A scalping EA with a high win rate and early take-profit that does not rely on the number of trades "Panda-B_M30_USDJPY"

Backtests show a win rate over 90%

Profits accumulated shine through compounding in a scalping EA

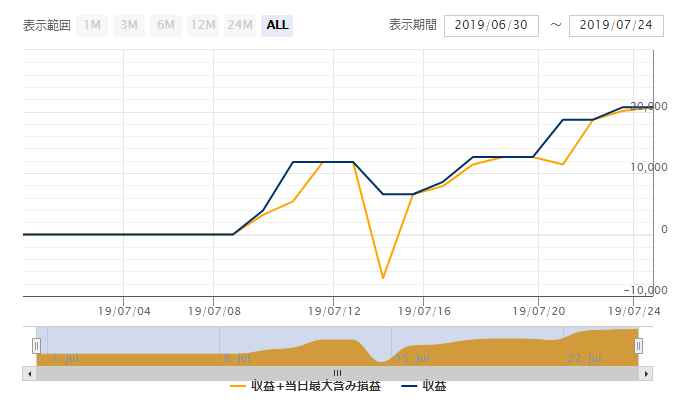

The forward period has just begun, about one month.

Since win rate is important for this EA, we expect it to gradually trend upward.

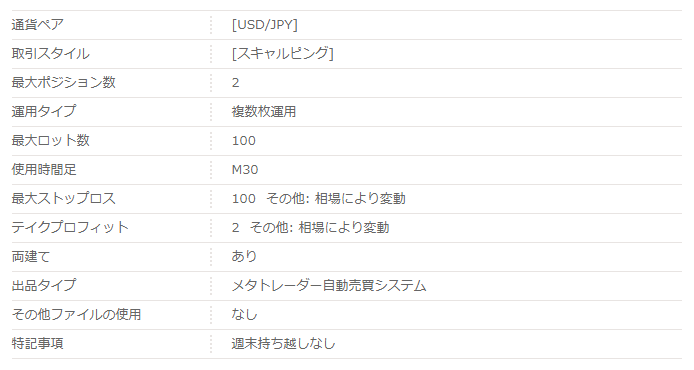

【Panda-B_M30_USDJPY Overview】

“Panda-B_M30_USDJPY” is a USD/JPY scalping EA.

The time frame used is relatively higher for scalping: the 30-minute chart; with a stop loss of 100(variable with the market) and a take profit set to 2(variable with the market), which is characteristic.

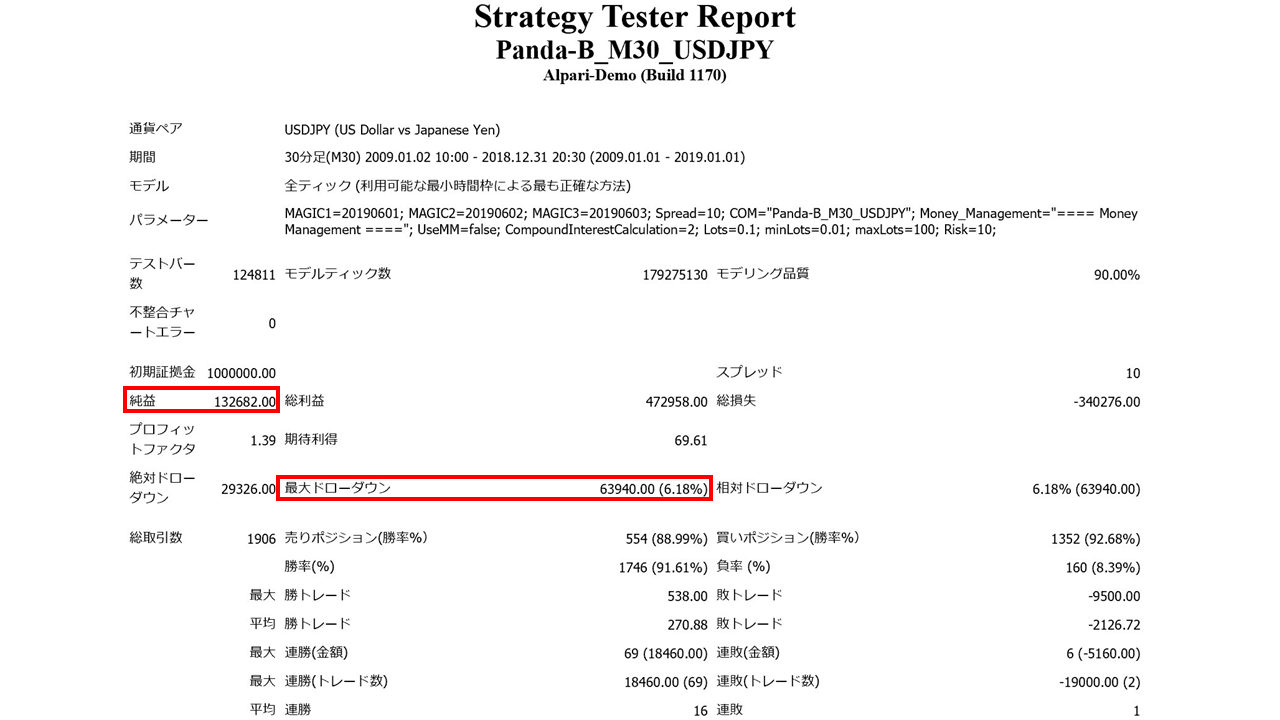

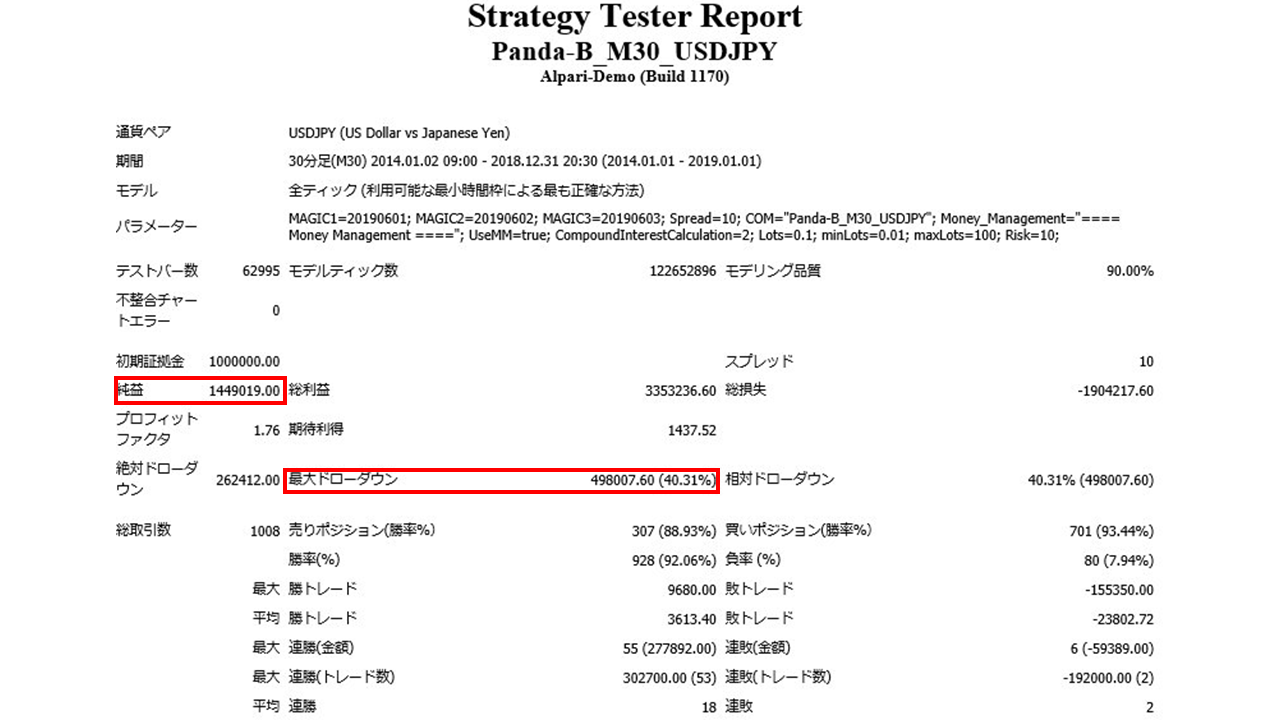

【Backtest Analysis】

We will look at the backtest with simple interest for 10 years and compound interest for 5 years.

・Simple interest operation

2009.01.01‐2019.01.01

Spread 1.0

0.1 lot fixed

Net profit +132,000 JPY(annual average 13,000 JPY)

Maximum drawdown −63,000 JPY

Total trades 1906 (annual average 190)

Win rate 91.61%

PF 1.39

Win rate 91% and PF 1.39 indicate a very good result.

Recommended margin with 0.1 lot fixed is

(4.5*2)+(6.3*2)=21.6(万円)

Therefore, aiming for at least 220,000 yen would allow for safer operation.

The expected annual return in this case isAbout 6.1%.

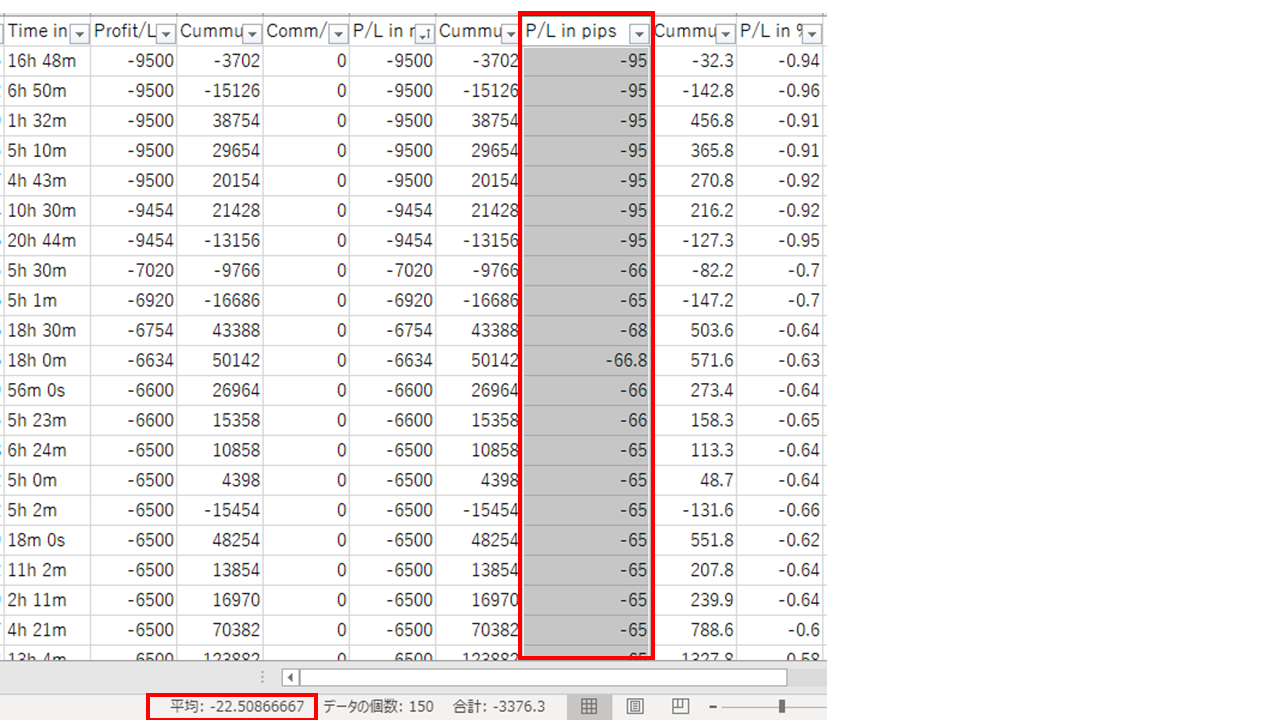

・About Stop Loss

In the overview it states “Maximum stop loss 100(variable)”(variable with market). Looking at backtest history, it is actually up to 95 points seven times (about 5% of total stop losses), with an average of 22.5

points to stop.

Therefore, due to the internal logic, proper stop loss is enforced and the stop loss value is lower than the displayed setting.

The same can be said for take profit as well.

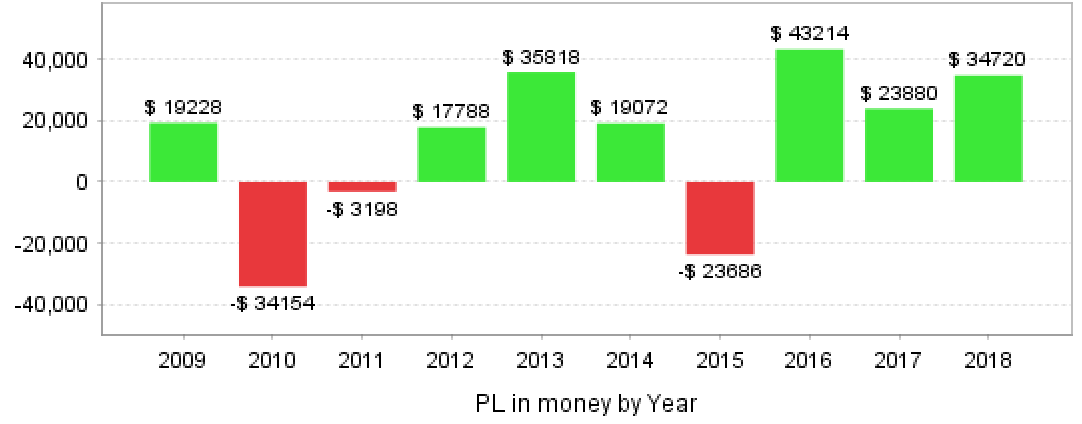

・Annual revenue ($→¥)

Over the past decade there were 3 losing years, but the most recent 3 years show relatively high profits, so there is hope for market conditions after 2019.

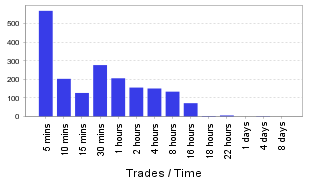

・Trading frequency

The number of trades remains around 200 regardless of profit differences.

・Holding time

Generally, since the maximum stop loss is deep and take profit is shallow, longer holding times tend to lead to a stop loss, while shorter times tend to take profit.

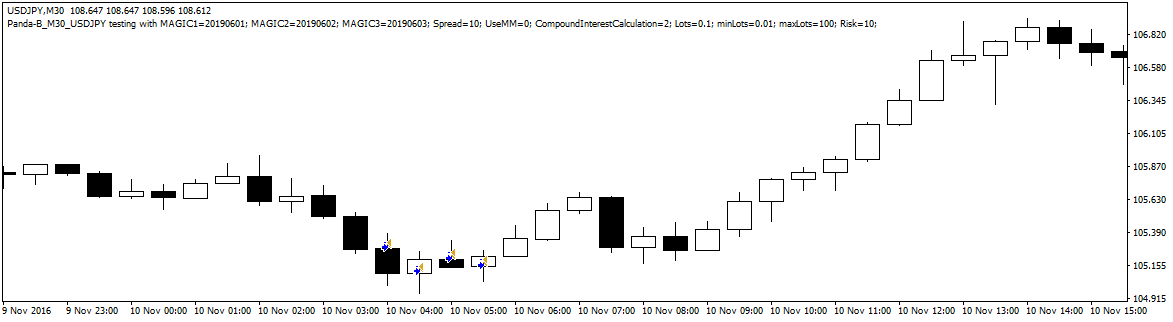

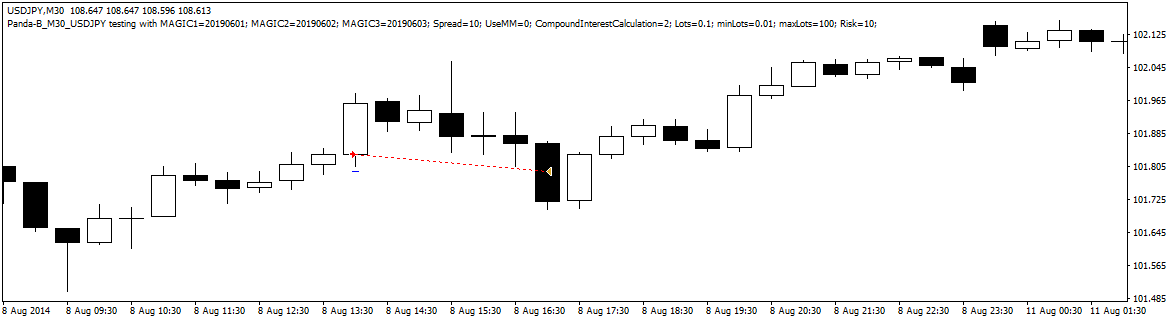

・Trade analysis

We will review the trades from the backtest period on the chart.

Blue: Long Red: Short

Because take profit is quick on the 30-minute chart, many trades are completed within a single candle.

On the other hand, the maximum stop loss is set deep. In this case, once it endures some adverse movement and then turns into a small profit, close immediately!

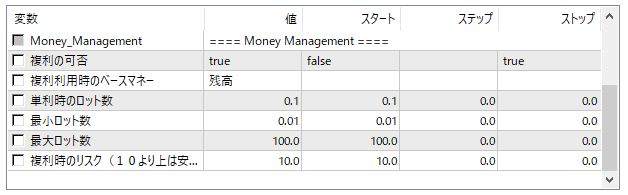

・Compounding

Compounding settings are default; backtesting was done over a 5-year period.

Net profit +1,449,000 JPY

Maximum drawdown −498,000 JPY

Total trades 1008

Win rate 92.06%

PF 1.76

Since net profit reached about 1.45 million yen, it means that the previously mentioned simple-interest equivalent of about 10 years of net profit was earned in 5 years.

Although drawdown is large, this EA with moderate trade count and high win rate should benefit from compounding in terms of profitability. This time the default settings were used, but risk management for lot size can also be configured in the EA settings.

From the above analysis, Panda-B_M30_USDJPY is not a scalping EA with an extremely high number of trades.

It is a type that gradually builds profits with a high win rate, so if starting with a low lot size, compounding is likely the best option for capital and earnings efficiency.

This EA, which builds profits by maintaining a high win rate with small profits, has a deep stop loss and a tight take-profit setting, so spreads directly affect profits.

Therefore, since USD/JPY has many FX brokers to choose from, you should carefully select your trading account.