Ask Alpaca FX, a famous FX blogger and trader, for tips to improve “EA operation” and “blog management.”

An introduction to recommended EAs and reports on your own trading performance“Enjoy FX”The operator Alpaca FX answered various questions from points of EA operation to know-how on blog management. Whether you’re considering EA trading or thinking about starting a FX blog, the content is engaging from both viewpoints.

The reason for starting EA trading was that my boss had tripled his funds

Editorial DepartmentPlease tell us how you started in FX.

Alpaca FX (hereafter, Alpaca)About seven years ago I started with the aim of asset management. At first, I traded using indicator sign tools. One night while drinking, I clicked on an enticing spam email titled “This method will multiply your assets fivefold!” and jumped in.

EditorialDid you invest in anything besides FX as a means of asset growth?

AlpacaI had previously traded Chinese stocks and such, but at that time I wasn’t involved in anything other than FX. When I thought about increasing assets, FX seemed capable of growing more.

EditorialHow were your initial trading results?

AlpacaAt the start I didn’t understand much, so I just bought when there was a signal and sold when there was a signal. On the first day, I increased my assets by 30,000 yen. On the second day I won about 100,000 yen and told my girlfriend, “I’ve found something amazing.” But on the third day the market reversed, and I couldn’t cut losses at the right moment. I ended up being dragged along without proper stop loss.

I earned 30,000 to 100,000 yen in a day and likewise lost 100,000 yen in a day. In the end I thought, “I must study this to win,” so I joined a so-called discretionary trading school, but during the learning period I didn’t win well, and I stepped away from FX for a while.

EditorialWhat led you to auto-trading and EA operation?

Alpaca: At a drinking session, my boss showed me an MT4 screen saying, “There’s something amazing. It wins every day.” The scalping EA there won almost daily. The boss, who he said learned it from someone else, claimed, “There’s the best parameter setting, so if you use that you can safely double your assets in a month.”

EditorialThat sounds very appealing.

AlpacaIndeed. I was taught a method where I start with 100,000 yen, grow to 1,000,000 yen, then withdraw half and continue. I started with 100,000 yen and won quickly. Seeing my boss grow more funds before me made me think, “If he’s winning this much, perhaps if I increase capital a bit more I can catch up faster.” I doubled the funds and the lot size. Then the timing turned unlucky and I started carrying significant drawdown. High-win EA often has wide stop-loss, so you can end up with large drawdown. I couldn’t bear it mentally, so I manually cut the EA, and suddenly the market recovered. Watching that, I thought, “I shouldn’t have cut it, but this EA is amazing,” and I reinvested and increased the lot size. Soon after, I hit another drawdown and nearly all the invested money disappeared.

EditorialThat’s a painful failure. How is your current EA operation?

AlpacaI took a break for a while, but when I decided to move to Thailand, I restarted EA operation. Rather than using overseas FX brokers with high leverage, I now trade with domestic FX companies. I operate with EA-HANA, InstaFX, Avail, and other recent ones.

Key point: choose EA with forward testing, a developer, and a long operation history

EditorialWhat criteria did you use when purchasing an EA?

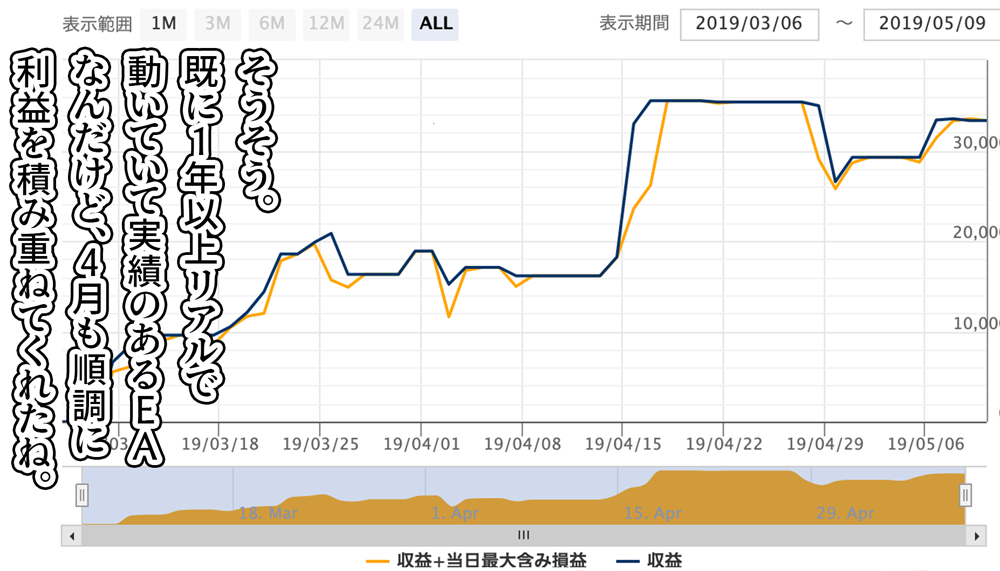

AlpacaAs I’ve written on my blog, it’s hard to decide to buy an EA based only on backtesting. The operating environment differs, so I also examine forward testing results and the developer’s background. Specifically, I prefer ones with a long operation history.

EditorialSo you choose ones with proven track records.

AlpacaYes. EA-HANA and InstaFX have been in operation for more than a year. Avail’s developer has over ten years of experience in automated trading, so I tend to buy EAs created by such developers.

EditorialAre there any other points when choosing an EA?

AlpacaFirst, consider your own problems. For the EA you want to use, what issues do you have? If you’re new to EAs, running multiple EAs simultaneously may be difficult.

EditorialFor beginners, buying multiple EAs at once is daunting. The first one becomes crucial.

AlpacaIn that case, simple and easy ones are good. For example, InstaFX and Avail are single-position EAs, offering relative stability. The logic isn’t always clear, but they have high win rates and long-use track records by their developers.

Also, Avail is a high-win-rate type, but its stop-loss is about 80 pips, not too wide, making it easier to endure mentally. In my past, an EA I used had a take profit of 10 pips and a drawdown of 200 pips; it used multiple positions, so recovering from a loss took too long. Compared to that, the EAs I mentioned earlier carry smaller drawdowns and have relatively strong recovery. They’re reassuring.

Discretionary traders starting with EAs often fear not understanding the logic behind drawdowns. If a discretionary trader has a well-defined exit rule, they can endure drawdowns because they trade based on rules. But with EAs, traders don’t know why drawdowns occur or how long they’ll last.

Therefore, for those with such concerns, EA-HANA is good because the logic is disclosed.

Also, many EAs are strong in ranges or trends. For example, there are EAs that excel at ranges or trends.

EditorialThere are EAs specialized for specific markets, too.

Alpaca: While some EAs struggle in euro-dollar ranges, there are others that move relatively stably. Those that target price movement rather than range are more like Copernicus. They enter when price movement overshoots.

The developer of Copernicus, Dabluwei, is also a discretionary trader, so I think EAs created by discretionary traders tend to align with personal rules, making them easier to trust and recommend.

EditorialSo, those who formalize discretionary methods into logic are more trusted?

AlpacaNot necessarily. There are discretionary-trader-created EAs that fail as well. The key is not being swayed by whether they are discretionary, but whether they can operate stably regardless of range or trend. An EA designed with price movement in mind is easier to operate year-round.

FX blogs should be written for the right audience

EditorialNext, about FX blog management. Are there SEO measures or other things you pay attention to when running a blog?

AlpacaMy blog is aimed at beginners. So, for those starting an FX blog, I think the important perspective is to be mindful of “who you’re writing for.”

For example, for beginners it’s good to write about failures and what triggered improvements in your operations. For intermediate readers, performance records are often read. Simply writing daily performance can reveal which FX company you use or how you combine EAs, which naturally creates distinction and originality. I think that’s how you should use the blog effectively.

EditorialSo beginners should look for useful information and personal experiences, while intermediates should see the characteristics of your performance?

AlpacaI worked in product management for an SEO monitoring tool in the US, and starting “Enjoy FX” came from my interest in EAs as a subject for SEO keyword monitoring. I investigated which keywords have search volume and popularity, and which keywords help you rank well.

When speaking to people who write EAs for SEO, for example, the genre “MT4 EA” has very low search volume and demand. So even if you write a blog, it won’t get many visits. The average page views for EA blogs without SEO measures are around 200–5,000. By comparison, general securities companies’ automated trading blogs have about 10,000 to 100,000 PV.

To solve this from an SEO perspective, use keywords other than “MT4 EA” well, and write with them. If you write only within the “MT4 EA” worldview, you can’t escape that world. Especially for beginner-targeted content, there might not be initial interest.

It’s important to shift the axis. Use keywords that general people might search for, such as USD/JPY, market, asset management, and so on. Free keyword tools exist, so rather than thinking, try entering keywords and consider how to guide your blog’s direction from them.

EditorialSo you should structure your blog with more general, searchable keywords that lead to EA or automated trading rather than focusing only on the subject?

AlpacaIn the beginning I started with keywords like EA product names or “EA name reputation,” but the search volume was tiny (3–5 per month), and clicks almost non-existent. If you don’t have social tools like Twitter, YouTube, or GoJangan blogs, shifting the search axis and writing for three months may raise your access.

How to solve the “issues with EAs”

EditorialI looked at your blog; since you target beginners and use many illustrations, it’s visually easy to read.

AlpacaYes. There are still many corrections to be made, but I try to make the structure as approachable as possible for beginners. I’ve even posted my earlier failure stories as manga or YouTube videos to make them easier to understand.

There are blogs operated by securities companies that show automated trading. But from that, I observe that very few people who are interested in automated trading actually reach MT4 EA. To have readers view EA operations as part of asset management, the content must be easy to understand and accessible to beginners, so I’ve increased illustration and manga content.

EditorialWhen introducing EAs on the site, what points do you consider or promote?

AlpacaAs mentioned earlier, it’s whether you can solve readers’ problems. I want to introduce many EAs and help readers judge whether they match their issues. I explain why an EA is good and who would find it easy to use.

Recently, since product pages don’t reveal everything, I interview developers directly and try to resolve readers’ concerns as much as possible.

EditorialNot only introducing, but content that resolves readers’ issues will naturally attract interest and engagement.

AlpacaOf course, if there were an EA with a continuously rising profit curve and no drawdown risk, you wouldn’t need to write anything. But that’s rarely the case. There are always risks, whether drawdown or profits fluctuating. Different risks exist for different EAs. Some take more risk, some are better long-term, and some take few positions but feel lacking. Because readers’ concerns vary, when introducing EAs I consider “which issue does this solve.”

EditorialFinally, any advice for people who want to start EA trading or are interested?

AlpacaI think there’s a need to increase assets in the long term. FX is speculative, so it’s best to operate a strategy you have confidence in. I usually introduce auto-trading and want to present lower-risk options and methods with as little risk as possible, encouraging readers to approach it that way.

Like me, many people feel EA is a godsend at first and ramp up positions, which leads to failure. Discretionary traders often say “losses from the first mistake are tuition.” but I don’t think so. If you want to start discretionary trading, prove you can win on a demo first, or for auto-trading use a forward-test-backed strategy with low risk, and preemptively avoid risk.

I’d like to provide such information as well. So I hope readers use this as reference.

EditorialThank you.

Alpaca FX profile

A trader who invests while doing content marketing in Thailand. Also runs “Enjoy FX,” updating EA introductions and his own performance. A couple working on FX together.

Twitter:https://twitter.com/M45FX

Blog:https://enjoy-fx.net/