Relying on technical analysis alone is dangerous! Fundamental knowledge is essential! "Fundamental Analysis - Basic Edition" a total of three sessions Mr. Tetsu Emori's video seminar

Tetsu Emori Special Lecture

『Foundations of Fundamental Analysis in the FX Market』

“Technical Analysis”

“Fundamental Analysis”

Among them, the fundamental analysis you usually pay attention to

A video seminar that explains from the basics has begun!

Are you being tossed about by the numbers in employment statistics?

In fact, there are economic indicators more important than employment statistics…

Which economic indicators should you watch among the various indicators?

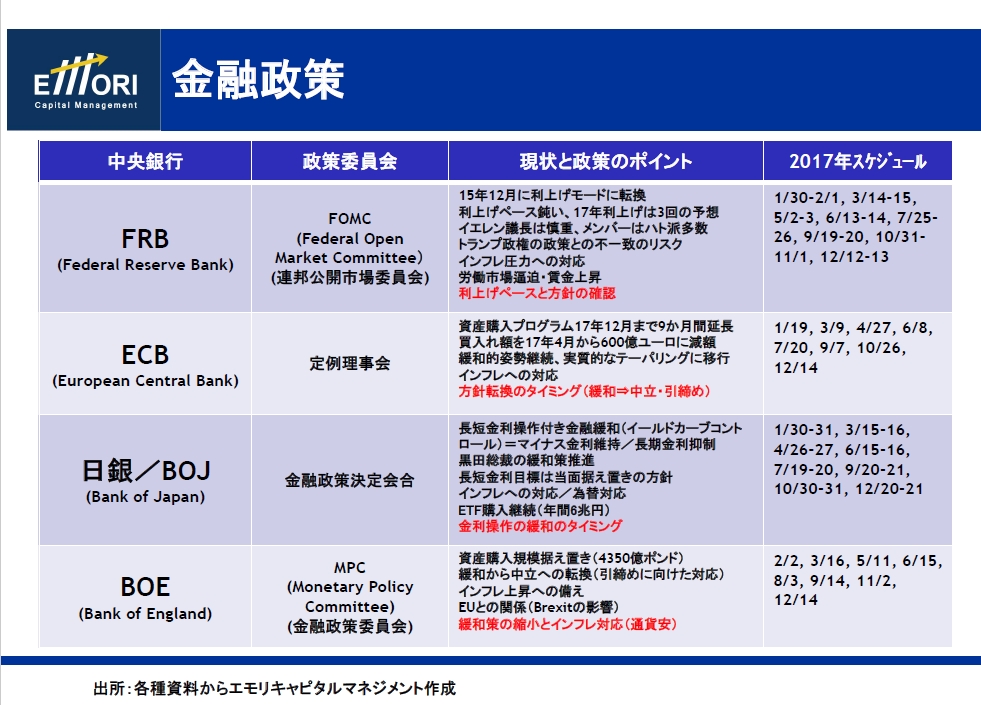

What are the monetary policies of each country?

In the end, will the yen weaken or strengthen under the Trump administration?

From the basic items you should keep in mind when performing fundamental analysis,

the path of the United States since 2017,

and the mechanisms of currency strength and weakness that don't follow the common sense,

are clearly explained by Emori Capital Management founder Tetsu Emori!

Session 1 is freely available up to 13 minutes!

Each session comes with detailed PDF materials,

and watching them together with the videos will deepen your understanding.

Excerpts from the materials used in Session 1

When you look at the final material,

the currency of a country with a strong economy, political stability, and favorable interest rates tends to rise in value—that is, currency appreciation

is the general rule, but in the world of forex, it isn't that simple.

How the currency's strength or weakness is created, and how to analyze and judge it, is the key focus of this foundational edition.

An overview of all three sessions

Session 1

・Market analysis ~ investment decisions

・Overview of fundamental analysis

・Important economic indicators

・Schedule of important US economic indicators

・About monetary policy

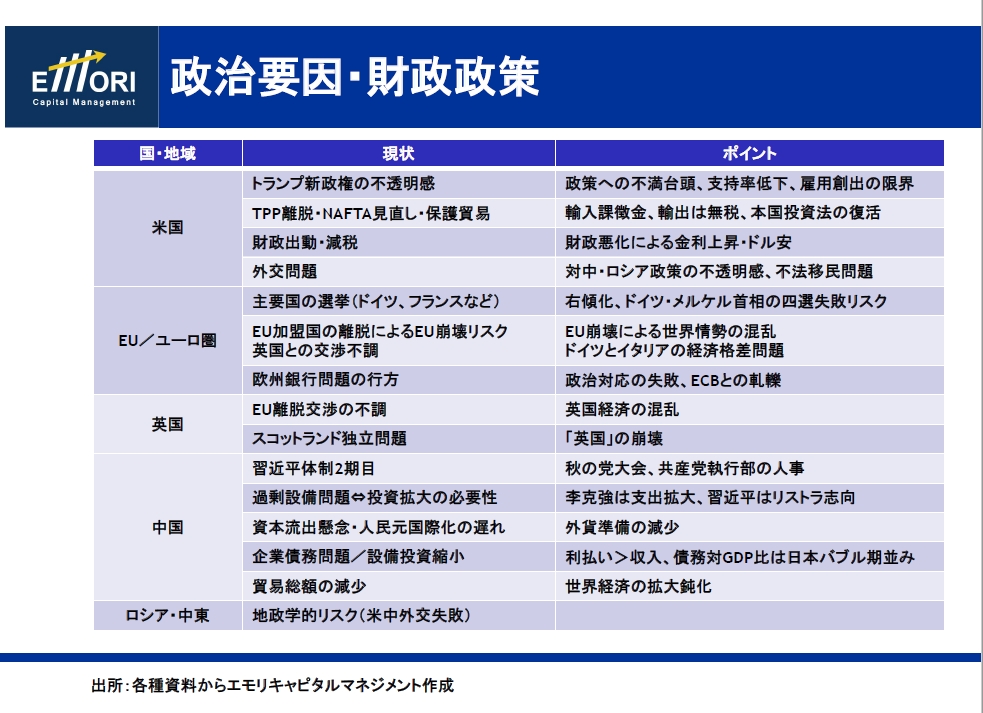

・Overview of political factors and fiscal policy of each country

・Speeches by leaders of various countries

・General interpretation of fundamentals and currencies

・Differences between Reaganomics and Mr. Trump's policies

・US fiscal balance and the dollar index trends

・Relationship between the US president's party and monetary policy

・Policy stances of FOMC members

・FF rate and USD/JPY movements

・Trends of major US economic indicators

・Trends in US employment statistics

・Trends in US personal consumption, retail sales, and USD/JPY

・Japan-US business sentiment and USD/JPY movements

・Japan-US GDP growth and USD/JPY movements

・Trends in Japan-US monetary base

・Japan-US current account balances and USD/JPY movements

・China's trade balance and foreign exchange reserves trends

・Global financial and economic risks

Session 3

・Trends in international yields of major countries

・Trends in inflation rates of major countries

・Real interest rate

・Inflation and deflation

・U.S.-Japan interest rate differential and USD/JPY trends

・Crude oil prices and CPI trends

・Disparity between actual and estimated USD/JPY

・Trends in commodity prices and currencies

After purchase, Sessions 1–3 will be viewable daily.

Includes all three sessions,

Release commemorative price through March 2017

Reference price ¥4,800

Special limited price ¥3,840 (tax included)

↓↓↓↓

【Tetsu Emori】Special online course to acquire elite fundamental analysis