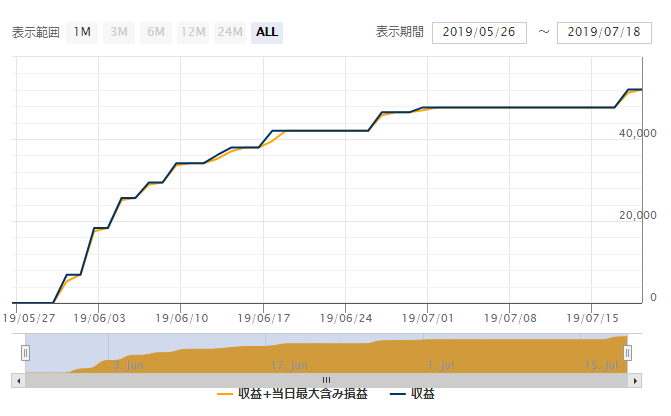

A scalping EA '刻' whose profitability has been enhanced through updates.

Top of System Trade Ranking

EA that surpassed 180 users in one month after its release

Further update!

100% win rate in a 1-month forward period!

Additionally, it was upgraded to the current ver.5 on July 18, 2019.

Further profits are expected to accumulate through future forward tests.

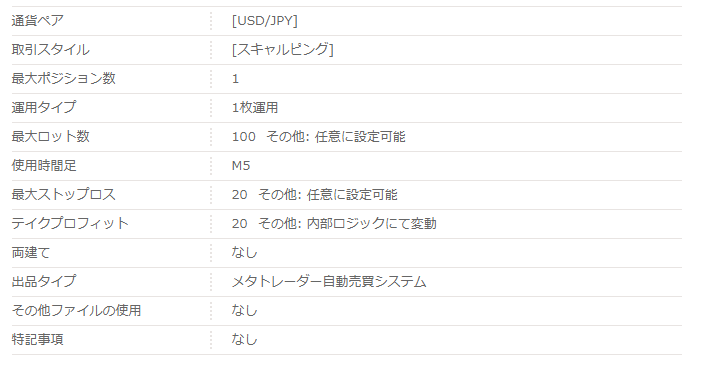

【Koku Overview】

“Koku” is a USD/JPY-only 5-minute EA.

It is a classic simple-swing scalping type with a single maximum position, shallow settings for both max stop loss and take profit at 20, and no averaging-down (no martingale) methods.

An update was made on July 18, 2019. ⇒Details

The update includes: 1) improvement of trading logic, 2) addition of a comment function, 3) visualization of stop and limit orders.

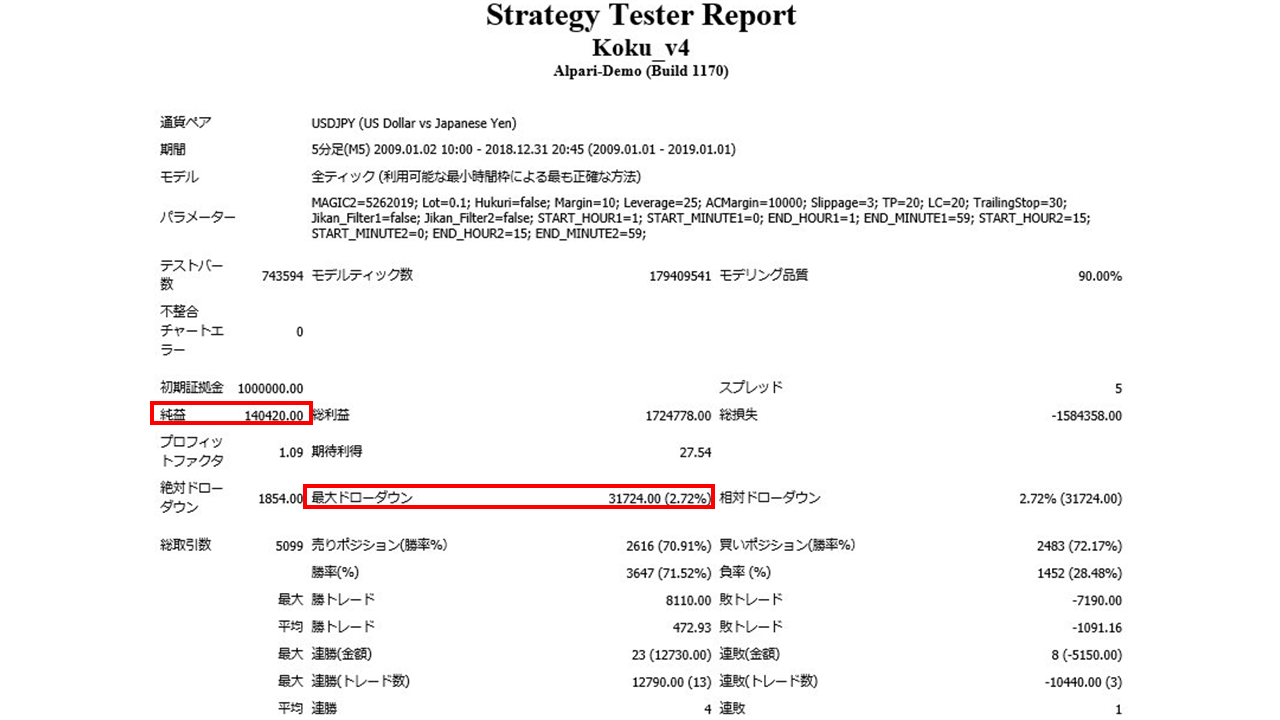

【Backtest Analysis】

We will examine 10 years of backtests.

This time, we will focus on differences in spreads important for scalping and how they actually changed with the July 18, 2019 update, comparing them accordingly.

・Koku Ver.4 (Old), Spread 5

2009.01.01‑2019.01.01

Spread 5

0.1 lot fixed

Net profit +140,000 JPY (annual average 14,000 JPY)

Maximum drawdown −31,000 JPY

Total trades 5,099 (annual average 509)

Win rate 71.52%

PF 1.09

Win rate around 70%, PF 1.09, and low drawdown; not a bad result, but for scalping the USD/JPY major pair, this performance may feel lacking.

・Ver.4 (Old), Spread 3

2009.01.01‑2019.01.01

Spread 3

0.1 lot fixed

Net profit +240,000 JPY (annual average 24,000 JPY)

Maximum drawdown −27,000 JPY

Total trades 5,099 (annual average 509)

Win rate 72.15%

PF 1.16

Net profit was +100,000 JPY and maximum drawdown was −4,000 JPY.

For domestic FX brokers, USD/JPY with a spread of 3 is not difficult to operate, so when trading, you should carefully select brokers with narrow spreads.

Recommended margin for 0.1 lot fixed is

4.5 + (2.7*2) = 9.9 (ten-thousand yen)

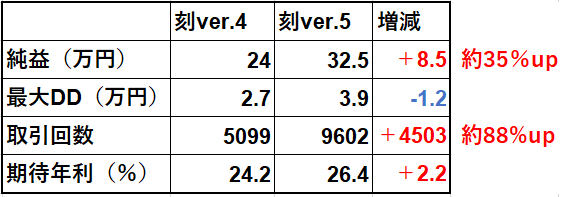

In this case, the expected annual return is about 24.2%.

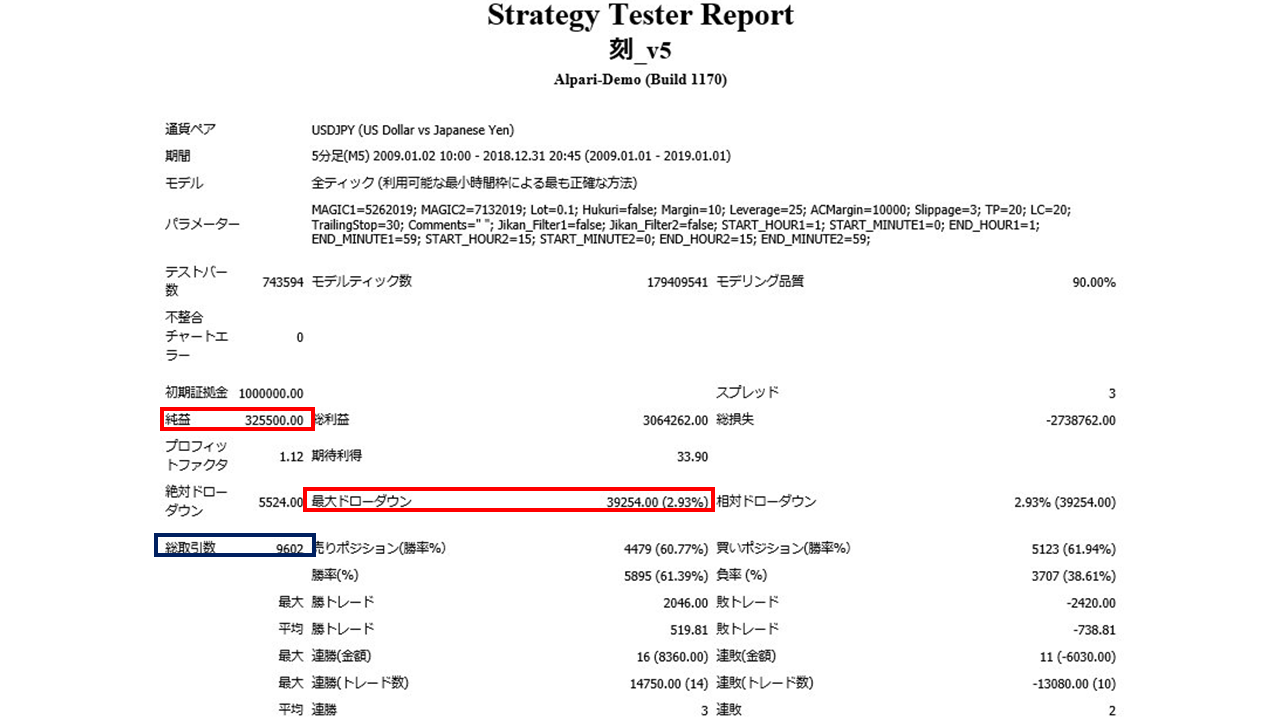

・Ver.5, Spread 3

From here, we will verify the backtest results for the updated Koku currently on sale.

2009.01.01‑2019.01.01

Spread 3

0.1 lot fixed

Net profit +325,000 JPY (annual average 32,000 JPY)

Maximum drawdown −39,000 JPY

Total trades 9,602 (annual average 960)

Win rate 61.39%

PF 1.12

The maximum drawdown has slightly increased, but net profit and number of trades have significantly increased.

Recommended margin for 0.1 lot fixed is

4.5 + (3.9*2) = 12.3 (ten-thousand yen)

It still seems feasible to operate with low capital.

In this case, the expected annual return is about 26.4%.

Looking at the main changes after the upgrade,

net profit and the number of trades have noticeably increased.

The number of trades has increased by about 1.88x, nearly doubling, so as previously noted, the difference in spreads can yield even larger profit, making the spread of the trading account more important.

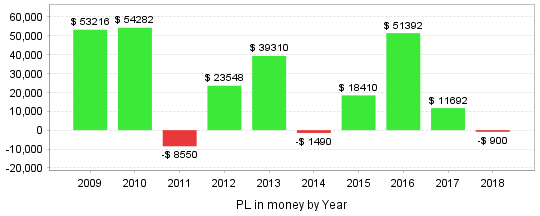

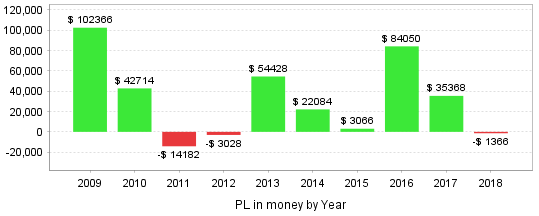

・Annual earnings (USD → JPY)

Koku ver.4

Koku ver.5

Compared to

2011 and 2018 saw losses increase by 1.5x

2010, 2012, 2015 saw profits decrease by 20% to 80%

2014 saw losses reverse to profit realization

In other years, profits increased by 1.3 to 3 times.

As shown below, there is a correlation with the number of trades; years with few trades tend to incur losses and have smaller profits.

However, since the growth in profits varies greatly by year, the total long-term final profit is large.

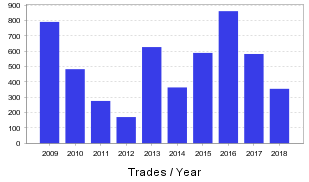

・Annual trades

Left is ver.4, right is ver.5. The overall ratio is similar, with each year seeing about 400–500 more trades.

Ver.5 has a maximum of 1,400 trades per year, and at least 600 per year, averaging around 1,000 trades per year.

From what we have seen, Koku has many trades and shallow stop loss and take profit settings, so

even as a scalping EA, it does not achieve an ultra-high win rate.

However, with a solid edge trading logic, profits are generated even with a win rate above 60% and with a strong level of profitability.

What becomes important then is the number of trades. By increasing the number of trades, the likelihood of staying profitable rises.

With this update, the trading logic, especially the number of trades, has significantly improved, strengthening this EA’s strengths even further.

Profitability and stability improve even without an ultra-high win rate.

For a high-frequency scalping EA, the spread is also important, so

to reduce the cost per trade, you should carefully select domestic FX brokers for your trading accounts.