AI-powered methods of elite professional FX traders! An EA that will generate profits for you, EA 'Terminator'

Lead to victory with carefully selected powerful logic!

A new EA featuring the trifecta of win rate, profit, and low drawdown has arrived

Its name is「Terminator」

【Terminator - The true 'AI' android will invest on your behalf! Overview】

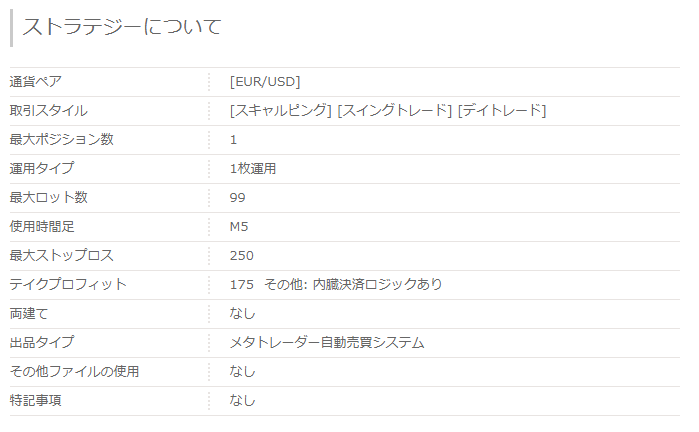

The trading style ranges from short-term to long-term, trading with a single position. According to the product page, it does not employ averaging down, martingale, or hedging.

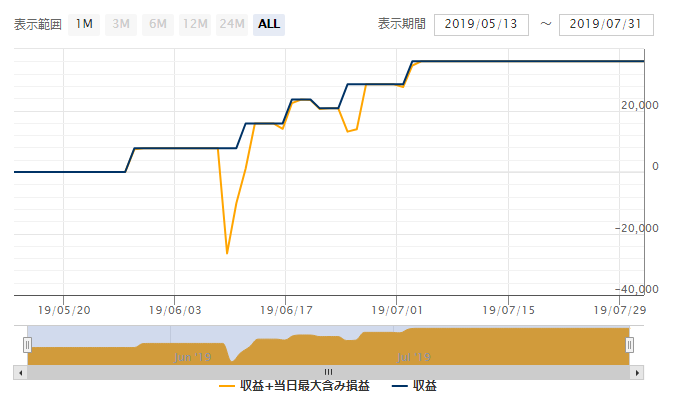

The forward test spans two months, with a win rate of 83.33% and a profit factor of 13.44, figures that look promising. The maximum drawdown is 4.75% at 0.1 lots, indicating low-risk operation.

According to the product page, it performs best with brokers that meet conditions: a stop level of 0, NDD/ECN execution, and EUR/USD spreads under 1.0 pips.

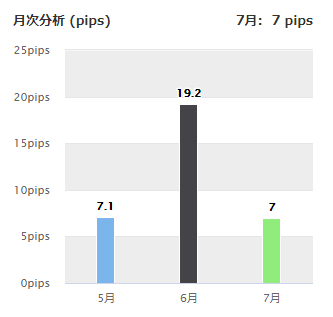

■Monthly Analysis

These are the pips earned over the last approximately three months. A total of 33.3 pips earned.

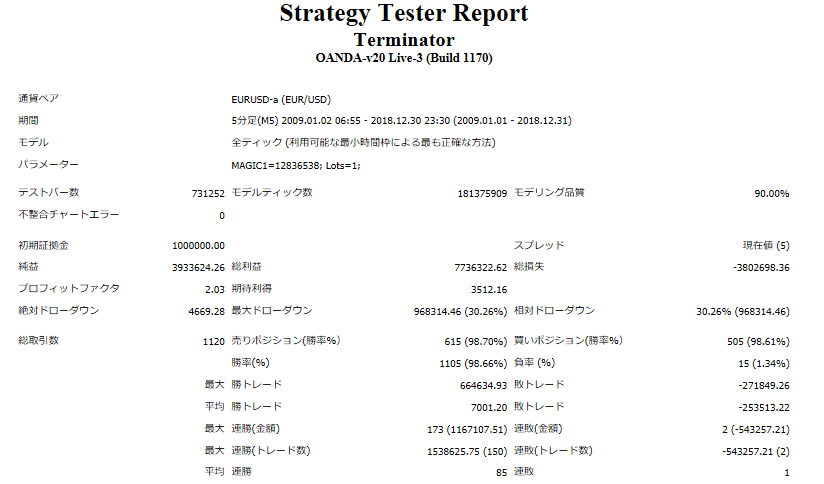

【Backtest Analysis】

2009.01.01–2018.12.31

Spread 5

Fixed 1 lot

Net profit +3,933,000 yen (annual average 393,000 yen)

Maximum drawdown −968,000 yen

Total trades 1,120 (annual average 112)

Win rate 98.66%

PF 2.03

The win rate is almost without losses, and with a profit factor of 2.03, it is an excellent EA.

Notably, the win rate is 98.66%, with almost no losses. The number of trades averages 112 per year.

(50)+(96.8*2)=243.6(万円)

This yields an expected annual return of 16%

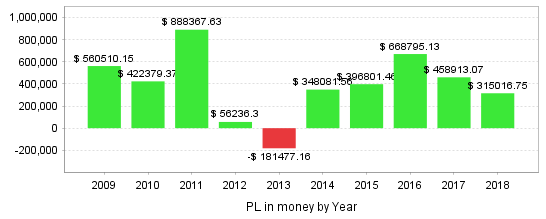

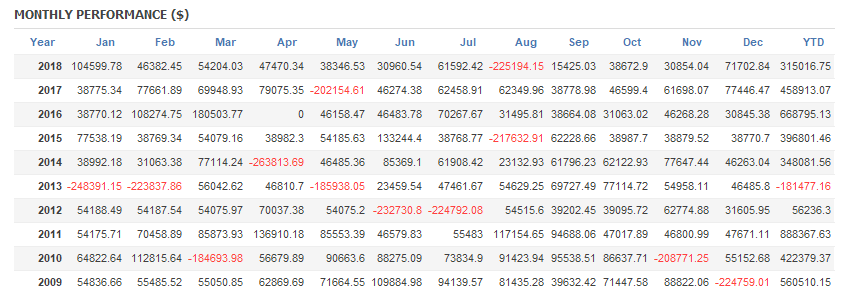

■Yearly and Monthly Profit and Loss

Losses occurred only in 2013; other years are positive.

In the most recent three years, significant gains have been made.

Looking at the monthly data, in most years only one month is a loss; the other months are profitable.

On the other hand, when losses hit, they can be large, so maintaining ample margin when operating seems important for profitability.

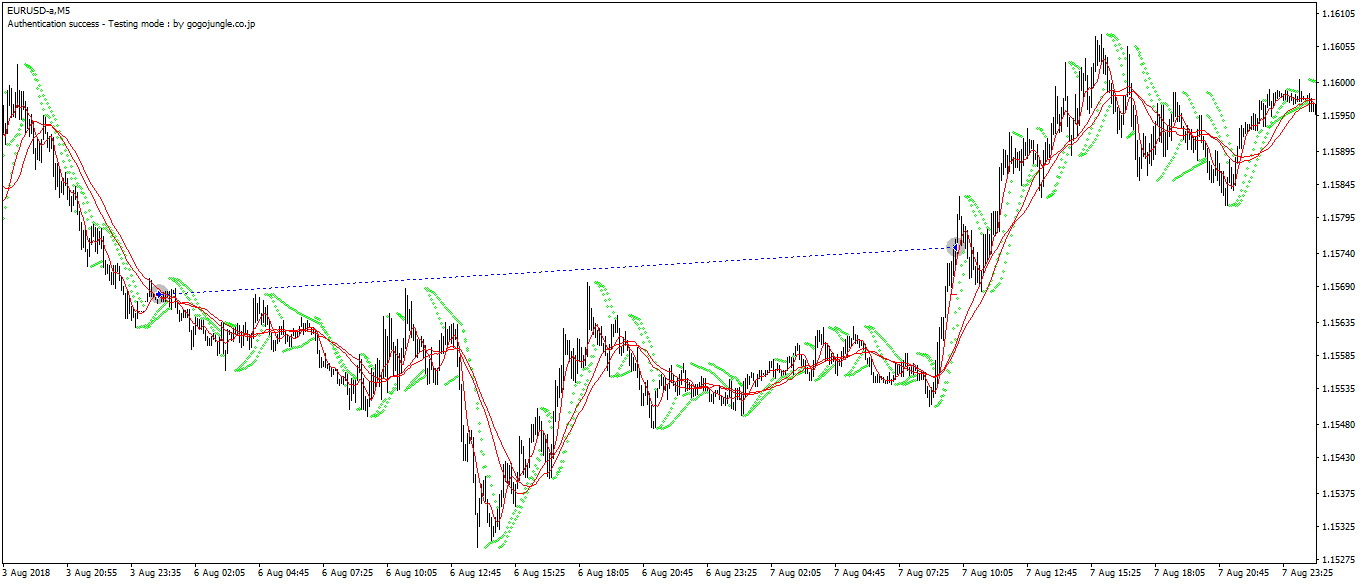

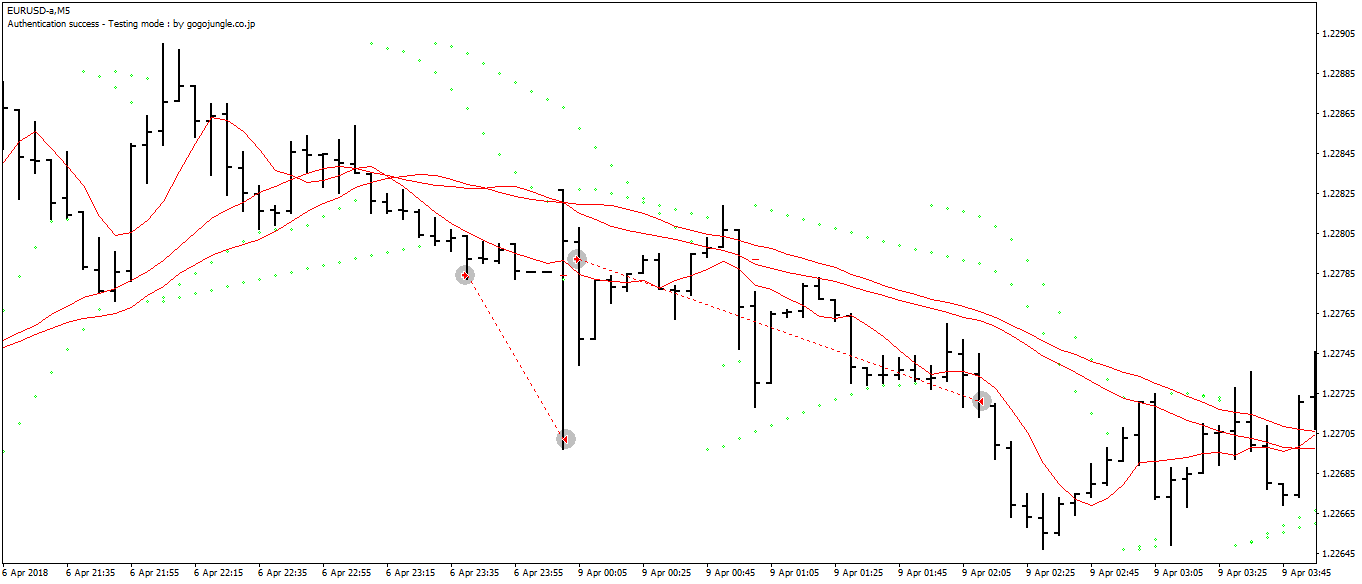

■Trade Image

▲By using multiple technical indicators such as OBV, CCI, MACD, etc., it enables trades with an edge. From this edge, a high win rate is derived.

▲A long (buy) trade example. It also performs swing and day trading, so this is a day trade. In longer periods it can be held for more than a month.

▲A short (sell) trade example. It trades using scalping and day trading. Most trades range from day trading to swing trading.

■Summary

One notable feature is the higher win rate in forward testing compared with backtests.

PF: Forward around 2 months is 13.44; backtest over 10 years yields 2.03, an excellent figure.

Maximum drawdown forward with 0.1 lot is 34,238 yen (4.75%), but in the backtest with 1 lot it is 968,314 yen, or 30.26%. Looking at the monthly profits/losses in the backtest, large losses can occur, so margin management is likely important for profitability.

Trades are single-position without averaging down, hedging, or martingale, so operating with smaller lot sizes should be beginner-friendly.

Let's look forward to how the results will be after one year.