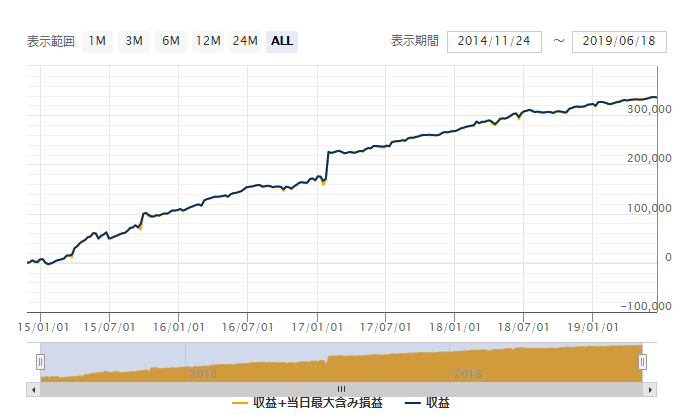

Proving performance through long-term forward testing! Day-trading EA 'SteadyFX'

No fine-tuning required

EURUSD-compatible day-trading EA

Has been delivering profits in a steadily rising trend since November 2014 in long-term forward testing.

It demonstrates stability as a product concept with more than four years of performance history.

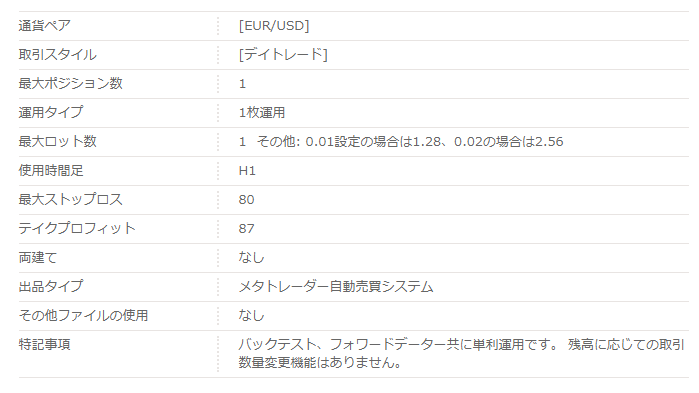

【Steady FX Overview】

An EA that uses the 1-hour timeframe for day trading.

SteadyFX has a maximum number of positions of 1, but the trading quantity is variable.

The value set in the parameters becomes the minimum trading quantity, and the maximum trading quantity can increase up to 128 times depending on the win/loss count.

Even with 0.01 lot, there is a possibility to trade as large as 1.28 lots, so note that the required margin is higher than elsewhere.

On the product page,The recommended minimum margin is about 750,000 yen with 25x leverage and a 0.01 lot settingis the case.

【Backtest Analysis】

SteadyFX has long-term forward testing, so we analyzed the past 10 years by dividing into two five-year periods roughly aligning with the forward test period: 2009-2013 and 2014-2018.

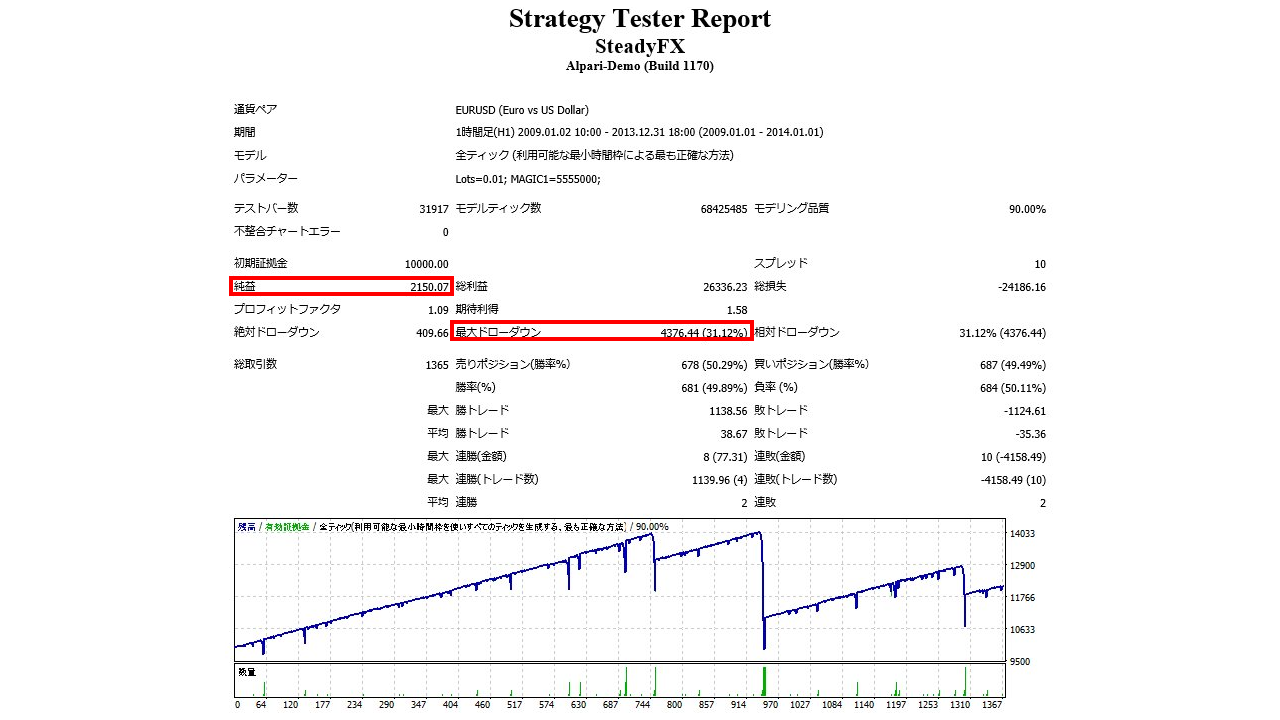

・2009.01.01‐2014.01.01

Spread 1.0

Net profit +236,000 yen (annual average 47,200 yen)

Maximum drawdown −481,000 yen

Total trades 1,365 (annual average 273)

Win rate 49.89%

PF 1.09

There were about three occasions where large losses occurred in the latter part of the period.

However, looking at the maximum drawdown, it is about 30%. The PF has not fallen below 1.

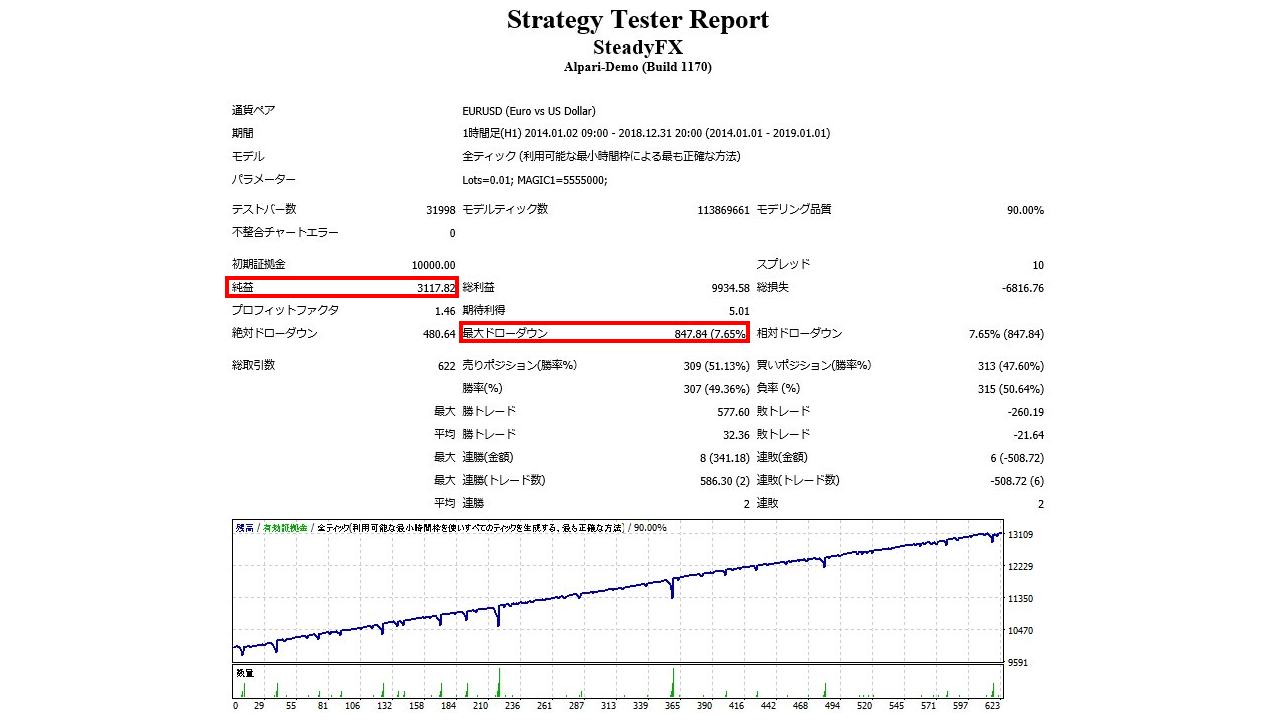

・2014.01.01‐2019.01.01

Spread 1.0

Net profit +342,000 yen (annual average 68,400 yen)

Maximum drawdown −93,000 yen

Total trades 622 (annual average 124)

Win rate 49.36%

PF 1.46

Maximum drawdown is relatively low at about 93,000 yen. The number of trades is about half of the previous five years.

The expected annual return is about 28.9%, which closely matches the forward results.

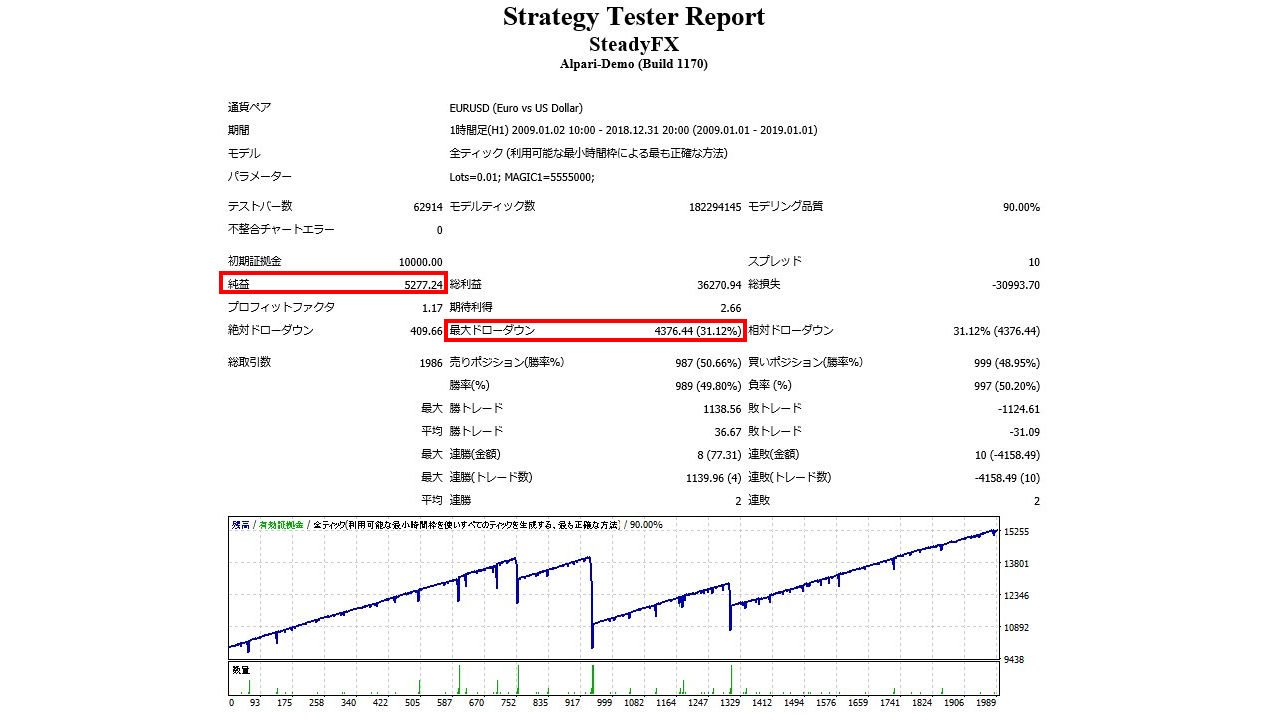

・2009.01.01‐2019.01.01(10年間)

Spread 1.0

Net profit +580,000 yen (annual average 50,000 yen)

Maximum drawdown −481,000 yen

Total trades 1,986 (annual average 198)

Win rate 49.80%

PF 1.17

The overall performance over 10 years is as follows.

The latter half is particularly stable and is thought to be well-suited to the current market.

In terms of number of trades, this EA alone may feel insufficient, but since you only need to set the initial parameters (minimum trade size), operation should be easy.

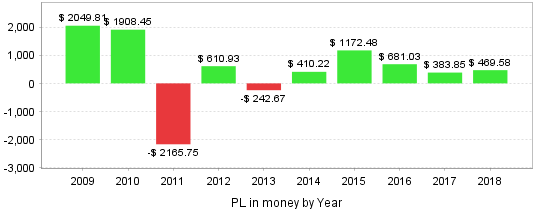

・Annual breakdown

2011 shows a large loss, but aside from that dip, profits are relatively stable.

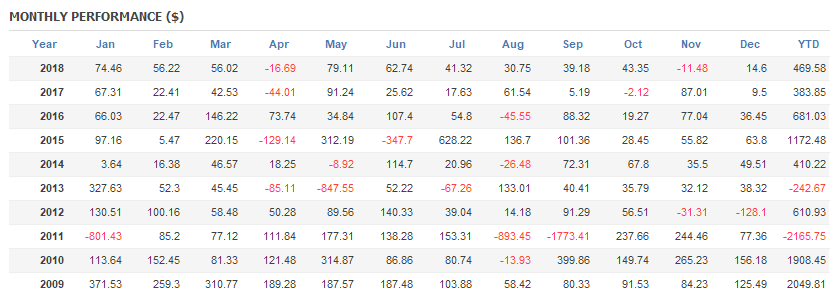

・By year and month

Monthly results show profit in more than 80% of months.

The win rate is about 50%, but monthly profits do not reflect that; the earnings are solid.

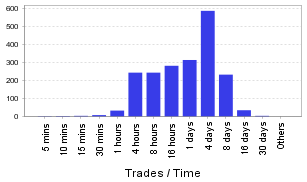

・Holding time

Because this is day trading, positions are held for at least 4 hours, and sometimes more than a week.

Regarding this EA, with few parameter changes, it seems you can operate it fairly hands-off.

・Chart analysis

Trades during the backtest period can be reviewed on the chart.

Blue: Long Red: Short

The number of trades is small, but because the holding period is long, during the operating period you will typically have positions open from entry to exit, and you may re-enter soon after.

If held longer, it can be more than two weeks.

From what we've seen, Steady FX does not often win big, but it reliably generates profits on a monthly and yearly basis.

With just the initial setting, you can then monitor it regularlyThe ease of operation, which doesn't require constant adjustments, also aligns with the EA's trading style.

Drawdown isn't very large, making it suitable for those who want to grow their assets over time.