High win rate and low risk of the original "Pistol" EUR/JPY version

Position size can be adjusted to suit your preferences

EA that earns profits stably with a high win rate "*Original* [Pistol] EURJPY Version"

Forward testing achieved a win rate above 80% in about two months.

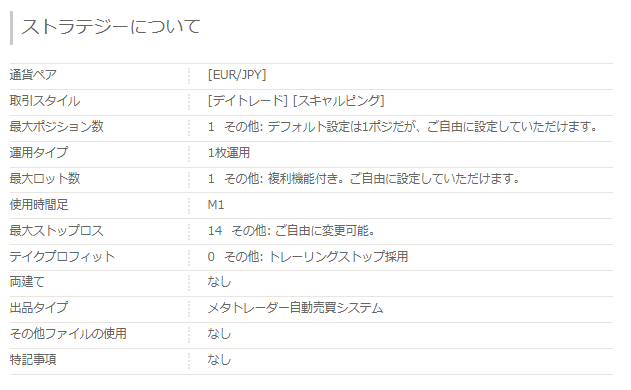

【*Original* 【Pistol】 EURJPY VersionOverview】

The default position is 1, but you can configure it freely.

It also includes a compounding feature.

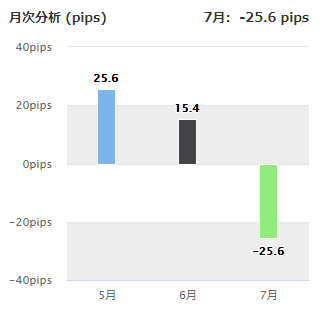

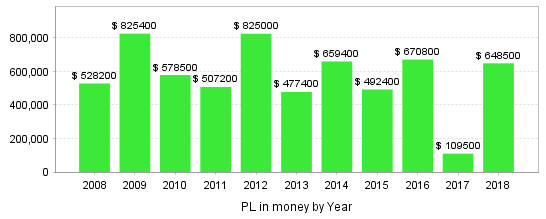

■Monthly Analysis

Gains over two months: May 25.6 pips, June 15.4 pips. July performance has declined, but total gains amount to 13.2 pips.

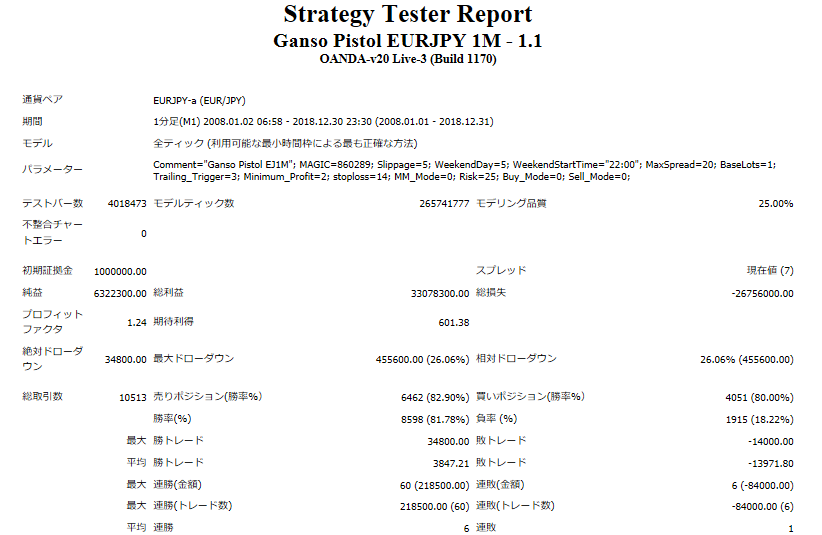

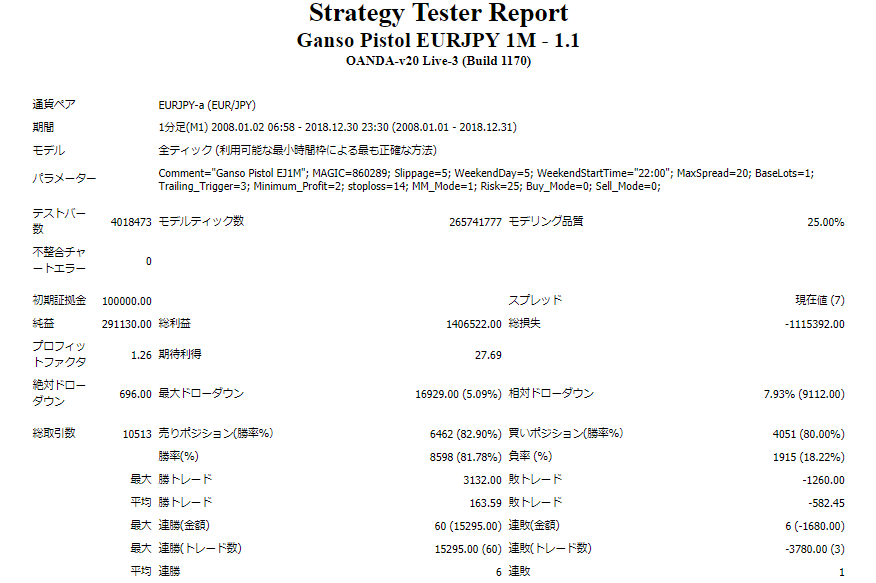

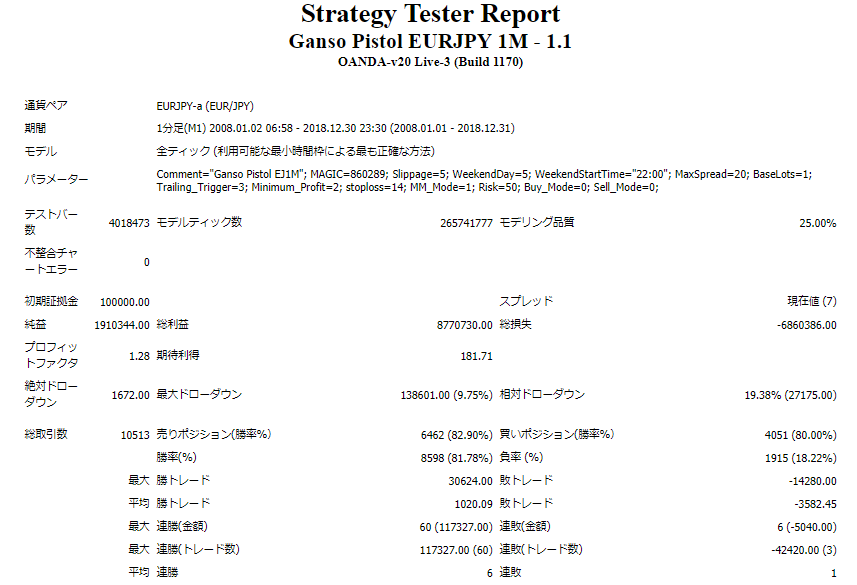

【Backtest Analysis】

2008.01.01‑2018.12.31

Spread 7point

Fixed at 1 lot

Net profit +6.32 million yen (annual average: 574,000 yen)

Maximum drawdown -¥456,000

Total trades: 10,513 (annual average 955)

Win rate 81.78%

Profit Factor 1.24

The win rate is high at 81.78% and appears to be stable.

Notably, the total number of trades exceeds 10,000, averaging nearly 1,000 trades per year.

Recommended margin amount is fixed at 1 lot.

(50) + (45.6×2) = 141.2 (ten-thousand yen)

This yields an expected annual return of 40%.

■Yearly and Monthly Profit/Loss

▲Yearly shows profits that have been stable over 11 years. There are no losses.

▲Monthly shows periods where losses can be large, so proper margin management is necessary. At the same time, profits also appear substantial.

■CompoundingOperation

With compounding, I ran a backtest with 100,000 yen. With default settings, it yielded about 290,000 yen in profit over 11 years.

Relative drawdown is 7.93%, relatively low.

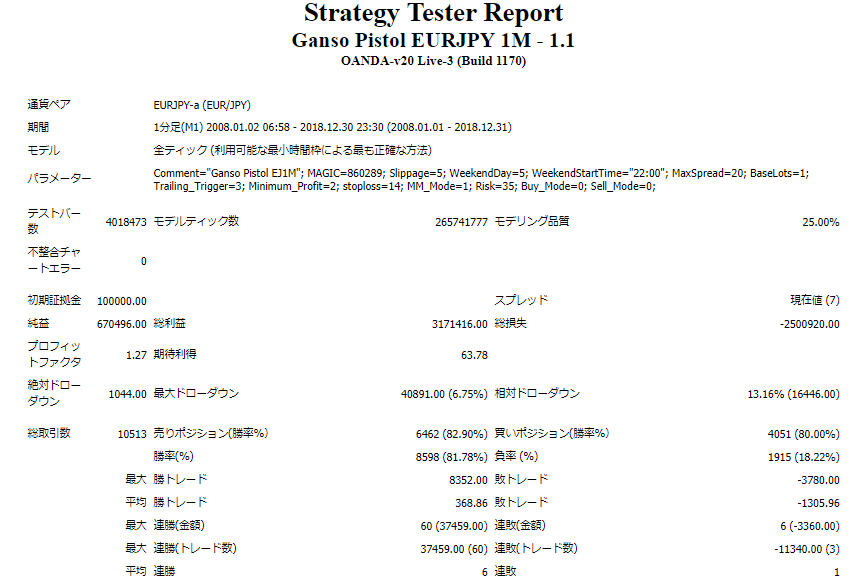

Risk value set to 35. This yielded about 670,000 yen in profit over 11 years.

Relative drawdown reached 13.16%.

Risk value set to 50. This yielded about 1,910,000 yen in profit over 11 years.

Relative drawdown is 19.38%, and there seems to be room for maintaining margin.

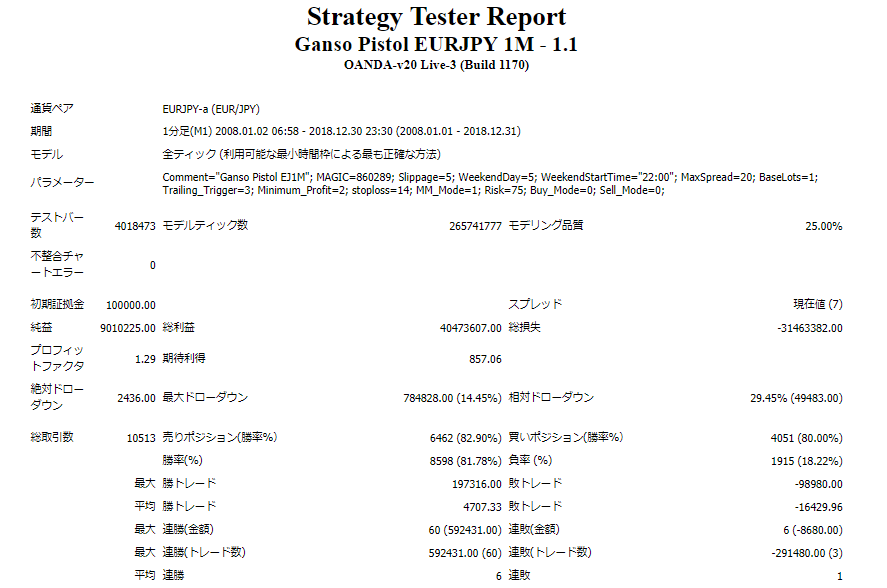

Risk value set to 75. This yielded about 9,000,000 yen in profit over 11 years.

The relative drawdown in this case was 29.45%.

High win rate and stability appear to be the main attractions.

However, because the maximum drawdown is large, careful capital management is important.

The compounding mode is advantageous for its lower relative drawdown. By adjusting the Risk value and managing account funds wisely, it could generate substantial profits.

The forward period is about two months, so we look forward to future results.