From a deep pullback, this time also a vertical plunge market. And the ultimate buying point for gold on the pullback

June 4, 2016 20:00

In May, the market was pricing in a possible rate hike by the United States, but in June the yen-buying resumed

In yesterday’s US employment report, it came as a negative surprise, turning from dollar buying to dollar selling,

and the USD/JPY pair again attempted to recover but plunged sharply.

Domestically, there were expectations perhaps due to the Ise-Shima Summit and Prime Minister Abe’s June 1 press conference,

but

externally, the uncertainty from the June UK referendum added to the factors,

and this week various factors were developing in a way that tended to push the yen higher,

resulting in a quick drop from the 111 yen level to the 106 yen level as a large downward candle.

This time, since a deep rebound was anticipated, it seems there will be another huge profit as well.

At the start of the week, since we have not seen 105 yen in the Tokyo market yet,

first, a move toward testing 105 yen is the natural course.

With momentum, 105 yen below is also possible,

and if the UK referendum this month remains to be a remain outcome,

it would likely be a sign of a bottom near term, but

from the Dow stock market, which remains in historically high territory,

in a sense Abe’s comments could bring about a market reaction akin to Lehman-era events.

From the 6/2 article: the USD/JPY movement has continued ignoring events

In this eventful week, today USD/JPY breached below 109 and headed further lower

becoming increasingly heavy on the upside.

The decline after the currency fix was severe, and until tomorrow’s employment statistics,

despite various important factors, USD/JPY

after trying to rebound for several months, has again plunged,

so buyers should be very cautious.

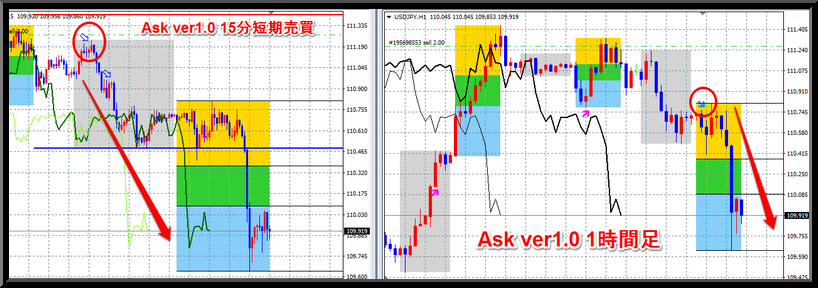

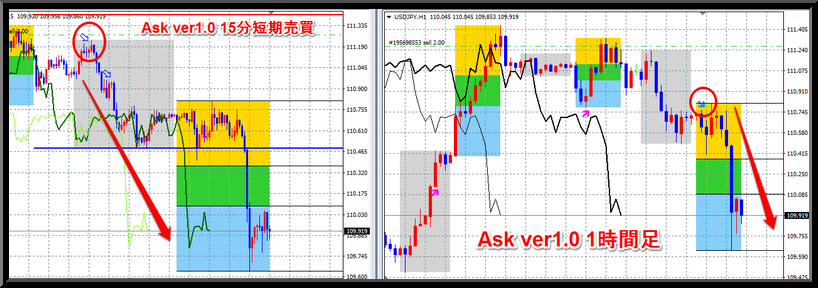

Indicators were continually flashing short‑term sell signals.

6/1 USD/JPY market

USD/JPY market as of 5/31.

The 1-hour chart also turned to selling from today.

USD/JPY as of 5/26

From the 6/1 article: 112 yen is near but far; concerns about a possible UK exit from the EU also weigh

In June, today Abe’s press conference followed postponement of the consumption tax increase.

Temporary stock gains and yen selling lost momentum around New York yesterday,

and in Tokyo today, there was coordinated yen selling, widening the downside.

Survey results on the UK leaving the EU continue to swing like a seesaw, and the pound is fluctuating sharply, with risk remaining until the end of this week

and if the US employment statistics come out negative, this month’s US rate hike could disappear quickly,

and the sentiment remains uncertain for the end of the week.

Until around summer, there might be a large 105–112 yen range, and near-term 105 yen may not break soon, but by year-end the possibility of a downside break seems strong.

Ask Ultimate MAX also covers Nikkei 225, US stocks, and commodity markets.

This time we focused on the Gold market.

On the weekly chart, a buy signal has appeared for the first time in a long while, suggesting a move away from the prolonged correction into a rebound.

After last week’s sharp drop, the daily chart indicated an oversold danger,

turning into a buying opportunity as the market rebounded significantly this week.

Moreover, many other long-term trend changes are evident in other markets as well,

and this year seems poised to be a year of triggering moves.

In May, the market was pricing in a possible rate hike by the United States, but in June the yen-buying resumed

In yesterday’s US employment report, it came as a negative surprise, turning from dollar buying to dollar selling,

and the USD/JPY pair again attempted to recover but plunged sharply.

Domestically, there were expectations perhaps due to the Ise-Shima Summit and Prime Minister Abe’s June 1 press conference,

but

externally, the uncertainty from the June UK referendum added to the factors,

and this week various factors were developing in a way that tended to push the yen higher,

resulting in a quick drop from the 111 yen level to the 106 yen level as a large downward candle.

This time, since a deep rebound was anticipated, it seems there will be another huge profit as well.

At the start of the week, since we have not seen 105 yen in the Tokyo market yet,

first, a move toward testing 105 yen is the natural course.

With momentum, 105 yen below is also possible,

and if the UK referendum this month remains to be a remain outcome,

it would likely be a sign of a bottom near term, but

from the Dow stock market, which remains in historically high territory,

in a sense Abe’s comments could bring about a market reaction akin to Lehman-era events.

From the 6/2 article: the USD/JPY movement has continued ignoring events

In this eventful week, today USD/JPY breached below 109 and headed further lower

becoming increasingly heavy on the upside.

The decline after the currency fix was severe, and until tomorrow’s employment statistics,

despite various important factors, USD/JPY

after trying to rebound for several months, has again plunged,

so buyers should be very cautious.

Indicators were continually flashing short‑term sell signals.

From the 6/1 article: 112 yen is near but far; concerns about a possible UK exit from the EU also weigh

In June, today Abe’s press conference followed postponement of the consumption tax increase.

Temporary stock gains and yen selling lost momentum around New York yesterday,

and in Tokyo today, there was coordinated yen selling, widening the downside.

Survey results on the UK leaving the EU continue to swing like a seesaw, and the pound is fluctuating sharply, with risk remaining until the end of this week

and if the US employment statistics come out negative, this month’s US rate hike could disappear quickly,

and the sentiment remains uncertain for the end of the week.

Until around summer, there might be a large 105–112 yen range, and near-term 105 yen may not break soon, but by year-end the possibility of a downside break seems strong.

Ask Ultimate MAX also covers Nikkei 225, US stocks, and commodity markets.

This time we focused on the Gold market.

On the weekly chart, a buy signal has appeared for the first time in a long while, suggesting a move away from the prolonged correction into a rebound.

After last week’s sharp drop, the daily chart indicated an oversold danger,

turning into a buying opportunity as the market rebounded significantly this week.

Moreover, many other long-term trend changes are evident in other markets as well,

and this year seems poised to be a year of triggering moves.

written by かわせりぐい

× ![]()