Also verify the portfolio with eight currency pairs! Multi-currency-pair compatible day-trading EA 'Day Trade Samurai'

Can be used with eight currency pairs and can also build a standalone portfolio

Single-position, low-drawdown day-trading EA

Forward testing has progressed for about one month, with favorable win rate and PF, and a low drawdown, providing a good start.

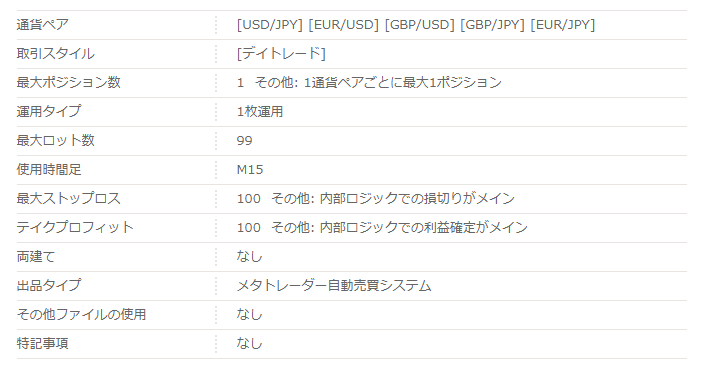

【Day Trader Samurai Overview】

“Day Trader Samurai” is a 15-minute, multi-currency day-trading EA targeting five major currency pairs.

On the product page, in addition to the five above, it is usable with AUD/USD, CHF/JPY, and USD/CAD, making a total of eight currency pairs supported.

Both the maximum stop loss and take profit are set to 100.

Because there is only one position, it helps keep the required margin per currency pair down and makes simultaneous operation of multiple currency pairs easier.

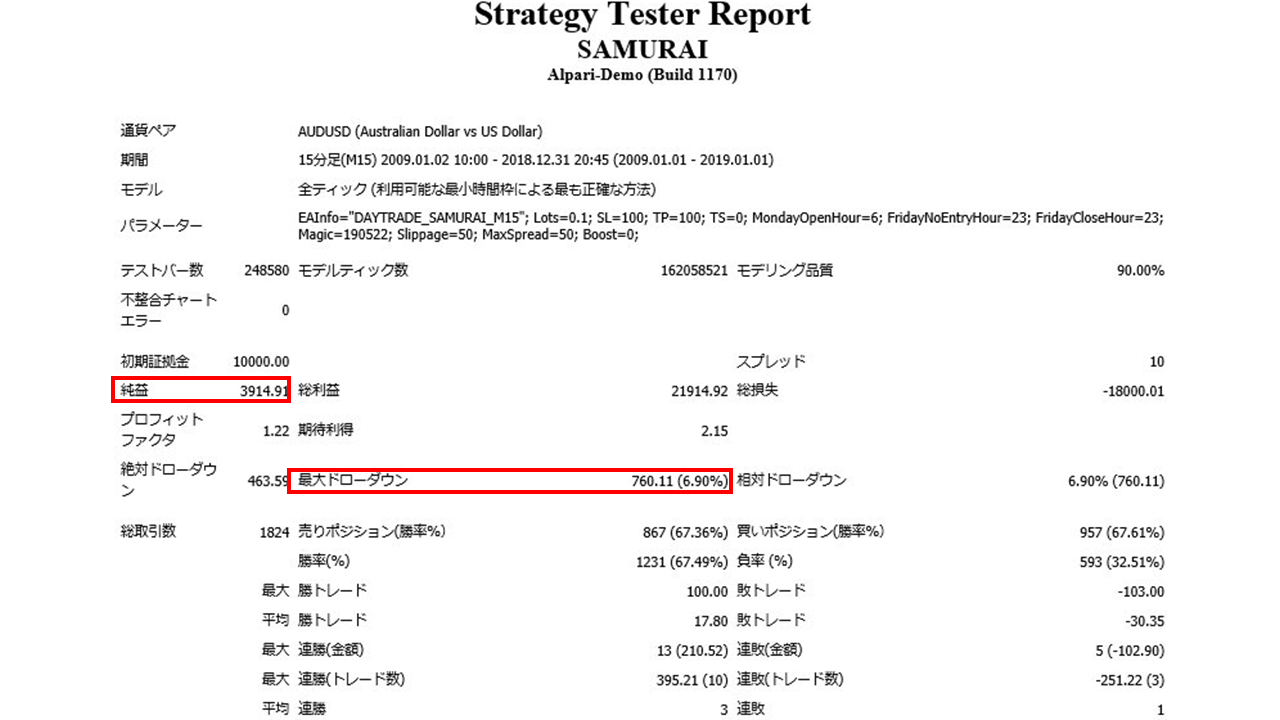

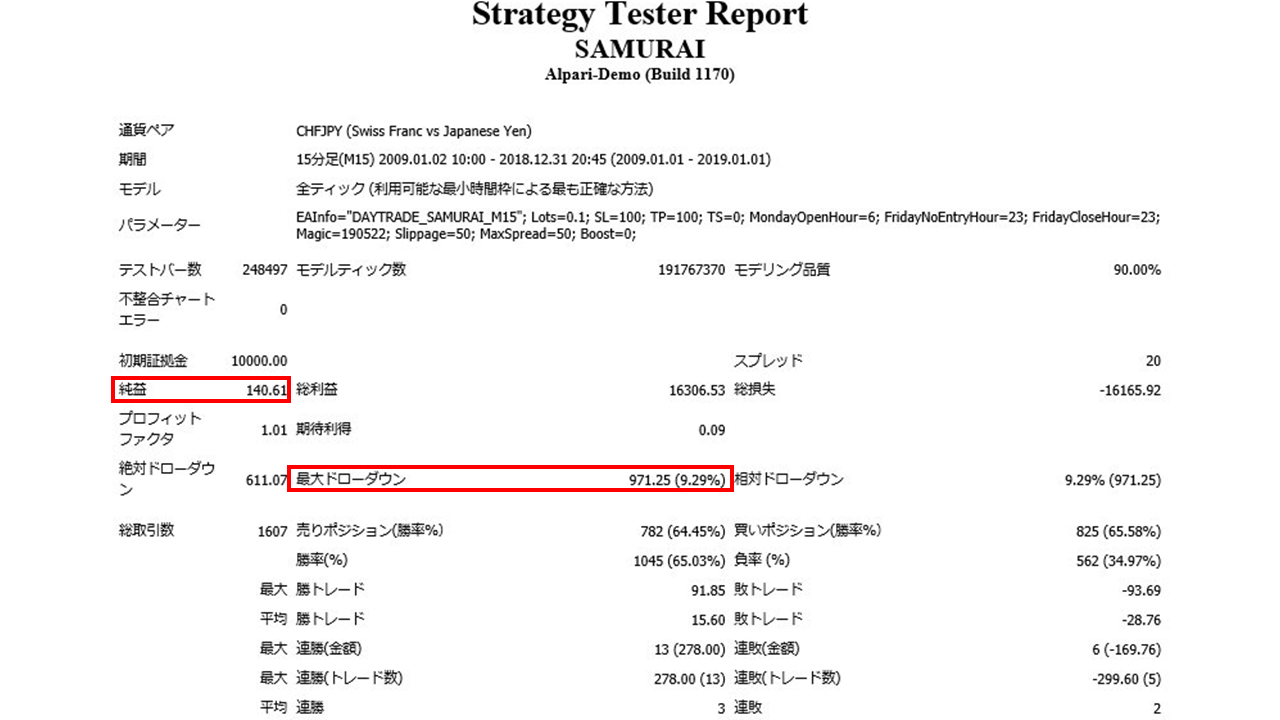

【Backtest Analysis】

Backtests cover ten years from 2009 to 2018 with a fixed 0.1-lot denomination in USD, spread set to 10, and GBP/JPY, CHF/JPY, and USD/CAD set to 20 for analysis.

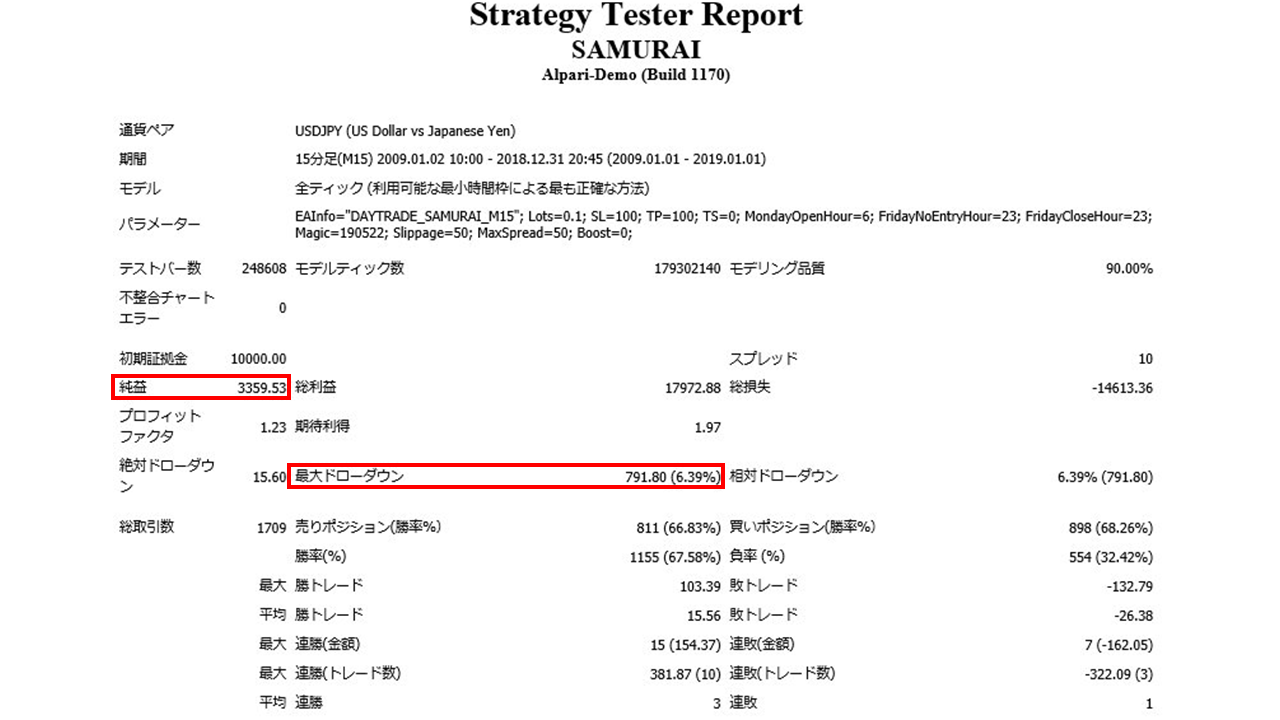

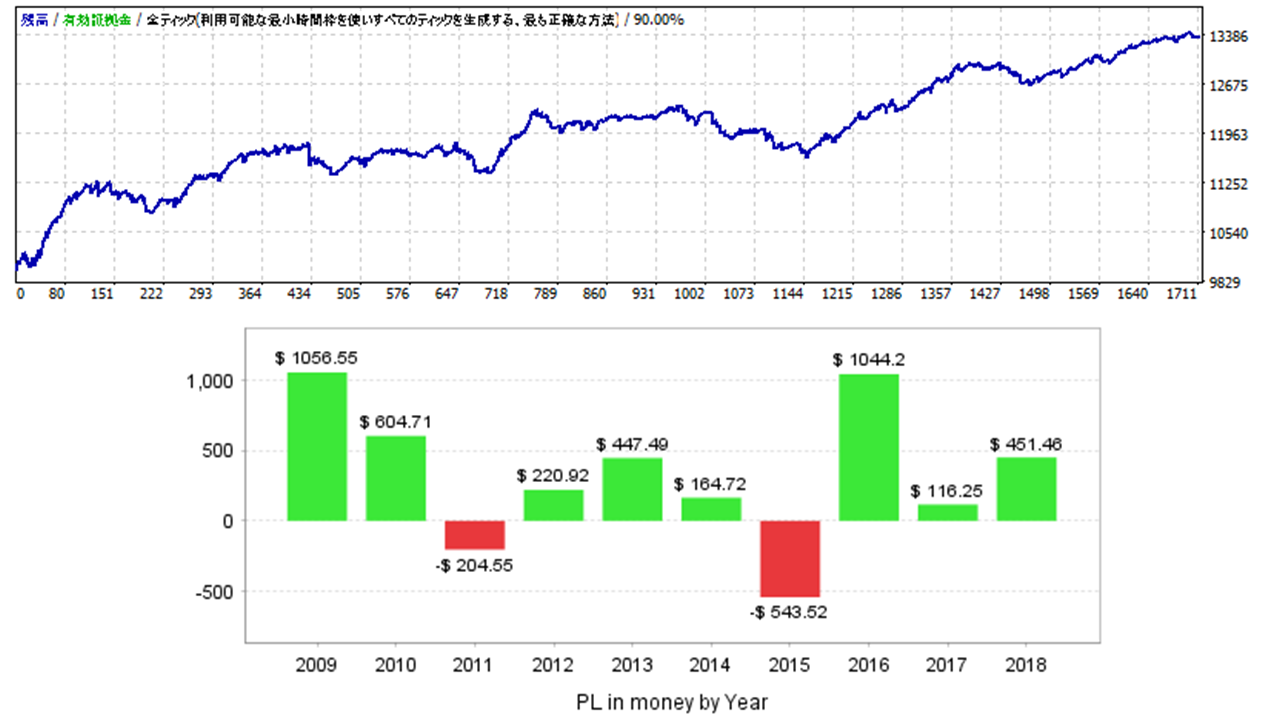

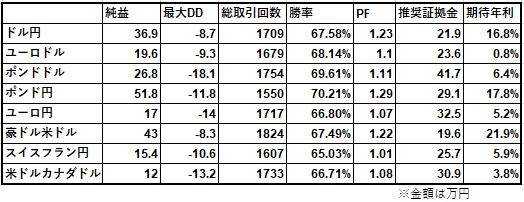

・USD/JPY

Spread 1.0

Net profit +36.9万 yen (annual average 3.6万 yen)

Maximum drawdown −8.7万 yen

Total trades 1709 (annual average 170)

Win rate 67.58%

PF 1.23

Recommended margin amount is fixed at 0.1 lot,4.5+(8.7*2)=21.9(万円)

Expected annual return16.8%

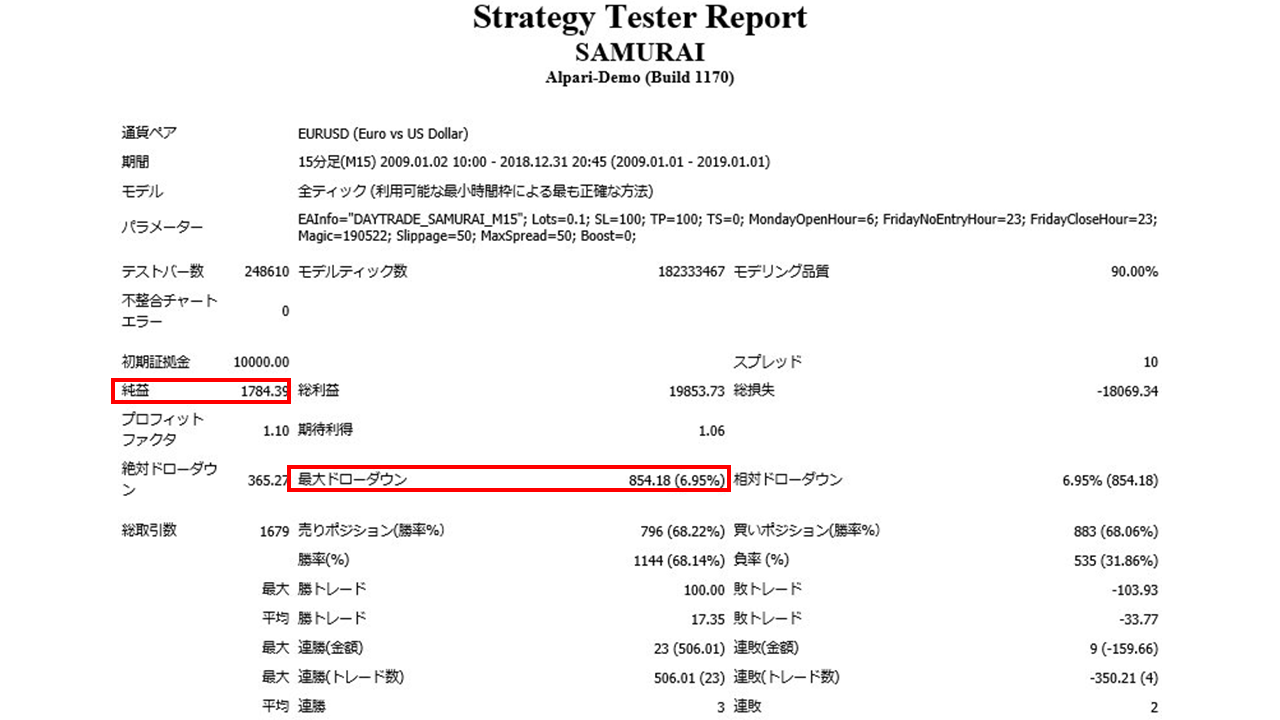

・EURUSD

Spread 1.0

Net profit +19.6万 yen (annual average 1.96万 yen)

Maximum drawdown −9.3万 yen

Total trades 1679 (annual average 167)

Win rate 68.14%

PF 1.10

Recommended margin amount is fixed at 0.1 lot,5+(9.3*2)=23.6(万円)

Expected annual return0.8%

・GBPUSD

Spread 1.0

Net profit +26.8万 yen (annual average 2.6万 yen)

Maximum drawdown −18.1万 yen

Total trades 1754 (annual average 175)

Win rate 69.61%

PF 1.11

Recommended margin amount is fixed at 0.1 lot,5.5+(18.1*2)=41.7(万円)

Expected annual return6.4%

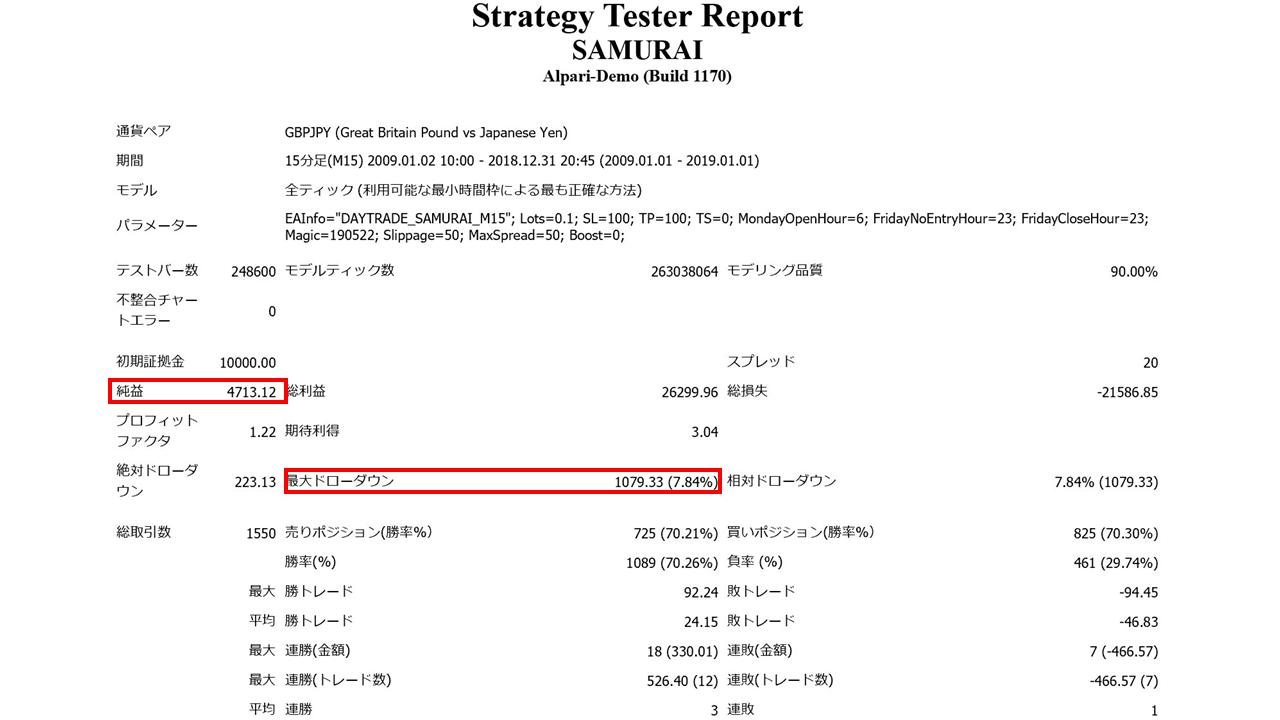

・GBPJPY

Spread 2.0

Net profit +51.8万 yen (annual average 5.1万 yen)

Maximum drawdown −11.8万 yen

Total trades 1550 (annual average 155)

Win rate 70.21%

PF 1.29

Recommended margin amount is fixed at 0.1 lot,5.5+(11.8*2)=29.1(万円)

Expected annual return17.8%

・EURJPY

Spread 1.0

Net profit +17万 yen (annual average 1.7万 yen)

Maximum drawdown −14万 yen

Total trades 1717 (annual average 171)

Win rate 66.80%

PF 1.07

Recommended margin amount is fixed at 0.1 lot,4.5+(14*2)=32.5(万円)

Expected annual return5.2%

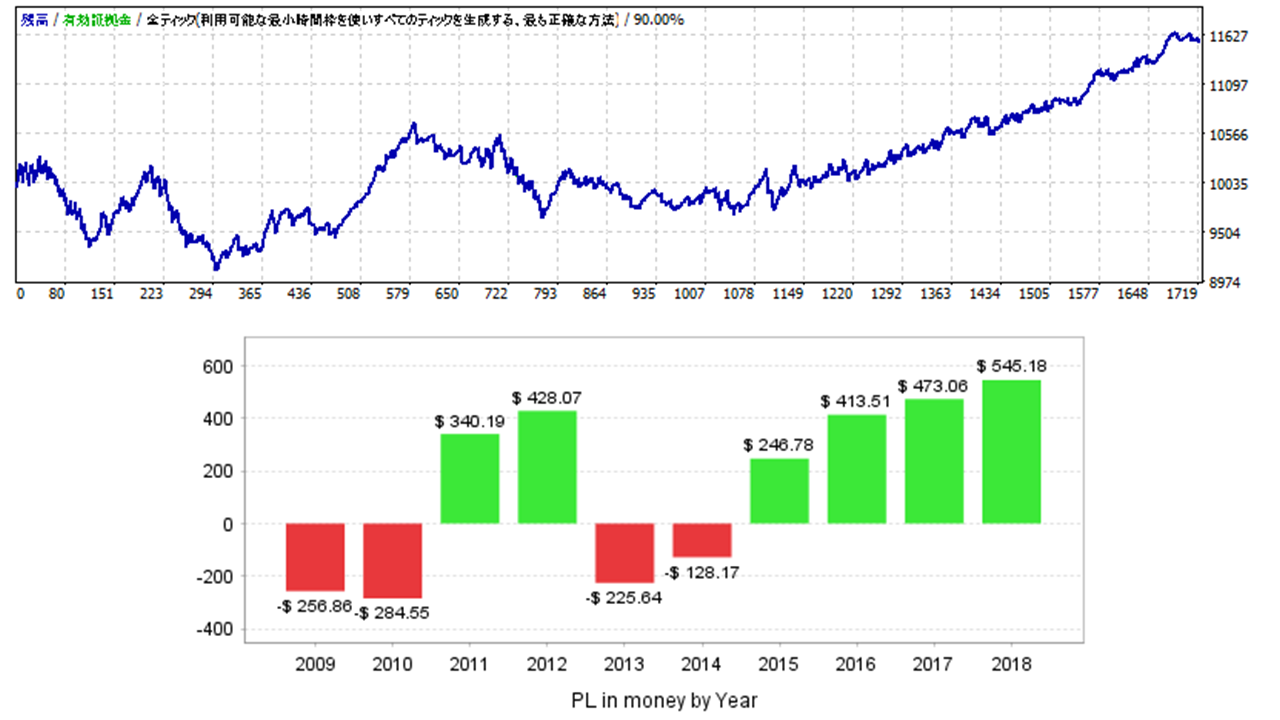

・AUDUSD

Spread 1.0

Net profit +43万 yen (annual average 4.3万 yen)

Maximum drawdown −8.3万 yen

Total trades 1824 (annual average 182)

Win rate 67.49%

PF 1.22

Recommended margin amount is fixed at 0.1 lot,3+(8.3*2)=19.6(万円)

Expected annual return21.9%

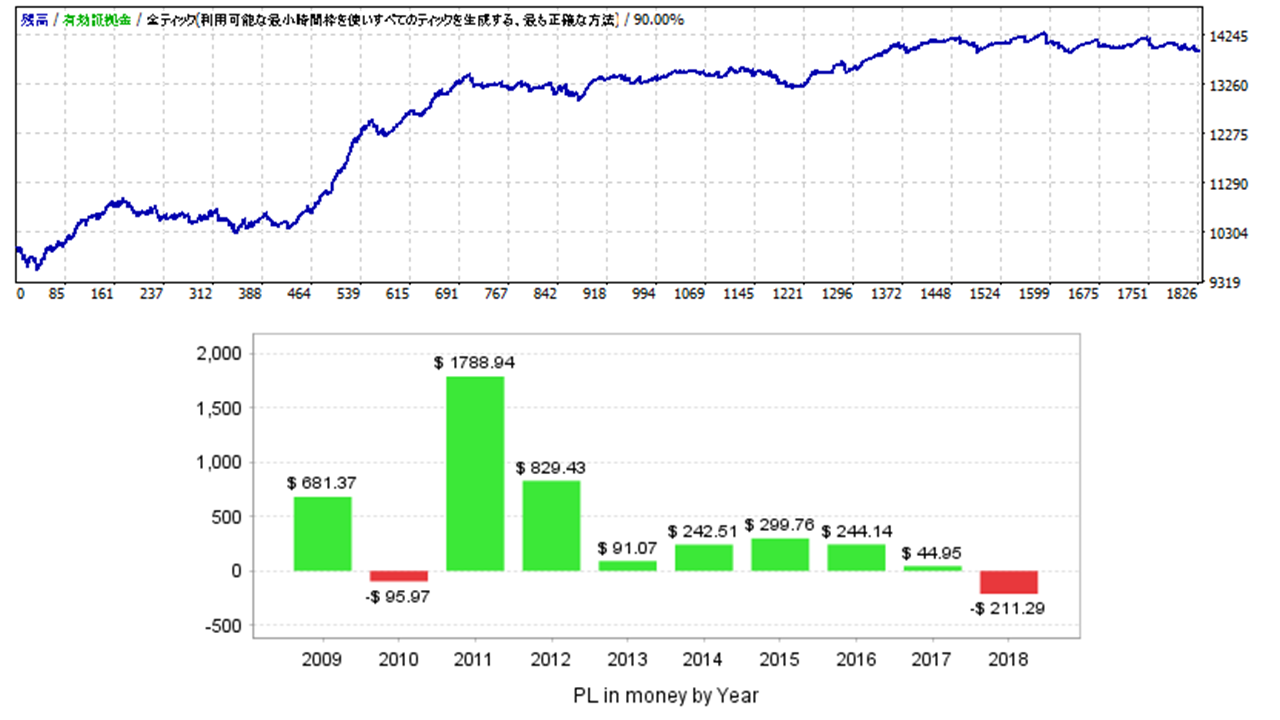

・CHFJPY

Spread 2.0

Net profit +15.4万 yen (annual average 1.5万 yen)

Maximum drawdown −10.6万 yen

Total trades 1607 (annual average 160)

Win rate 65.03%

PF 1.01

Recommended margin amount is fixed at 0.1 lot,4.5+(10.6*2)=25.7(万円)

Expected annual return5.9%

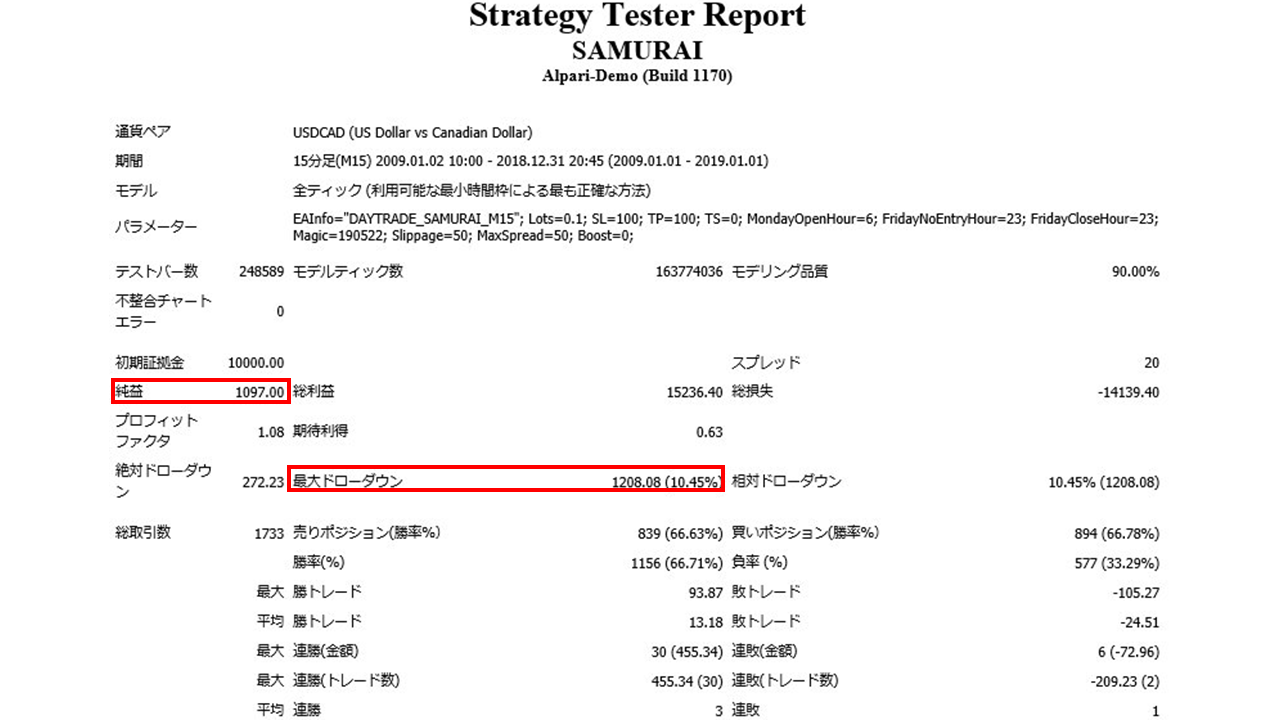

・USDCAD

Spread 2.0

Net profit +12万 yen (annual average 1.2万 yen)

Maximum drawdown −13.2万 yen

Total trades 1733 (annual average 173)

Win rate 66.71%

PF 1.08

Recommended margin amount is fixed at 0.1 lot,4.5+(13.2*2)=30.9(万円)

Expected annual return3.8%

The results for each currency pair are summarized as follows.

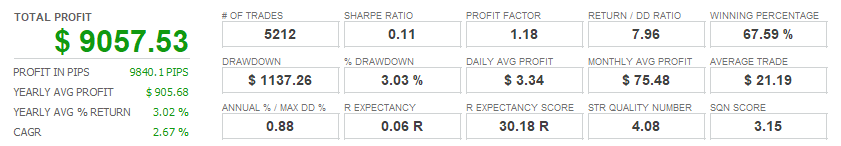

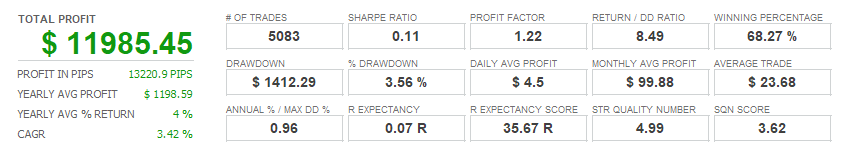

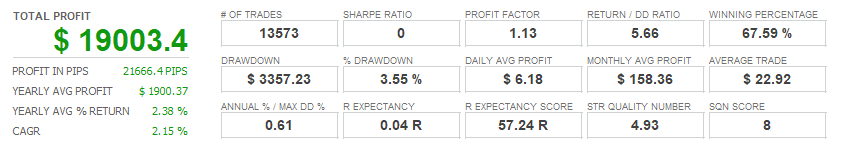

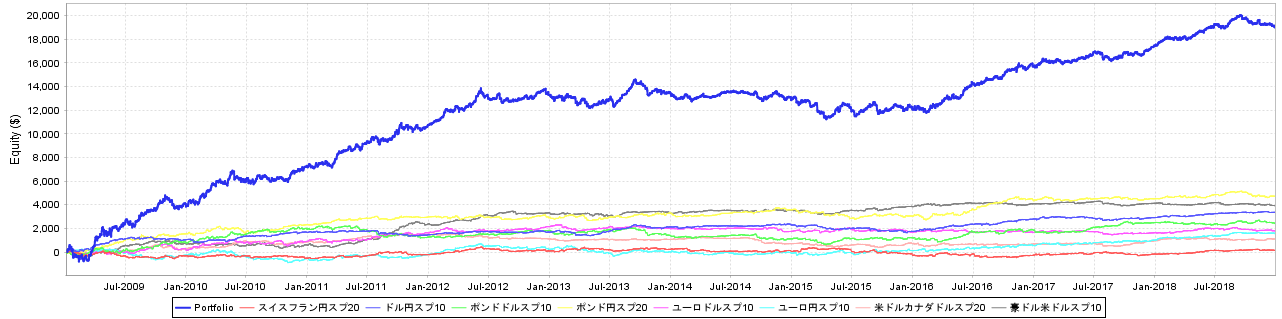

・Portfolio Analysis

We will look at several portfolios formed from the Day Trader Samurai backtests above.

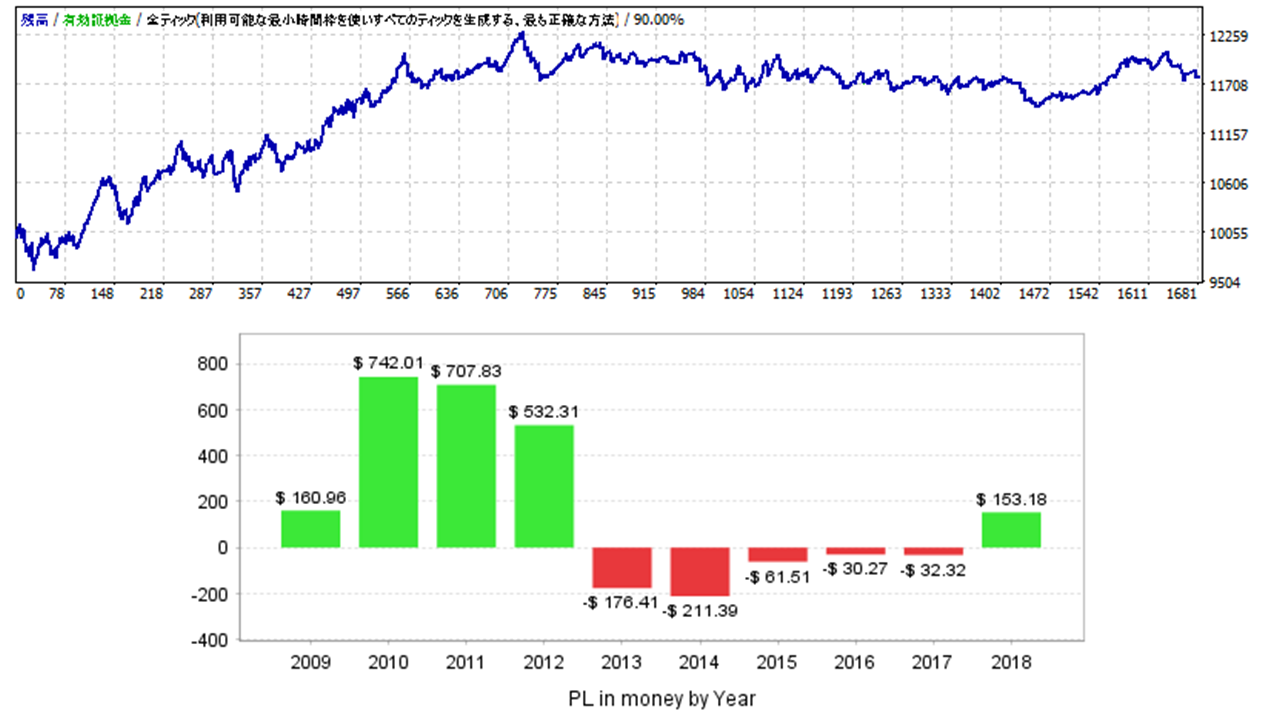

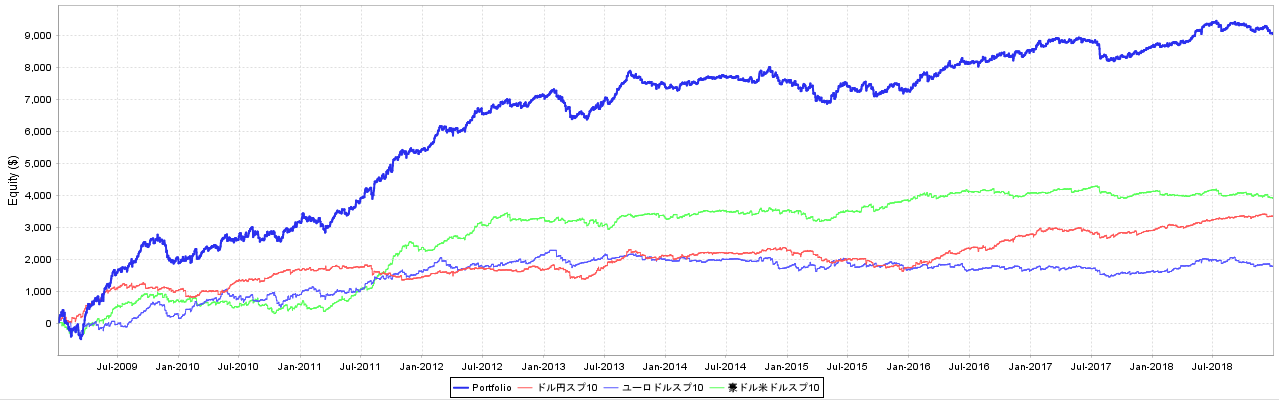

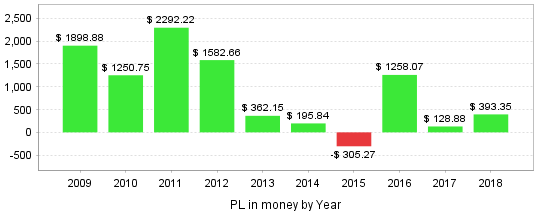

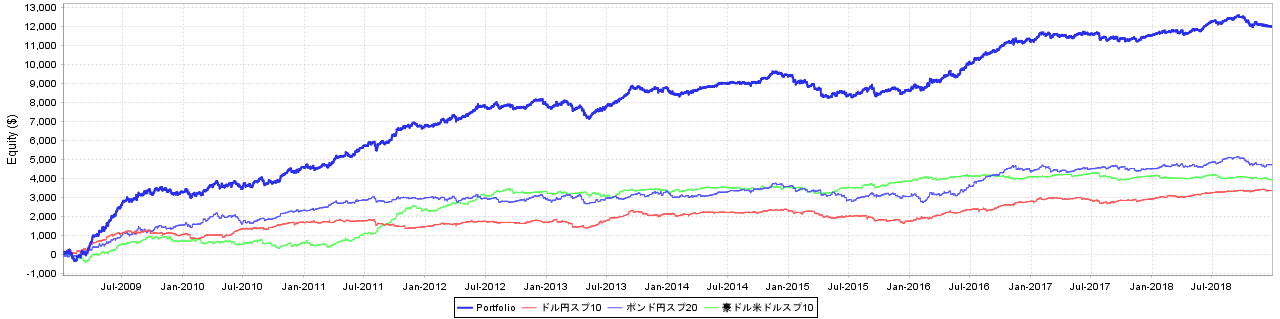

・Three currency pairs with the lowest drawdown

A portfolio formed with USD/JPY, EUR/USD, and AUD/USD where drawdown was kept to a few tens of thousands of yen.

Because AUD/USD performed well overall, you can see it stands out from the others.

Since the drawdown is low, the years with losses were only 2015.

In a single-asset operation, the losses across multiple years offset each other and turn into profits.

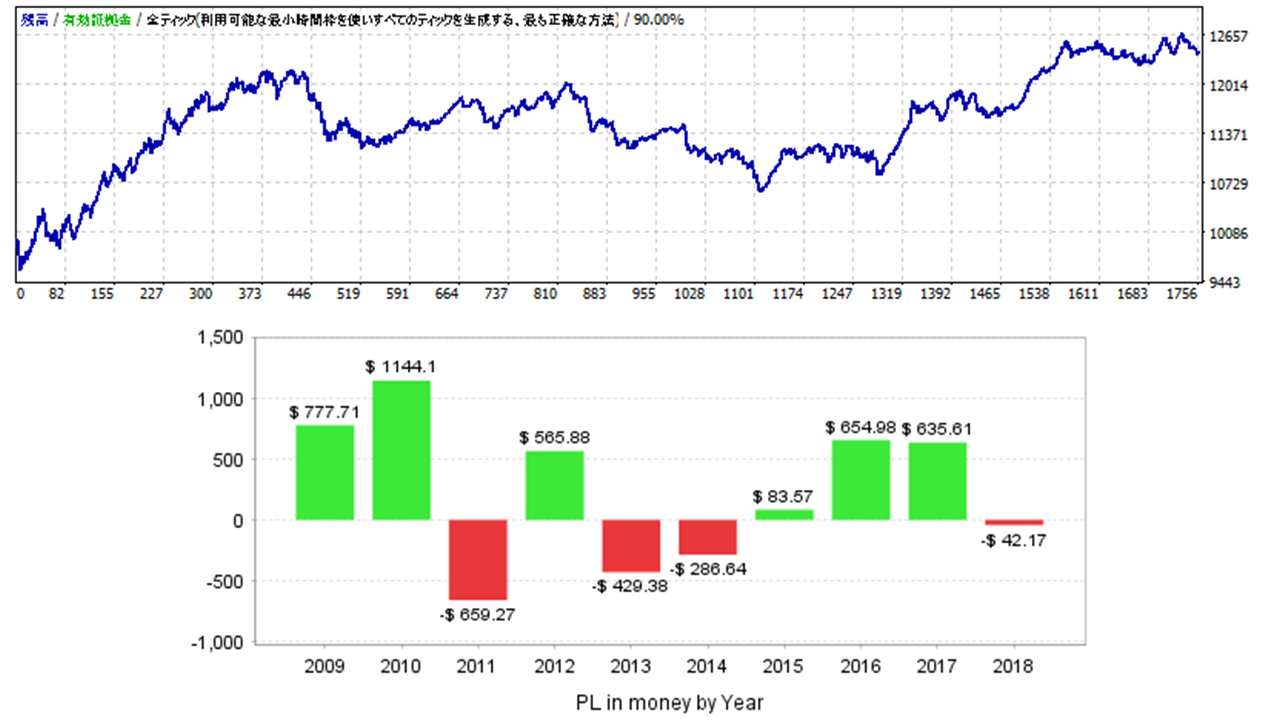

・Three currency pairs with the highest PF

Next, a portfolio formed with USD/JPY, GBP/JPY, and AUD/USD where PF was 1.2 or higher.

The profit curves are close to each other, but total profit is nearly 300,000 yen higher than the previously formed portfolio.

This portfolio also had losses only in 2015, but the magnitude of the losses is larger than the previous one.

Profit here is thought to be easier to obtain, so which elements to emphasize when forming a portfolio matters; even with the same EA, the combination of currency pairs becomes important.

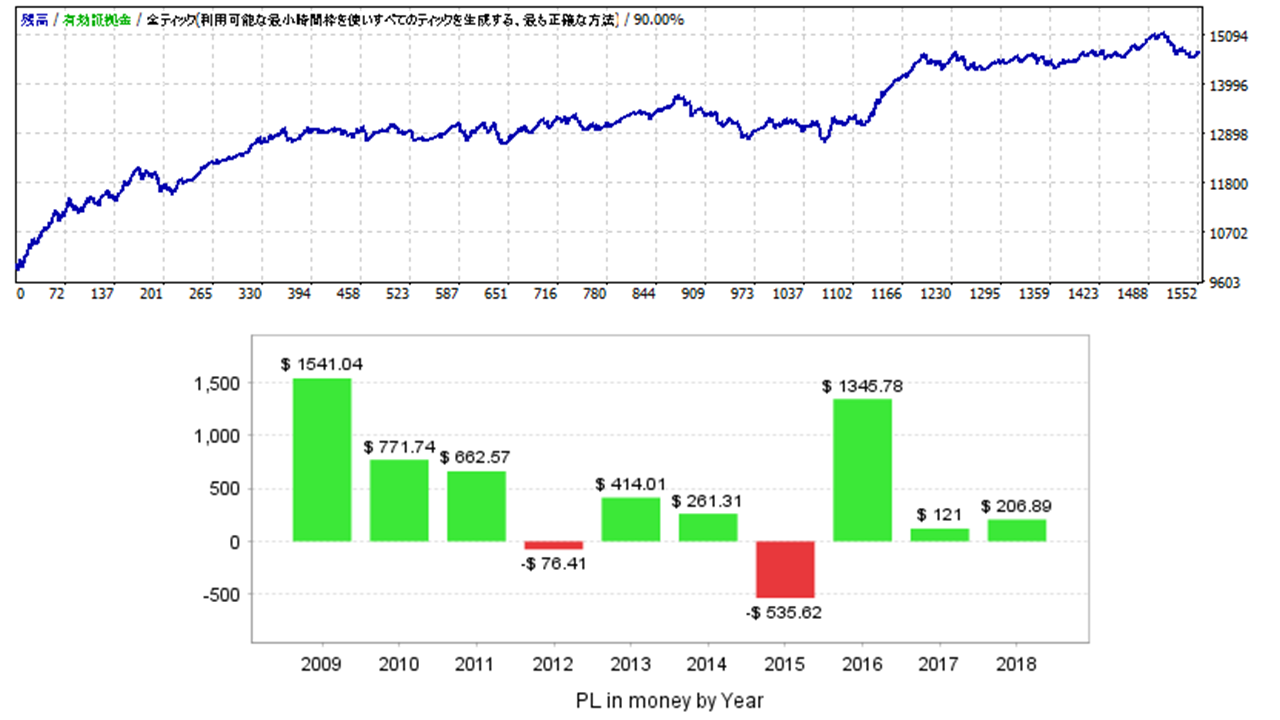

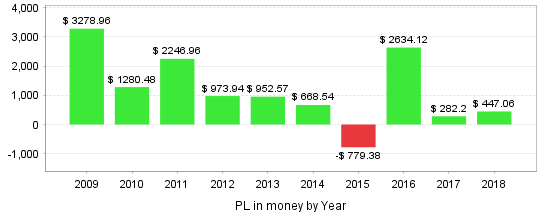

・All eight supported currency pairs

We formed portfolios using all eight currency pairs tested in the backtest.

Since the profit curves for each currency pair form a thick band overall, losses between them are thought to be offset. And with all currency pairs’ profits (PF 1.0 or higher) stacking up, they yield stable profits.

Because eight currency pairs are used, up to eight positions can be held simultaneously, and depending on operation, required margin can become quite large, but this is one of the operating styles Day Trader Samurai aims for.

Looking at annual earnings,

The absolute amounts are large with eight pairs, but losses by year are small relative to gains, and profits have grown substantially, indicating the portfolio is functioning well.

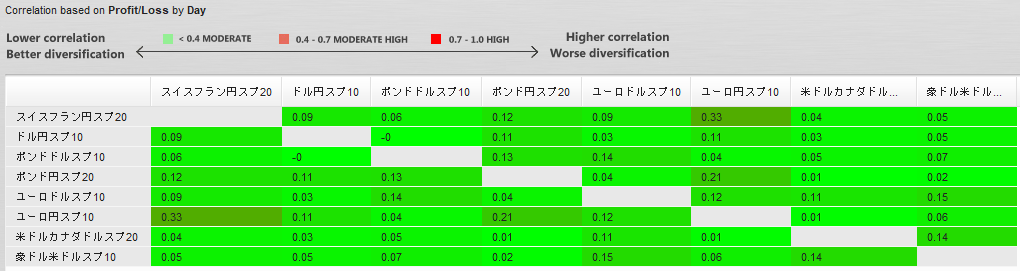

Correlation between currency pairs.

The lower the value, the lower the correlation, and if the color is green, there is no problem.

We formed portfolios with all eight currency pairs, and from these results you can see that you can assemble your own preferred portfolio to fit your margin.

That’s all for now, but Day Trader Samurai is an EA with many trades and low drawdown. Since it allows at most one position per currency pair, it can be safely operated with a small margin in single-pair use, and when forming a portfolio, the correlations between currency pairs look favorable, helping to reduce sizable losses and sustain stable operation.