Supports three currency pairs! An EA useful for portfolios as well: 'RECOBA Triple Swing M5'

Profit from GBP/JPY, EUR/JPY, and AUD/JPY.

An EA that’s three-times profitable in one『RECOBA Triple Swing M5』

【RECOBA Triple Swing M5 Overview】

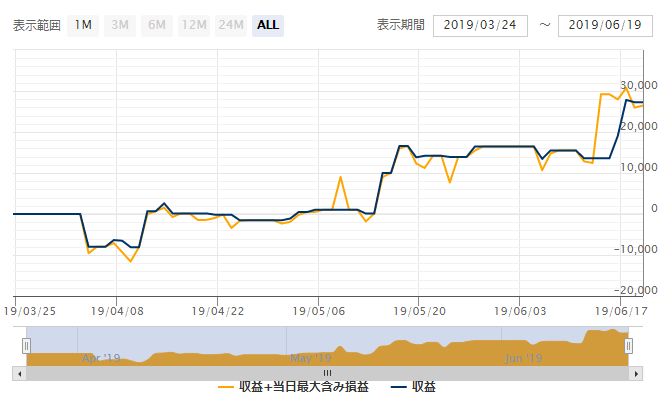

The forward period was about three months from April 2019 to June 2019; the PF was 2.18, and the maximum drawdown was 8.19%, making it an excellent EA.

According to the product page, it’s for GBP/JPY, but it also supports EUR/JPY and AUD/JPY, and can operate all three currency pairs with exactly the same logic.

It trades with a single position.

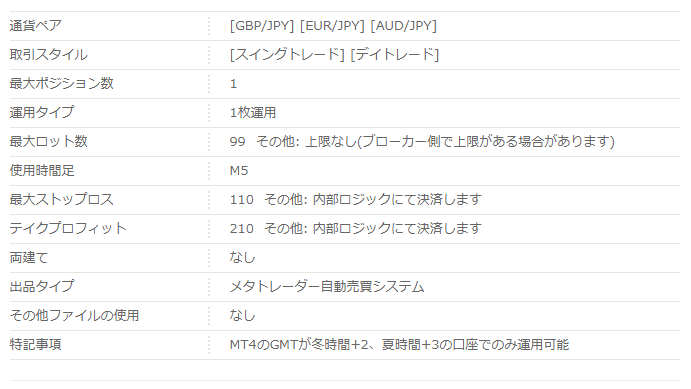

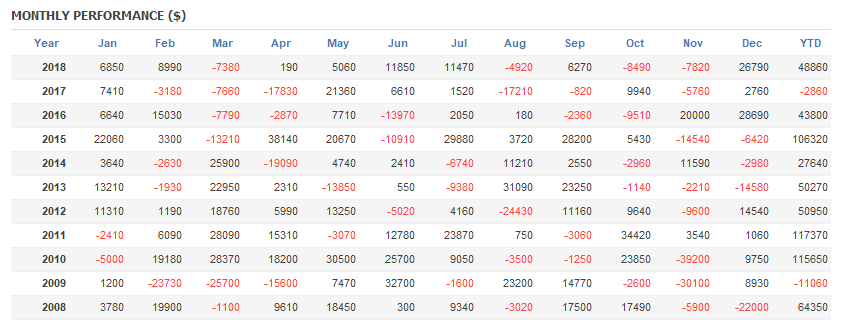

■Monthly Analysis

These are the pips gained over three months. April was -13.5 pips and failed to start well, but May gained 179.1 pips and June 109.4 pips, showing an improving trend.

【Backtest Analysis】

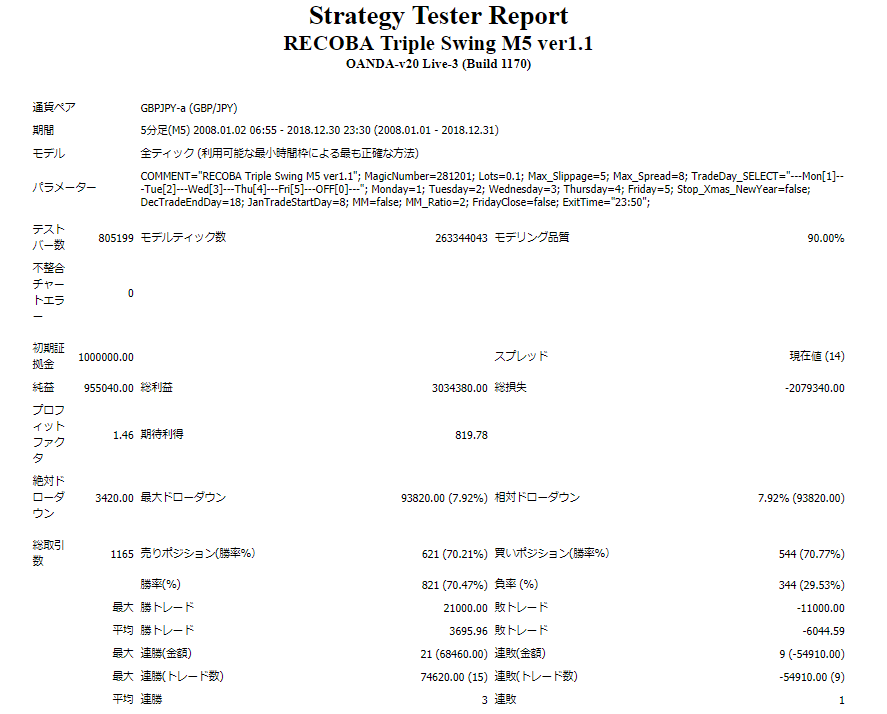

(GBP/JPY)

2008.01.01‐2018.12.31

Spread 14.0

0.1 lot fixed

Net profit +¥955,000 (annual average ¥87,000)

Maximum drawdown −¥93,000

Total trades 1,165 (annual average 105 trades)

Win rate 70.47%

PF 1.46

Maximum drawdown was −¥93,000, or 7.92%, making risk management easy.

Recommended margin is fixed at 0.1 lots

(5.5)+(9.3×2)=24.1万円

This yields an expected annual return of 36%.

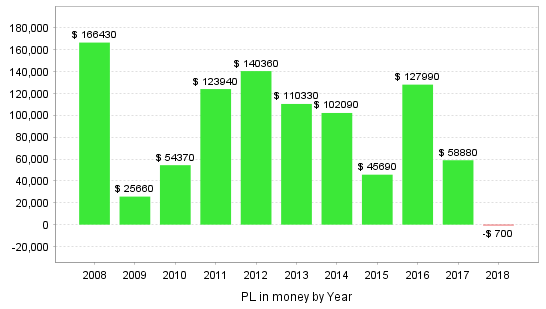

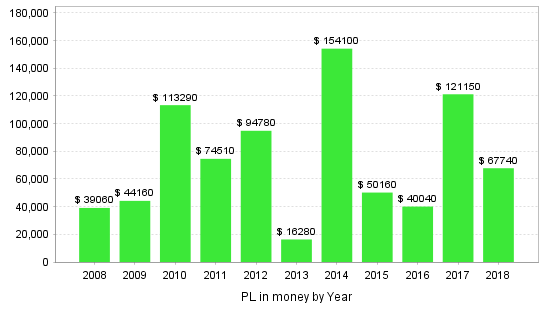

■Yearly & Monthly Profit/Loss

Looking at yearly results, 2018 is negative, but other years are stable.

Looking at monthly results, there are months with large gains as well as months with larger losses.

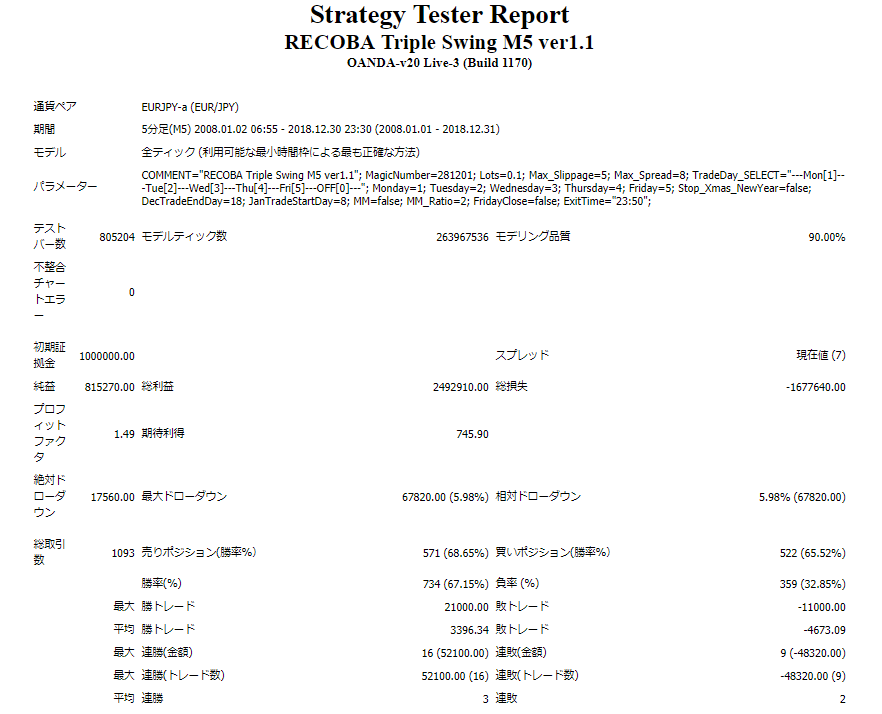

(EUR/JPY)

2008.01.01‐2018.12.31

Spread 7.0

0.1 lot fixed

Net profit +¥815,000 (annual average ¥74,000)

Maximum drawdown −¥67,000

Total trades 1,093 (annual average 99 trades)

Win rate 67.15%

PF 1.49

Recommended margin is fixed at 0.1 lots

(4.8)+(6.8×2)=18.4万円

This yields an expected annual return of 40%.

■Yearly & Monthly Profit/Loss

Monthly, it has consistently earned profits over 11 years.

Monthly there are months with larger losses as well, but they are covered, so as long as you manage margin, it should be fine.

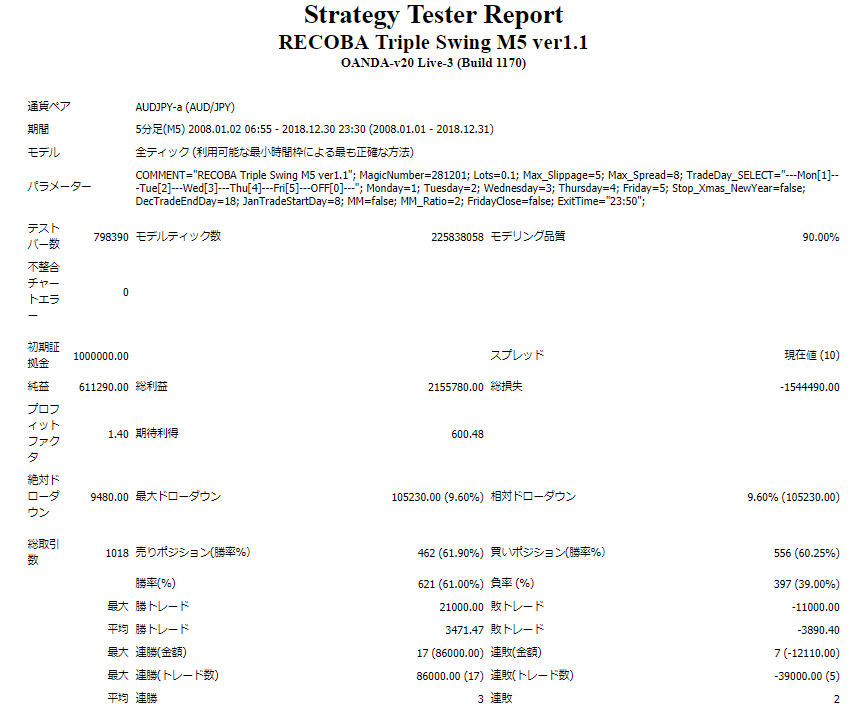

(AUD/JPY)

2008.01.01‐2018.12.31

Spread 10.0

0.1 lot fixed

Net profit +¥611,000 (annual average ¥56,000)

Maximum drawdown −¥107,000

Total trades 1,018 (annual average 92 trades)

Win rate 61.00%

PF 1.40

Recommended margin is fixed at 0.1 lots

(3.0)+(10.5×2)=24.0万円

This yields an expected annual return of 23%.

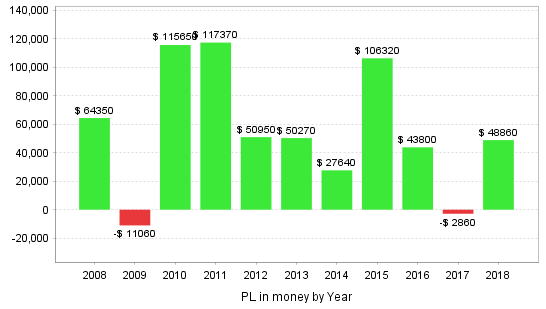

■Yearly & Monthly Profit/Loss

In 2009 and 2017 there are losses, but in other years profits exceed losses.

Monthly, there are months with losses, but they are covered.

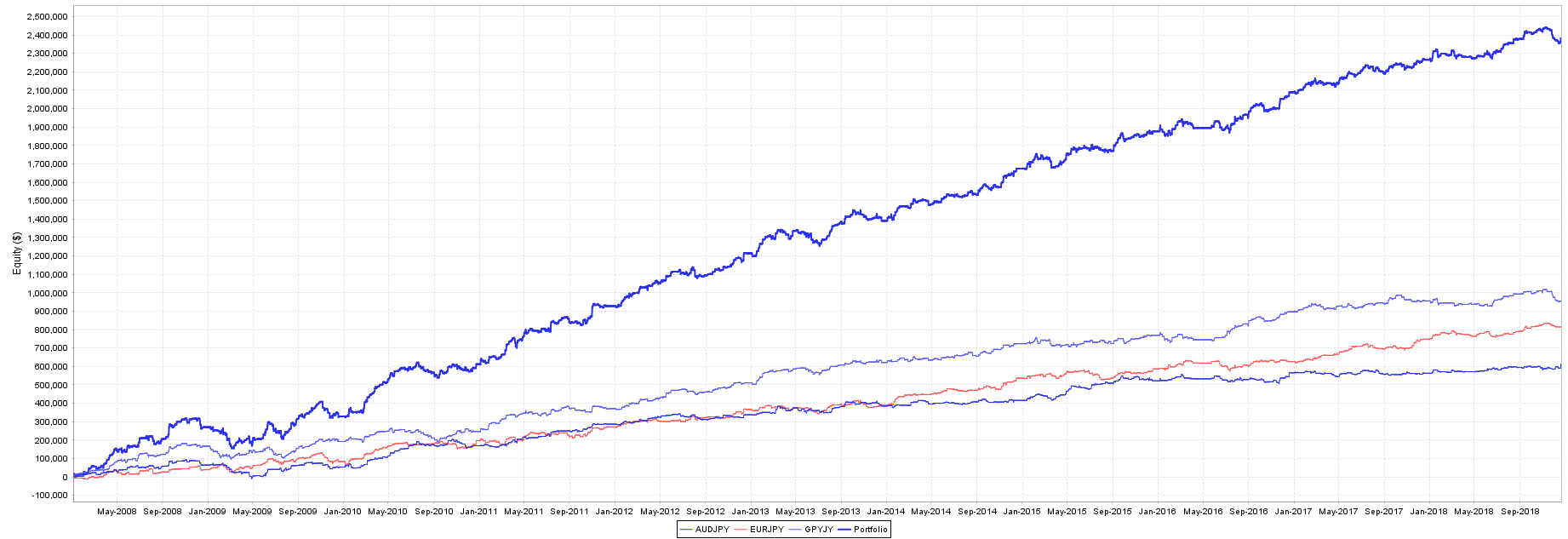

【Portfolio】

This is a chart of a portfolio built with three currencies. It shows a clean upward trend.

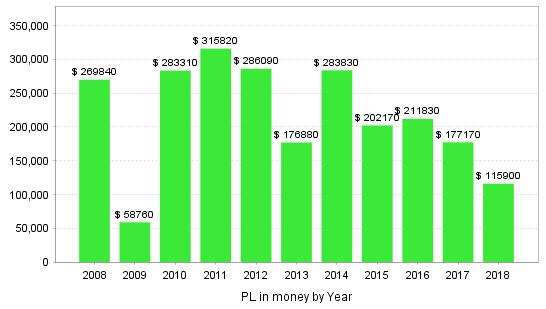

■Yearly & Monthly Profit/Loss

Yearly results have been consistently profitable over 11 years.

Monthly results are also highly profitable.

All three currency pairs have low maximum drawdowns, making margin management easy.

Since these are cross-Yen pairs, they are relatively easy to use, and because they are not minor currencies, it could be interesting to pair them with a USD-denominated EA in a portfolio.

The forward period is still a few months away, so it will be interesting to see the results after a year.