US financial policy is gradually gaining the upper hand; has the Bank of Japan been pressed to tighten? This latest move backfired. And the ECB is also approaching the limits of its easing.

April 30, 2016 19:00

The headline this week was surely the additional monetary easing at the Bank of Japan meeting. Looking back, Bloomberg's coverage suggested that if the additional easing was hinted at, the dollar/yen could stay firm until the announcement, and it wouldn't be surprising if they suspected that a week earlier the bait was scattered. But for the BOJ, it may have been a new strategy.

That said, even with the additional easing, the dollar/yen seems to be in a downtrend, so selling would resume where it rose. Over the weekend, there were further attempts to test lower levels overseas, pushing the drop to the low 106s before closing. News to reinforce that also emerged.

On the 29th, the U.S. Treasury released the semi-annual Currency Report analyzing major trading partners’ exchange-rate policies, for the first time adding Japan to the "watch list" of currency policies. Regarding the yen’s exchange rate against the dollar, it stated that it was "orderly" and warned against Japan's easy market intervention. This article was published before close, and by early next week the possibility of further yen buying cannot be denied. In the near term, the rate has fallen to the low 106s, with 105 as the attention point for the Golden Week market.

From the current market, it seems that U.S. monetary policy is proceeding with gradual rate hikes, but it is not prompting dollar buying; U.S. stock indices are near historical highs and can dip somewhat, but the USD is entering a trend that discourages further purchases. Depending on Yellen's magic, further dollar weakness may be possible.

Therefore, the currency to watch is the euro-dollar pair, which has been showing a W-shaped bottom since the end of last year. Ask Ultimate MAX has finally shown a strong signal on the weekly chart. The range-bound movement continues, but the Ichimoku cloud is narrowing, and there is a possibility of temporarily breaking above the cloud ceiling soon.

With the BOJ’s easing policy currently supporting yen buying and the ECB postponing easing for the moment, the overall market could be influenced by U.S. monetary policy. While the dollar/yen matters, first we should watch for a break in the resistance on the euro-dollar pair.

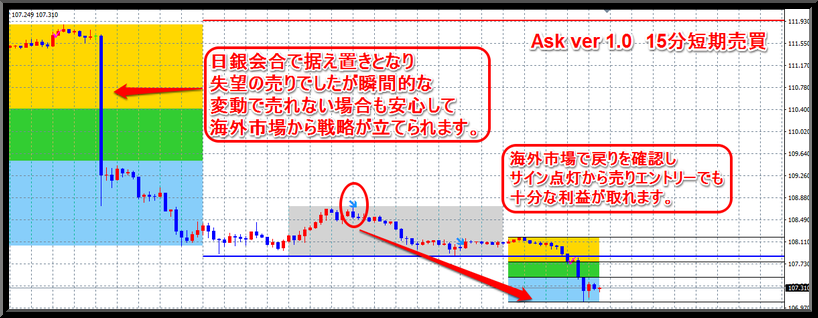

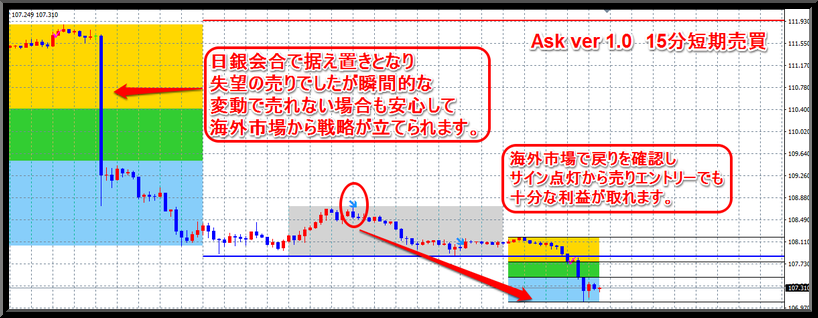

As for the dollar/yen, it resumed its decline after the BOJ meeting held firm, but did traders sell immediately?

From the April 29 article: The dollar/yen that missed a sale yesterday — where was it sold? It could have been sold here!

Yesterday, the BOJ kept rates unchanged and the dollar/yen briefly fell before moving

During the 15:30 press conference with Governor Kuroda, it did not sell off and the market moved,

and many probably felt frustrated.

However, without aiming for large profits,

if you wait for the right opportunity, selling opportunities will come from the market itself.

This is the Ask ver1.0 short-term trading tool for dollar/yen on the 15-minute chart,

and a selling signal has lit up in New York at the ultimate point.

While confirming signals on several other timeframes, today is a Singapore holiday, but

until around noon it was possible to extend profits.

Dollar/yen carries downside risk, but in the short term, since it is the weekend,

it would be prudent to close positions and plan next week’s strategy.

Ask ver1.0 Dollar/Yen 15-minute chart

Last week, just before the major earthquake, Ask Ultimate MAX was upgraded in version

Following multi-frame analysis, signs of overbought and oversold were added to indicate profit-taking targets

so that it would be easy to see when to take profits.

Enter with the ultimate buy/sell signals and exit with overbought/oversold signals!

It detects signs that the market is about to undergo a major turning point and tells you the perfect timing to exit!

Furthermore, there has been a huge amount of inquiries about the dollar/yen, so we prepared a limited edition Ultimate MAX Dollar/Yen.

If you purchase this together with Ask ver1.0, for a limited time you can get 20% off and nearly

the MAX Dollar/Yen edition for free.

Additionally, we prepared a luxurious 8-item bonus set and a special, cost-effective Dollar/Yen bundle for a limited time!

Ask ver1.0 / Ask_Ultimate MAX Dollar/Yen Limited Edition + 8-item bonus set!

The headline this week was surely the additional monetary easing at the Bank of Japan meeting. Looking back, Bloomberg's coverage suggested that if the additional easing was hinted at, the dollar/yen could stay firm until the announcement, and it wouldn't be surprising if they suspected that a week earlier the bait was scattered. But for the BOJ, it may have been a new strategy.

That said, even with the additional easing, the dollar/yen seems to be in a downtrend, so selling would resume where it rose. Over the weekend, there were further attempts to test lower levels overseas, pushing the drop to the low 106s before closing. News to reinforce that also emerged.

On the 29th, the U.S. Treasury released the semi-annual Currency Report analyzing major trading partners’ exchange-rate policies, for the first time adding Japan to the "watch list" of currency policies. Regarding the yen’s exchange rate against the dollar, it stated that it was "orderly" and warned against Japan's easy market intervention. This article was published before close, and by early next week the possibility of further yen buying cannot be denied. In the near term, the rate has fallen to the low 106s, with 105 as the attention point for the Golden Week market.

From the current market, it seems that U.S. monetary policy is proceeding with gradual rate hikes, but it is not prompting dollar buying; U.S. stock indices are near historical highs and can dip somewhat, but the USD is entering a trend that discourages further purchases. Depending on Yellen's magic, further dollar weakness may be possible.

Therefore, the currency to watch is the euro-dollar pair, which has been showing a W-shaped bottom since the end of last year. Ask Ultimate MAX has finally shown a strong signal on the weekly chart. The range-bound movement continues, but the Ichimoku cloud is narrowing, and there is a possibility of temporarily breaking above the cloud ceiling soon.

With the BOJ’s easing policy currently supporting yen buying and the ECB postponing easing for the moment, the overall market could be influenced by U.S. monetary policy. While the dollar/yen matters, first we should watch for a break in the resistance on the euro-dollar pair.

As for the dollar/yen, it resumed its decline after the BOJ meeting held firm, but did traders sell immediately?

From the April 29 article: The dollar/yen that missed a sale yesterday — where was it sold? It could have been sold here!

Yesterday, the BOJ kept rates unchanged and the dollar/yen briefly fell before moving

During the 15:30 press conference with Governor Kuroda, it did not sell off and the market moved,

and many probably felt frustrated.

However, without aiming for large profits,

if you wait for the right opportunity, selling opportunities will come from the market itself.

This is the Ask ver1.0 short-term trading tool for dollar/yen on the 15-minute chart,

and a selling signal has lit up in New York at the ultimate point.

While confirming signals on several other timeframes, today is a Singapore holiday, but

until around noon it was possible to extend profits.

Dollar/yen carries downside risk, but in the short term, since it is the weekend,

it would be prudent to close positions and plan next week’s strategy.

Last week, just before the major earthquake, Ask Ultimate MAX was upgraded in version

Following multi-frame analysis, signs of overbought and oversold were added to indicate profit-taking targets

so that it would be easy to see when to take profits.

Enter with the ultimate buy/sell signals and exit with overbought/oversold signals!

It detects signs that the market is about to undergo a major turning point and tells you the perfect timing to exit!

Furthermore, there has been a huge amount of inquiries about the dollar/yen, so we prepared a limited edition Ultimate MAX Dollar/Yen.

If you purchase this together with Ask ver1.0, for a limited time you can get 20% off and nearly

the MAX Dollar/Yen edition for free.

Additionally, we prepared a luxurious 8-item bonus set and a special, cost-effective Dollar/Yen bundle for a limited time!

Ask ver1.0 / Ask_Ultimate MAX Dollar/Yen Limited Edition + 8-item bonus set!

× ![]()