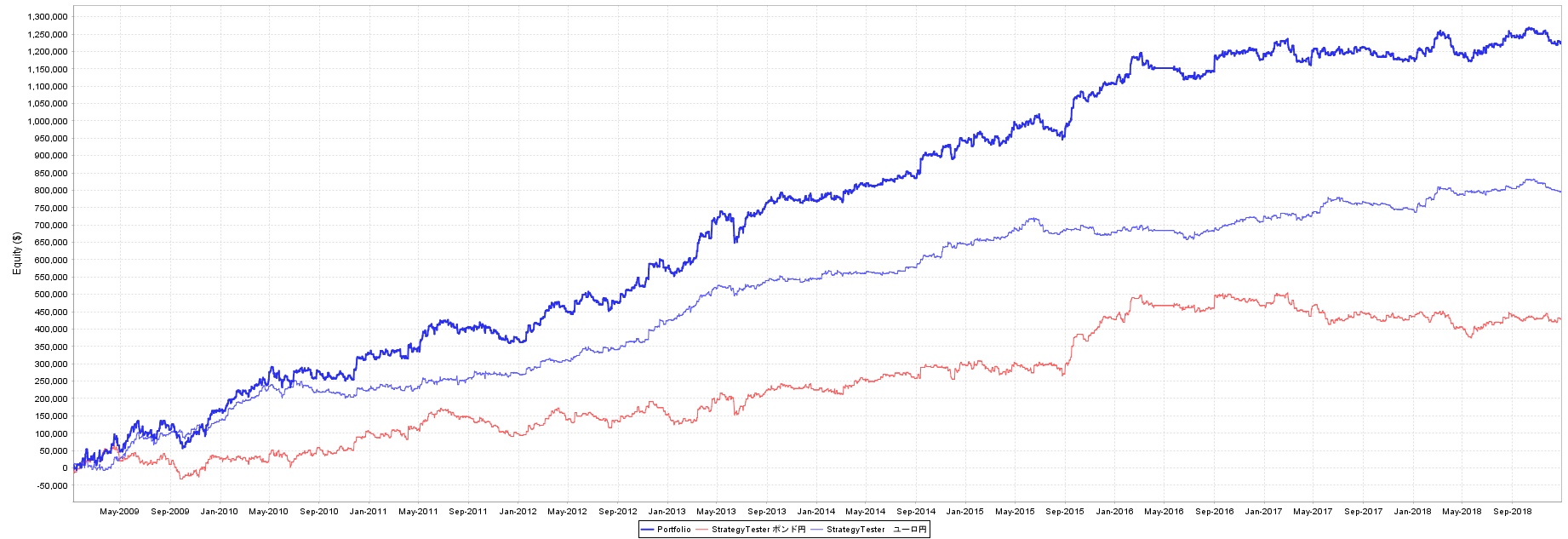

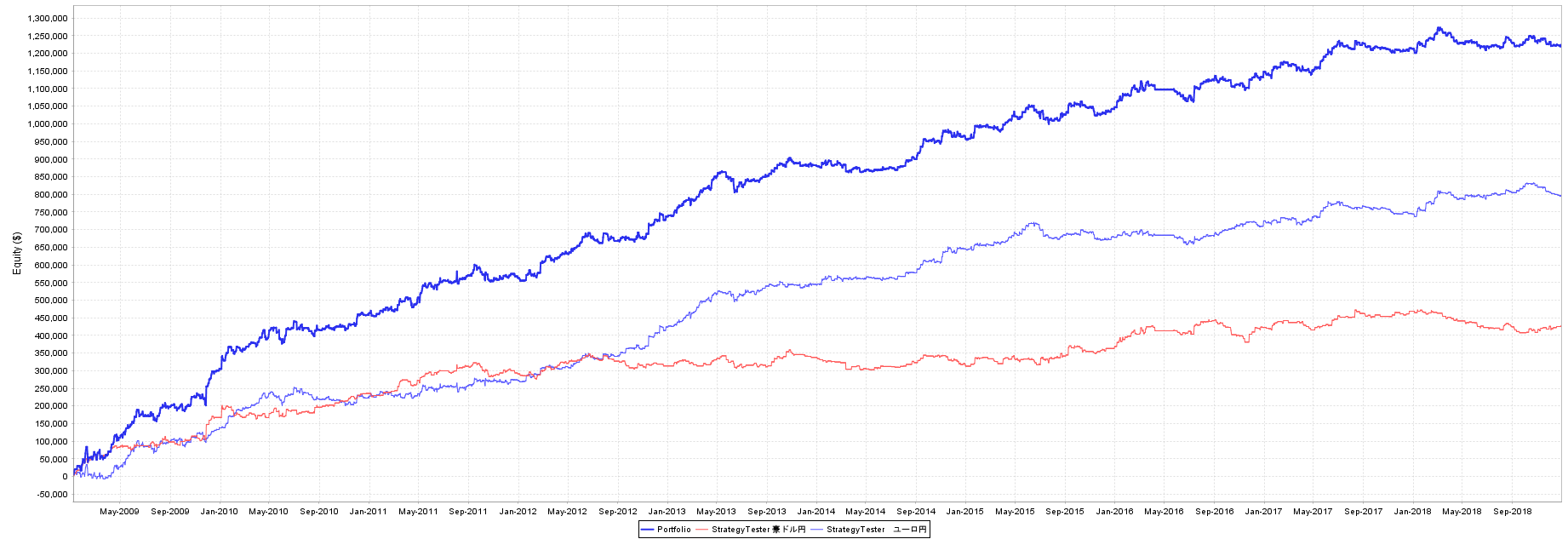

●GBP/JPY / EUR/JPY

This is the GBP/JPY and EUR/JPY portfolio. It is also rising.

■Yearly Profit/Loss

Yearly results show a loss in 2017, but 2018 recovered the following year. Other years remained stable.

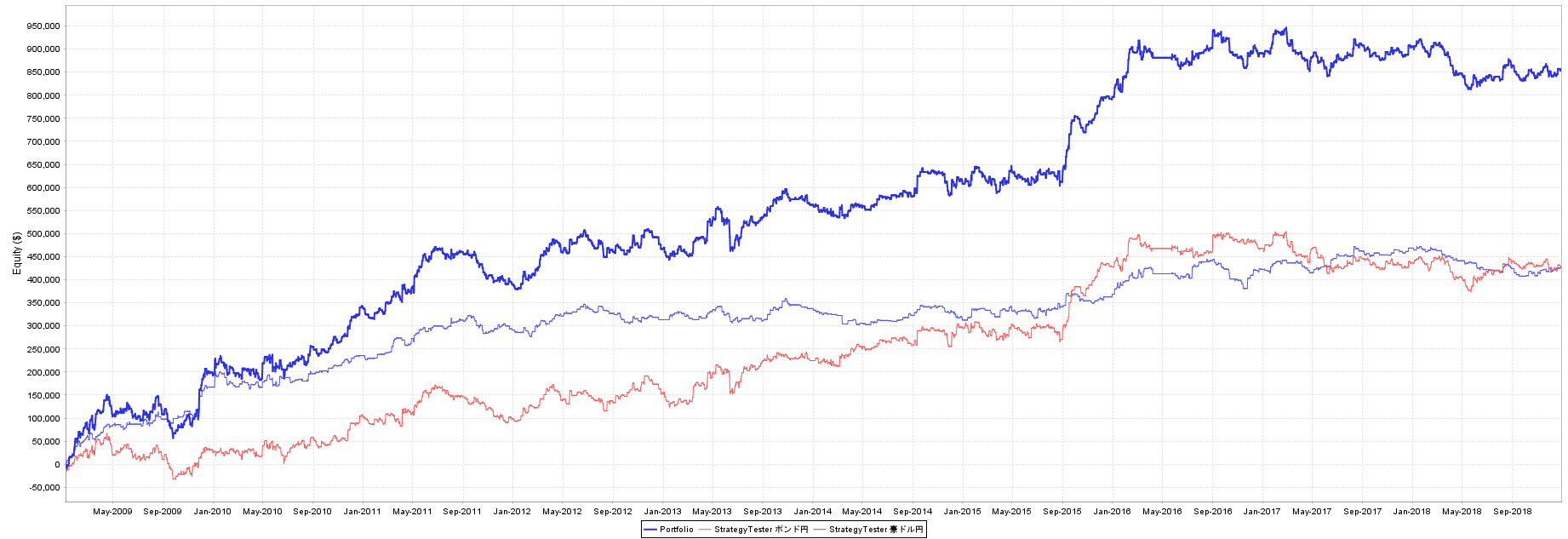

●GBP/JPY / AUD/JPY

GBP/JPY and AUD/JPY. It has been flattening since around 2016.

■Yearly Profit/Loss

There was a large negative in 2018.

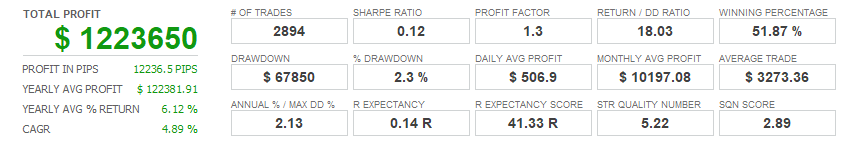

●EUR/JPY / AUD/JPY

EUR/JPY and AUD/JPY. In 2018 momentum slowed slightly, but the trend is upward.

■Yearly Profit/Loss

Looking at yearly results, there has never been a year with a negative result over the 10 years.

Individually, all three pairs have maximum drawdowns under 10%, indicating low risk. Setting to 0.1 lot reduces the required margin and makes risk management easier for this EA.

However, it also seems to shine when used in a portfolio.

Because the currency pairs are yen crosses and drawdowns remain low even in portfolio mode, it should be user-friendly for beginners.

Of course, it would be interesting to pair it with other EAs in a portfolio. It may pair well with dollar-straight (USD-based) crosses.

This time we performed a backtest with a lot size of 0.1, but adjusting it could change the results.