From beginners to intermediate, this orthodox trading training material is recommended for those who find the "one more step" difficult! "FX Dojo: Mastering the Perfect Entry Point"

For beginners, you can learn from 1 to 10, from theory to practice, and

For intermediate traders, a very good teaching material has appeared for those who know the theory but can't win in ranges, sometimes incur large losses, and want to acquire that one final 'skill'!

The author isa full-time FX trader "Futa".

On his blog, he publishes daily USD/JPY technical analysis and updates on support and resistance.

FX ScaToRe Futa: Aiming from 200,000 yen to 100 million yen!!

"FX ScaToRe Futa: Aiming from 200,000 yen to 100 million yen!!"

■Introduction

===============================================

It took me a year and a half to become able to win.

Now I have captured winning patterns, no longer suffer large losses, and am able to keep winning, but getting here involved many bitter experiences and setbacks.

Nevertheless, I did not give up and kept striving; while it is only a stepping stone, I have come this far.

In this teaching material, I focus on the methods that allowed me to become a full-time trader, and for beginners or those with some experience but not yet winning, I will introduce methods you can use immediately, how to read crowd psychology, and winning points.

Also, I believe this book will allow anyone who is thinking of starting FX to begin with confidence.

FX is not forgiving, but if you follow the rules and enter where you have an edge, your win rate will rise, and you can definitely win.

Why not reset your mind completely and start FX in a simple way?

===============================================

Now, from here I would like to introduce just a few important parts from the main part of the "FX Dojo"!

Just reading this might give you new insights that resonate!

■ Things Beginners Specifically Need

Chapter 2: Important Points Before Real Trades

2-8 Consider Scenarios

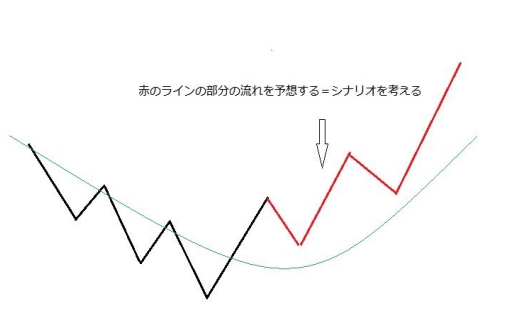

In trading, you enter after forecasting how the price will move next.

Buy when prices go down, and sell when they rise; simply doing that might win temporarily, but you cannot win consistently.

Thinking through scenarios is very important in trading.

A scenario is predicting the future path—whether it will rise or fall in the near future with a certain pattern.

If you enter without considering any scenario, you will be swayed by short-term moves and won’t do well.

Therefore, before entering, you should lay out a sequence: since it has dropped to this level, it should rise to here; if it doesn’t rise, you will cut losses here, including a plan based on technical analysis.

As in the red line of the diagram, predicting price movement scenarios will help you justify your entry and reduce unnecessary entries. Also, by always thinking about justification, you will grow as a trader, so always consider a scenario.

Chapter 3: Mindset for Stabilizing Profits

3-2 Minimize Losses

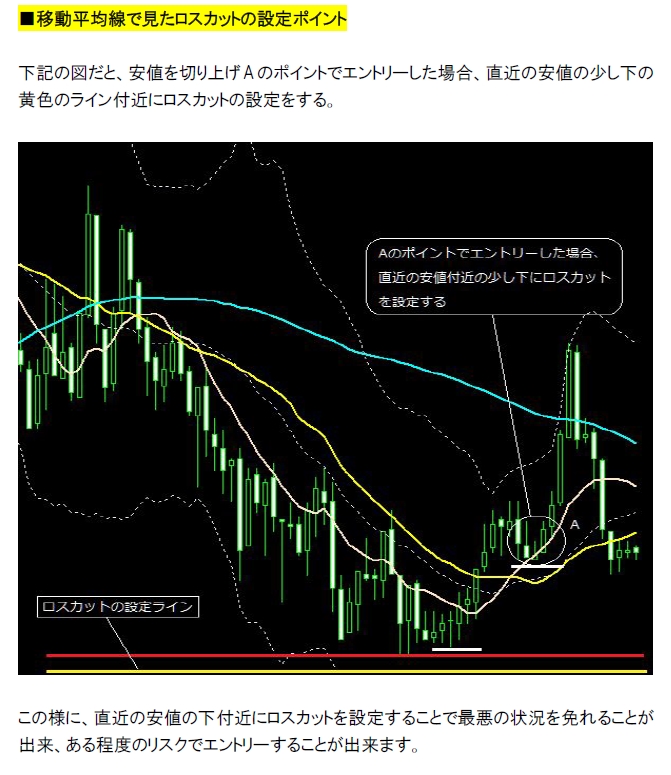

…When losses occur, the psychological state tends to be thinking, “Let’s wait for it to come back” or “Surely it will bounce back,” and you end up unable to cut losses.

Rather than waiting blindly, it’s fine to wait if there is a basis such as a support or resistance line; waiting without any basis is very dangerous.

…With experience you’ll realize that even with analysis, things don’t always go as planned.

So the important thing is “stop-loss orders.”

【Key Point】

For long entries, place the stop-loss slightly below the support line or near the most recent low; for short entries, place it slightly above the resistance line or near the most recent high.

Chapter 5: The Basics That Will Help You Win with This Much

5-1 Finding the Invisible Lines

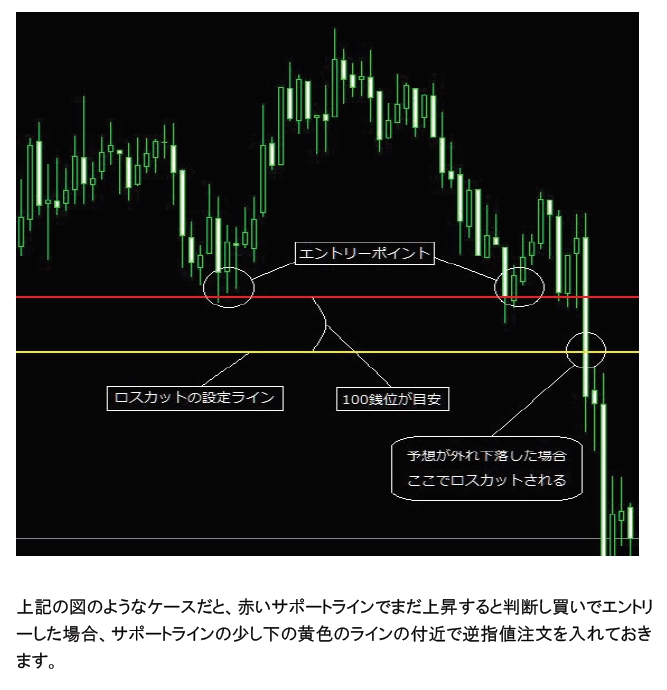

The invisible lines refer to the support and resistance lines, which are very important in trading.

Support and resistance lines are naturally watched by large traders as well, so riding their flow is a key to winning.

When entering, you should seek out as advantageous support and resistance lines as possible and enter accordingly to win.

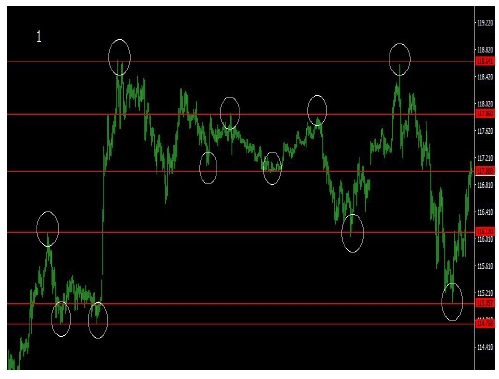

This chart is USD/JPY on a 60-minute timeframe, and the red lines indicate the support and resistance lines.

Basically, you aim to enter a buy when the price is above the support line, and a sell when it falls below the support line.

If you break a strong support line, the support line becomes a resistance line.

■ Entry Points

In line with the higher-timeframe trend, if the higher timeframe is in an uptrend, enter “buy”; if the higher timeframe is in a downtrend, enter “sell” to ride the flow.

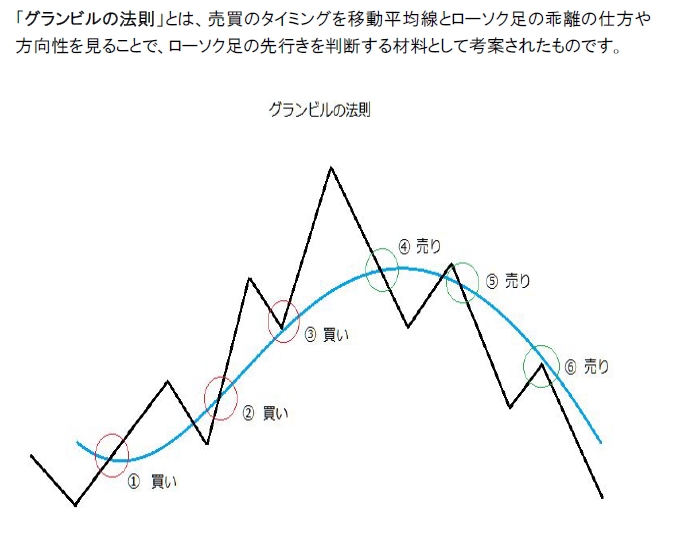

5-5 Immediate Granville's Rule

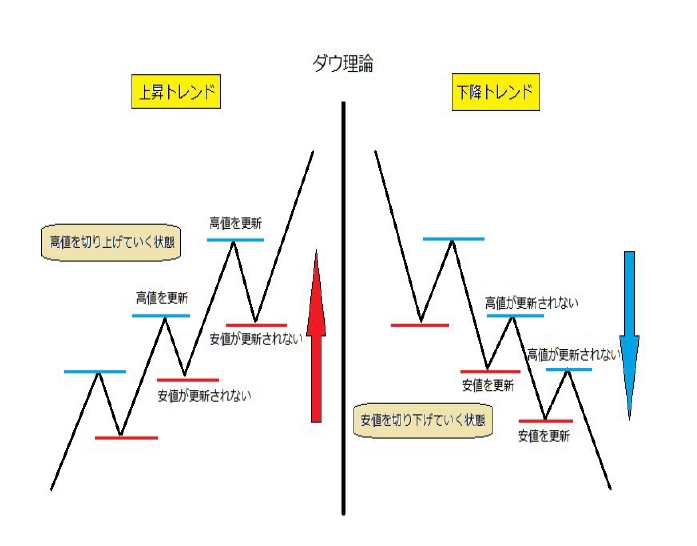

5-6 Immediate Dow Theory Concepts

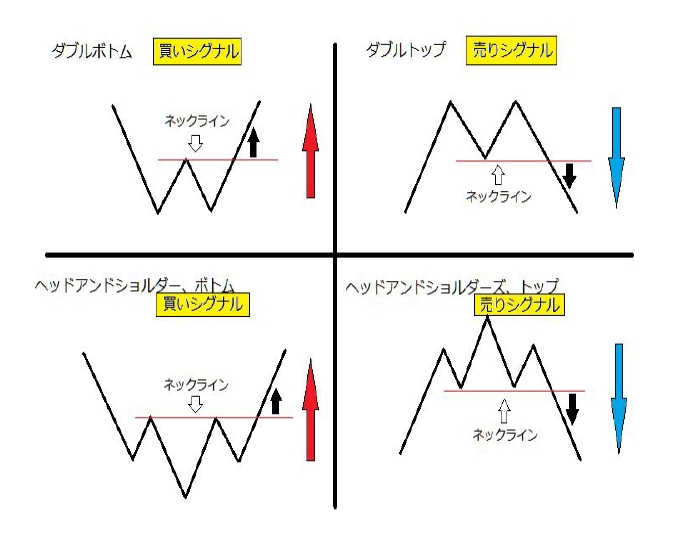

5-7 Forecasting Trend Reversals

The above is only a part of the book's first half.

Preparations before starting to trade, essential basics to know, setting personal rules, etc.

are described in detail.

Although detailed, it covers only the essential points, making it very easy to absorb into your mind.

into your mind.

Next time, we will finally cover the intermediate level,Technical Analysis – Real Trading Practice!