Is Nampin guilty? Got instructed on strategic averaging by Kawasaki Doraemon

Kawasaki Doruemon, the developer of Guruguru Train, says he uses averaging down (nampin) when performing discretionary trading. Averaging down is generally considered a bad move, but how does Kawasaki Doruemon master it? It becomes clear that “planned averaging down is not a bad move.”

What you can learn from this video

In this video, you will learn the following:

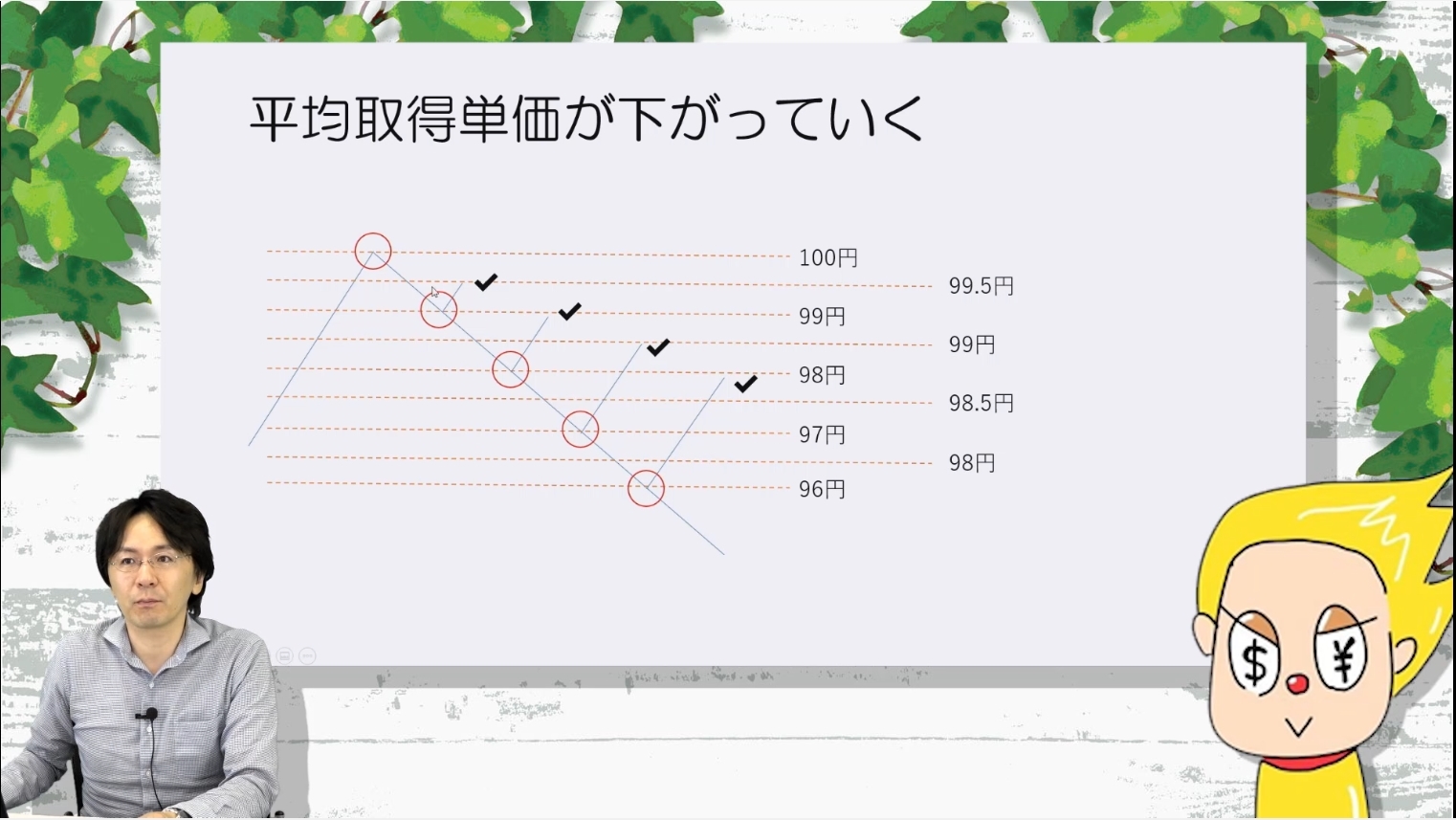

- Nampin (averaging down) is, roughly speaking, a method to lower the average entry price

- Nampin is difficult in one-way markets (for example, USD/JPY in Turkish lira terms)

- The difference between trading 10,000 units and buying down every 10 pips when trading 1,000 units

- Introducing concrete planned nampin! An example of nampoing 5 pips against you

- Able to adapt freely to currency pairs and market conditions

- How do you think about taking profits?

- Points to consider when implementing planned nampin

● Video: 15 minutes 6 seconds

Kawasaki Doruemon Profile

Feeling limits in discretionary trading, he sought a system-trading method that could be profitable with minimal mental load. After various simulations, Guruguru Train was completed.

Official site:Kawasaki Doruemon’s FX Blog

Twitter:https://twitter.com/kawasakidoruemo

How to view FX technique videos

The FX technique videos are embedded in the section below this article, which is accessible to readers who have purchased the article. Click the play button to start the video.